Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 18P

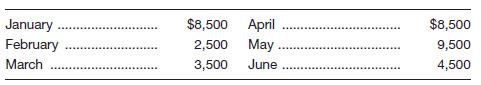

Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows:

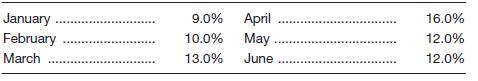

Short-term financing will be utilized for the next six months. Here are the projected annual interest rates:

a. Compute total dollar interest payments for the six months. To convert an annual rate to a monthly rate, divide by 12. Then multiply this value times the monthly balance. To get your answer, add up the monthly interest payments.

b. If long-term financing at 12 percent had been utilized throughout the six months, would the total-dollar interest payments be larger or smaller? Compute the interest owed over the six months and compare your answer to that in part a.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Make a report on Human Resource Development Practices in Nepalese Private Sector Business Industries.

Eccles Inc., a zero-growth firm, has an expected EBIT of $100.000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%.

If the effective personal tax rates on debt income and stock income are Td = 25% and TS = 20% respectively, what is the value of the firm according to the Miller model (Based on the same unlevered firm value in the earlier question)?

a. $475,875

b. $536,921

c. $587,750

d. $623,050

e. $564,167

Refer to the data for Eccles Inc. earlier. If the effective personal tax rates on debt income and stock income are Td = 25% and TS = 20% respectively, what is the value of the firm according to the Miller model (Based on the same unlevered firm value in the earlier question)?

a. $475,875

b. $536,921

c. $587,750

d. $623,050

O $564,167

Chapter 6 Solutions

Foundations of Financial Management

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Prob. 4DQCh. 6 - “The most appropriate financing pattern would be...Ch. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - What are three theories for describing the shape...Ch. 6 - Since the mid-1960s, corporate liquidity has been...

Ch. 6 - Gary’s Pipe and Steel Company expects sales next...Ch. 6 - Prob. 2PCh. 6 - Tobin Supplies Company expects sales next year to...Ch. 6 - Antivirus Inc. expects its sales next year to be...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Boatler Used Cadillac Co. requires $850,000 in...Ch. 6 - Biochemical Corp. requires $550,000 in financing...Ch. 6 - Sauer Food Company has decided to buy a new...Ch. 6 - Assume that Hogan Surgical Instruments Co. has...Ch. 6 - Assume that Atlas Sporting Goods Inc. has $840,000...Ch. 6 - Colter Steel has $4,200,000 in assets. Short-term...Ch. 6 - Prob. 13PCh. 6 - Guardian Inc. is trying to develop an asset...Ch. 6 - Lear Inc. has $840,000 in current assets, $370,000...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Carmen’s Beauty Salon has estimated monthly...Ch. 6 - Prob. 19PCh. 6 - Eastern Auto Parts Inc. has 15 percent of its...Ch. 6 - Bombs Away Video Games Corporation has forecasted...Ch. 6 - Esquire Products Inc. expects the following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Warren Supply Inc. wants to use debt and common equity for its capital budget of $800,000 in the coming year, but it will not issue any new common stock. It is forecasting an EPS of $3.00 on its 500,000 outstanding shares of stock and is committed to maintaining a $2.00 dividend per share. Given these constraints, what percentage of the capital budget must be financed with debt? a. 33.84% b. 37.50% c. 32.15% d. 30.54% e. 35.63%arrow_forwardEccles Inc., a zero-growth firm, has an expected EBIT of $100.000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%. What is the firm's cost of equity according to MM with corporate taxes? Ο 32.0% Ο 25.9% Ο 21.0% Ο 28.8% Ο 23.3%arrow_forwardP&L Corporation wants to sell some 20-year, annual interest, $1,000 par value bonds. Its stock sells for $42 per share, and each bond would have 75 warrants attached to it each exercisable into one share of stock at an exercise price of $47. The firm's straight bonds yield 10%. Each warrant is expected to have a market value of $2.00 given that the stock sells for $42. What coupon interest rate must the company set on the bonds in order to sell the bonds with-warrants at par? a. 9.54% b. 8.65% c. 9.08% d. 8.24% e. 83%arrow_forward

- Potter & Lopez Inc. just sold a bond with 50 warrants attached. The bonds have a 20-year maturity and an annual coupon of 12%, and they were issued at their $1,000 par value. The current yield on similar straight bonds is 15%. What is the implied value of each warrant? Ο $4.35 O $3.76 O $4.56 O $4.14 O $3.94arrow_forwardIf a firm adheres strictly to the residual dividend policy, the issuance of new common stock would suggest that The dividend payout ratio is decreasing. The dividend payout ratio has remained constant. The dollar amount of investments has decreased. No dividends were paid during the year. the dividend payout ratio is increasing.arrow_forwardq6) Which of the following statements is CORRECT? If Congress increases taxes on capital gains but leaves tax rates on dividends unchanged, this will motivate companies to increase stock repurchases. The clientele effect explains why firms change their dividend policies so often.. One advantage of the residual dividend policy is that it helps corporations to develop a specific and well-identified dividend clientele. If a firm splits its stock 2-for-1, then its stock price will be doubled. If a firm follows the residual dividend policy, then a sudden increase in the number of profitable projects is likely to reduce the firm's dividend payout.arrow_forward

- Amold Rossiter is a 40-year-old employee of the Barrington Company who will retire at age 60 and expects to live to age 75. The firm has promised a retirement income of $20.000 at the end of each year following retirement until death. The firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. What is Barrington's annual pension contribution to the nearest dollar for Mr. Rossiter? (Assume certainty and end-of-year cash flows. a. $3,642 b.$4,443 c. $4,967 d.$5,491 e.$2,756arrow_forwardMorales Publishing's tax rate is 40%, its beta is 1.10, and it uses no debt. However, the CFO is considering moving to a capital structure with 30% debt and 70% equity. If the risk free rate is 5.0% and the market risk premium is 6.0%, by how much would the capital structure shift change the firm's cost of equity? Ο 1.53% Ο 2.05% Ο 1.70% Ο 1.87% O 2.26%arrow_forwardThe common stock of Southern Airlines currently sells for $33, and its 8% convertible debentures (issued at par, or $1,000) sell for $850. Each debenture can be converted into 25 shares of common stock at any time before 2025. What is the conversion value of the bond? a. $825.00 b.$866.25 c. $744.56 d. $783.75 e. $707.33arrow_forward

- Bailey and Sons has a levered beta of 1.10, its capital structure consists of 40% debt and 60% equity, and its tax rate is 40%. What would Bailey's beta be if it used no debt, i.e., what is its unlevered beta? a. 0.79 b. 0.71 c. 0.67 d. 0.64 e. 0.75arrow_forwardEccles Inc., a zero-growth firm, has an expected EBIT of $100.000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%. What is the value of the firm according to MM with corporate taxes? a. $710,875 b. $587,500 c. $646,250 d. $475,875 e. $528,750arrow_forwardMikkleson Mining stock is selling for $40 per share and has an expected dividend in the coming year of $2.00 and has an expected constant growth rate of 5%. The company is considering issuing a 10-year convertible bond that would be priced at $1,000 par value. The bonds would have an 8% annual coupon, and each bond could be converted into 20 shares of common stock. The required rate of return on an otherwise similar nonconvertible bond is 10.00%. What is the estimated floor price of the convertible at the end of Year 3? a. $926.10 b. $794.01 c. $835.81 d. $879.80 $972.41arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY