Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 9E

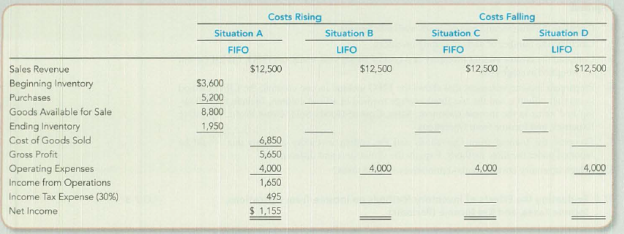

Choosing LIFO versus FIFO When Costs Are Rising and Falling

Use the following information to complete this exercise: sales, 550 units for 512,500; beginning inventory 300 units; purchases, 400 units; ending inventory, 150 units; and operating expenses, $4,000. Begin by setting up the following table and then complete the requirements that follow.

Required:

- 1. Complete the table for each situation. In Situations A and B (costs rising), assume the following: beginning inventory, 300 units at $12 = $3,600; purchases, 400 units at $13 $5,200. In Situations C and D (costs falling), assume the opposite; that is, beginning inventory, 300 units at $13 = $3,900; purchases, 400 units at $12 = $4,800. Use periodic inventory procedures.

- 2. Describe the relative effects on Income from Operations as demonstrated by requirement 1 when costs are rising and when costs are falling.

- 3. Describe the relative effects on Income Tax Expense for each situation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Building from the Module 2 Critical Thinking assignment about your company’s water purification product and target country market, research the components needed to build the product.

Use the following questions to guide your decisions about production and components, respond to the following topics for this week’s critical thinking assignment.

What does the target country produce and export?

What does the target country import; what are the imports used for?

To what degree does the target country have relevant and cost-effective component manufacturing capabilities?

Does the target country have relevant and cost-effective manufacturing/assembly capabilities to create products of acceptable quality?

If the target country does not have relevant component and manufacturing skills, where will the water purification components/devices be sourced from given the target country’s trade agreements?

How do trade profiles and trade relationships enter into your decision about manufacturing…

What is the variable overhead efficiency variance for the month?

MCQ

Chapter 7 Solutions

Fundamentals Of Financial Accounting

Ch. 7 - What are three goals of inventory management?Ch. 7 - Describe the specific types of inventory reported...Ch. 7 - The chapter discussed four inventory costing...Ch. 7 - Which inventory cost flow method is most similar...Ch. 7 - Where possible, the inventory costing method...Ch. 7 - Contrast the effects of LIFO versus FIFO on ending...Ch. 7 - Contrast the income statement effect of LIFO...Ch. 7 - Several managers in your company are experiencing...Ch. 7 - Explain briefly the application of the LCM rule to...Ch. 7 - Prob. 10Q

Ch. 7 - You work for a made-to-order clothing company,...Ch. 7 - Prob. 12QCh. 7 - (Supplement 7B) Explain why an error in ending...Ch. 7 - Which of the following statements are true...Ch. 7 - The inventory costing method selected by a company...Ch. 7 - Which of the following is not a name for a...Ch. 7 - Which of the following correctly expresses the...Ch. 7 - A New York bridal dress designer that makes...Ch. 7 - If costs are rising, which of the following will...Ch. 7 - Which inventory method provides a better matching...Ch. 7 - Which of the following regarding the lower of cost...Ch. 7 - An increasing inventory turnover ratio a....Ch. 7 - In which of the following situations is an LCM/NRV...Ch. 7 - Matching Inventory Items to Type of Business Match...Ch. 7 - Reporting Goods in Transit Abercrombie Fitch Co....Ch. 7 - Prob. 3MECh. 7 - Reporting Inventory-Related Accounts in the...Ch. 7 - Matching Financial Statement Effects to Inventory...Ch. 7 - Matching Inventory Costing Method Choices to...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Prob. 10MECh. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Reporting Inventory under Lower of Cost or...Ch. 7 - Preparing the Journal Entry to Record Lower of...Ch. 7 - Determining the Effects of Inventory Management...Ch. 7 - Interpreting LCM Financial Statement Note...Ch. 7 - Calculating the Inventory Turnover Ratio and Days...Ch. 7 - Prob. 19MECh. 7 - Prob. 20MECh. 7 - Prob. 21MECh. 7 - (Supplement 7A) Calculating Cost of Goods Sold and...Ch. 7 - (Supplement 7B) Determining the Financial...Ch. 7 - Prob. 24MECh. 7 - Reporting Goods in Transit and Consignment...Ch. 7 - Determining the Correct Inventory Balance Seemore...Ch. 7 - Determining the Correct Inventory Balance Seemore...Ch. 7 - Calculating Cost of Ending Inventory and Cost of...Ch. 7 - Calculating Cost of Ending Inventory and Cost of...Ch. 7 - Prob. 6ECh. 7 - Analyzing and Interpreting the Financial Statement...Ch. 7 - Evaluating the Effects of Inventory Methods on...Ch. 7 - Choosing LIFO versus FIFO When Costs Are Rising...Ch. 7 - Using FIFO for Multiproduct Inventory Transactions...Ch. 7 - Reporting Inventory at Lower of Cost or Market/Net...Ch. 7 - Reporting Inventory at Lower of Cost or Market/Net...Ch. 7 - Analyzing and Interpreting the Inventory Turnover...Ch. 7 - Analyzing and Interpreting the Effects of the...Ch. 7 - Prob. 15ECh. 7 - Analyzing and Interpreting the Financial Statement...Ch. 7 - Prob. 17ECh. 7 - Analyzing the Effects of Four Alternative...Ch. 7 - Evaluating the Income Statement and Income Tax...Ch. 7 - Calculating and Interpreting the Inventory...Ch. 7 - Prob. 4CPCh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Analyzing the Effects of Four Alternative...Ch. 7 - Evaluating the Income Statement and Income Tax...Ch. 7 - Prob. 3PACh. 7 - Prob. 4PACh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Prob. 1PBCh. 7 - Prob. 2PBCh. 7 - Prob. 3PBCh. 7 - Prob. 4PBCh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Prob. 1COPCh. 7 - (Supplement 7A) Recording Inventory Transactions,...Ch. 7 - (Supplement 7A) Recording Inventory Purchases,...Ch. 7 - (Supplement 7A) Recording Inventory Purchases,...Ch. 7 - Prob. 5COPCh. 7 - Prob. 6COPCh. 7 - Prob. 7COPCh. 7 - Prob. 8COPCh. 7 - Prob. 9COPCh. 7 - Prob. 10COPCh. 7 - Prob. 11COPCh. 7 - Prob. 12COPCh. 7 - Prob. 1SDCCh. 7 - Prob. 2SDCCh. 7 - Critical Thinking: Income Manipulation under the...Ch. 7 - Accounting for Changing Inventory Costs In...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License