Fred, Inc., and Herman Corporation formed a business combination on January 1, 2016, when Fred acquired a 60 percent interest in Herman’s common stock for $312,000 in cash. The book value of Herman’s assets and liabilities on that day totaled $300,000 and the fair value of the noncontrolling interest was $208,000. Patents being held by Herman (with a 12-year remaining life) were undervalued by $90,000 within the company’s financial records and a customer list (10-year life) worth $130,000 was also recognized as part of the acquisition-date fair value.

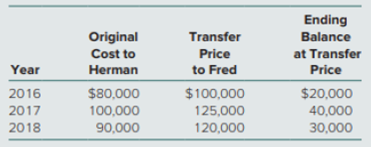

Intra-entity inventory transfers occur regularly between the two companies. Merchandise carried over from one year to the next is always sold in the subsequent period.

Fred had not paid for half of the 2018 inventory transfers by year-end.

On January 1, 2017, Fred sold $15,000 in land to Herman for $22,000. Herman is still holding this land.

On January 1, 2018, Herman acquired $20,000 (face value) of Fred’s bonds in the open market. These bonds had an 8 percent cash interest rate. On the date of repurchase, the liability was shown within Fred’s records at $21,386, indicating an effective yield of 6 percent. Herman’s acquisition price was $18,732 based on an effective interest rate of 10 percent.

Herman indicated earning a net income of $25,000 within its 2018 financial statements. The subsidiary also reported a beginning

- a. Prepare consolidation worksheet adjustments for 2018.

- b. Calculate the amount of consolidated net income attributable to the noncontrolling interest for 2018. In addition, determine the ending 2018 balance for noncontrolling interest in the consolidated balance sheet.

- c. Determine the consolidation worksheet adjustments needed in 2019 in connection with the intra-entity bonds.

a.

Prepare consolidation worksheet adjustments for 2018.

Explanation of Solution

| Entry *TL | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Investment in Company H | 7,000 | |||

| Land | 7,000 | |||

| (Being intra-entity gain eliminated)) | ||||

| Entry *G | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Retained earnings of Company H | 8,000 | |||

| Cost of goods sold | 8,000 | |||

| (being opening unrealized gross profit eliminated) | ||||

| Entry S | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Common stock | 100,000 | |||

| Retained earnings on 01/01/2017 | 292,000 | |||

| Investment in Company H | 235,200 | |||

| Non controlling interest | 156,800 | |||

| (being controlling and non-controlling interest recorded) | ||||

| Entry A | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Patents | 75,000 | |||

| Customer List | 104,000 | |||

| Investment in Company H | 107,400 | |||

| Non controlling interest | 71,600 | |||

| (being assets transferred to controlling and non-controlling interest) | ||||

| Entry I | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Investment income | 3,000 | |||

| Investment in Company H | 3,000 | |||

| (being intra-entity equity income eliminated) | ||||

| Entry D | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Investment in Company H | 2,400 | |||

| Dividend expense | 2,400 | |||

| (being intra-entity dividend expense eliminated) | ||||

| Entry E | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Amortization expense | 20,500 | |||

| Patents | 7,500 | |||

| Customer List | 13,000 | |||

| (being amortization expense of current year recorded) | ||||

| Entry P | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Accounts Payable | 60,000 | |||

| Accounts Receivable | 60,000 | |||

| (being intra-entity receivables and payables eliminated) | ||||

| Entry B | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Bond payable | 20,000 | |||

| Premium on Bond payable | 1,069 | |||

| Interest Income | 1,873 | |||

| Investment in Bonds | 19,005 | |||

| Interest expense | 1,283 | |||

| Gain on retirement of Bonds | 2,654 | |||

| (being the intra-entity bonds recognized) | ||||

| Entry TI | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Sales | 120,000 | |||

| Cost of goods sold | 120,000 | |||

| (being intra-entity sale eliminated) | ||||

| Entry G | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| Cost of goods sold | 7,500 | |||

| Inventory | 7,500 | |||

| (being unrealized gross profit on ending inventory eliminated) | ||||

Table: (1)

b.

Calculate the amount of consolidated net income attributable to the non-controlling interest for 2018. In addition, determine the ending 2018 balance for non-controlling interest in the consolidated balance sheet.

Explanation of Solution

Computation of the amount of consolidated net income attributable to the non-controlling interest for 2018:

| Particulars | Amount |

| Net income reported by company H in 2018 | $ 25,000 |

| Excess fair value amortizations | $ (20,500) |

| Deferred gross profit recognized | $ 8,000 |

| Unrecognized gross profit deferred | $ (7,500) |

| Net income realized in 2018 | $ 5,000 |

| Ownership of non-controlling interest | 40% |

| Net income attributable to non-controlling interest | $ 2,000 |

Table: (2)

Computation of the ending 2018 balance for non-controlling interest in the consolidated balance sheet:

| Particulars | Amount |

| Non-controlling interest as on 01/01/2018 | $ 228,400 |

| Net income attributable to non-controlling interest | $ 2,000 |

| Share of non-controlling interest in dividend | $ (1,600) |

| Non-controlling interest as on 12/31/2018 | $ 228,800 |

Table: (3)

c.

Determine the consolidation worksheet adjustments needed in 2019 in connection with the intra-entity bonds.

Explanation of Solution

The consolidation worksheet adjustments needed in 2019 in connection with the intra-entity bonds:

| Entry *B | ||||

| Date | Accounts Title and Explanation | Post Ref. | Debit ($) | Credit ($) |

| 12/31/2019 | Bond payable | 20,000 | ||

| Premium on Bond payable | 733 | |||

| Interest Income | 1,901 | |||

| Investment in Bonds | 2,064 | |||

| Interest expense | 19,306 | |||

| Gain on retirement of Bonds | 1,264 | |||

| (being the intra-entity bonds eliminated) | ||||

Table: (4)

Want to see more full solutions like this?

Chapter 6 Solutions

GEN COMBO ADVANCED ACCOUNTING; CONNECT ACCESS CARD

- Pitino acquired 90 percent of Brey’s outstanding shares on January 1, 2016, in exchange for $342,000 in cash. The subsidiary’s stockholders’ equity accounts totaled $326,000 and the noncontrolling interest had a fair value of $38,000 on that day. However, a building (with a nine-year remaining life) in Brey’s accounting records was undervalued by $18,000. Pitino assigned the rest of the excess fair value over book value to Brey’s patented technology (six-year remaining life).Brey reported net income from its own operations of $64,000 in 2016 and $80,000 in 2017. Brey declared dividends of $19,000 in 2016 and $23,000 in 2017.Brey sells inventory to Pitino as follows:At December 31, 2018, Pitino owes Brey $16,000 for inventory acquired during the period.The following separate account balances are for these two companies for December 31, 2018, and the year then ended. Credits are indicated by parentheses.Answer each of the following questions:a. What was the annual amortization resulting…arrow_forwardOn January 1, 2017, Palka, Inc., acquired 70 percent of the outstanding shares of Sellinger Company for $1,666,000 in cash. The price paid was proportionate to Sellinger’s total fair value, although at the acquisition date, Sellinger had a total book value of $2,070,000. All assets acquired and liabilities assumed had fair values equal to book values except for a patent (six-year remaining life) that was undervalued on Sellinger’s accounting records by $300,000. On January 1, 2018, Palka acquired an additional 25 percent common stock equity interest in Sellinger Company for $656,250 in cash. On its internal records, Palka uses the equity method to account for its shares of Sellinger. During the two years following the acquisition, Sellinger reported the following net income and dividends: 2017 2018 $525,000 $701,000 Net…arrow_forwardPython acquired 75% of Slither’s stock for $316 million in cash on January 2, 2015. The fair value of the noncontrolling interest in Slither was $89 million. Slither’s book value at that time was $120 million. The assets and liabilities reported on Slither’s balance sheet had balances that approximated fair value at the date of acquisition. However, Slither had previously unreported developed technology (10 year life, straight-line), valued at $40 million. There has been no impairment loss on the developed technology since acquisition. Goodwill was impaired $6 million in 2015, and a $3 million impairment loss should be recorded for 2016. It is now December 31, 2016. The trial balances of Python and Slither appear below. (in thousands) Python Dr (Cr) Slither Dr (Cr) Current assets $ 113,500 $ 35,000 Plant assets, net 1,200,000 500,000 Investment in Slither 323,800 – Liabilities (1,342,950) (387,000) Capital stock (40,000) (20,000) Retained earnings, Jan. 1 (215,000) (110,000)…arrow_forward

- On January 1, 2018, Pine Company owns 40 percent (40,000 shares) of Seacrest, Inc., which it purchased several years ago for $182,000. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment account as of January 1, 2018, is $293,600. Excess patent cost amortization of $12,000 is still being recognized each year. During 2018, Seacrest reports net income of $342,000 and a $120,000 other comprehensive loss, both incurred uniformly throughout the year. No dividends were declared during the year. Pine sold 8,000 shares of Seacrest on August 1, 2018, for $93,000 in cash. However, Pine retains the ability to significantly influence the investee. During the last quarter of 2017, Pine sold $50,000 in inventory (which it had originally purchased for only $30,000) to Seacrest. At the end of that fiscal year, Seacrest’s inventory retained $10,000 (at sales price) of this merchandise, which was subsequently sold in the first quarter of…arrow_forwardOn January 1, 2018, Pine Company owns 40 percent (40,000 shares) of Seacrest, Inc., which it purchased several years ago for $182,000. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment account as of January 1, 2018, is $293,600. Excess patent cost amortization of $12,000 is still being recognized each year. During 2018, Seacrest reports net income of $342,000 and a $120,000 other comprehensive loss, both incurred uniformly throughout the year. No dividends were declared during the year. Pine sold 8,000 shares of Seacrest on August 1, 2018, for $93,000 in cash. However, Pine retains the ability to significantly influence the investee.During the last quarter of 2017, Pine sold $50,000 in inventory (which it had originally purchased for only $30,000) to Seacrest. At the end of that fiscal year, Seacrest’s inventory retained $10,000 (at sales price) of this merchandise, which was subsequently sold in the first quarter of…arrow_forwardOn January 2, 2016, Miller Properties paid $19 million for 1 million shares of Marlon Company’s 6 million outstanding common shares. Miller’s CEO became a member of Marlon’s board of directors during the first quarter of 2016. The carrying amount of Marlon’s net assets was $66 million. Miller estimated the fair value of those net assets to be the same except for a patent valued at $24 million above cost. The remaining amortization period for the patent is 10 years. Marlon reported earnings of $12 million and paid dividends of $6 million during 2016. On December 31, 2016, Marlon’s common stock was trading on the NYSE at $18.50 per share. Required: 1. When considering whether to account for its investment in Marlon under the equity method, what criteria should Miller’s management apply? 2. Assume Miller accounts for its investment in Marlon using the equity method. Ignoring income taxes, determine the amounts related to the investment to be reported in its 2016 a. Income statement. b.…arrow_forward

- On January 1, 2016, Plymouth Corporation acquired 80 percent of the outstanding voting stock of Sander Company in exchange for $1,200,000 cash. At that time, although Sander’s book value was $925,000, Plymouth assessed Sander’s total business fair value at $1,500,000. Since that time, Sander has neither issued nor reacquired any shares of its own stock. The book values of Sander’s individual assets and liabilities approximated their acquisition-date fair values except for the patent account, which was undervalued by $350,000. The undervalued patents had a five-year remaining life at the acquisition date. Any remaining excess fair value was attributed to goodwill. No goodwill impairments have occurred. Sander regularly sells inventory to Plymouth. Below are details of the intra-entity inventory sales for the past three years: Gross Profit Intra-Entity Rate on Ending Inv. Intra-Entity Intra-Entity Transfer Inventory Year Sales Price Transfers 2016 $…arrow_forwardHarper, Inc. acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2017, for $316,100 in cash. The book value of Kinman's net assets on that date was $610,000, although one of the company's buildings, with a $69,800 carrying amount, was actually worth $128,050. This building had a 10-year remaining life. Kinman owned a royalty agreement with a 20-year remaining life that was undervalued by $122,000. Kinman sold inventory with an original cost of $75,600 to Harper during 2017 at a price of $108,000. Harper still held $15,150 (transfer price) of this amount in inventory as of December 31, 2017. These goods are to be sold to outside parties during 2018. Kinman reported a $46,200 net loss and a $25,600 other comprehensive loss for 2017. The company still manages to declare and pay a $19,000 cash dividend during the year. During 2018, Kinman reported a $41,000 net income and declared and paid a cash dividend of $21,000. It made additional inventory sales…arrow_forwardOn January 2, 2018, Miller Properties paid $19 million for 1 million shares of Marlon Company’s 6 million outstanding common shares. Miller’s CEO became a member of Marlon’s board of directors during the first quarter of 2018.The carrying amount of Marlon’s net assets was $66 million. Miller estimated the fair value of those netassets to be the same except for a patent valued at $24 million above cost. The remaining amortization period forthe patent is 10 years.Marlon reported earnings of $12 million and paid dividends of $6 million during 2018. On December 31,2018, Marlon’s common stock was trading on the NYSE at $18.50 per share.Required:1. When considering whether to account for its investment in Marlon under the equity method, what criteriashould Miller’s management apply?2. Assume Miller accounts for its investment in Marlon using the equity method. Ignoring income taxes, determine the amounts related to the investment to be reported in its 2018:a. Income statementb. Balance…arrow_forward

- Harper, Inc. acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2017, for $276,500 in cash. The book value of Kinman's net assets on that date was $530,000, although one of the company's buildings, with a $71,600 carrying amount, was actually worth $122,850. This building had a 10-year remaining life. Kinman owned a royalty agreement with a 20-year remaining life that was undervalued by $110,000. Kinman sold inventory with an original cost of $52,500 to Harper during 2017 at a price of $75,000. Harper still held $15,900 (transfer price) of this amount in inventory as of December 31, 2017. These goods are to be sold to outside parties during 2018. Kinman reported a $58,200 net loss and a $29,900 other comprehensive loss for 2017. The company still manages to declare and pay a $11,000 cash dividend during the year. During 2018, Kinman reported a $44,600 net income and declared and paid a cash dividend of $13,000. It made additional inventory sales…arrow_forwardDuring January 2018, Varren, Inc. acquired 30% of the outstanding common stock of Wolf Co. for $1,400,000. This investment gave Varren the ability to exercise significant influence over Wolf. Wolf's assets on that date were recorded at $6,400,000 with liabilities of $3,000,000. Any excess of cost over book value of Varren's investment was attributed to unrecorded patents having a remaining useful life of ten years.In 2018, Wolf reported net income of $600,000. For 2019, Wolf reported net income of $750,000. Dividends of $200,000 were paid in each of these two years. What was the reported balance of Varren's Investment in Wolf Co. at December 31, 2019?arrow_forwardDuckworth Corporation purchases an 80% interest in Panda Corporation on January 1, 2017, in exchange for 5,000 Duckworth shares (market value of $18) plus $155,000 cash. The fair value of the NCI is proportionate to the price paid by Duckworth for its interest. The appraisal shows that some of Panda’s equipment, with a 4-year estimated remaining life, is undervalued by $20,000. The excess is attributed to goodwill. Panda Corporation’s balance sheet on December 31, 2016 is attached.The following information relates to the activities of the two companies for 2017:a. Panda pays off $10,000 of its long-term debt.b. Duckworth purchases production equipment for $76,000.c. Consolidated net income is $103,200; the NCI’s share is $5,000. Depreciation expense taken by Duckworth and Panda on their separate books is $92,000 and $28,000, respectively.d. Duckworth pays $30,000 in dividends; Panda pays $15,000.Prepare the consolidated statement of cash flows for the year ended December 31, 2017, for…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education