Intermediate Financial Management

14th Edition

ISBN: 9780357516782

Author: Brigham, Eugene F., Daves, Phillip R.

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 13P

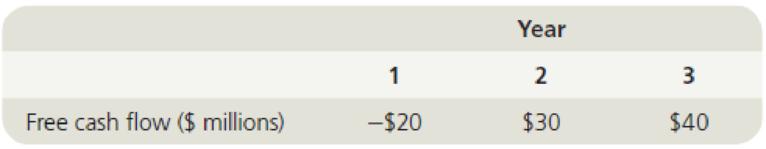

Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dozier’s weighted average cost of capital is WACC = 13%.

- a. What is Dozier’s horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.)

- b. What is the current value of operations for Dozier?

- c. Suppose Dozier has $10 million in marketable securities, $100 million in debt, and 10 million shares of stock. What is the intrinsic price per share?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

CORPORATE VALUATION

Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dantzler's WACC is 12%.

*Chart is included as a screenshot*

What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55.$ million

What is the firm's value today? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round your intermediate calculations.$ million

Suppose Dantzler has $102 million of debt and 30 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decimal places. Write out your answer…

Free Cash Flow Valuation

Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 8% rate. Dozier's weighted

average cost of capital is WACC = 14%.

Free cash flow (millions of dollars)

1

-$20

Year

2

$30

per share

3

$40

a. What is Dozier's horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as

10.55. Round your answer to two decimal places.

$

million

b. What is the current value of operations for Dozier? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to

two decimal places.

million

c. Suppose Dozier has $10 million in marketable securities, $100 million in debt, and 10 million shares of stock. What is the…

HappyTunes Inc. forecasts the free cash flows (in millions) shown below. The weighted

average cost of capital is 11.75%, the cost of equity is 19.25%, and the FCFs are expected to

continue growing at a 5.25% rate after Year 5. Assuming that the ROIC is expected to remain

constant in Year 5 and beyond, what is the Year O value of operations?

Year:

1

2

3

4

5

Free cash flow:

-$995

$15

$55

$80

$125

O-$310.32 million

O $387.53 million

O $139.31 million

$445.46 million

O-$176.72 milli

Chapter 8 Solutions

Intermediate Financial Management

Ch. 8 - Define each of the following terms: a. Proxy;...Ch. 8 - Two investors are evaluating General Electric’s...Ch. 8 - A bond that pays interest forever and has no...Ch. 8 - Explain how to use the free cash flow valuation...Ch. 8 - Thress Industries just paid a dividend of 1.50 a...Ch. 8 - Prob. 7PCh. 8 - Prob. 8PCh. 8 - A company currently pays a dividend of $2 per...Ch. 8 - Prob. 10PCh. 8 - Value of Operations

Kendra Enterprises has never...

Ch. 8 - Free Cash Flow Valuation

Dozier Corporation is a...Ch. 8 - Brushy Mountain Mining Companys coal reserves are...Ch. 8 - Constant Growth Valuation Crisp Cookwares common...Ch. 8 - Prob. 17PCh. 8 - Prob. 18PCh. 8 - Nonconstant Growth Stock Valuation Simpkins...Ch. 8 - Prob. 20PCh. 8 - Prob. 1MCCh. 8 - Prob. 2MCCh. 8 - Prob. 3MCCh. 8 - Prob. 4MCCh. 8 - Use B&M’s data and the free cash flow valuation...Ch. 8 - Prob. 6MCCh. 8 - Prob. 7MCCh. 8 - Prob. 8MCCh. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 11MCCh. 8 - Prob. 13MCCh. 8 - (1) Write out a formula that can be used to value...Ch. 8 - Assume that Temp Force has a beta coefficient of...Ch. 8 - Prob. 16MCCh. 8 - Now assume that the stock is currently selling at...Ch. 8 - Prob. 19MCCh. 8 - Prob. 20MCCh. 8 - Prob. 21MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 4% rate. Dantzler's WACC is 12%. Year 0 1 2 3 FCF ($ millions) $-11 $15 $56 What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places.$ million What is the firm's market value today? Assume that Dantzler has zero nonoperating assets. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places.$ million Suppose Dantzler has $95.80 million of debt and 36 million shares of…arrow_forwardDantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dantzler's WACC is 13%. Year ° 1 2 3 FCF (5 millions) $9 $26 $53 a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round Intermediate calculations. Round your answer to two decimal places. $ million b. What is the firm's market value today? Assume that Dantzler has zero nonoperating assets. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. $ million c. Suppose Dantzler has $126.80 million of debt and 6 million shares of stock outstanding. What is your estimate of the…arrow_forwardDantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dantzler's WACC is 13%. Year 1 2 3 FCF ($ millions) - $12 $20 $47 a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. $ million b. What is the firm's market value today? Assume that Dantzler has zero non-operating assets. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. $ million c. Suppose Dantzler has $98.50 million of debt and 35 million shares of stock outstanding. What is your estimate of…arrow_forward

- Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 6% rate. Dantzler's WACC is 15%. Year FCF ($ millions) $ $ 0 393.56 $ million 1 a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. - $14 million 2 $21 3 b. What is the firm's value today? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round your intermediate calculations. $60 c. Suppose Dantzler has $68 million of debt and 28 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decimal places. Write out your…arrow_forwardDantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 5% rate. Dantzler's WACC is 16%. HIH Year 1 2 3 FCF (S millions) - $15 $33 $59 a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. million b. What is the firm's market value today? Assume that Dantzler has zero nonoperating assets. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. million c. Suppose Dantzler has $129.60 million of debt and 23 million shares of stock outstanding. What is your estimate of…arrow_forwardDantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which the FCF is expected to grow at a constant 5% rate. Dantzler's WACC is 11%. Year 1 FCF= -$11 Year 2 FCF= $17 Year 3 FCF= $45. a) What is Dantzler's horizon, or continuing value? b) What is the firm's market value today? Assume that Dantzler has zero non-operating assets. c) Suppose Dantzler has $112.60 of debt and 25 shares of stock outstanding. What is your estimate of the current price per share?arrow_forward

- Dozier Corporation is a fast-growing supplier of office products. Analyst project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7 percent rate. WACC= 13 percent. Year : 0 1 2 3 FCF(RM Millions): NA - RM 20 RM 30 RM 40 (i) What is Dozier’s terminal, or horizon, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3) (ii) What is the firm’s value today? (iii) Suppose Dozier has RM 100 million of debt and 10 million shares of stock outstanding. What is your estimate of the price per share?arrow_forwardDozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 10% rate. Dozier's weighted average cost of capital is WACC = 16%. Year 2 $30 Free cash flow (millions of dollars) a. What is Dozier's horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. million $ 1 -$20 $40 $ b. What is the current value of operations for Dozier? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. million $ c. Suppose Dozier has $10 million in marketable securities, $100 million in debt, and 10 million shares of stock. What is the intrinsic price per share? Do not…arrow_forwardNeed Help with this Question solution providearrow_forward

- Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows during the next 3 years, after which FCF is expected to grow at a constant 7.40% rate. Dozier's WACC is 11.40%. Year 01 2 10 FCF ($ millions) a. What is Dozier's horizon, or continuing, value? b. What is the firm's value today? 3 20 30 c. Suppose Dozier has $200 million of debt and 100 million shares of stock outstanding. What is your estimate of the current price per share?arrow_forwarddetailed solution neededarrow_forward3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License