Concept Introduction:

Income Comparisons and cost flows:

Calculation of cost of goods sold, ending inventories, gross profits and net incomes are impacted by the application of

FIFO, LIFO and Weighted Average are most common methods used. Periodic System of inventory depends on physical count of inventory units as tracking is not done on frequent basis.

A brief description of each of the method is as follows:

• FIFO Method: First in First Out method which states that goods that are first purchased are also to be sold first.

• LIFO Method: Last in First Out method states that goods which are purchased new or recently are to be sold first.

• Weighted Average Method: The unit of goods or inventories are sold simultaneously. The costs of inventories are assigned based on the average of the inventory costs.

Requirement-1:

To determine:

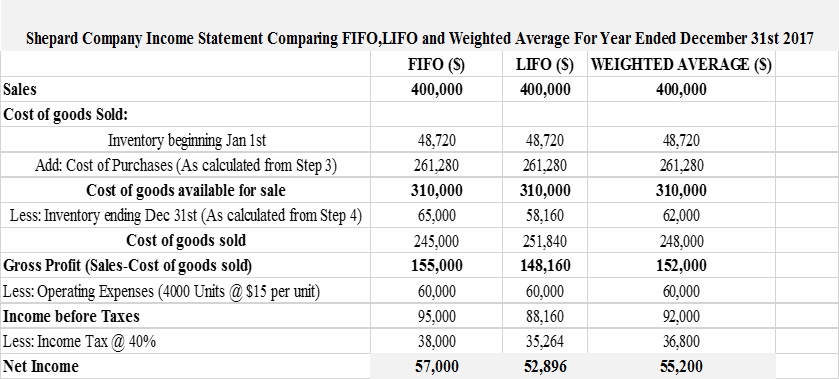

The net income of Shepard Company for the year end December 31st by preparing its income statement with comparisons to the methods of FIFO, LIFO and Weighted Average of inventory valuation.

Explanation of Solution

Below is the income statement of Shepard Company comparing FIFO, LIFO and Weighted Average methods:

Step-1:

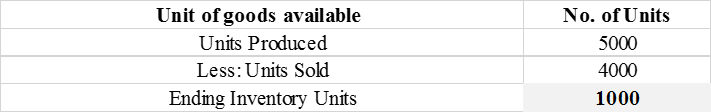

Step-2: Calculation of total number of ending inventory of goods available:

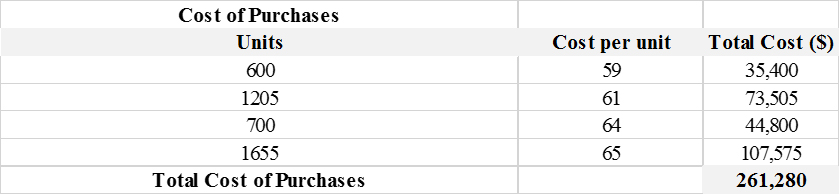

Step-3: Calculation of cost of purchases:

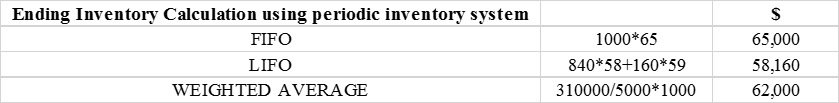

Step-4: Ending inventory calculation:

The explanation for the ending inventories calculation made for the determining the cost of goods sold in the above table are as follows:

a. FIFO Method: Ending inventories is calculated by multiplying the ending inventories available (As calculated in Step 2) .

b. LIFO Method: Ending inventories of is calculated by multiplying the first purchased inventory units of per unit and the difference between ending inventory (As calculated in Step 2) with the beginning inventory

c. Weighted Average Method: Ending inventory of is calculated by using the below formula:

Hence the net income of Shepard Company from three inventory costing methods are as follows:

1. FIFO:

2. LIFO:

3. Weighted Average:

Requirement-2:

To discuss:

The effect of financial results of Shepard Company from using three inventory costing methods in case of decrease in prices of its purchasing inventories.

Explanation:

In case the company had been experiencing decreasing prices in its purchases, cost of goods sold would have decreased and there will be increase in its gross profit and net income in the three alternative inventory costing methods.

Requirement-3:

To discuss:

The advantages and disadvantages of using LIFO and FIFO assuming there is continuing trend of increasing costs.

Explanation:

a. Advantages and disadvantages of LIFO assuming increasing trend of inventory costs:

Advantages:

1. Cost of goods sold for the company is increased.

2. Gross Profit margin is decreased.

3. As the LIFO reports in lower profits, the main advantage is that the company pays less taxes compared to FIFO.

Disadvantages:

1. Inventory valuation has no relevance is assessing present situations as current prices are unknown in LIFO method.

2. LIFO calculations are more complicated.

3. As LIFO method reports inventory on past costs, the inventory in balance sheet account is understated.

b. Advantages and disadvantages of FIFO assuming increasing trend of inventory costs:

Advantages:

1. The value of the remaining inventory during the period is enhanced thereby bringing the higher net income.

2. FIFO reports higher assets and income which helps the company for potential investors and lenders.

3. Closing stock of materials are valued at market price as it comprises of most recent purchases.

Disadvantages:

1. As FIFO reports higher assets and income, there is no tax benefit.

2. Cash flow will be less which affects the potential growth of the company.

3. FIFO model fails to depict the accurate costs as inventories are valued based on past costs. So the managers face difficulties in finding the accurate costs when prices increases rapidly.

Requirement-2:

To discuss:

The effect of financial results of Shepard Company from using three inventory costing methods in case of decrease in prices of its purchasing inventories.

Explanation of Solution

In case the company had been experiencing decreasing prices in its purchases, cost of goods sold would have decreased and there will be increase in its gross profit and net income in the three alternative inventory costing methods.

Requirement-3:

To discuss:

The advantages and disadvantages of using LIFO and FIFO assuming there is continuing trend of increasing costs.

Explanation:

a. Advantages and disadvantages of LIFO assuming increasing trend of inventory costs:

Advantages:

1. Cost of goods sold for the company is increased.

2. Gross Profit margin is decreased.

3. As the LIFO reports in lower profits, the main advantage is that the company pays less taxes compared to FIFO.

Disadvantages:

1. Inventory valuation has no relevance is assessing present situations as current prices are unknown in LIFO method.

2. LIFO calculations are more complicated.

3. As LIFO method reports inventory on past costs, the inventory in

b. Advantages and disadvantages of FIFO assuming increasing trend of inventory costs:

Advantages:

1. The value of the remaining inventory during the period is enhanced thereby bringing the higher net income.

2. FIFO reports higher assets and income which helps the company for potential investors and lenders.

3. Closing stock of materials are valued at market price as it comprises of most recent purchases.

Disadvantages:

1. As FIFO reports higher assets and income, there is no tax benefit.

2.

3. FIFO model fails to depict the accurate costs as inventories are valued based on past costs. So the managers face difficulties in finding the accurate costs when prices increases rapidly.

Requirement-3:

To discuss:

The advantages and disadvantages of using LIFO and FIFO assuming there is continuing trend of increasing costs.

Explanation of Solution

a. Advantages and disadvantages of LIFO assuming increasing trend of inventory costs:

Advantages:

1. Cost of goods sold for the company is increased.

2. Gross Profit margin is decreased.

3. As the LIFO reports in lower profits, the main advantage is that the company pays less taxes compared to FIFO.

Disadvantages:

1. Inventory valuation has no relevance is assessing present situations as current prices are unknown in LIFO method.

2. LIFO calculations are more complicated.

3. As LIFO method reports inventory on past costs, the inventory in balance sheet account is understated.

b. Advantages and disadvantages of FIFO assuming increasing trend of inventory costs:

Advantages:

1. The value of the remaining inventory during the period is enhanced thereby bringing the higher net income.

2. FIFO reports higher assets and income which helps the company for potential investors and lenders.

3. Closing stock of materials are valued at market price as it comprises of most recent purchases.

Disadvantages:

1. As FIFO reports higher assets and income, there is no tax benefit.

2. Cash flow will be less which affects the potential growth of the company.

3. FIFO model fails to depict the accurate costs as inventories are valued based on past costs. So the managers face difficulties in finding the accurate costs when prices increases rapidly.

Want to see more full solutions like this?

Chapter 6 Solutions

Loose Leaf for Fundamental Accounting Principles

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education