Concept explainers

LO2 19 Interest Rate Risk. Both Bond Bill and Bond Ted have 6.2 percent coupons, make semiannual payments, and are priced at par value. Bond Bill has 5 years to maturity, whereas Bond Ted has 25 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Bill? Of Bond Ted? Both bonds have a par value of $1,000. If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Bill be then? Of Bond Ted? Illustrate your answers by graphing

To determine: The percentage change in bond price.

Introduction:

A bond refers to the debt securities issued by the governments or corporations for raising capital. The borrower does not return the face value until maturity. However, the investor receives the coupons every year until the date of maturity.

Bond price or bond value refers to the present value of the future cash inflows of the bond after discounting at the required rate of return.

Answer to Problem 19QP

The percentage change in bond price is as follows:

| Yield to maturity | Bond B | Bond T |

| 4.2% | 8.94% | 30.77% |

| 8.2% | (8.071%) | (21.12%) |

The interest rate risk is high for a bond with longer maturity, and the interest rate risk is low for a bond with shorter maturity period. The maturity period of Bond B is 5 years, and the maturity period of Bond T is 25 years. Hence, the Bond T’s bond price fluctuates higher than the bond price of Bond B due to longer maturity.

Explanation of Solution

Given information:

There are two bonds namely Bond B and Bond T. The coupon rate of both the bonds is 6.2 percent. The bonds pay the coupons semiannually. The price of the bond is equal to its par value. Assume that the par value of both the bonds is $1,000. Bond B will mature in 5 years, and Bond T will mature in 25 years.

Formulae:

The formula to calculate the bond value:

Where,

“C” refers to the coupon paid per period

“F” refers to the face value paid at maturity

“r” refers to the yield to maturity

“t” refers to the periods to maturity

The formula to calculate the percentage change in price:

Determine the current price of Bond B:

Bond B is selling at par. It means that the bond value is equal to the face value. It also indicates that the coupon rate of the bond is equal to the yield to maturity of the bond. As the par value is $1,000, the bond value or bond price of Bond B will be $1,000.

Hence, the current price of Bond B is $1,000.

Determine the current yield to maturity on Bond B:

As the bond is selling at its face value, the coupon rate will be equal to the yield to maturity of the bond. The coupon rate of Bond B is 6.2 percent.

Hence, the yield to maturity of Bond B is 6.2 percent.

Determine the current price of Bond T:

Bond T is selling at par. It means that the bond value is equal to the face value. It also indicates that the coupon rate of the bond is equal to the yield to maturity of the bond. As the par value is $1,000, the bond value or bond price of Bond T will be $1,000.

Hence, the current price of Bond T is $1,000.

Determine the current yield to maturity on Bond T:

As the bond is selling at its face value, the coupon rate will be equal to the yield to maturity of the bond. The coupon rate of Bond T is 6.2 percent.

Hence, the yield to maturity of Bond T is 6.2 percent.

The percentage change in the bond value of Bond B and Bond T when the interest rates rise by 2 percent:

Compute the new interest rate (yield to maturity) when the interest rates rise:

The interest rate refers to the yield to maturity of the bond. The initial yield to maturity of the bonds is 6.2 percent. If the interest rates rise by 2 percent, then the new interest rate or yield to maturity will be 8.2 percent

Compute the bond value when the yield to maturity of Bond B rises to 8.2 percent:

The coupon rate of Bond B is 6.2 percent, and its face value is $1,000. Hence, the annual coupon payment is $62

The yield to maturity is 8.2 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 4.1 percent

The remaining time to maturity is 5 years. As the coupon payment is semiannual, the semiannual periods to maturity are 10

Hence, the bond price of Bond B will be $919.29 when the interest rises to 8.2 percent.

Compute the percentage change in the price of Bond B when the interest rates rise to 8.2 percent:

The new price after the increase in interest rate is $919.29. The initial price of the bond was $1,000.

Hence, the percentage decrease in the price of Bond B is (8.071 percent) when the interest rates rise to 8.2 percent.

Compute the bond value when the yield to maturity of Bond T rises to 8.2 percent:

The coupon rate of Bond T is 6.2 percent, and its face value is $1,000. Hence, the annual coupon payment is $62

The yield to maturity is 8.2 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 4.1 percent

The remaining time to maturity is 25 years. As the coupon payment is semiannual, the semiannual periods to maturity are 50

Hence, the bond price of Bond T will be $788.8075 when the interest rises to 8.2 percent.

Compute the percentage change in the price of Bond T when the interest rates rise to 8.2 percent:

The new price after the increase in interest rate is $788.8075. The initial price of the bond was $1,000.

Hence, the percentage decrease in the price of Bond T is (21.12 percent) when the interest rates rise to 8.2 percent.

The percentage change in the bond value of Bond B and Bond T when the interest rates decline by 2 percent:

Compute the new interest rate (yield to maturity) when the interest rates decline:

The interest rate refers to the yield to maturity of the bond. The initial yield to maturity of the bonds is 6.2 percent. If the interest rates decline by 2 percent, then the new interest rate or yield to maturity will be 4.2 percent

Compute the bond value when the yield to maturity of Bond B declines to 4.2 percent:

The coupon rate of Bond B is 6.2 percent, and its face value is $1,000. Hence, the annual coupon payment is $62

The yield to maturity is 4.2 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 2.1 percent

The remaining time to maturity is 5 years. As the coupon payment is semiannual, the semiannual periods to maturity are 10

Hence, the bond price of Bond B will be $1,089.36 when the interest declines to 4.2 percent.

Compute the percentage change in the price of Bond B when the interest rates decline to 4.2 percent:

The new price after the increase in interest rate is $1,089.36. The initial price of the bond was $1,000.

Hence, the percentage increase in the price of Bond B is 8.94 percent when the interest rates decline to 4.2 percent.

Compute the bond value when the yield to maturity of Bond T declines to 4.2 percent:

The coupon rate of Bond T is 6.2 percent, and its face value is $1,000. Hence, the annual coupon payment is $62

The yield to maturity is 4.2 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 2.1 percent

The remaining time to maturity is 25 years. As the coupon payment is semiannual, the semiannual periods to maturity are 50

Hence, the bond price of Bond T will be $1,307.73 when the interest declines to 4.2 percent.

Compute the percentage change in the price of Bond T when the interest rates decline to 4.2 percent:

The new price after the increase in interest rate is $1,307.73. The initial price of the bond was $1,000.

Hence, the percentage increase in the price of Bond T is 30.77 percent when the interest rates decline to 4.2 percent.

A summary of the bond prices and yield to maturity of Bond B and Bond T:

Table 1

|

Yield to maturity |

Bond B | Bond T |

| 4.2% | $1,089.36 | $1,307.73 |

| 6.2% | $1,000.00 | $1,000.00 |

| 8.2% | $919.29 | $788.81 |

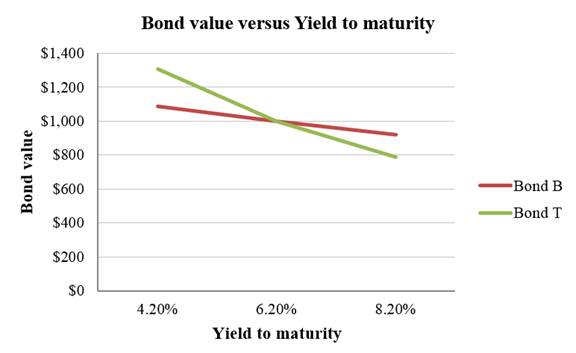

A graph indicating the relationship between bond prices and yield to maturity based on Table 1:

Interpretation of the graph:

The above graph indicates that the price fluctuation is higher in a bond with higher maturity. Bond T has a maturity period of 25 years. As its maturity period is longer, its price sensitivity to the interest rates is higher. Bond B has a maturity period of 5 years. As its maturity period is shorter, its price sensitivity to the interest rates is lower. Hence, a bond with longer maturity is subject to higher interest rate risk.

Want to see more full solutions like this?

Chapter 6 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Don't used Ai solutionarrow_forwardLiterature Review Based Essay on Contemporary Issues of Business Ethics and Corporate Social Responsibility Essay Format Cover Page with your Name Table of Content • Introduction ⚫ Objectives ⚫ Discussion with Literature Support • Conclusion References (10+) Words Limit-3000-3500 wordsarrow_forwardPlease don't use hand ratingarrow_forward

- "Dividend paying stocks cannot be growth stocks" Do you agree or disagree? Discuss choosing two stocks to help justify your view.arrow_forwardA firm needs to raise $950,000 but will incur flotation costs of 5%. How much will it pay in flotation costs? Multiple choice question. $55,500 $50,000 $47,500 $55,000arrow_forwardWhile determining the appropriate discount rate, if a firm uses a weighted average cost of capital that is unique to a particular project, it is using the Blank______. Multiple choice question. pure play approach economic value added method subjective approach security market line approacharrow_forward

- When a company's interest payment Blank______, the company's tax bill Blank______. Multiple choice question. stays the same; increases decreases; decreases increases; decreases increases; increasesarrow_forwardFor the calculation of equity weights, the Blank______ value is used. Multiple choice question. historical average book marketarrow_forwardA firm needs to raise $950,000 but will incur flotation costs of 5%. How much will it pay in flotation costs? Multiple choice question. $50,000 $55,000 $55,500 $47,500arrow_forward

- Question Mode Multiple Choice Question The issuance costs of new securities are referred to as Blank______ costs. Multiple choice question. exorbitant flotation sunk reparationarrow_forwardWhat will happen to a company's tax bill if interest expense is deducted? Multiple choice question. The company's tax bill will increase. The company's tax bill will decrease. The company's tax bill will not be affected. The company's tax bill for the next year will be affected.arrow_forwardThe total market value of a firm is calculated as Blank______. Multiple choice question. the number of shares times the average price the number of shares times the future price the number of shares times the share price the number of shares times the issue pricearrow_forward