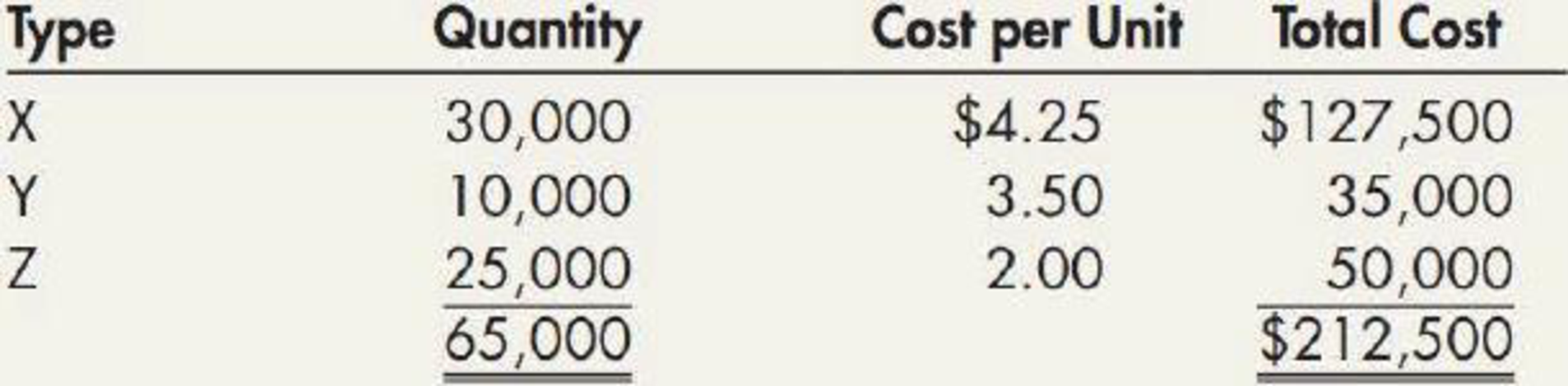

Webster Company adopted do liar-value LIFO on January 1, 2019. Webster produces three products: X, Y, and Z. Webster’s beginning inventory consisted of the following:

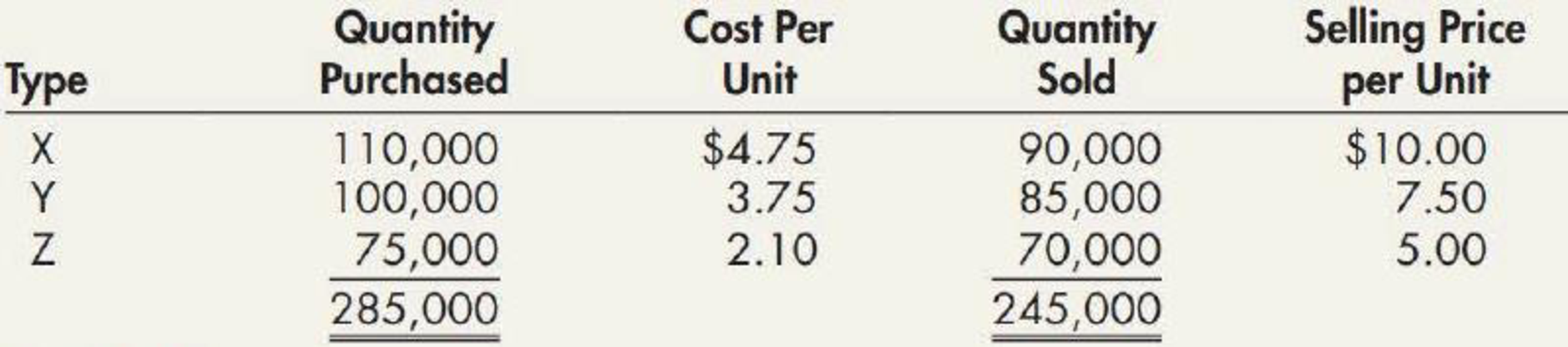

During 2019, Webster had the following purchases and sales:

Required:

- 1. Compute the LIFO cost of the ending inventory assuming Webster uses a single inventory pool. Round cost index to 4 decimal places.

- 2. Compute the LIFO cost of the ending inventory assuming Webster uses three inventory pools. Round cost indexes to 4 decimal places.

1.

Calculate the ending inventory for LIFO cost if single inventory pool is used.

Explanation of Solution

Cost index:

Cost index refer to the index which relates the inventory cost of current year with the base year. The cost index is usually prepared with a sample from the total inventory.

Double-extension method:

Under the double-extension method of cost index, the ending inventory of the current year are valued at the current year costs and related with the base year’s cost.

Calculate the ending inventory in units:

| Particulars | Product X | Product Y | Product Z |

| Beginning inventory | 30,000 | 10,000 | 25,000 |

| Add: Net Purchases | 110,000 | 100,000 | 75,000 |

| Units available for sale | 140,000 | 110,000 | 100,000 |

| Less: Sales | (90,000) | (85,000) | (70,000) |

| Ending inventory | 50,000 | 25,000 | 30,000 |

Table (1)

Calculate the cost index:

Cost Index = Ending inventory at Current year costEnding inventory at Base year cost×100=(50,000×$4.75)+(25,000×$3.75)+(30,000×$2.10)(50,000×$4.25)+(25,000×$3.50)+(30,000×$2.00)×100=$394,250$360,000×100=109.5139

Calculate the ending inventory at the Base year cost:

Ending inventory atBase year cost} = 100Cost Index×Ending inventory at Current year cost=100109.5139×$394,250=$360,000 rounded

Calculate the increase in inventory at the Base year cost:

Increase in inventoryat Base year cost} = $360,000−$212,500=$147,500

Calculate the layer increase in inventory at the Current year cost:

Layer increase atcurrent year cost} = $147,500×109.5139100=$161,533 rounded

Calculate the LIFO ending inventory cost:

LIFO Endinginventory cost} = $212,500+$161,533=$374,033

Thus, the ending inventory for LIFO cost if single inventory pool is used is $374,033.

2.

Calculate the ending inventory for LIFO cost if three inventory pools are used.

Explanation of Solution

Calculate the cost index for Product X:

Cost Index = Ending inventory at Current year costEnding inventory at Base year cost×100=(50,000×$4.75)(50,000×$4.25)×100=$237,500$212,500×100=111.7647

Calculate the ending inventory at the Base year cost for Product X:

Ending inventory atBase year cost} = 100Cost Index×Ending inventory at Current year cost=100111.7647×$237,500=$212,500 rounded

Calculate the increase in inventory at the Base year cost for Product X:

Increase in inventoryat Base year cost} = $212,500−$127,500=$85,000

Calculate the layer increase in inventory at the Current year cost for Product X:

Layer increase atcurrent year cost} = $85,000×111.7647100=$95,000 rounded

Calculate the LIFO ending inventory cost for Product X:

LIFO Endinginventory cost} = $127,500+$95,000=$222,500

Thus, the ending inventory for LIFO cost for Product X if three inventory pools are used is $222,500.

Calculate the cost index for Product Y:

Cost Index = Ending inventory at Current year costEnding inventory at Base year cost×100=(25,000×$3.75)(25,000×$3.50)×100=$93,750$87,500×100=107.1429

Calculate the ending inventory at the Base year cost for Product Y:

Ending inventory atBase year cost} = 100Cost Index×Ending inventory at Current year cost=100107.1429×$93,750=$87,500 rounded

Calculate the increase in inventory at the Base year cost for Product Y:

Increase in inventoryat Base year cost} = $87,500−$35,000=$52,500

Calculate the layer increase in inventory at the Current year cost for Product Y:

Layer increase atcurrent year cost} = $52,500×107.1429100=$56,252 rounded

Calculate the LIFO ending inventory cost for Product Y:

LIFO Endinginventory cost} = $35,000+$56,252=$91,252

Thus, the ending inventory for LIFO cost for Product Y if three inventory pools are used is $91,252.

Calculate the cost index for Product Z:

Cost Index = Ending inventory at Current year costEnding inventory at Base year cost×100=(30,000×$2.10)(30,000×$2.00)×100=$63,000$60,000×100=105

Calculate the ending inventory at the Base year cost for Product Z:

Ending inventory atBase year cost} = 100Cost Index×Ending inventory at Current year cost=100105×$63,000=$60,000 rounded

Calculate the increase in inventory at the Base year cost for Product Z:

Increase in inventoryat Base year cost} = $60,000−$50,000=$10,000

Calculate the layer increase in inventory at the Current year cost for Product Z:

Layer increase atcurrent year cost} = $10,000×105100=$10,500

Calculate the LIFO ending inventory cost for Product Z:

LIFO Endinginventory cost} = $50,000+$10,500=$60,500

Thus, the ending inventory for LIFO cost for Product Z if three inventory pools are used is $60,500.

Calculate the LIFO ending inventory cost:

Ending Inventory = Product X + Product Y+ Product Z= $222,500+$91,252+$60,500=$374,252

Thus, the ending inventory for LIFO cost if three inventory pools are used is $374,252.

Want to see more full solutions like this?

Chapter 7 Solutions

Intermediate Accounting: Reporting And Analysis

- General accounting and questionarrow_forwardCalculate the labor variance? General accountingarrow_forwardA firm sells 2,800 units of an item each year. The carrying cost per unit is $3.26 and the fixed costs per order are $74. What is the economic order quantity? (Please round units to the nearest whole number) need help mearrow_forward

- Calculate the labor variance?arrow_forwardFinancial accounting questionarrow_forwardDuring FY 2005 T-REX Manufacturing had total manufacturing costs are $418,000. Their cost of goods manufactured for the year was $448,000. The January 1, 2006 balance of the Work-in-Process Inventory is $49,000. Use this information to determine the dollar amount of the FY 2005 beginning Work-in-Process Inventory. Answerarrow_forward

- Cooper Audio Systems produces car sound systems. Estimated sales (in units) are 45,000 in April, 38,000 in May, and 36,500 in June. Each unit is priced at $75. Cooper wants to have 40% of the following month's sales in ending inventory. That requirement was met on April 1. Each sound system requires 4 speakers and 10 feet of wiring. Speakers cost $6 each, and wiring is $0.50 per foot. Cooper wants to have 25% of the following month's production needs in ending raw materials inventory. On April 1, Cooper had 30,000 speakers and 95,000 feet of wire in inventory. What is Cooper's expected sales revenue for May?arrow_forwardGeneral accounting questionarrow_forwardNeed answerarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College