Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 22EP

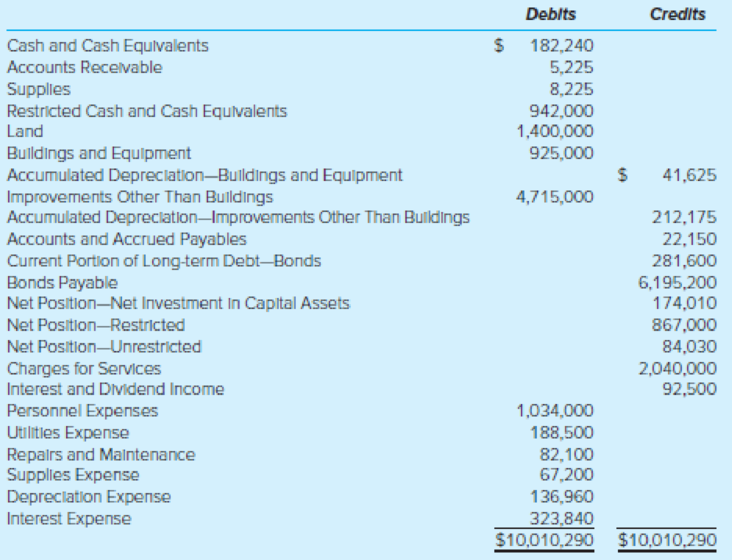

Tribute Aquatic Center Enterprise Fund. (LO7-5) The City of Saltwater Beach established an enterprise fund two years ago to construct and operate Tribute Aquatic Center, a public swimming pool. The pool was completed and began operations last year. All costs, including repayment of debt, are to be paid by user fees. The fund’s preclosing

Additional information concerning the Tribute Aquatic Center Fund follows.

- 1. All bonds payable were used to acquire property, plant, and equipment.

- 2. Each year a payment is required on January 1 to retire an equal portion of the bonds payable.

- 3. Equipment was sold for cash at its carrying value of $9,250.

- 4. Total cash received from customers was $2,038,355 and cash received for interest and dividends was $92,500; of this amount, $75,000 was restricted cash. There were no other changes to restricted cash during the year.

- 5. Cash payments included $1,038,800 for personnel expenses, $185,800 for utilities, $86,225 for repairs and maintenance, $323,840 for interest on bonds, and $65,900 for supplies.

- 6. The beginning balance in Cash was $99,300,

Accounts Receivable was $3,580, Supplies was $9,525, and Accounts and Accrued Payables was $28,375. Accrued Payables include personnel expenses, utilities, and repairs and maintenance. - 7. The net position categories shown on the preclosing trial balance have not been updated to reflect correct balances at year-end.

Required

- a. Prepare the statement of revenues, expenses, and changes in fund net position for the Tribute Aquatic Center for the year just ended.

- b. Prepare the statement of net position for the Tribute Aquatic Center at year-end.

- c. Prepare the statement of

cash flows for the Tribute Aquatic Center at year-end.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The General Fund of the Town of Mashpee transfers $115,000 to the debt service fund for a

$100,000 principal and $15,000 interest payment. The recording of this transaction would include:

a. A debit to Interest Expenditures in the General Fund.

b. A debit to Interest Expenditures in the governmental activities accounts.

c. A credit to Other Financing Sources - Interfund Transfers In in the debt service fund only.

d. A credit to Other Financing Sources - Interfund Transfers In in both the debt service fund and

governmental activities accounts.

Harrison City operates a water utility fund as an enterprise fund. You are provided with the following information for year 2021:

1. The beginning net position balances are net investment in capital assets, S650,000; restricted, S8,000; and unrestricted, S480,000.

2. Bonds in the amount of $200,000 were issued and immediately used to acquire capital assets from the bond proceeds at a cost of $200,000. At the end of year,

depreciation on the assets was $10,000. The enterprise fund also had paid back $40,000 of the debt principal.

3. Cash receipts for customer deposits totaled S3,000 for the year.

4. Additional depreciation totaled S12,000.

5. Net income for year 2021 was $300,000 (Note: this amount includes any item that needs to be included in net income from 2. to 4. above)

Required:

Compute the following items as of December 31, 2021:

1. Net position - net investment in capital assets

2. Net position

restricted

3. Net position ---

unrestricted

A city is building a new park. To finance the

construction of the park, the city will issue a

$1,800,000 bond, and receive a transfer of

$200,000 from the general

Please record the journal entries for the Capital

Project Fund and the Government-Wide financial

statements.

1. The city signed a contract with a construction

company to construct the park for $2,000.000.

2. The $1.800.000 bonds were issued at par.

3. The construction company billed the city for

$2,000,000 upon completion of the project.

4. The park is completed.

Chapter 7 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 7 - Prob. 1QCh. 7 - Explain the reporting requirements for internal...Ch. 7 - A member of the city commission insists that the...Ch. 7 - Prob. 4QCh. 7 - What is the purpose of the Restricted Assets...Ch. 7 - Prob. 6QCh. 7 - Prob. 7QCh. 7 - When do GASB standards require interfund...Ch. 7 - Prob. 9QCh. 7 - What is meant by segment information for...

Ch. 7 - Prob. 11QCh. 7 - Internal Service Fund Reporting. (LO7-2) Financial...Ch. 7 - Proprietary Fund Operating Statement. (LO7-1)...Ch. 7 - Enterprise Fund Golf Course Management. (LO7-1)...Ch. 7 - Prob. 17.1EPCh. 7 - Which of the following would most likely be...Ch. 7 - Under GASB standards, the City of Parkview is...Ch. 7 - Prob. 17.4EPCh. 7 - Which of the following events would generally be...Ch. 7 - Proprietary funds a. Are permitted to integrate...Ch. 7 - Prob. 17.7EPCh. 7 - Prob. 17.8EPCh. 7 - Prob. 17.9EPCh. 7 - Prob. 17.10EPCh. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - Prob. 18EPCh. 7 - Prob. 19EPCh. 7 - Central Garage Internal Service Fund. (LO7-2) The...Ch. 7 - Internal Service Fund Statement of Cash Flows....Ch. 7 - Tribute Aquatic Center Enterprise Fund. (LO7-5)...Ch. 7 - Net Position Classifications. (LO7-5) During the...Ch. 7 - Central Station Enterprise Fund. (LO7-5) The Town...Ch. 7 - Enterprise Fund Journal Entries and Financial...Ch. 7 - Net Position Classifications. (LO7-5) The Village...Ch. 7 - Enterprise Fund Statement of Cash Flows. (LO7-5)...Ch. 7 - AppendixSolid Waste Enterprise Fund. (LO7-6) Brown...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Falmouth City owns and operates a mini-bus system which it accounts for in an enterprise fund. Prepare journal entries to record the following transactions, which occurred in a recent year. a) The mini-bus system issued $5 million of 8 percent revenue bonds at par and used the proceeds to acquire new mini-buses. b) As required by the bond covenant, the system set aside 1 percent of the gross bond proceeds for repair contingencies. c) The system accrued 6 months interest on the revenue bonds at year-end. d) The system incurred $30,000 of repair costs and paid for them with cash set aside for repair contingenciesarrow_forward5. 2. The City of Paradise issued Bonds of $1,250,000 for the Construction of a City Hall. The City Hall’s bonds are sold at a premium of $150,000; therefore the estimated cost of the Hall is $1,100,000. Required: a. Prepare general journal entries to record the issue of the bonds by General Fund. b. Prepare general journal entries to transfer the premium amount to the debt service fund.arrow_forwardOn April 1, 2020, the City purchased a swimming pool from a private operator for $500,000 and created a Swimming Pool (Enterprise) Fund. The city has a calendar year as its fiscal year. During the year ended December 31, 2020, the following transactions occurred related to the City’s Swimming Pool Fund: On April 1, 2020, $300,000 was provided by a one-time contribution from the General Fund, and $200,000 was provided by a loan from a local bank (secured by a note), both of which were received in cash. The loan (Notes Payable) has an annual interest rate of 5%, payable semiannually on October 1 and April 1. The purchase of the pool was recorded (paid in cash). Based on an appraisal, it was decided to allocate $100,000 to the land, $300,000 to improvements other than buildings (the pool), and $100,000 to the building. Charges for services amounted to $270,000, all received in cash. Salaries paid to employees amounted to $172,500, all paid in cash, of which $100,000 was cost of services…arrow_forward

- Prepare journal entries for a local government to record the following transactions, first for fund financial statements and then for government-wide financial statements.a. The government sells $900,000 in bonds at face value to finance construction of a warehouse.b. A $1.1 million contract is signed for construction of the warehouse. The commitment is required, if allowed.c. A $130,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a).d. Equipment for the fire department is received with a cost of $12,000. When it was ordered, an anticipated cost of $11,800 had been recorded.e. Supplies to be used in the schools are bought for $2,000 cash. The consumption method is used.f. A state grant of $90,000 is awarded to supplement police salaries. The money will be paid to reimburse the government after the supplement payments have been made to the police officers.g. Property tax assessments are mailed to citizens of the government. The total assessment is…arrow_forwardPrepare journal entries for a local government to record the following transactions, first for fund financial statements and then for government-wide financial statements. The government sells $900,000 in bonds at face value to finance construction of a warehouse. A $1.1 million contract is signed for construction of the warehouse. The commitment is required, if allowed. A $130,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a). Equipment for the fire department is received with a cost of $12,000. When it was ordered, an anticipated cost of $11,800 had been recorded. Supplies to be used in the schools are bought for $2,000 cash. The consumption method is used. A state grant of $90,000 is awarded to supplement police salaries. The money will be paid to reimburse the government after the supplement payments have been made to the police officers. Property tax assessments are mailed to citizens of the government. The total assessment is $600,000,…arrow_forwardThis year Riverside began work on an outdoor amphitheater and concession stand at the city's park. It is to be financed by a $3,500,000 bond issue and supplemented by a $500,000 General Fund transfer. The following transactions occurred during the current year: 1.The General Fund transferred $500,000 to the Park Building Capital Projects Fund (hint: credit "Other Financing Sources-Interfund Transfers In" for $500,000). 2.A contract was signed with Restin Construction Company for the major part of the project on a bid of $2,700,000. 3.Preliminary planning and engineering costs of $69,000 were vouchered for e Great Pacific Engineering Company. (This cost had not been encumbered, therefore, we do not need the reverse journal entries for encumbrances, but we need to record expenditures and liability for this cost in the capital projects fund.) 4.An invoice in the amount of $1,000,000 was received from Restin for progress to date on the project. 5.The $3,500,000 bonds were issued at par.…arrow_forward

- Ibri township issued the following bonds during the year. The bond issued to purchase equipment for vehicle repair service that is accounted for in an internal service fund RO 30,000, The bonds issued to construct a new city hall RO 10,000 The bonds issued to improve its water utility, which is accounted for in an enterprise fund RO 50,000. The amount of bond issued to be reported in the general fund is a. RO 10,000 b. RO 50,000 c. None of the options d. RO 30,000arrow_forwardThe City of Jonesboro engaged in the following transactions during the fiscal year ended September 30, 2018. Record the following transactions related to interfund transfers. Be sure to indicate in which fund the entry is being made. a. The city transferred $400,000 from the general fund to a debt service fund to make the interest payments due during the fiscal year. The payments due during the fiscal year were paid. The city also transferred $200,000 from the general fund to a debt service fund to advance-fund the $200,000 interest payment due October 15, 2019. b. The city transferred $75,000 from the Air Operations Special Revenue Fund to the general fund to close out the operations of that fund. c. The city transferred $150,000 from the general fund to the city’s Electric Utility Enterprise Fund to pay for the utilities used by the general and administrative offices during the year. d. The city transferred the required pension contribution of $2 million from the general fund to the…arrow_forwardA city transfers cash of $90,000 from its general fund to start construction on a police station. The city issues a bond at its $1.8 million face value. The police station is built for a total cost of $1.89 million. a. Prepare all necessary journal entries for these transactions for both fund and government-wide financial statements. Assume that the city does not record the commitment for this construction. (Select the appropriate fund for each situation when required. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollar, not in millons.)arrow_forward

- 1. Employees of the General Fund of Scott City earn ten days of vacation for each 12 months of employment. The City permits employees to carry the vacation days forward as long as they wish. During the current year employees earned $800,000 of vacation benefits, of which the City estimates that $500,000 will be taken in the next year and the balance will be carried forward. Assuming that the City maintains its books and records in a manner that facilitates the preparation of its fund financial statements, which of the following entries is the correct entry in the General Fund to record the vacation pay earned during the current period? a. Debit Expenditures $800,000; Credit Vacation Pay Payable $800,000. b. Debit Expenditures $500,000; Credit Vacation Pay Payable $500,000. c. Debit Vacation Expense $800,000; Credit Vacation Pay Payable $800,000. d. No entry required. 2.Employees of the General Fund of Scott City earn ten days of vacation for each 12 months of employment. The City…arrow_forwardThe City of Touchstone issued $1,000,000 general obligation bonds at 102 to build a new community center. As part of the bond issue, the city also paid a $2,500 underwriter fee and $4,000 in debt issue costs. What amount should the City of Touchstone report as other financing sources? From Governmental Non-Profit Accounting Classarrow_forwardRose City formally integrates budgetary accounts into its general fund. During the year ended December 31, 2019, Rose received a state grant to buy a bus and an additional grant for bus operation in 2019. In 2019, only 90% of the capital grant was used for the bus purchase, but 100% of the operating grant was disbursed. Rose has incurred the following long-term obligations:a. General obligation bonds issued for the water and sewer fund which will service the debt.b. Revenue bonds to be repaid from admission fees collected from users of the municipal recreation center.These bonds are expected to be paid from enterprise funds and are secured by Rose’s full faith, credit, and taxing power as further assurance that the obligations will be paid. Rose’s 2019 expenditures from the general fund include payments for structural alterations to a firehouse and furniture for the mayor’s office.In Rose’s general fund balance sheet presentation at December 31, 2019, which of the following…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License