Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 6PA

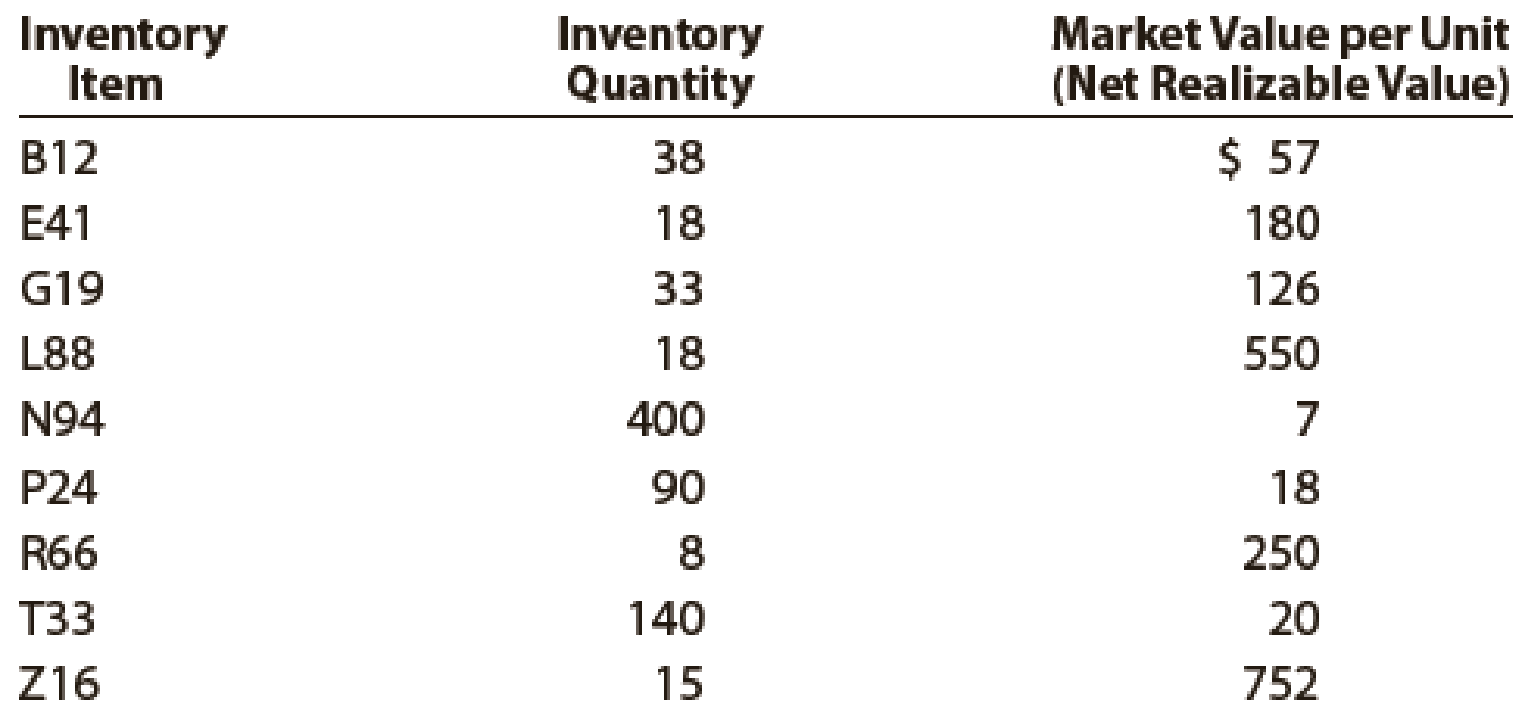

Data on the physical inventory of Ashwood Products Company as of December 31 follow:

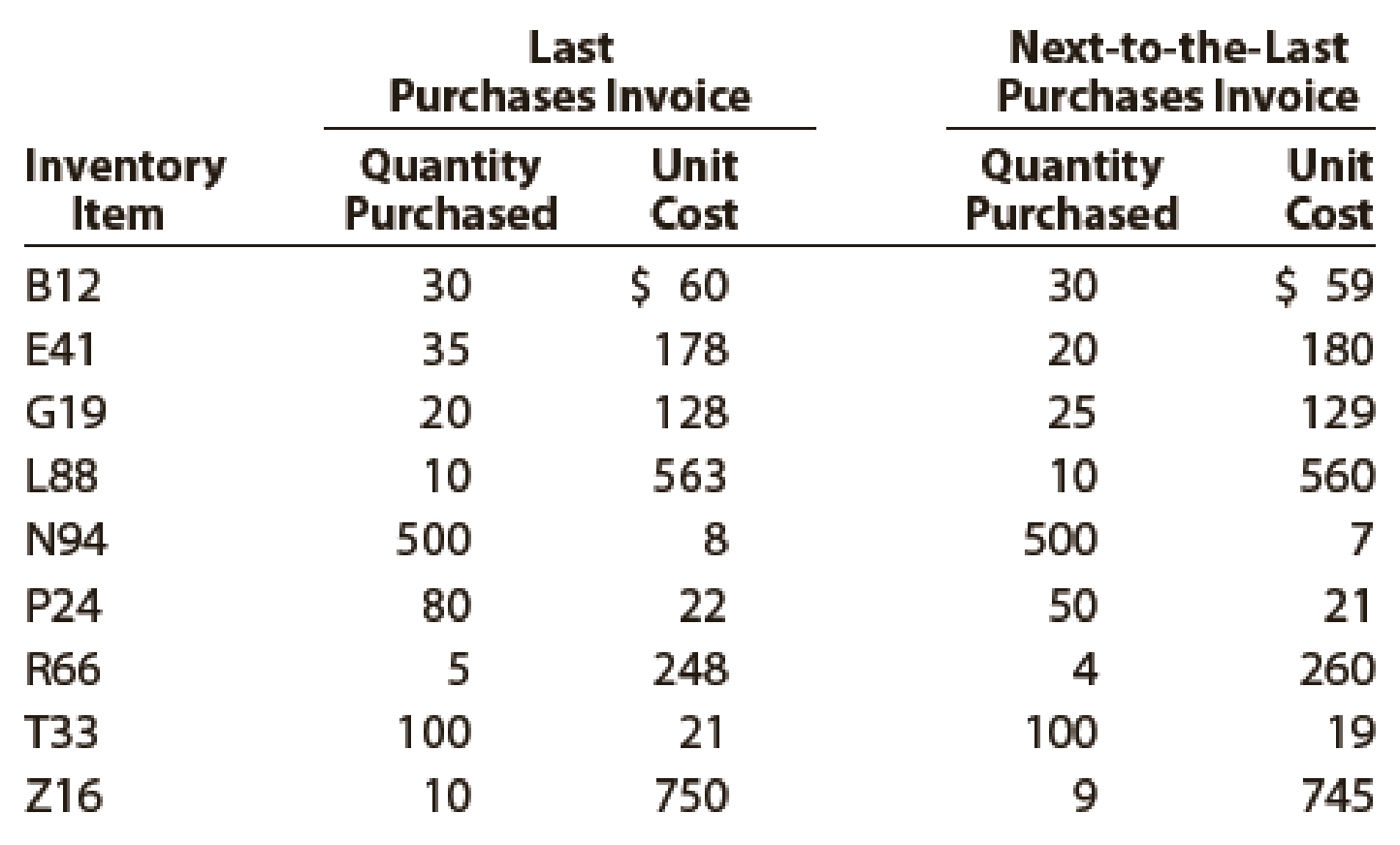

Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows:

Instructions

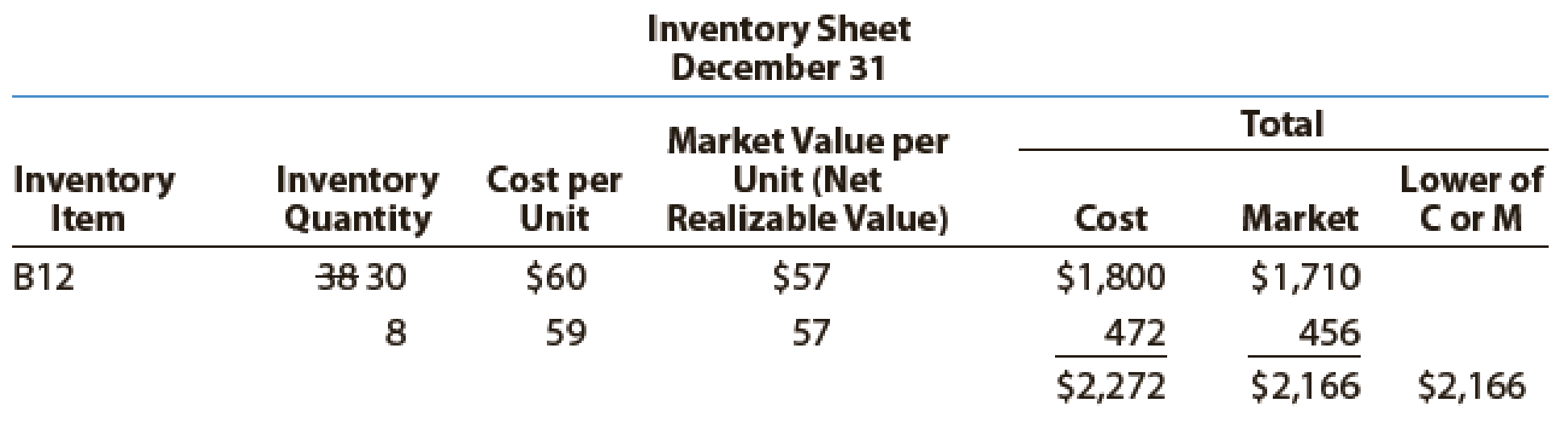

Determine the inventory at cost as well as at the lower of cost or market, using the first-in, first-out method. Record the appropriate unit costs on the inventory sheet and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows:

- 1. Draw a line through the quantity and insert the quantity and unit cost of the last purchase.

- 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase.

- 3. Total the cost and market columns and insert the lower of the two totals in the Lower of C or M column. The first item on the inventory sheet has been completed as an example.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The company's price earnings ratio is equal accounting

What is the firm's debt equity ratio

hi expert please help me

Chapter 7 Solutions

Financial Accounting

Ch. 7 - Prob. 1DQCh. 7 - Why is it important to take a physical inventory...Ch. 7 - Do the terms FIFO, LIFO, and weighted average...Ch. 7 - If merchandise inventory is being valued at cost...Ch. 7 - Which of the three methods of inventory...Ch. 7 - If inventory is being valued at cost and the price...Ch. 7 - Using the following data, how should the...Ch. 7 - The inventory at the end of the year was...Ch. 7 - Hutch Co. sold merchandise to Bibbins Company on...Ch. 7 - A manufacturer shipped merchandise to a retailer...

Ch. 7 - The following three identical units of Item BZ1810...Ch. 7 - The following three identical units of Item Beta...Ch. 7 - Beginning inventory, purchases, and sales for Item...Ch. 7 - Beginning inventory, purchases, and sales for Item...Ch. 7 - Beginning inventory, purchases, and sales for Item...Ch. 7 - Beginning inventory, purchases, and sales for Item...Ch. 7 - Beginning inventory, purchases, and sales for 30xT...Ch. 7 - Beginning inventory, purchases, and sales for...Ch. 7 - The units of an item available for sale during the...Ch. 7 - Prob. 5PEBCh. 7 - On the basis of the following data, determine the...Ch. 7 - Prob. 6PEBCh. 7 - Prob. 7PEACh. 7 - During the taking of its physical inventory on...Ch. 7 - Financial statement data for years ending December...Ch. 7 - Financial statement data for years ending December...Ch. 7 - Triple Creek Hardware Store currently uses a...Ch. 7 - Hardcase Luggage Shop is a small retail...Ch. 7 - Prob. 3ECh. 7 - Assume that the business in Exercise 7-3 maintains...Ch. 7 - Beginning inventory, purchases, and sales data for...Ch. 7 - Assume that the business in Exercise 7-5 maintains...Ch. 7 - The following units of an item were available for...Ch. 7 - Prob. 8ECh. 7 - The following units of a particular item were...Ch. 7 - Assume that the business in Exercise 7-9 maintains...Ch. 7 - Assume that the business in Exercise 7-9 maintains...Ch. 7 - Prob. 12ECh. 7 - Prob. 13ECh. 7 - Assume that a firm separately determined inventory...Ch. 7 - Prob. 15ECh. 7 - Based on the data in Exercise 7-15 and assuming...Ch. 7 - Missouri River Supply Co. sells canoes, kayaks,...Ch. 7 - Fonda Motorcycle Shop sells motorcycles, ATVs, and...Ch. 7 - During 2016, the accountant discovered that the...Ch. 7 - The following data (in thousands) were taken from...Ch. 7 - Kroger, Safeway Inc., and Whole Foods Markets,...Ch. 7 - A business using the retail method of inventory...Ch. 7 - A business using the retail method of inventory...Ch. 7 - A business using the retail method of inventory...Ch. 7 - On the basis of the following data, estimate the...Ch. 7 - The merchandise inventory was destroyed by fire on...Ch. 7 - Based on the following data, estimate the cost of...Ch. 7 - Based on the following data, estimate the cost of...Ch. 7 - The beginning inventory at Funky Party Supplies...Ch. 7 - The beginning inventory at Funky Party Supplies...Ch. 7 - The beginning inventory for Funky Party Supplies...Ch. 7 - The beginning inventory for Funky Party Supplies...Ch. 7 - Prob. 5PACh. 7 - Data on the physical inventory of Ashwood Products...Ch. 7 - Selected data on merchandise inventory, purchases,...Ch. 7 - The beginning inventory of merchandise at Dunne...Ch. 7 - The beginning inventory for Dunne Co. and data on...Ch. 7 - The beginning inventory for Dunne Co. and data on...Ch. 7 - The beginning inventory for Dunne Co. and data on...Ch. 7 - Pappas Appliances uses the periodic inventory...Ch. 7 - Data on the physical inventory of Katus Products...Ch. 7 - Selected data on merchandise inventory, purchases,...Ch. 7 - Anstead Co. is experiencing a decrease in sales...Ch. 7 - The following is an excerpt from a conversation...Ch. 7 - Golden Eagle Company began operations in 2016 by...Ch. 7 - Prob. 4CPCh. 7 - Prob. 5CPCh. 7 - Prob. 6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License