Concept explainers

a)

To calculate: The annual percentage rate and the effective annual rate.

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

a)

Answer to Problem 75QP

The annual percentage rate is 416% and the effective annual rate is 5,370.60%.

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake consumers up. The store offers a week loan at the rate of interest of 8% per week. Then, after a few days, the store makes a one-week loan again at a discount interest rate of 8% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 8% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $36.05. As this is a discount interest rate, the net proceeding of Person X will be $63.95. Thus, Person X has to pay $100 for a month and the store lets Person X to pay $25 in installments fora week.

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate withthe number of months in a year. Here, the interest is calculated per week;therefore,the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 416%.

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 0.53,70604084 or 5,370.60%.

b)

To calculate: The annual percentage rate and the effective annual rate.

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

b)

Answer to Problem 75QP

The annual percentage rate is 451.88% and the effective annual rate is 7,518.31%.

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake consumers up. The store offers a week loan at the rate of interest of 8% per week. Then, after a few days, the store makes a one-week loan again at a discount interest rate of 8% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 8% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $36.05. As this is a discount interest rate, the net proceeding of Person X will be $63.95. Thus, Person X has to pay $100 for a month and the store lets Person X to pay $25 in installments fora week.

Explanation:

In the discount loan, the amount that Person X gets is reduced by the discount and Person X has to pay the full principal value back. Person X receives $9.2 for each $10 as the principal value, with the discount of 8%. The weekly interest rates are calculated as follows:

Note: The dollar values that are used above are not relevant. In other words,it can also be written as $0.92 and $1, or $92 and $100, or in any other combination that provides a similar rate of interest.

Hence, the r value is 0.0869 or 8.69%.

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate withthe number of months in a year. Here, the interest is calculated per week, and so the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 451.88%.

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 75.18309552 or 7,518.31%

c)

To calculate: The annual percentage rate and the effective annual rate.

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

c)

Answer to Problem 75QP

The annual percentage rate is 1,072.76%and the effective annual rate is 17,204.88622%.

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake consumers up. The store offers a week loan at the rate of interest of 8% per week. Then, after a few days, the store makes a one-week loan again at a discount interest rate of 8% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 8% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $36.05. As this is a discount interest rate, the net proceeding of Person X will be $63.95. Thus, Person X has to pay $100 for a month and the store lets Person X to pay $25 in installments fora week.

Explanation:

In this part, the present value of anannuity and the cash flow is given; with the help of the present value of

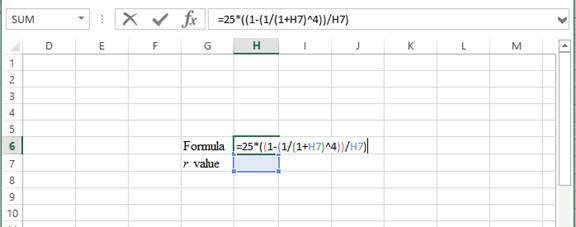

Formula to calculate the present value annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period. Using the formula of the present value of annuity, the interest rate is computed throughthe spreadsheet method.

Compute the present value annuity:

Compute the interest rate using the spreadsheet:

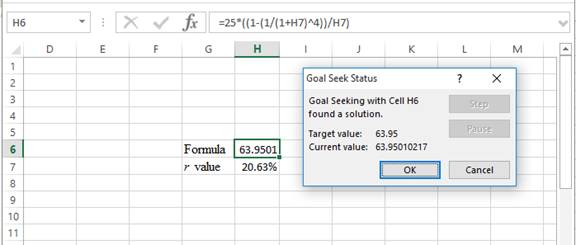

Step 1:

- Type the formula of the present value annuity in H6 in the spreadsheet and consider the r value as H7.

Step 2:

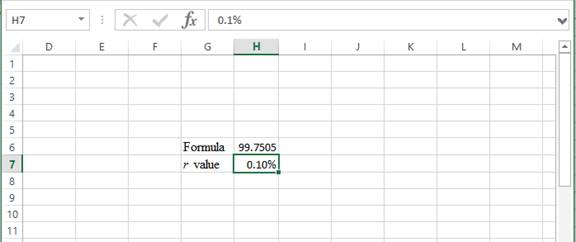

- Assume the r value as 0.10%.

Step 3:

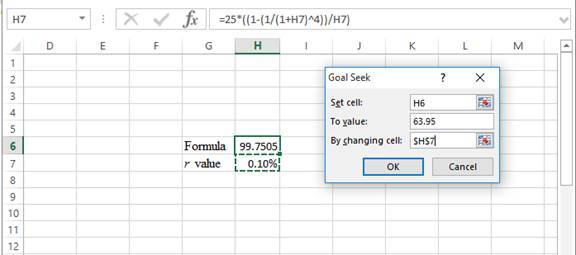

- In the spreadsheet, go to Dataand select What-If-Analysis.

- UnderWhat-If-Analysis,select Goal Seek.

- In set cell, select H6 (the formula).

- The To value is considered as 63.95 (the value of the present value of annuity).

- The H7 cell is selected for the by changing cell.

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the r value.

Step 5:

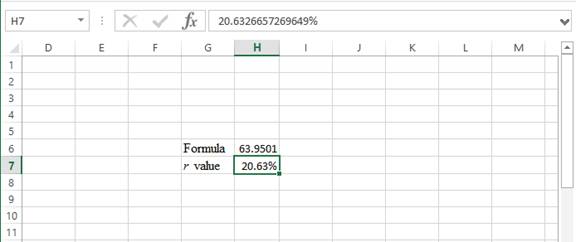

- The r value appears to be 20.6326657269649%.

Hence, the r value is 20.63%.

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate withthe number of periods in a year. Here, the interest is calculated per week, and so the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 1,072.76%.

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 17,204.88622%.

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamentals of Corporate Finance Alternate Edition

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education