PAYROLL ACCT.,2019 ED.(LL)-TEXT

19th Edition

ISBN: 9781337619783

Author: BIEG

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 12PA

Kelsey Gunn is the only employee of Arsenault Company. His pay rate is $23.00 per hour with an overtime rate of 1½ times for hours over 40 in a workweek.

For the week ending March 31, 20--, he worked 48 hours. Calculate his gross pay for the week using the overtime premium approach to calculate the overtime pay.

Since the company holds back one week of pay, Gunn will not be paid until April 7, 20--. What

- a. Regular pay....................................................................... $ ________

- b. Overtime premium pay..................................................... $ ________

- c. Gross pay.......................................................................... $ ________

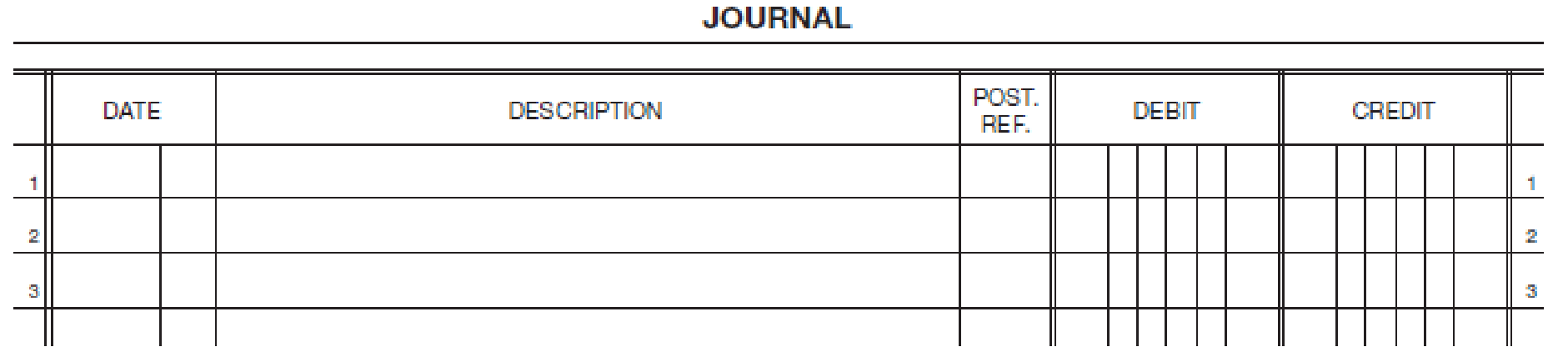

- d. Adjusting entry

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Robin Market works for Cycle Industries. Her pay rate is $14.50 per hour and she receives overtime pay at one and one-half times her

regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31, 20X1, Robin worked 42

hours. She is married and claims three withholding allowances on her W-4 form. Robin's cumulative earnings prior to this pay period

total $32,000. This week's wages are subject to the following deductions:

1. Social Security tax at 6.2 percent

2. Medicare tax at 1.45 percent

3. Federal income tax (use the withholding table shown in Figure 10.2b)

4. Health and disability insurance premiums, $180

5. Charitable contribution, $25

Required:

1. Compute Robin's regular, overtime, gross, and net pay.

2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31.

Analyze:

Based on Robin's cumulative earnings through December 31, how much overtime pay did she earn this year?

Complete…

Winter submitted a pay card reflecting the following hours worked at Kicy, Incorporated. Winter earns $15.95 per hour. The

company pays overtime only on hours worked exceeding 40 per week. The company is considering changing from quarter-hour

to hundredth-hour time collection. Under the current quarter-hour system, each time the employee clocks in or out, the time is

rounded to the nearest quarter-hour.

Required:

1. Calculate Winter's time for both the quarter-hour and hundredth-hour systems.

2. Calculate Winter's total pay in the hundredth-hour and quarter-hour systems.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Calculate Winter's time for both the quarter-hour and hundredth-hour systems.

Note: Round your intermediate calculations and final answers to 2 decimal places.

In

7:00

9:29

7:15

10:02

Out

11:16

12:28

11:43

11:00

In

12:15

1:43

12:30

12:06

Out

5:20

6:10

5:33

3:00

Total Hours with Total Hours with

Quarter-hour

Hundredth-hour

John Torre is the only employee of Bambert Company. His pay rate is $19.70 per hour with an overtime rate of 1½ times for hours over 40 in a workweek.

For the week ending March 31, 20--, he worked 44 hours. Calculate his gross pay for the week using the overtime premium approach to calculate the overtime pay.

Chapter 6 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

Ch. 6 - The totals from the payroll register of Olt...Ch. 6 - Olt Companys gross payroll for the week of January...Ch. 6 - _____ 1. 1. Employees earnings record A. Expense...Ch. 6 - Prob. 1QRCh. 6 - For what reason are distribution columns sometimes...Ch. 6 - Prob. 3QRCh. 6 - Prob. 4QRCh. 6 - Prob. 5QRCh. 6 - Prob. 6QRCh. 6 - Prob. 7QR

Ch. 6 - What portions of an employees take-home pay are...Ch. 6 - Prob. 9QRCh. 6 - Prob. 10QRCh. 6 - Prob. 11QRCh. 6 - What must the employer do with unclaimed...Ch. 6 - What special accounts must usually be opened in...Ch. 6 - Prob. 14QRCh. 6 - Prob. 15QRCh. 6 - Prob. 16QRCh. 6 - What accounts are debited and credited when an...Ch. 6 - Prob. 18QRCh. 6 - Prob. 19QRCh. 6 - Prob. 20QRCh. 6 - Prob. 1QDCh. 6 - Prob. 2QDCh. 6 - Prob. 3QDCh. 6 - Prob. 1PACh. 6 - Prob. 2PACh. 6 - a. Cal Ruther, an employer, is subject to FICA...Ch. 6 - The employees of Donnelly Music Company earn total...Ch. 6 - Vulcra, Inc., has a semimonthly payroll of 67,000...Ch. 6 - Prob. 6PACh. 6 - Prob. 7PACh. 6 - The employees of Pelter Company earn wages of...Ch. 6 - The following information pertains to a weekly...Ch. 6 - Prob. 10PACh. 6 - On December 31, 20--, Karmansky Company needed to...Ch. 6 - Kelsey Gunn is the only employee of Arsenault...Ch. 6 - Prob. 13PACh. 6 - At the end of April, Hernandez Company had a...Ch. 6 - Prob. 15PACh. 6 - In the Illustrative Case in this chapter, payroll...Ch. 6 - Prob. 1PBCh. 6 - Prob. 2PBCh. 6 - Prob. 3PBCh. 6 - The employees of Carson Bakery Company earn total...Ch. 6 - Purnell, Inc., has a semimonthly payroll of 53,900...Ch. 6 - Adams, Inc., pays its employees weekly wages in...Ch. 6 - Prob. 7PBCh. 6 - The employees of Portonegra Company earn wages of...Ch. 6 - The following information pertains to a weekly...Ch. 6 - Prob. 10PBCh. 6 - Prob. 11PBCh. 6 - Prob. 12PBCh. 6 - Prob. 13PBCh. 6 - At the end of June, Morton Company had a balance...Ch. 6 - Prob. 15PBCh. 6 - In the Illustrative Case in this chapter, payroll...Ch. 6 - Frank Flynn is the payroll manager for Powlus...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joseph Cavato is paid $12.96 per hour. During the past week, he worked 46 hours, and he is a covered employee who must be paid for overtime. Calculate his gross pay using the overtime premium approach. Round your overtime rate to two decimal places and use the rounded amount in subsequent computations. Round your final answers to the nearest cent. a. Regular pay (46 hours) c. Gross payarrow_forwardPeter Jones is paid $13.76 per hour. During the past week, he worked 44 hours, and he is a covered employee who must be paid for overtime. Calculate his gross pay using the overtime premium approach. Round your overtime rate to two decimal places and use the rounded amount in subsequent computations. Round your final answers to the nearest cent. a. Regular pay (44 hours) b. Overtime premium pay c. Gross pay $ $arrow_forwardWinter submitted a pay card reflecting the following hours worked at Kicy, Incorporated. Winter earns $14.15 per hour. The company pays overtime only on hours worked exceeding 40 per week. The company is considering changing from quarter-hour to hundredth- hour time collection. Under the current quarter-hour system, each time the employee clocks in or out, the time is rounded to the nearest quarter-hour. Required: 1. Calculate Winter's time for both the quarter-hour and hundredth-hour systems. 2. Calculate Winter's total pay in the hundredth-hour and quarter-hour systems. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate Winter's time for both the quarter-hour and hundredth-hour systems. Note: Round your intermediate calculations and final answers to 2 decimal places. In 7:30 9:25 7:10 6:02 Out 11:20 12:28 11:43 11:05 In 12:17 1:40 12:26 12:06 Out 5:18 6:12 5:35 6:04 Total Hours with Total Hours with Hundredth-hour Quarter-hourarrow_forward

- Marcell Teague submitted a pay card reflecting the following hours worked at Kicy Inc. He earns $15.65 per hour. The company pays overtime only on hours worked exceeding 40 per week. The company is considering changing from quarter-hour to hundredth-hour time collection. Under the current quarter-hour system, each time the employee clocks in or out, the time is rounded to the nearest quarter-hour. Required: Calculate Marcell’s time for both the quarter-hour and hundredth-hour systems. Calculate Marcell’s total pay in the hundredth-hour and quarter-hour systems. Calculate Marcell’s time for both the quarter-hour and hundredth-hour systems. (Round your intermediate calculations and final answers to 2 decimal places.) In Out In Out Total Hours with Hundredth-hour Total Hours with Quarter-hour 9:30 11:18 12:20 3:18 7:27 12:30 1:41 4:09 9:13 11:39 12:29 3:31 6:00 11:02 12:02 6:03 Calculate Marcell’s total pay in the hundredth-hour and…arrow_forwardSean Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. 2021 Wage-Bracket Method Tables. Round your answer to the two decimal places. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, married, 2 allowances), social security taxes, and state income tax (2%).arrow_forwardCarson Beck has been working for the last 4 months at the local Worst Buy Shop. As a full-time student at the local university, he is being paid an hourly rate of $4.20 an hour. One week, Beck worked 37 hours. Round your answers to the nearest cent. a. Beck's earnings for the week are$fill in the blank 1 b. Is the hourly rate in violation of the FLSA? c. If the hourly rate is in violation of the FLSA, what is the amount the shop should pay Beck for the week? When computing the per hour rate, use the government's rounding rule in your calculation.$fill in the blank 3arrow_forward

- Lenny Florita, an unmarried employee, works 50 hours in the week ended January 12. His pay rate is $11 per hour, and his wages are subject to no deductions other than FICA Social Security, FICA Medicare, and federal income taxes. He claims two withholding allowances. Compute his regular pay, overtime pay (for this company, workers earn 150% of their regular rate for hours in excess of 40 per week), and gross pay. Then compute his FICA tax deduction (use 6.2% for the Social Security portion and 1.45% for the Medicare portion), income tax deduction (use the wage bracket withholding table from 2nd image .), total deductions, and net pay. (Round your intermediate calculations and final answers to 2 decimal places.)arrow_forwardSheila Williams, a medical secretary, earns $2,498 monthly for a 34-hour week. For overtime work, she receives extra pay at the regular hourly rate up to 40 hours and time and one-half beyond 40 hours in any week. During one semimonthly pay period, Williams worked 10 hours overtime. Only 2 hours of this overtime were beyond 40 hours in any one week. Compute the following amounts. a. The regular semimonthly earnings b. The overtime earnings c. The total earningsarrow_forwardStephanie Parker is a salaried, nonexempt administrator for Forise Industries and is paid biweekly. Her annual salary is $39,000, and her standard workweek is 45 hours. During the pay period ending February 3, 20XX, she worked 8 hours overtime. She is single with two withholding allowances. Required: Complete the following payroll register for Stephanie's pay. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Company Name Stephanie Parker Forise Industries M/S # of W/H Annual Salary Hourly Rate Overtime Rate No. of Regular Hours Period Ended: No. of Overtime Regular Hours Earnings 2/3/20XX Overtime Earnings Gross Earningsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Step 5: Base Pay Structure; Author: GreggU;https://www.youtube.com/watch?v=CnBsWsY6O7k;License: Standard Youtube License