The Activity rate based on activity measures for each activity pool.

Answer to Problem 10E

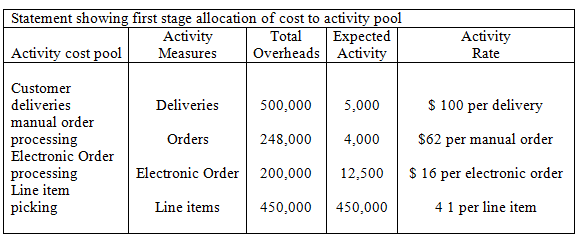

Solution: The Statement showing the activity rate for each activity cost pool shall be follows:

Here, Other organization-sustaining cost is a pool which is not allocated to products as it is related to sustaining of the organization which is not directly related to products.

Explanation of Solution

Given: The Estimated

Formula: The formula used in the given problem for computing the activity rate is as follows:

Activity rate =

Calculation: The Computation for activity rate for each activity pool shall be computed as follows:

- Customer Deliveries:

=

Manual Order processing:

=

Electronic Order processing:

=

Line item picking:

=

The activity related to organization sustainability shall not allocated o product as it is related to organization as a whole and cannot be directly allocated to product.

To conclude, the activity rate is based on actual overheads incurred and activity measures undertaken during the period.

Requirement3:

The Activity cost assigned to Hospitals University and Memorial.

Answer to Problem 10E

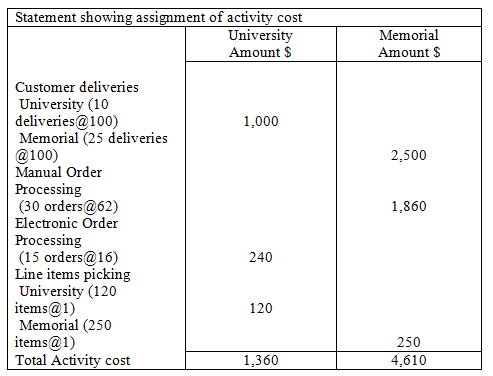

Solution: The Statement showing the assignment of activity cost to both the hospitals shall be computed as follows:

Explanation of Solution

Given: The Activity rate of each activity cost pool and actual activity undertaken under each of both the hospitals have been given in the problem.

Calculation: The Computation for assignment of activity cost of each pool under both the hospitals has been explained as under:

- Customer deliveries (based on number of deliveries):

University (10 deliveries@$100): $ 1,000

Memorial (25 deliveries@ $100): $ 2,500

Manual order Processing (based on manual order):

Memorial (30 orders @ $62): $1,860

Electronic Order Processing (Based on Electronic order):

University (15 orders @ $16): $240

Line item Picking (based onnumber of line items):

University (120 items @$ 1.00): $120

Memorial (250 items @ $1.00): $ 250

The activity cost assigned for each activity shall be computed by multiplying the actual activity undertaken for each jobs with the activity rate for respective activity pool.

To conclude, it must be said that overheads are assigned on the basis of actual activity undertaken for the products.

Requirement4:

The customer margin of each hospital.

Answer to Problem 10E

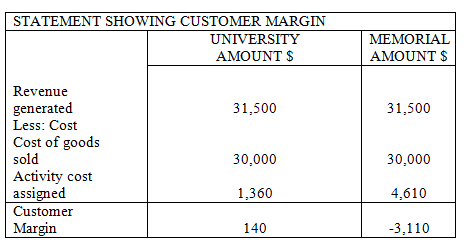

Solution: The statement showing customer margin for each hospital shall be computed as follows:

Explanation of Solution

The activity cost assigned and cost of goods sold and revenue generated from each hospital has been given in the problem. The Customer margin shall be computed by deducting the cost of goods sold and activity cost assigned to hospitals from sales revenue generated from each hospital.

Other organizational cost relating to organizational sustainability shall not be deducted from the customer margin as it is not related to customer but to the organization as a whole.

To conclude, it must be said that the customer margin is net of revenue and cost of goods sold and activity cost assigned.

Requirement5:

The purchasing behavior of the hospitals

Answer to Problem 10E

Solution: The purchasing memorial is somehow not desirable and least profitable as it is apparent from the computation of customer margin. The Memorial hospital is incurring a loss of $3,110 due to purchasing behavior.

Explanation of Solution

The Purchasing behavior of Memorial is not desirable in the sense that it is based on manual order processing rather than electronic order processing, which resulted in higher order

To conclude, it must be said that the Purchasing behavior of the customer will affect the customer margin generated.

Want to see more full solutions like this?

Chapter 7 Solutions

MANAGERIAL ACCOUNTING (LL)W/CONNECT

- A researcher believes that the mean earnings of top-paid actors, thletes and musicians are the same. The earnings (in millions of dollars) for several randomly selected people from each category are shown in the table below. It has been confirmed that the population variance for each group is equal and that earnings follow a normal distribution for top-pain actors, athletes and musicians. Use a 1% significance to test the claim. Actor Athlete Musician 34 46 31 29 58 38 20 45 43 29 35 43 29 37 36 27 34 59 27 45 44 28 45 57 37 28 40 26 41 44 37 49 35 35 25 42 38 40 59 Test statistic: If 7.0507 is wrong, what is the correct answer?P-value: If 0.0026 is wrong, what is the correct answer?arrow_forwardFinancial accountingarrow_forwardPlease provide correct answer general accountingarrow_forward

- General accountingarrow_forwardAn entry light has a total cost of $125 per unit, of which 80 is product costarrow_forwardHOW DO BASKET PURCHASE TRANSACTIONS AFFECT INDIVIDUAL ASSET VALUATIONS? A) RECORD EACH AT INVOICE PRICE B) USE INDEPENDENT APPRAISALS ONLY C) ALLOCATE TOTAL COST BASED ON FAIR VALUES D) BOOK AT SELLER'S CARRYING VALUEarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education