Governmental and Nonprofit Accounting (11th Edition)

11th Edition

ISBN: 9780133799569

Author: Robert J. Freeman, Craig D. Shoulders, Dwayne N. McSwain, Robert B. Scott

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 6E

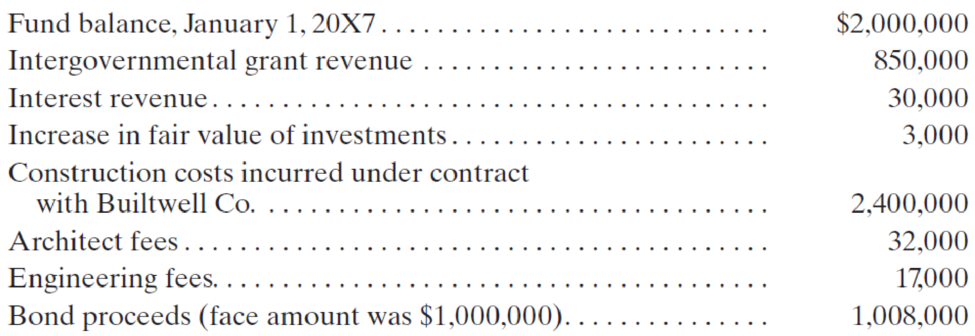

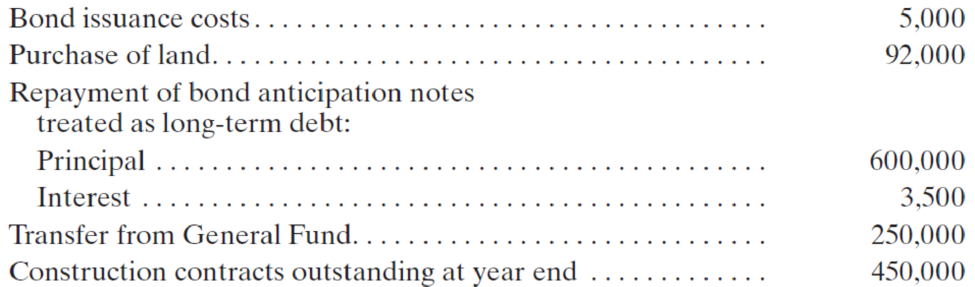

(Statement of Revenues, Expenditures, and Changes in Fund Balance) Prepare a statement of revenues, expenditures, and changes in fund balance for the Ahmed Village Park Improvement Capital Projects Fund for 20X7, given the following information:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following General Fund information is available for the preparation of the financial statements for the City of Eastern Shores for the

year ended September 30, 2024:

Inflow of Financial Resources:

Property taxes

Sales taxes

Fees and fines

Licenses and permits

Intergovernmental

Investment earnings

Proceeds from sale of land

Outflows of Financial Resources:

Current:

General government

Public safety

Public works

Health and sanitation

Culture and recreation

Transfer to capital project fund

Fund balance, October 1, 2023

Revenues:

Taxes:

Total Revenues

Required:

From the information given above, prepare a General Fund Statement of Revenues, Expenditures, and Changes in Fund Balance for

the city of Eastern Shores General Fund for the year ended September 30, 2024.

Note: Negative entries should be entered with a minus sign and will appear in parenthesis.

CITY OF EASTERN SHORES

Statement of Revenues, Expenditures, and Changes in Fund Balance

General fund

For the Year Ended September 30,…

From the information given above, prepare a Water and Sewer Fund column for the proprietary fund Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended December 31, 2020. (Deductions should be entered with a minus sign.)

please do not give images format

Chapter 7 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Ch. 7 - When is a Capital Projects Fund used by a...Ch. 7 - Prob. 2QCh. 7 - What is the life cycle of a Capital Projects Fund?Ch. 7 - Why is each significant capital project usually...Ch. 7 - In what situations could several capital projects...Ch. 7 - Prob. 6QCh. 7 - Prob. 7QCh. 7 - Prob. 8QCh. 7 - Prob. 9QCh. 7 - Prob. 10Q

Ch. 7 - Prob. 11QCh. 7 - Prob. 12QCh. 7 - Which of the following general government capital...Ch. 7 - Budgets for Capital Projects Funds are a. often...Ch. 7 - Which of the following are sometimes reported as...Ch. 7 - Wakefield Heights sold 6,000,000 of general...Ch. 7 - Which of the following statements regarding the...Ch. 7 - Common expenditures in a Capital Projects Fund...Ch. 7 - Prob. 1.7ECh. 7 - In practice, which of the following is false...Ch. 7 - The funding sources for a Capital Projects Fund...Ch. 7 - Prob. 2.2ECh. 7 - When grant resources are received before...Ch. 7 - Bonds are sold to finance the construction of a...Ch. 7 - After restricted and committed levels of fund...Ch. 7 - Which of the following would not be reported on...Ch. 7 - The City of Hope received an unrestricted grant in...Ch. 7 - Expenditures are made in a Capital Projects Fund...Ch. 7 - A GAAP-based Statement of Revenues, Expenditures,...Ch. 7 - Prob. 2.10ECh. 7 - (General Ledger Entries) The following...Ch. 7 - (Long-Term Debt Issuances) Swenson Township issued...Ch. 7 - (Short Discussion and Analysis) Briefly discuss...Ch. 7 - (Statement of Revenues, Expenditures, and Changes...Ch. 7 - (Multiple Choice Problems and Computations)...Ch. 7 - Prob. 2PCh. 7 - (Statement of Revenues, Expenditures, and Changes...Ch. 7 - Prob. 6PCh. 7 - (CPF Journal EntriesBlue Earth County, Montana)...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources. Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year. Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…arrow_forwardPrepare the journal entries necessary for the following transactions. For each transaction you must identify the fund in which the entries are recorded. Make the entries only for the Fund-Based Financial Statements for the fiscal year ended 6/30/2021. 1. The board of commissioners of the Cosmo City adopted a General Fund budget for the year ending June 30, 2021, which indicated revenues of $5,100,000, bond proceeds of $620,000, appropriations of $1,900,000 for salaries, $800,000 for advertising, $400,000 for supplies, and $800,000 for utilities, and also operating transfers out of $980,000. 2. Cosmo City collected $22,000 from parking meters. 3. On March 12, 2021, Cosmo City ordered a new computer at an anticipated cost of $414,000. The computer was received on April 16 with an actual cost of $416,200. Payment was subsequently made on May 15, 2021. 4. Property taxes of 1,800,000 are levied for Cosmo City. The city expects that 5% will be uncollectible. Of the levied amount,…arrow_forwardThe City of Fox is evaluating which of its funds it will present as a major fund in its fund financial statements on December 31, Year 1. The city presents the following partial listing of asset data at December 31, Year 1: Total Governmental Fund Type Assets $ 3,000,000 Total Enterprise Fund Assets 2,000,000 General Fund Assets 280,000 Community Development Special Revenue Fund 290,000 Faberville River Bridge Capital Project Fund 100,000 Faberville Water & Sewer Utility Fund 1,800,000 Faberville Landfill 200,000 Based purely on assets, how many funds should be displayed as major funds? A.) Four B.) Five C.) TWO D.) Threearrow_forward

- Accounting Questionarrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease help with problem Preparation of fund financial statements and schedules Prepare a governmental funds balance sheet; a governmental funds statement of revenues, expenditures, and changes in fund balances; and a General Fund budgetary comparison schedule. In the budgetary comparison schedule, include a column for variances. To ease financial statement preparation, we supply you with the pre-closing trial balances for Croton City’s General Fund, Library Special Revenue Fund, Capital Projects Fund, and Debt Service Fund. Consider all funds as major funds for this exercise and classify the fund balance for the Debt Service Fund as Assigned fund balance. In addition, make calculations to determine which of the funds would be considered as nonmajor if Croton had not considered all of them to be major. Preclosing Trial Balance for Croton City General Fund December 31, 2019 Debits Credits Budgetary Accounts Estimated revenues – property taxes $9,000 Estimated…arrow_forward

- Prepare the Balance Sheet for the Debt Service fund for the Village of Earl as of June 30, 2020 using the trial balance provided below: Account Title Cash Matured Notes Payable Matured Interst Payable Estimated other Financing Sources Estimated Revenues Appropriations Budgetary Fund Balance Revenues Financial Statement Expenditures-Debt Service Principal Expenditures-Debt Service Interest Village of Earl Debt Service Fund Adjusted Trial Balance 6/30/2020 Other Financing Sources-Transfer from General Fund Other Financing Sources-Transfer from Capital Project Fund Debit $22,000 10,000 18,000 20,000 7,600 $77,600 Credit 10,000 3,600 27,600 400 20,000 10,000 6,000 $77,600arrow_forwardPrepare entries in general journal form to record the following transactions in the Roadway Fund general ledger accounts for City of Kettering for the fiscal year 2018. Use modified accrual accounting. At the beginning of the fiscal year, the fund $1,360,000 was offset by the assigned fund balance in the same amount. The city was awarded $4,200,000 for road inspections and repairs during the year. The award requires reimbursement for expenditures, not an allotment upfront. Work contracted for the year amounted to $4,175,000. Invoices received for the work performed totaled $4,150,000. $3,980,000 of that amount was paid in cash as of year-end. The state reimbursed the city $4,000,000 for the completed work before year-end. Prepare a statement of Revenues, Expenditures, and Changes in Fund Balance for the Roadway Fund.arrow_forwardPreparation of governmental funds balance sheet Ted's Village has five governmental funds: a General Fund, a Debt Service Fund, and three Special Revenue Funds. It has no proprietary funds. The following information is available at December 31, 2022 for each of the funds. Debt Special Revenue Fund A General Service Fund B Fund C Cash $20,000 $10,000 $1,200 $600 $1,400 Taxes receivable 10,000 4,000 Accounts payable 12,000 400 200 800 Assigned fund balance 2,000 800 400 600 Restricted fund balance 14,000 Unassigned fund balance 16,000 Total revenues 104,000 12,000 4,800 2,400 6,800 Total expenditures 96,000 10,000 4,600 2,200 6,400 a) Identify which of the funds are major funds as defined in GASB Statement No. 34, amended by GASB Statement No. 37. General Fund Debt Service Fund Special Revenue Fund A Special Revenue Fund B Special Revenue Fund Carrow_forward

- The City of Algonquin maintains its books to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: Deferred inflows of resources—property taxes of $73,500 at the end of the previous fiscal year were recognized as property tax revenue in the current year's Statement of Revenues, Expenditures, and Changes in Fund Balance. The City levied property taxes for the current fiscal year in the amount of $13,789,400. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $309,200 is thought to be uncollectible, $365,000 would likely be collected during the 60-day period after the end of the fiscal year, and $52,800 would be collected after that time. The City had recognized the maximum of property taxes allowable under modified accrual accounting. In addition to the expenditures…arrow_forwardPrepare a statement of Revenues, Expenditures, and changes in fund balance for the governemental funds ( the General Fund and special revenue fund financial statements have already been prepared).arrow_forwardAssume the following information was derived from the fund financial statements prepared by the city of Tallahassee, Florida for the fiscal year ended September 30, 2019: City of Tallahassee General Fund City of Tallahassee General Fund Statement of Revenues, Expenditures, and Changes in Fund Balance Balance Sheet (in thousands) Assets: Cash and cash equivalents $2,480 Due from other governments All other assets 11,848 Total assets $14,328 Liabilities: Total current liabilities $11,287 Fund balance: Nonspendable 1,500 Committed 0 Assigned 0 Unassigned 1,541 Total fund balance 3,041 Total liabilities and fund balance $14,328 (in thousands) Total revenues $109,901 Total expenditures 164,473 Excess of revenues over (under) expenditures 54,572 Other financing sources (uses): Transfers in 49,597 Transfers out -21,522 Proceeds from sale of capital assets 430 Total other financing sources (uses) 28,505 Net change in fund balance -26,067 Fund balance, October 1, 2019 Fund balance, September…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License