Concept explainers

Recording Cash Sales, Credit Sales, Sales Returns, and Sales Allowances and Analyzing Gross Profit Percentage

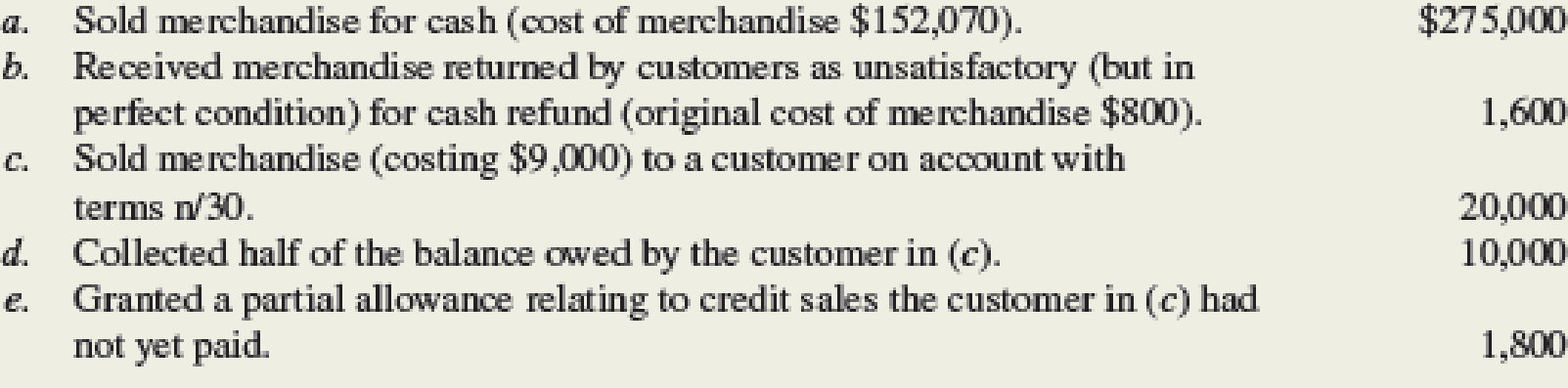

Campus Stop, Inc., is a student co-op. Campus Stop uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis:

Required:

- 1. Compute Net Sales and Gross Profit for Campus Stop. No additional sales returns/allowances are expected.

- 2. Compute the gross profit percentage (using the formula shown in this chapter and rounding to one decimal place).

- 3. Prepare

journal entries to record transactions (a)–(e). - 4. Campus Stop is considering a contract to sell merchandise to a campus organization for $15,000. This merchandise will cost Campus Stop $12,000. Would this contract increase (or decrease) Campus Stop’s dollars of gross profit and its gross profit percentage (round to one decimal place)?

TIP: The impact on gross profit dollars may differ from the impact on gross profit percentage.

1.

Calculate the net sales and gross profit of Company C.

Explanation of Solution

Net sales:

Net sales is the balance of remaining amount that is arrived after subtracting sales discounts, allowances for damaged goods and return of goods from sales.

Gross Profit:

Gross Profit is the difference between the net sales, and the cost of goods sold. Gross profit usually appears on the income statement of the company.

Calculate the net sales and gross profit of Company C as follows:

| Particulars | Amount($) |

| Sales Revenue (1) | 295,000 |

| Less: Sales Returns and Allowances(2) | (3,400) |

| Net Sales | 291,400 |

| Less: Cost of Goods Sold (3) | 160,270 |

| Gross Profit | 131,130 |

Table (1)

Working note 1:

Calculate the value of sales revenue:

Working note 2:

Calculate the sales returns and allowances

Working note 3:

Calculate the cost of goods sold

Therefore, the net sales and gross profit of Company C are $291,600 and $131,330 respectively.

2.

Compute the gross profit percentage of Company C.

Explanation of Solution

Gross Profit Percentage:

Gross profit is the financial ratio that shows the relationship between the gross profit and net sales. It represents gross profit as a percentage of net sales. Gross Profit is the difference between the net sales revenue, and the cost of goods sold. It can be calculated by dividing gross profit and net sales.

Compute the gross profit percentage of Company C as follows:

Thus, the gross profit percentage of Company C is 45.0%

3.

Prepare the journal entries to record transaction from (a) to (e).

Explanation of Solution

Prepare the journal entries to record transaction from (a) to (e) as follows:

a. Record the sales revenue and cost of goods sold:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash | 275,000 | ||

| Sales Revenue | 275,000 | ||

| (To record the sales revenue recognized in cash ) |

Table (1)

- Cash is an asset and it increases the value of assets. Therefore, debit cash by $275,000

- Sales revenue is component of stockholders’ equity and it increases the value of stockholder’s equity. Therefore, credit sales revenue by $275,000

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cost of goods sold | 152,070 | ||

| Inventory | 152,070 | ||

| (To record the cost of goods sold incurred during the year) |

Table (2)

- Cost of goods sold is a component of stockholders’ equity and it is decreases the value of stockholder’s equity. Therefore, debit cost of goods sold by $152,070.

- Inventory is an asset and it decreases the value of asset. Therefore, credit inventory account by $152,070.

b. Record the sales return and the cost of inventory used for production.

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Sales revenue | 1,600 | ||

| Cash | 1,600 | ||

| (To record the sales returns from customer) |

Table (3)

- Sales revenue is a component of stockholders’ equity and it increases the value of stockholder’s equity. Therefore, debit sales revenue by $1,600

- Cash is an asset and it decreases the value of assets. Therefore, credit cash by $1,600

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Inventory | 800 | ||

| Cost of goods sold | 800 | ||

| (To record the cost of inventory used for production) |

Table (4)

- Inventory is an asset and it increases the value of assets. Therefore, debit inventory by $800.

- Cost of goods sold is a component of stockholders’ equity and it decreases the value of stockholder’s equity. Therefore, credit cost of goods sold by $800.

c. Record the sale of merchandise on account and put back of inventory from production:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Accounts Receivable | 20,000 | ||

| Sales Revenue | 20,000 | ||

| (To record the sales made on account) |

Table (5)

- Accounts receivable is an asset and it increases the value of assets. Therefore, debit accounts receivable by $20,000.

- Sales revenue is component of stockholders’ equity and it increases the value of stockholder’s equity. Therefore, credit sales revenue by $20,000.

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cost of goods sold | 9,000 | ||

| Inventory | 9,000 | ||

| (To record the cost of inventory return) |

Table (6)

- Cost of goods sold is a component of stockholders’ equity and it decreases the value of stockholder’s equity. Therefore, debit cost of goods sold by $9,000.

- Inventory is an asset and it decreases the value of asset. Therefore, credit inventory by $9,000.

d. Record the cash received from credit customer.

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash | 10,000 | ||

| Accounts Receivable | 10,000 | ||

| (To record the cash received from the credit customer) |

Table (7)

- Cash is an asset and it increases the value of assets. Therefore, debit cash by $10,000.

- Accounts receivable is an asset and it decreases the value of assets. Therefore, credit accounts receivable by $10,000.

e. Record the sales return and allowances:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Sales revenue | 1,800 | ||

| Accounts receivable | 1,800 | ||

| (To record the sales returns and allowances ) |

Table (8)

- Sales revenue is a component of stockholders’ equity and it decreases the value of stockholder’s equity. Therefore, debit sales returns and allowances by $1,800

- Accounts receivable is an asset and it decreases the value of assets. Therefore, credit accounts receivable by $1,800

4.

Describe whether the given contract would increase the gross profit and gross profit percentage of Company C.

Explanation of Solution

Describe whether the given contract would increase the gross profit and gross profit percentage of Company C as follows:

In this case, the gross profit percentage is decreased from 45% to 43.8% (refer working note 5), because of the sale of contract.

Working note 4:

Calculate the gross profit for sale of contract:

Working note 5:

Calculate the gross profit percentage of Company after the sale of contract.

Want to see more full solutions like this?

Chapter 6 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

- Match each defınition with the term that best describes it. An income measure that includes gains and [ Choose ] [Choose ] Sales revenue (Sales) Expenses incurred in the process of earning sales revenue. losses that are excluded from the determination of net income. An account that is offset against a revenue Contra revenue account account on the income statement. Cost of goods sold Periodic inventory system FOB destination The total cost of merchandise sold during the Comprehensive income FOB shipping point Perpetual inventory system period. An inventory system under which the [ Choose ] company does not keep detailed inventory records throughout the accounting period but determines the cost of goods sold only at the end of an accounting period. An inventory system under which the [ Choose ] company keeps detailed records of the cost of each inventory purchase and sale, and the records continuously show the inventory that should be on hand. The primary source of revenue in a [ Choose…arrow_forwardRequired 1. Assume that Urban One sells a $300 gift certificate to a customer, collecting the $300 cash in advance. Prepare the journal entry for (a) collection of the cash for delivery of the gift certificate to the customer and (b) revenue from the subsequent delivery of merchandise when the gift certificate is used. 2. How can keeping less inventory help to improve Urban One's profit margin? 3. Cathy Hughes understands that many companies carry considerable inventory, and she is thinking of carrying additional inventory of merchandise for sale. Cathy desires your advice on the pros and cons of carrying such inventory. Provide at least one reason for, and one reason against, carrying additional inventory.arrow_forwardPlease solve the following question. Using the accounts below, prepare a basic Income Statement. All accounts will be used once. Use the example below to help with the solution Cost of Goods Sold General & Admininstrative Expense Interest Expense Net Sales Revenue Net Sales COGS Selling Expense Wages Expense Gross Profit or Margin Operating Expenses: Selling Exp General & Admininstrative Exp Research & Development Exp Insurance Exp Here an example of this type of question that you can use to help with the solution Income Statement For Year Ending Dec. 31, 2022 Wages Exp Depreciation, Amortization, & Depletion Exp Total Operating Expenses Operating Income Other Income/Loss: Interest Income Gain on Sale of Asset Loss on Sale of Asset Interest Expense Income before Taxes Income Tax Expense $ $ $ $ $ $ Net Income 22,000 15,000 2,200 100,000 $ 10,000 5,000 $1,000,000 (450,000) 550,000 15,000 225,000 5,000 7,500 85,000 20,000 357,500 192,500 20,000 5,000 (5,000) (10,000) 202,500 (142,500)…arrow_forward

- Enter the missing dollar amounts for the income statement for each of the following independent cases. (Hint: In Case B, work from the bottom up.) Net sales revenue Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold Case A $ Case B 7,590 $ 11,020 $ 6,610 4,880 10,250 15,250 10,960 Case C $ 6,120 $ 3,990 9,330 13,320 4,350 Gross profit Expenses 1,350 300 550 Pretax income (loss) $ 1,640 $ (470) $ 1,220arrow_forwardThe following is select account information for August Sundries. Sales: $850,360; Sales Returns and Allowances: $148,550; COGS: $300,840; Operating Expenses: $45,770; Sales Discounts: $231,820. If August Sundries uses a multi-step income statement format, what is their gross margin?arrow_forwardUse the following information to answer the questions that follow. A. Calculate the operating income percentage for each of the stores. Comment on how your analysis has changed for each store. B. Perform a vertical analysis for each store. Based on your analysis, what accounts would you want to investigate further? How might management utilize this information? C. Which method of analysis (using a dollar value or percentage) is most relevant and/or useful? Explain.arrow_forward

- Required information CP6-3 Recording Cash Sales, Credit Sales, Sales Returns, and Sales Allowances and Analyzing Gross Profit Percentage [LO 6-4, LO 6-6] [The following information applies to the questions displayed below.] Campus Stop, Inc., is a student co-op. Campus Stop uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $152,590). $ 276,700 b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $810). 1,610 c. Sold merchandise (costing $9,450) to a customer on account with terms n/30. 21,000 d. Collected half of the balance owed by the customer in (c). 10,500 e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. 1,820 CP6-3 Part 1 Required: Compute Net Sales and Gross Profit for Campus Stop.arrow_forward! Required information [The following information applies to the questions displayed below.] The following data were provided by Mystery Incorporated for the year ended December 31: Cost of Goods Sold Income Tax Expense Merchandise Sales (gross revenue) for Cash Merchandise Sales (gross revenue) on Credit Office Expense Sales Returns and Allowances Salaries and Wages Expense Required: 1. Prepare a multistep income statement for external reporting purposes. MYSTERY INCORPORATED Income Statement For the Year Ended December 31 Net Sales Sales Returns and Allowances Gross Profit Revenues Total Operating Expenses Income from Operations Net Income $ 286,800 (7,170) 279,630 0 279,630 $ 279,630 $ 167,000 18,350 244,000 42,800 19, 200 7,170 41,000arrow_forwardI. Solve the following problem using MS Excel In many situations, a retailer may not compile a profit or loss statement for individual departments. Suppose that you are a retail buyer, and you decide to recreate the statement for your own department using the following data: Gross sales of $72,300.00, net sales of $60,900.00, opening inventory of $13,900.00, ending inventory of $19,400.00, purchases of $14,000.00, inward freight of 2%, cash discounts of 5%, returns to vendors of $500.00, alterations and workroom costs of 3%, direct expenses of $19,600.00 and total expenses worth $35,000.00, complete the profit or loss statement.(Hint: Remember that freight and cash discount %’s are calculated as % of Purchases, while the alteration/workroom costs % is expressed as % of NS).arrow_forward

- Required information CP6-3 Recording Cash Sales, Credit Sales, Sales Returns, and Sales Allowances and Analyzing Gross Profit Percentage [LO 6-4, LO 6-6] [The following information applies to the questions displayed below.] Campus Stop, Inc., is a student co-op. Campus Stop uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $152,590). $ 276,700 b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $810). 1,610 c. Sold merchandise (costing $9,450) to a customer on account with terms n/30. 21,000 d. Collected half of the balance owed by the customer in (c). 10,500 e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. 1,820 CP6-3 Part 4 Campus Stop is considering a contract to sell merchandise to a campus…arrow_forwardUse the following information to calculate Goods Available for Sale (GAFS) and Cost of Goods Sold (COGS). You will not need all of the information: Purchases $100 Purchase discounts $2 Beginning Inventory $10 Purchase returns $3 Sales Discounts $8 Accounts Receivable $25 Purchase Freight (on purchases, buyer responsible) $15 Delivery Expense (on sales to customers, seller responsible) $10 Sales $200 Accounts Payable $35 GAFS is $ Now..Assume ending inventory is $50. Use all the information provided to determine Cost of goods sold (COGS) COGS is $arrow_forwardRequired 1 Required 2 Prepare a contribution format income statement. Cherokee, Incorporated Contribution Format Income Statement Variable expenses: Fixed expenses:arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College