FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

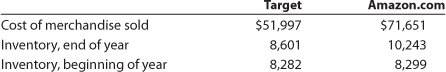

Target Corp. sells merchandise primarily through its retail stores. On the other hand, Amazon.com uses its e-commerce services, features, and technologies to sell its products through the Internet. Recent

- Determine the inventory turnover for Target and Amazon.com. Round to two decimal places.

- Determine the days’ sales in inventory for Target and Amazon.com. Use 365 days and round to one decimal place.

- Interpret your results.

Transcribed Image Text:Target

Cost of merchandise sold

Inventory, end of year

Inventory, beginning of year

$51,997

8,601

8,282

Amazon.com

$71,651

10,243

8,299

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail Inventory method to estimate ending inventory and cost of goods sold. The following data are available: Cost Beginning inventory. $ 190,000 Net purchases 660,000 Net markups Net markdowns Net sales Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold using the information provided. Assume stable retail prices during the period. Note: Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign. Beginning inventory Net purchases Net markups Net markdowns Retail $ 290,000 865,000 20,000 5,000 836,000 Goods available for sale (excluding beginning inventory) Goods available for sale (including beginning inventory) Cost-to-retail percentage (beginning) Cost-to-retail percentage (current) Net sales Estimated ending inventory at retail…arrow_forwardSuppose The Style Fashions, a specialty retailer, had these records for evening gowns during 2018: (Click the icon to view inventory data.) Assume that The Style sold 120 gowns during 2018 and uses the LIFO method to account for inventory. The Style's income tax rate is 35%. Read the requirements. Requirement 1. Compute The Style's cost of goods sold for evening gowns in 2018. Unit price Total Units From beginning inventory From purchase in February From purchase in June From purchase in December LIFO cost of goods sold Requirement 2. Compute what cost of goods sold would have been if The Style had purchased enough inventory in December-at $1,325 per evening gown-to keep year-end inventory at the same level it was at the beginning of the year. Cost of goods sold without LIFO liquidation 18 $ 23 52 27 Units 950 1,225 1,275 1,325 $ 17,100 28,175 66,300 35,775 147,350 Unit price Totalarrow_forwardColonial Corporation uses the retail method to value its inventory. The following information is available for the year: Beginning inventory Purchases Freight-in Net markups Net markdowns Net sales Beginning inventory Purchases Freight-in Net markups Required: Determine ending inventory and cost of goods sold by applying the conventional retail method using the information provided. Note: Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign. Net markdowns Goods available for sale Cost-to-retail percentage Net sales Cost $ 190,000 600,000 8,000 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold Retail $ 280,000 840,000 $ 20,000 4,000 800,000 Cost 190,000 $ 600,000 8,000 798,000 $ Retail 280,000 840,000 20,000 1,140,000 (4,000) 1,136,000 79,520 1,056,480 Cost-to-Retail Ratio 70.00 %arrow_forward

- Skysong Company's record of transactions for the month of April was as follows. (b) Assuming that perpetual inventory records are kept in dollars, determine the inventory using (1) FIFO and (2) LIFO. Purchases Sales April 1 (balance on hand) 1,800 @ $5.60 April 3 1,500 @ $10.00 4 4,500 @ 5.70 9 4,200 @ 10.00 8 2,400 @ 6.00 11 1,800 @ 11.00 Inventory $ 13 3,600 @ 6.10 21 2,100 @ 6.20 27 22 23 3,600 @ 11.00 2,700 @ 12.00 eTextbook and Media 29 1,500 @ 6.40 13,800 Save for Later 15,900 (1) FIFO $ (2) LIFO 11790 Attempts: 0 of 3 used Submit Answarrow_forward[The following information applies to the questions displayed below.] Autumn Company began the month of October with inventory of $25,000. The following inventory transactions occurred during the month: The company purchased inventory on account for $37,000 on October 12. Terms of the purchase were 2/10, n/30. Autumn uses the net method to record purchases. The inventory was shipped f.o.b. shipping point and freight charges of $600 were paid in cash. On October 31, Autumn paid for the inventory purchased on October 12 During October inventory costing $19,500 was sold on account for $30,000. It was determined that inventory on hand at the end of October cost $42,360. Assuming Autumn Company uses a periodic inventory system, prepare journal entries for the above transactions including the adjusting entry at the end of October to record cost of goods sold. Autumn considers purchase discounts lost as part of interest expense.arrow_forwardZonkey Enterprises uses LIFO with a periodic inventory system to keep track of its inventory. It began the year with 100 units that cost $10 each. It made the following purchases: January 7, 100 for $12 each; January 22, 100 for $13 each. During the month it sold 120 units. How much ending inventory should be reported on the balance sheet, COGS on the January income statement, and cost of goods available for sale during the month? How is ending inventory being calculated?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education