The effects of tax on

Concept Introduction:

Tax:

Tax is a compulsory levy on the citizens by the government.

Demand:

Demand is a quantity of a commodity that a consumer is willing to purchase at a particular price in a given period of time.

Supply:

Supply is the quantity of a commodity that a producer is willing to sell at a particular price in a given period of time.

It is the amount of goods and services a particular amount of money can purchase. It is basically the purchasing power of money.

Explanation of Solution

Let us take the example of a motor bike. Suppose, the cost of the motor bike is $100 and the government imposes 10% tax on the sale of it. Now, for the consumer earlier it was costing $100 but now it is costing $110, thus it has become relatively expensive. In other words, the real income of the consumer has reduced. With the reduction in the real income and substitution effect, the consumer will demand less quantity, that is, the consumer will move along the demand curve towards higher price and lesser quantity. Being conscious of this, the producer will also take an action. The supply curve will shift leftward implying less supply.

Thus, the taxes reduce both demand and supply.

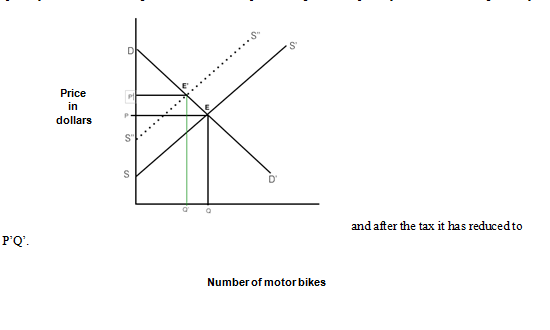

As we can observe in the figure, where on vertical axis we have prices and on horizontal axis we have quantity, that before the imposition of tax, the

and after the tax it has reduced to P’Q’.

and after the tax it has reduced to P’Q’.

Want to see more full solutions like this?

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education