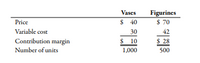

Parker Pottery produces a line of vases and a line of ceramic figurines. Each line uses the same

equipment and labor; hence, there are no traceable fixed costs. Common fixed cost equals

$30,000. Parker’s accountant has begun to assess the profitability of the two lines and has gathered the following data for last year:

Required:

1. Compute the number of vases and the number of figurines that must be sold for the

company to break even.

2. Parker Pottery is considering upgrading its factory to improve the quality of its products.

The upgrade will add $5,260 per year to total fixed cost. If the upgrade is successful, the

projected sales of vases will be 1,500, and figurine sales will increase to 1,000 units. What

is the new break-even point in units for each of the products?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- A local company has two machines for producing wrenches. Each machine requires a full- time operator - regardless of production - specialized on that machine. The operator for Machine A costs $75,000 a year in fixed costs in salary and benefits. The operator for Machine B costs $62,000 a year in fixed costs in salary and benefits. The production costs of Machine A is $16. B is $20. (a) if the wrenches sell for $28, find the break-even point of each machine. (b) at what level of production do the two production machines cost the same. ( Answer it in excel)arrow_forward1.what is the cost pf lobor required to operate the production line per month 2.If you require astorage area of 600 sq.ft and with an average rent $12 per sq.ft/month what is the estimated cost of rent per month for the production line including the storage area.(Rounded to the nearest $1000). 3.how many operators do you need for the production line. 4. what is the cost of buying and installing the production line.arrow_forwardBridgeport Racers makes bicycles. It has always purchased its bicycle tires from the Cullumber Tires at $26 each but is currently considering making the tires in its own factory. The estimated costs per unit of making the tires are as follows: Direct materials $9 Direct labor $5 Variable manufacturing overhead $8 The company’s fixed expenses would increase by $73,000 per year if managers decided to make the tire.(a1) Calculate total relevant cost to make or buy if the company needs 11,300 tires a year. Make Buy Total relevant cost $enter a dollar amount $enter a dollar amount (a2) Ignoring qualitative factors, if the company needs 11,300 tires a year, should it continue to purchase them from Balyo or begin to produce them internally? The company select an option should not continueshould continue to purchase the tires.arrow_forward

- Roadside Inc. manufactures the Megalite, and is reviewing the product's cost structure. Accounting records show these costs:factory space: $250,000 per yearinsurance: $47,000 per yearsupervisor salaries: $125,000 per yearmaterials: $5.00 per lampdirect labor: $2.69 per lamprecycling charge: $0.37 per lampRoadside Inc sells the Megalite to wholesalers for $13.69 each. Calculate Roadside's contribution margin as percent of selling price on the Megalite. (Rounding: tenth of a percent. Report 25.3%, for example, as "25.3".)arrow_forwardRacer Industries has fixed costs of $900,000. The selling price per unit is $250, and the variable cost per unit is $130. Required: a. How many units must Racer sell in order to break even? units b. How many units must Racer sell in order to earn a profit of $480,000? units c. A new e Accounting numeric field dustries sponsor a 10K marathon as a form of advertising. The cost to sponsor the event is $7,200. How many more units must be sold to cover this cost? unitsarrow_forwardUrmila benarrow_forward

- Hoi Chong Transport, Limited, operates a fleet of delivery trucks in Singapore. The company has determined that if a truck is driven 162,000 kilometers during a year, the average operating cost is 13.2 cents per kilometer. If a truck is driven only 108,000 kilometers during a year, the average operating cost increases to 16.6 cents per kilometer. Required: 1. Using the high-low method, estimate the variable operating cost per kilometer and the annual fixed operating cost associated with the fleet of trucks. 2. Express the variable and fixed costs in the form Y = a + bX. 3. If a truck were driven 135,000 kilometers during a year, what total operating cost would you expect to be incurred? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Variable cost Fixed cost Required 3 Using the high-low method, estimate the variable operating cost per kilometer and the annual fixed operating cost associated with the fleet of trucks. (Do not round your…arrow_forwardElroy Racers makes bicycles. It has always purchased its bicycle tires from the M. Wilson Tires at $25 each but is currently considering making the tires in its own factory. The estimated costs per unit of making the tires are as follows: Direct materials $8 Direct labor $5 Variable manufacturing overhead $7 The company’s fixed expenses would increase by $60,000 per year if managers decided to make the tire.(b)What qualitative factors should Elroy Racers consider in making this decision?arrow_forwardMorning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-1,900 units, and monthly production costs for the production of 1,600 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Suppose it sells each birdbath for $24. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,800 units.arrow_forward

- Deluxe Homes is a residential Home Builder. Based on their current production of 300 homes per year, they currently make a profit of $20,000 per unit, based on the following costs per unit: Direct labor $ 20,000 Direct materials 200,000 Variable overhead 30,000 Fixed overhead 40,000 Variable selling costs 10,000 Fixed selling costs 10,000 Total costs per unit $310,000 Required Each of these are separate situations: A. Prepare an income statement based on the information provided. B. What is the profit and cost per unit if production is increased to 400 homes per year, and there is an increase of $1.50 million in total fixed overhead costs?arrow_forwardBig Chill, Inc. sells portable dehumidifier units at $193. Unit variable costs are $110. Fixed costs are $4,175,000. Management has set a profit objective of 15.1% return on sales. Calculate the sales volume in dollars that will provide a 15.1% return on sales. Round your answer to the nearest dollar .arrow_forwardMuspest Supplies is currently evaluating the cost of manufacturing some of the components utilised in their products. Currently the company expects to need 6 000 parts each month. A supplier of the part has been identified and the total cost of purchasing the parts on a monthly basis would be $97 000. In analysing the part costs, the direct labour and materials cost would be $64 000 and the variable overheads would be $22 000.Based only on the relevant cost per unit, which would be the preferred option of Muspest Supplies?HD EDUCATIONA. Unit costs to produce the part would be $14.33 with the unit cost to purchase of $ 16.17. In this case, the best option would be to commence purchasing the part.B. Unit costs to produce the part would be $10.67 with the unit cost to purchase of $ 16.17. In this case, the best option would be to continue to make the part.C. None of the other answers D. Unit costs to produce the part would be $14.33 with the unit cost to purchase of $ 16.17. In this case,…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education