Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 19E

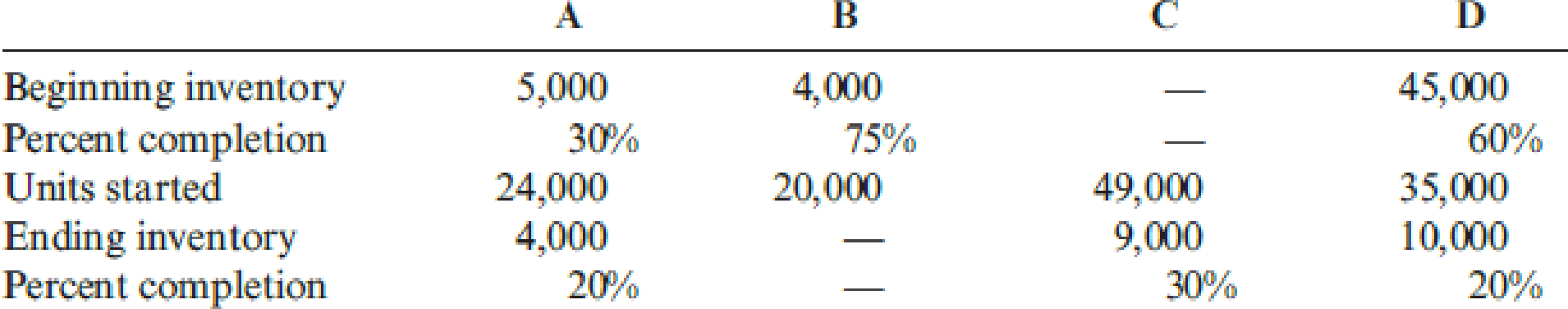

Using the data from Exercise 6.18, compute the equivalent units of production for each of the four departments using the FIFO method.

The following data are for four independent process-costing departments. Inputs are added continuously.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Indicate which of the following phrases correctly completesthis sentence: “Equivalent units of production . . .” (Indicateall correct answers.)a. Are a measure of productive activity.b. Represent work done on units still in process, as well asthose completed during the period.c. Are used as the basis for computing per-unit costs inmost process cost accounting systems.

d. Are computed separately for each significant input con-sumed in the production process.

Please follow the directions seen in the picture.

The four steps necessary to complete a cost of production report in a process cost system are

1. allocate costs to units transferred out and partially completed units

2. determine the units to be assigned costs

3. determine the cost per equivalent unit

4. compute equivalent units of production

The correct ordering of the steps is

Oa. 2,4, 3, 1

ОБ. 2,3, 1, 4

Oc. 2,3, 4, 1

Od. 4,2, 3, 1

Chapter 6 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 6 - What is a process? Provide an example that...Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 3DQCh. 6 - What are transferred-in costs?Ch. 6 - Explain why transferred-in costs are a special...Ch. 6 - What is a production report? What purpose does...Ch. 6 - Can process costing be used for a service...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - How is the equivalent unit calculation affected...Ch. 6 - Describe the five steps in accounting for the...

Ch. 6 - Under the weighted average method, how are...Ch. 6 - Under what conditions will the weighted average...Ch. 6 - In assigning costs to goods transferred out, how...Ch. 6 - Prob. 14DQCh. 6 - What is operation costing? When is it used?Ch. 6 - Lamont Company produced 80,000 machine parts for...Ch. 6 - Lising Therapy has a physical therapist who...Ch. 6 - Fleming, Fleming, and Johnson, a local CPA firm,...Ch. 6 - During October, McCourt Associates incurred total...Ch. 6 - Tomar Company produces vitamin energy drinks. The...Ch. 6 - Apeto Company produces premium chocolate candy...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Gunnison Company had the following equivalent...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Morrison Company had the equivalent units schedule...Ch. 6 - Shorts Company has three process departments:...Ch. 6 - A local barbershop cuts the hair of 1,200...Ch. 6 - Friedman Company uses JIT manufacturing. There are...Ch. 6 - Lacy, Inc., produces a subassembly used in the...Ch. 6 - Softkin Company manufactures sun protection...Ch. 6 - Heap Company manufactures a product that passes...Ch. 6 - K-Briggs Company uses the FIFO method to account...Ch. 6 - The following data are for four independent...Ch. 6 - Using the data from Exercise 6.18, compute the...Ch. 6 - Holmes Products, Inc., produces plastic cases used...Ch. 6 - Dama Company produces womens blouses and uses the...Ch. 6 - Fordman Company has a product that passes through...Ch. 6 - Using the same data found in Exercise 6.22, assume...Ch. 6 - Baxter Company has two processing departments:...Ch. 6 - Tasty Bread makes and supplies bread throughout...Ch. 6 - Under either weighted average or FIFO, when...Ch. 6 - During the month of June, the mixing department...Ch. 6 - As goods are transferred from a prior process to a...Ch. 6 - During March, Hanks Manufacturing started and...Ch. 6 - Proteger Company manufactures insect repellant...Ch. 6 - Swasey Fabrication, Inc., manufactures frames for...Ch. 6 - Refer to the data in Problem 6.31. Assume that the...Ch. 6 - Hatch Company produces a product that passes...Ch. 6 - FIFO Method, Single Department Analysis, One Cost...Ch. 6 - Hepworth Credit Corporation is a wholly owned...Ch. 6 - Muskoge Company uses a process-costing system. The...Ch. 6 - Prob. 37PCh. 6 - Healthway uses a process-costing system to compute...Ch. 6 - FIFO Method, Two-Department Analysis Refer to the...Ch. 6 - Jacson Company produces two brands of a popular...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - Larkin Company produces leather strips for western...Ch. 6 - Novel Toys, Inc., manufactures plastic water guns....Ch. 6 - Prob. 44P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data are for four independent process-costing departments. Inputs are added continuously. Required: Compute the equivalent units of production for each of the preceding departments using the weighted average method.arrow_forwardMeester Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Equipment expense Supervisory expense Distribution of Resource Consumption Across Activity Cost Pools: Equipment expense Supervisory expense $80, 400 $ 4, 100 Product MO Product H2 Total Activity Cost Pools Machining Order Filling 0.60 0.60 MHS (Machining) 1,300 9,540 10,840 Machining costs are assigned to products using machine-hours (MHS) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: 0.20 0.10 Orders (Order Filling) 790 1,480 2,270 Other 0.20 0.30…arrow_forwardRex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity.arrow_forward

- The following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added at the beginning of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forwardRocks Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity.arrow_forwardLacy, Inc., produces a subassembly used in the production of hydraulic cylinders. The subassemblies are produced in three departments: Plate Cutting, Rod Cutting, and Welding. Materials are added at the beginning of the process. Overhead is applied using the following drivers and activity rates: Other data for the Plate Cutting Department are as follows: Required: 1. Prepare a physical flow schedule. 2. Calculate equivalent units of production for: a. Direct materials b. Conversion costs 3. Calculate unit costs for: a. Direct materials b. Conversion costs c. Total manufacturing 4. Provide the following information: a. The total cost of units transferred out b. The journal entry for transferring costs from Plate Cutting to Welding c. The cost assigned to units in ending inventoryarrow_forward

- The following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added 50% at the beginning of the process and 50% at the end of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forwardThe following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added 50% at the beginning of the process and 50% at the end of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forwardThe cost behavior patterns below are lettered A through H. The vertical axes of the graphs represent total dollars of expense, and the horizontal axes represent production in units, machine hours, or direct labor hours. In each case, the zero point is at the intersection of the two axes. Each graph may be used no more than once. Required: Select the graph that matches the lettered cost described here. a. Depreciation of equipmentthe amount of depreciation charged is computed based on the number of machine hours that the equipment was operated. b. Electricity billflat fixed charge, plus a variable cost after a certain number of kilowatt hours are used. c. City water billcomputed as follows: d. Depreciation of equipmentthe amount is computed by the straight-line method. e. Rent on a factory building donated by the citythe agreement calls for a fixed fee payment, unless 200,000 labor hours are worked, in which case no rent need be paid. f. Salaries of repair workersone repair worker is needed for every 1,000 machine hours or less (i.e., 0 to 1,000 hours requires one repair worker, 1,001 to 2,000 hours requires two repair workers, etc.).arrow_forward

- Frenchys has three cost pools and an associated cost driver to allocate the costs to the product. The cost pools, cost driver, estimated overhead, and estimated activity for the cost pool are: What is the predetermined overhead rate for each activity?arrow_forwardAssuming that all materials are added at the beginning of the process and that labor and factory overhead are applied evenly during the process, compute the figures to be inserted in the blank spaces of the following data, using the weighted average cost method. [Hint: for best success in solving each Case, solve them in numerical order starting with (1)]arrow_forwardCustoms has three cost pools and an associated cost driver to allocate the costs to the product. The cost pools, cost driver, estimated overhead, and estimated activity for the cost pool are: What is the predetermined overhead rate for each activity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY