Concept explainers

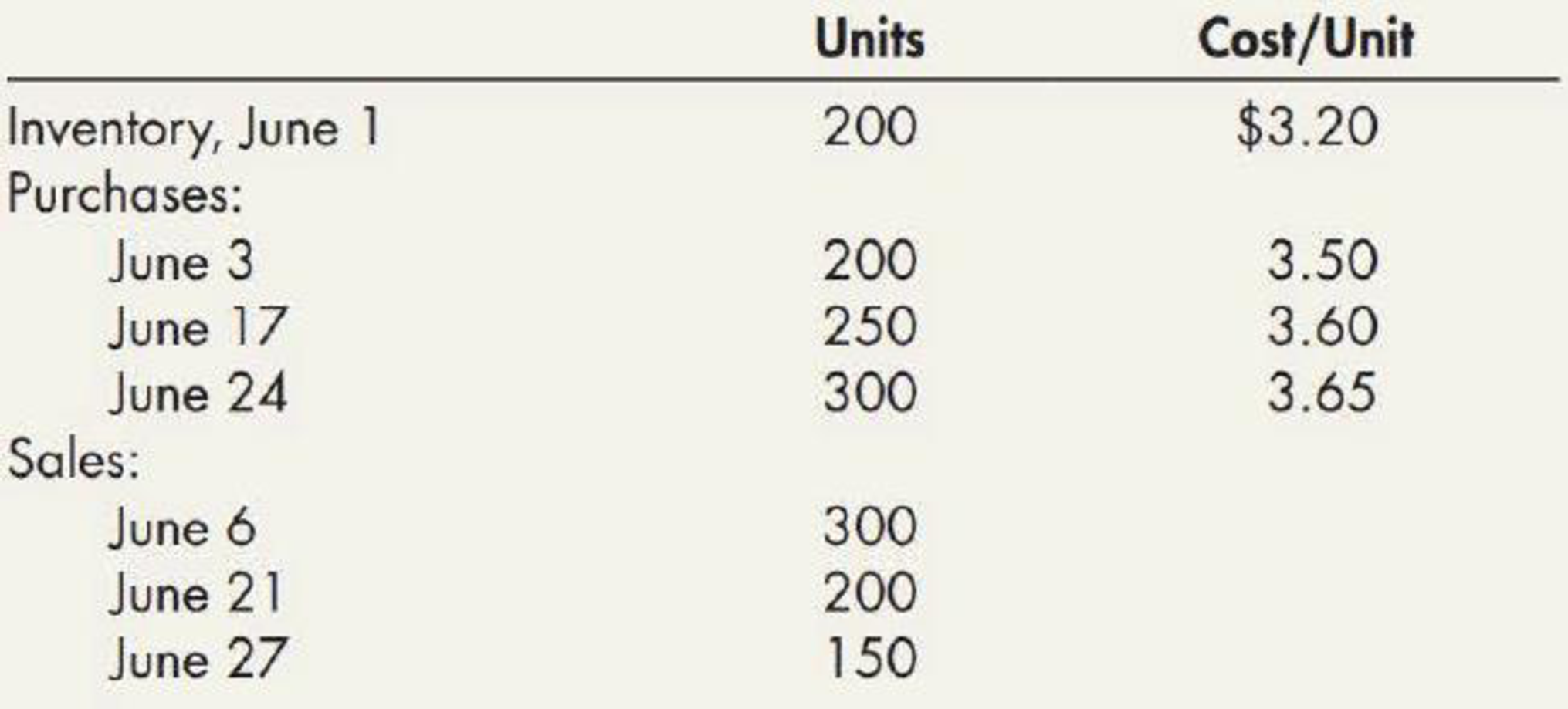

Alternative Inventory Methods Park Company’s perpetual inventory records indicate the following transactions in the month of June:

Required:

- 1. Compute the cost of goods sold for June and the inventory at the end of June using each of the following cost flow assumptions:

- a. FIFO

- b. LIFO

- c. Average cost (Round unit costs to 3 decimal places and other amounts to the nearest dollar.)

- 2. Next Level Why are the cost of goods sold and ending inventory amounts different for each of the three methods? What do these amounts tell us about the purchase price of inventory during the year?

- 3. Next Level Which method produces the most realistic amount for net income? For inventory? Explain your answer.

- 4. Next Level If Park uses IFRS, which of the previous alternatives would be acceptable and why?

1 a

Calculate the ending inventories and the cost of goods sold for the month of June using FIFO method under perpetual system.

Explanation of Solution

Perpetual inventory system: The method or system of maintaining, recording, and adjusting the inventory perpetually throughout the year, is referred to as perpetual inventory system.

FIFO: In First-in-First-Out method, items purchased initially are sold first. So, the value of the ending inventory consist the recent cost for the remaining unsold items.

Compute the ending inventory and cost of goods sold for June using FIFO method:

| Date | Particulars | Cost of goods sold | Inventory Balance | ||||

| Units | Cost per unit | Amount | Units | Cost per unit | Amount | ||

| June | |||||||

| 01 | Beginning inventory | 200 | $3.20 | $640 | |||

| 03 | 200 | $3.20 | $640 | ||||

| Purchase | 200 | $3.50 | $700 | ||||

| $1,340 | |||||||

| 06 | Sale (300) units | 200 | $3.20 | $640 | 100 | $3.50 | $350 |

| 100 | $3.50 | $350 | |||||

| $2,350 | |||||||

| 17 | 100 | $3.50 | $350 | ||||

| Purchase | 250 | $3.60 | $900 | ||||

| $1,250 | |||||||

| 21 | Sale (200) units | 100 | $3.50 | $350 | 150 | $3.60 | $540 |

| 100 | $3.60 | $360 | |||||

| $540 | |||||||

|

24 | 150 | $3.60 | $540 | ||||

| Purchase | 300 | $3.65 | $1,095 | ||||

| $1,635 | |||||||

| 27 | Sale (150) units | 150 | $3.60 | $540 | 300 | $3.65 | $1,095 |

| Total | 650 | $2,240 | 300 | $1,095 | |||

Table (1)

Thus, under FIFO cost method the cost of goods sold is $2,240 and the ending inventory in units are 300 and in dollars are $1,095.

1 b

Calculate the ending inventories and the cost of goods sold for the month of June using LIFO method under perpetual system.

Explanation of Solution

LIFO: In Last-in-First-Out method, items purchased recently are sold first. So, the value of the ending inventory consist the initial cost for the remaining unsold items.

Compute the ending inventory and cost of goods sold for June:

| Date | Particulars | Cost of goods sold | Inventory Balance | ||||

| Units | Cost per unit | Amount | Units | Cost per unit | Amount | ||

| June | |||||||

| 1 | Beginning inventory | 200 | $3.20 | $640.00 | |||

| 3 | 200 | $3.20 | $640.00 | ||||

| Purchase | 200 | $3.50 | $700.00 | ||||

| $1,340.00 | |||||||

| 6 | Sale (300) units | 200 | $3.50 | $700.00 | 100 | $3.20 | $320.00 |

| 100 | $3.20 | $320.00 | |||||

| 17 | 100 | $3.20 | $320.00 | ||||

| Purchase | 250 | $3.60 | $900.00 | ||||

| $1,220.00 | |||||||

| 21 | Sale (200) units | 200 | $3.60 | $720.00 | 100 | $3.20 | $320.00 |

| 50 | $3.60 | $180.00 | |||||

| $500.00 | |||||||

| 24 | 100 | $3.20 | $320.00 | ||||

| 50 | $3.60 | $180.00 | |||||

| Purchase | 300 | $3.65 | $1,095.00 | ||||

| $1,595.00 | |||||||

| 27 | Sale (150) units | 150 | $3.65 | $547.50 | 100 | $3.20 | $320.00 |

| 50 | $3.60 | $180.00 | |||||

| 150 | $3.65 | $547.50 | |||||

| Total | 650 | $2,287.50 | 300 | $1,047.50 | |||

Table (2)

Thus, under LIFO cost method the cost of goods sold is $2,287.50 and the ending inventory in units are 300 and in dollars are $1,047.50.

1 c.

Calculate the ending inventories and the cost of goods sold for the month of June using average cost method.

Explanation of Solution

Average cost method: Under average cost method, company calculates a new average after every purchase. It is determined by dividing the cost of goods available for sale by the units on hand.

Calculate the ending inventories and the cost of goods sold for the month of June:

| Date | Particulars | Cost of goods Sold | Ending inventory |

| June | |||

| 01 | Beginning inventory | ||

| 03 | Purchase of 200 units | ||

| 06 | Sale of 300 units | ||

| 17 | Purchase of 250 units | ||

| 21 | Sale of 150 units | ||

| 24 | Purchase of 300 units | ||

| 27 | Sale of 150 units | ||

| Total Cost of goods sold | $2,252 |

Table (3)

Thus, under average cost method the cost of goods sold is $2,252 and the ending inventory in units are 300 and in dollars are $1,083.

2.

Explain the reasons behind the difference in cost of goods sold and ending inventory among three methods. Identify the trend of purchase prices of inventory during the year.

Explanation of Solution

The unit costs of and closing inventory and cost of goods sold are different for each cost flow assumption and such variances arise due to different unit costs that are allocated to cost of goods sold and closing inventory. The use of FIFO method leads to lower cost of goods sold, although the use of LIFO method leads to higher cost of goods sold. Hence, the amounts reveal an upward trend in the purchase price of inventory.

3.

Identify the method that produces accurate amount of net income and inventory and explain the same.

Explanation of Solution

LIFO provides the most accurate amount of net income because the current costs are matched against the revenues.

FIFO reflects the accurate amount of inventory because it values the inventory at the recent prices in the balance sheet.

4.

Identify the alternative that would be acceptable by Company P, if it follows IFRS and also explain the reasons.

Explanation of Solution

International Financial Reporting Standards (IFRS): IFRS are a set of international accounting standards which are framed, approved, and published by IASB for the preparation and disclosure of international financial reports.

If Company P follows IFRS, it might value its inventory in FIFO, average or specific identification method. Since, LIFO method is not consistent with the physical flow of inventory and this method is also not applicable to inventory under IFRS. Moreover, there are no tax incentives for a company to use the LIFO method in most of the countries.

Want to see more full solutions like this?

Chapter 7 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

- Hello tutor provide solutionarrow_forwardI want to correct answer general accounting questionarrow_forwardQuestion Content Area Work in Process Account Data for Two Months; Cost of Production Reports Pittsburgh Aluminum Company uses process costing to record the costs of manufacturing rolled aluminum, which consists of the smelting and rolling processes. Materials are entered from smelting at the beginning of the rolling process. The inventory of Work in Process—Rolling on September 1 and debits to the account during September were as follows:arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning