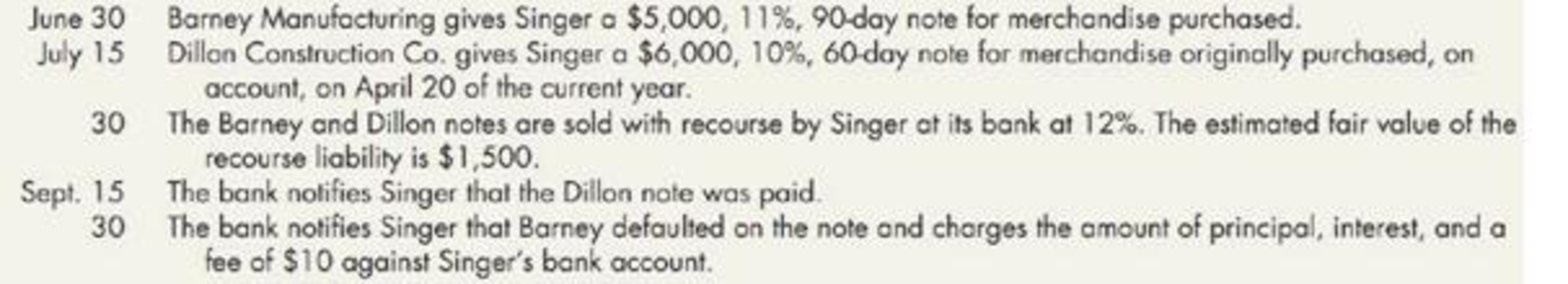

Recording the Sale of Notes Receivable Singer Corporation was involved in the following events in the current year:

Required:

Prepare the

Provide journal entries to record the previous information on Corporation S’ accounts.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Prepare journal entries:

| Date | Account titles and explanation | Debit ($) | Credit ($) |

| June 30 | Notes Receivable (Company B) | 5,000 | |

| Sales Revenue | 5,000 | ||

| (To record the receipt of the interest bearing note) | |||

| July 15 | Notes Receivable (Company D) | 6,000 | |

| Accounts Receivable | 6,000 | ||

| (To record the notes receivable) | |||

| June 30 | Cash | 11,043.25 | |

| Loss from Sale of Receivable | |||

| 1,527.58 | |||

| Recourse Liability | 1,500.00 | ||

| Notes Receivable (Company B and D) | 11,000.00 | ||

| Interest Income | 70.83 | ||

| (To record the note discounted on July 30) | |||

| September 30 | Recourse liability | 1,500 | |

| Notes receivable dishonored | 3,647.50 | ||

| Cash | 5,147.50 | ||

| (To record the notes dishonored) |

Table (1)

To record the receipt of the interest bearing note:

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $5,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $5,000.

To record the notes receivable:

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $6,000.

- Accounts receivable is an asset and it is decreased. Therefore, credit accounts receivable account by $6,000.

To record the note discounted on July 30:

- Cash is an asset and it is increased. Therefore, debit cash account by $11,043.25

- Loss from sale of receivable is a component of stockholders’ equity and it is decreased. Therefore, debit loss from sale of receivables by $1,527.58

- Recourse liability is a liability and it is increased. Therefore, credit recourse liability by $1,500.

- Notes receivable is an asset and it is increased. Therefore, credit notes receivable account by $11,000.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $70.83.

To record the notes dishonored:

- Recourse liability is a liability and it is decreased. Therefore, debit recourse liability account by $1,500.

- Notes dishonored are a component of stockholders’ equity and it is decreased. Therefore, debit notes dishonored account by $3,647.50.

- Cash is an asset and it is decreased. Therefore, credit cash account by $5,147.50.

Working note:

(1) Calculate the loss from sale of receivables:

| Particulars | Company B | Company D |

| Face value of note | $5,000 | $6,000 |

| Interest to maturity | (2)$137.50 | (6)$100 |

| Maturity value of note | $5,137.50 | $6,100 |

| Discount | (3)($102.75) | (7)($91.50) |

| Proceeds | $5,034.75 | $6,008.50 |

| Book value of note | (5)$5,045.83 | (9)$6,025 |

| Loss from sale of receivable | ($11.08) | ($16.50) |

Table (2)

(2) Calculate the interest to maturity of note for Company B:

(3) Calculate the discount amount for company B:

Note: 30 days is calculated from June 30 to July 30.

(4) Calculate the amount of accrued interest income for Company B:

Note: 30 days is calculated from June 30 to July 30.

(5) Calculate the amount of book value note for company B:

(6) Calculate the interest to maturity of note for Company D:

(7) Calculate the discount amount for company D:

Note: 15 days is calculated from June 30 to July 15.

(8) Calculate the amount of accrued interest income for company D:

Note: 15 days is calculated from June 30 to July 15.

(9) Calculate the amount of book value note company D:

Want to see more full solutions like this?

Chapter 6 Solutions

Intermediate Accounting: Reporting and Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage