Concept explainers

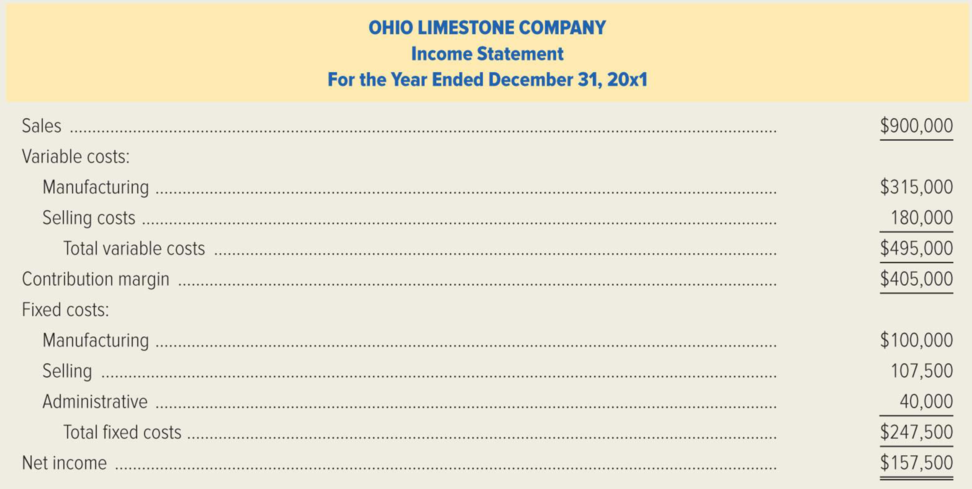

Ohio Limestone Company produces thin limestone sheets used for cosmetic facing on buildings. The following income statement represents the operating results for the year just ended. The company had sales of 1,800 tons during the year. The manufacturing capacity of the firm’s facilities is 3,000 tons per year. (Ignore income taxes.)

Required:

- 1. Calculate the company’s break-even volume in tons for 20x1.

- 2. If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts, what is the net income that management can expect for 20x2?

- 3. Ohio Limestone has been trying for years to get a foothold in the European market. The company has a potential German customer that has offered to buy 1,500 tons at $450 per ton. Assume that all of the firm’s costs would be at the same levels and rates as in 20x1. What net income would the firm earn if it took this order and rejected some business from regular customers so as not to exceed capacity?

- 4. Ohio Limestone plans to market its product in a new territory. Management estimates that an advertising and promotion program costing $61,500 annually would be needed for the next two or three years. In addition, a $25 per ton sales commission to the sales force in the new territory, over and above the current commission, would be required. How many tons would have to be sold in the new territory to maintain the firm’s current net income? Assume that sales and costs will continue as in 20x1 in the firm’s established territories.

- 5. Management is considering replacing its labor-intensive process with an automated production system. This would result in an increase of $58,500 annually in fixed

manufacturing costs . The variable manufacturing costs would decrease by $25 per ton. Compute the new break-even volume in tons and in sales dollars. - 6. Ignore the facts presented in requirement (5). Assume that management estimates that the selling price per ton would decline by 10 percent next year. Variable costs would increase by $40 per ton, and fixed costs would not change. What sales volume in dollars would be required to earn a net income of $94,500 next year?

1.

Calculate the O Limestone Company’s break-even volume in tons for 20x1.

Explanation of Solution

Break-Even Point: It is the point of sales at which entity neither earns a profit nor suffers a loss. It can also be said that the point of sales at which sales value of the entity recovers the entire cost of fixed and variable nature is called break-even point.

Calculate break-even volume in tons.

2.

Calculate the net income, if the sales volume is estimated to be 2,100 tons in the next year and costs stay at the same levels.

Explanation of Solution

Net income: The bottom line of income statement which is the result of excess of earnings from operations (revenues) over the costs incurred for earning revenues (expenses) is referred to as net income.

Calculate the projected net income.

| Particulars | Amount ($) |

| Projected contribution margin (1) | $472,500 |

| Projected fixed costs | 247,500 |

| Projected net income | $225,000 |

Table (1)

Working Notes:

(1) Calculate the projected contribution margin.

3.

Compute the net income, if the order is taken and rejected some business from regular customers so as not to exceed capacity.

Explanation of Solution

Compute the net income.

Step 1: Compute the contribution margin.

| Particulars | Amount ($) | Amount ($) |

| Sales in tons | 1,500 | 1,500 |

| Contribution margin per ton: | ||

| Foreign order (2) | ×$175 | |

| Regular sales (3) | × $225 | |

| Total contribution margin | $262,500 | $337,500 |

Table (2)

Working Notes:

(2) Calculate the foreign order.

(3) Calculate the regular sales.

(4) Calculate the variable cost per ton.

(5) Calculate the sales price per ton for regular orders.

Step 2: Compute the net income.

| Particulars | Amount ($) |

| Contribution margin on foreign order | $262,500 |

| Contribution margin on regular sales | 337,500 |

| Total contribution margin | $600,000 |

| Fixed costs | 247,500 |

| Net income | $352,500 |

Table (3)

4.

Calculate the number of tons to sell in the new territory to maintain the firm’s current net income.

Explanation of Solution

O Limestone Company needs to break even on sales in the new territory, to maintain its current net income. So, calculate the break-even point as given below:

Hence, the number of tons to sell in the new territory to maintain the firm’s current net income would be 307.5 tons.

5.

Calculate the new break-even volume in tons and sales dollars, if fixed manufacturing costs increases by $58,500 and variable manufacturing costs decreases by $25 per ton.

Explanation of Solution

Calculate the break-even point in tons.

Calculate the break-even point in sales dollars.

6.

Calculate the sales volume in dollars to earn a net income of $94,500 next year, if selling price per ton decreases by 10 percent next year and variable cost increases by $40 per ton; fixed cost would not change.

Explanation of Solution

Variable cost: A variable cost is the cost that proportionately changes with the changes in the activity base such as units of production.

Fixed Cost: It is the cost that remains constant in total dollar amount irrespective to the changes in the activity base such as units of production.

Calculate the sales volume in dollars to earn a net income of $94,500 next year.

Step 1: Calculate the new contribution margin ratio.

Working note:

(1) Calculate new contribution margin.

Step 2: Calculate the sales volume in dollars.

Hence, the sales volume in dollars to earn a net income of $94,500 next year is $1,140,000.

Want to see more full solutions like this?

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Hello tutor please provide this question solution general accountingarrow_forwardTriton Manufacturing had a beginning finished goods inventory of $23,500 and an ending finished goods inventory of $21,000 during FY 2023. Beginning work-in-process was $19,500 and ending work-in-process was $18,000. Factory overhead was $28,600. The total manufacturing costs amounted to $298,000. Use this information to determine the FY 2023 Cost of Goods Sold. (Round enter as whole dollars only.)arrow_forwardprovide correct answer accountingarrow_forward

- Answerarrow_forwardHow much is Samuels disposable income?arrow_forwardTriton Manufacturing had a beginning finished goods inventory of $23,500 and an ending finished goods inventory of $21,000 during FY 2023. Beginning work-in-process was $19,500 and ending work-in-process was $18,000. Factory overhead was $28,600. The total manufacturing costs amounted to $298,000. Use this information to determine the FY 2023 Cost of Goods Sold. (Round enter as whole dollars only.) Provide answerarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education