Inventory Costing and LCM

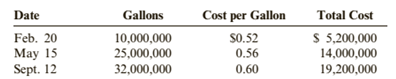

Ortman Enterprises sells a chemical used in various manufacturing processes. On January 1, 2019, Ortman had 5,000,000 gallons on hand, for which it had paid $0.50 per gallon. During 2019, Ortman made the following purchases:

During 2019, Ortman sold 65 000,000 gallons at $0.75 per gallon (35,000,000 gallons were sold on June 29 and 30,000,000 gallons were sold on Nov. 22), leaving an ending inventory of 7,000,000 gallons. Assume that Ortman uses a perpetual inventory system. Ortman uses the lower of cost or market for its inventories, as required by generally accepted accounting principles.

Required:

1. Assume that the market value of the chemical is $0.76 per gallon on December 31, 2019. Compute the cost of ending inventory using the FIFO and average cost methods, and then apply LCM. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

2. Assume that the market value of the chemical is $0.58 per gallon on December 31, 2019. Compute the cost of ending inventory using the FIFO and average cost methods, and then apply LCM. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

(a)

Lower of cost or market value:

Usually the businesses follow the historical cost principle in which the inventory is valued at the cost of the purchase. But in some instances, it has been seen that the market value falls below the cost due to its obsolescence or damaged nature. In those cases, the businesses follow the principle to value the inventory at lower of cost or market value.

The cost of ending inventory using the FIFO and other cost methods and then apply LCM with given market value of 0.76 per gallon.

Answer to Problem 70APSA

| Particular | FIFO ($) 2019 | LIFO ($) 2019 | Average Cost ($) 2019 |

| Closing inventory value | 4200000 | 3700000 | 4130000 |

Explanation of Solution

The given information for the year 2019 is as follows:

Total available gallons are:

Opening inventory=5000000 gallons @ $0.50 each

Purchases=10000000 gallons @ $0.52 eachPurchases=25000000 gallons @ $0.56 eachPurchases=32000000 gallons @ $0.60 each

Total Purchased gallons = 67000000

Total available gallons = 5000000+67000000=72000000 gallons

Sales=35000000+30000000 gallons=65000000 gallons

Closing inventory=7000000 gallons

The given market value in the question is of 0.76 per gallon.

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| 5000000 @$0.50 = $2500000 | ||

| 10000000 @$0.52 = $5200000 | ||

| 20000000 @$0.56=$11200000 | ||

| 5000000 @$0.56=$2800000 | ||

| 7000000 @$0.60=$4200000 | 25000000 @$0.60=$15000000 | |

| Total | 7000000 @$0.60=$4200000 |

As the cost of closing inventory is $0.60 per gallon which is lower than the market value given in the question i.e. 0.76 per gallon. Hence, the valuation of closing inventory is to be done on the cost only.

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Closing inventory | Cost of Goods sold | |

| 25000000 @$0.56 = $14000000 | ||

| 10000000 @$0.52 = $5200000 | ||

| 30000000 @$0.60=$18000000 | ||

| 5000000 @$0.50=$2500000 | ||

| 2000000 @$0.60=$1200000 | ||

| Total | 7000000 gallons=$3700000 |

As the cost of closing inventory are $0.60 per gallon and $0.50 per gallon which are lower than the market value given in the question i.e. 0.76 per gallon. Hence, the valuation of closing inventory is to be done on the cost only.

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

| Closing inventory | Cost of Goods sold | |

| 35000000 @$0.54=$18900000 | ||

| 30000000 @$0.59=$17700000 | ||

| 7000000 @$0.59=$4130000 | ||

| Total | 7000000 @$0.59=$4130000 |

As the cost of closing inventory is $0.59 per gallon which is lower than the market value given in the question i.e. 0.76 per gallon. Hence, the valuation of closing inventory is to be done on the cost only.

Weighted average cost per unit=Cost of Goods available for saleUnits available for sale=$2500000+$5200000+$1400000040000000=$0.54

Weighted average cost per unit=Cost of Goods available for saleUnits available for sale=($5000000×0.54)+$1920000037000000=$2700000+$1920000037000000=$0.59.

(b)

Lower of cost or market value:

Usually the businesses follow the historical cost principle in which the inventory is valued at the cost of the purchase. But in some instances, it has been seen that the market value falls below the cost due to its obsolescence or damaged nature. In those cases, the businesses follow the principle to value the inventory at lower of cost or market value.

The cost of ending inventory using the FIFO and other cost methods and then apply LCM with given market value of 0.58 per gallon.

Answer to Problem 70APSA

| Particular | FIFO ($) 2019 | LIFO ($) 2019 | Average Cost ($) 2019 |

| Closing inventory value | 4060000 | 3660000 | 4060000 |

Explanation of Solution

The given information for the year 2019 is as follows:

Total available gallons are:

Opening inventory=5000000 gallons @ $0.50 each

Purchases=10000000 gallons @ $0.52 eachPurchases=25000000 gallons @ $0.56 eachPurchases=32000000 gallons @ $0.60 each

Total Purchased gallons = 67000000

Total available gallons = 5000000+67000000=72000000 gallons

Sales=35000000+30000000 gallons=65000000 gallons

Closing inventory=7000000 gallons

The given market value in the question is of 0.76 per gallon.

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| 5000000 @$0.50 = $2500000 | ||

| 10000000 @$0.52 = $5200000 | ||

| 20000000 @$0.56=$11200000 | ||

| 5000000 @$0.56=$2800000 | ||

| 7000000 @$0.60=$4200000 | 25000000 @$0.60=$15000000 | |

| Total | 7000000 @$0.60=$4200000 |

As the cost of closing inventory is $0.60 per gallon which is higher than the market value given in the question i.e. 0.58 per gallon. Hence, the valuation of closing inventory is to be done on the market value. So, the closing value is $4060000(7000000 gallons×$0.58).

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Closing inventory | Cost of Goods sold | |

| 25000000 @$0.56 = $14000000 | ||

| 10000000 @$0.52 = $5200000 | ||

| 30000000 @$0.60=$18000000 | ||

| 5000000 @$0.50=$2500000 | ||

| 2000000 @$0.60=$1200000 | ||

| Total | 7000000 gallons=$3700000 |

As the cost of closing inventory are $0.60 per gallon and $0.50 per gallon. The cost of 5000000 gallons is $0.50 per gallon which is lower but the cost of 2000000 gallons which is $0.60 per gallon is higher than the market value given in the question i.e. 0.58 per gallon. Hence, the valuation of closing inventory is to be done on the cost and market value both. So, the closing value is $3660000((5000000×$0.50)+(2000000×$0.58))

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

| Closing inventory | Cost of Goods sold | |

| 35000000 @$0.54=$18900000 | ||

| 30000000 @$0.59=$17700000 | ||

| 7000000 @$0.59=$4130000 | ||

| Total | 7000000 @$0.59=$4130000 |

As the cost of closing inventory is $0.59 per gallon which is higher than the market value given in the question i.e. 0.58 per gallon. Hence, the valuation of closing inventory is to be done on the market value. So, the closing value is $4060000(7000000×$0.58)

Weighted average cost per unit=Cost of Goods available for saleUnits available for sale=$2500000+$5200000+$1400000040000000=$0.54

Weighted average cost per unit=Cost of Goods available for saleUnits available for sale=($5000000×0.54)+$1920000037000000=$2700000+$1920000037000000=$0.59.

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Financial Accounting

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning