FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

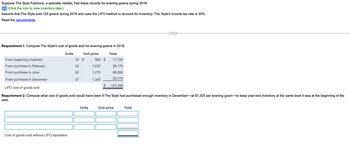

Transcribed Image Text:Suppose The Style Fashions, a specialty retailer, had these records for evening gowns during 2018:

(Click the icon to view inventory data.)

Assume that The Style sold 120 gowns during 2018 and uses the LIFO method to account for inventory. The Style's income tax rate is 35%.

Read the requirements.

Requirement 1. Compute The Style's cost of goods sold for evening gowns in 2018.

Unit price

Total

Units

From beginning inventory

From purchase in February

From purchase in June

From purchase in December

LIFO cost of goods sold

Requirement 2. Compute what cost of goods sold would have been if The Style had purchased enough inventory in December-at $1,325 per evening gown-to keep year-end inventory at the same level it was at the beginning of the

year.

Cost of goods sold without LIFO liquidation

18 $

23

52

27

Units

950

1,225

1,275

1,325

$

17,100

28,175

66,300

35,775

147,350

Unit price

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Required information [The following information applies to the questions displayed below.] During the year, TRC Corporation has the following inventory transactions. Number Unit Date Transaction of Units Cost Total Cost $38 $1,748 5,040 8,428 4,664 Jan. 1 Beginning inventory Purchase 46 Apr. 7 Jul. 16 126 40 Purchase 196 43 Oct. 6 Purchase 106 44 474 $19,880 For the entire year, the company sells 425 units of inventory for $56 each. 2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. Cost of Goods Sold Ending Inventory LIFO Cost of Goods Available for Sale Cost of Average Cost of Average Averagearrow_forwardlouie company sells Astro's photocards for P30 each. the following was taken from the inventory records during march: date photocard units cost march 03 purchase 500 P15 march10 sale 300 17 purchase 1000 P17 20 sale 600 23 sale 300 30 purchase 1000 P20 1. Determine the cost of sales and cost of ending inventory using First-in-First-out Method (Periodic) 2.Determine the cost of sales and cost of ending inventory using Weighted Average Method 3. Determine the cost of sales and cost of ending inventory using Moving Average Methodarrow_forwardAdler Inc. has the following information for four inventory items, reported using the retail method, on July 31. The normal profit margin is 20% of selling price. Cost to Sell Cost per Replacement Cost Item Selling Price per No. Quantity Unit per Unit Unit per Unit #101 80 $20 $5 $15 $12 #102 50 22 4 14 15 #211 30 35 5 30 28 #212 40 40 8 28 35 Required Determine the inventory cost to report on the balance sheet on July 31 assuming that the company applies the lower of cost or market value rule to each individual inventory item. Note Do not use any negative signs with your answers. Per Unit Total Total Cost Cost to Cost Replacement Total Sell per Replacement Ceiling Floor Market Cost Lower of Selling Price Item per per No. Quantity Unit Unit Unit per Unit Cost #101 80 $20 $5 $15 $12 $ 0 $ #102 50 22 #211 30 35 45 14 15 0 30 28 0 #212 40 40 8 28 35 0 000 O 0 ос 00 Cost or Market 0 $ 0 $ 0 $ 0 $ 0 0 0 0 0 0 0 0 0 0 $ 0 $ 0 $ 0arrow_forward

- The following is the detail of the purchase and sale of inventory of a product of Simco Co. May 1 Beg. Inventory 60 units @ $220 May 2 Purchase 100 units @ $216 May 14 Purchase 50 units @ $224 May 22 Purchase 60 units @ $234 May 30 Sale 200 units Required: 1. Compute the cost of goods sold and cost of ending inventory for Simco Co. for May under the FIFO, LIFO, and weighted average cost assumptions. 2. Which method results in Simco Co. paying the least tax?arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forwardDuring 2021, a company sells 280 units of inventory for $89 each. The company has the following inventory purchase transactions for 2021: Number of Units 69 169 189 Unit Cost $64 Date Transaction Jan. 1 Beginning inventory May 5 Purchase Nov. 3 Purchase Total Cost $ 4,416 10,985 12,663 $28,064 65 67 427 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses FIFO. Ending inventory %24 147 Cost of goods soldarrow_forward

- Please help me prepare the single step income statement for this one.arrow_forwardWan Tan Corp. made the following four inventory purchases in June: June 1 150 units $5.20 June 10 200 units $5.85 June 15 200 units $6.30 June 28 150 units $6.60 On June 22, 450 units were sold. The company uses the perpetual inventory system and the weighted average to value the inventory. Calculate the cost of goods sold for the sale. Round to the nearest whole dollar. Select one: a. $2,580 b. $2,628 c. $2,700 d. $1,572arrow_forwardRefer to the following selected financial information from Phantom Corp. Compute the company's days' sales in inventory for Year 2. (Use 365 days a year.) Year 2 Year 1 Merchandise inventory 287,000 269, 500 Cost of goods sold 470,400 417,100 Multiple Choice 222.7. 251.2.arrow_forward

- You have the following information for Bramble Inc. for the month ended June 30, 2022. Bramble uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $31 June 4 Purchase 135 34 June 10 Sale 110 61 June 11 Sale return 15 61 June 18 Purchase 55 37 June 18 Purchase return 10 37 June 25 Sale 65 67 June 28 Purchase 35 41arrow_forwardNeed answer thank you.arrow_forwardCompute the gross income for 2019 assuming a FIFO.cost formulaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education