Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

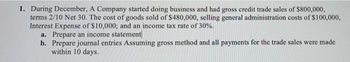

Transcribed Image Text:1. During December, A Company started doing business and had gross credit trade sales of $800,000,

terms 2/10 Net 30. The cost of goods sold of $480,000, selling general administration costs of $100,000,

Interest Expense of $10,000; and an income tax rate of 30%.

a. Prepare an income statement

b. Prepare journal entries Assuming gross method and all payments for the trade sales were made

within 10 days.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardFitbands estimated sales are: What are the balances in accounts receivable for January, February, and March if 65% of sales is collected in the month of sale, 25% is collected the month after the sale, and 10% is second month after the sale?arrow_forwardAmusement tickets estimated sales are: What are the balances in accounts receivable for April, May, and June if 60% of sales are collected in the month of sale, 30% are collected the month after the sale, and 10% are collected the second month after the sale?arrow_forward

- FINANCIAL RATIOS Based on the financial statements, shown on pages 603604, for McDonald Carpeting Co. (income statement, statement of owners equity, and balance sheet), prepare the following financial ratios. All sales are credit sales. The balance of Accounts Receivable on January 1, 20--, was 6,800. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and average number of days required to collect receivables 6. Inventory turnover and average number of days required to sell inventoryarrow_forwardFINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8B. All sales are credit sales. The Accounts Receivable balance on January 1 was 38,200. REQUIRED Prepare the following financial ratios: (a)Working capital (b)Current ratio (c)Quick ratio (d)Return on owners equity (e)Accounts receivable turnover and the average number of days required to collect receivables (f)Inventory turnover and the average number of days required to sell inventoryarrow_forwardFINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8B. All sales are credit sales. The Accounts Receivable balance on January 1 was 38,200. REQUIRED Prepare the following financial ratios: (a) Working capital (b) Current ratio (c) Quick ratio (d) Return on owners equity (e) Accounts receivable turnover and the average number of days required to collect receivables (f) Inventory turnover and the average number of days required to sell inventoryarrow_forward

- FINANCIAL RATIOS Based on the financial statements for Jackson Enterprises (income statement, statement of owners equity, and balance sheet) shown on pages 596597, prepare the following financial ratios. All sales are credit sales. The Accounts Receivable balance on January 1, 20--, was 21,600. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and average number of days required to collect receivables 6. Inventory turnover and average number of days required to sell inventoryarrow_forwardFINANCIAL RATIOS Based on the financial statements, shown on pages 605606, for McDonald Carpeting Co. (income statement, statement of owners equity, and balance sheet), prepare the following financial ratios. All sales are credit sales. The balance of Accounts Receivable on January 1, 20--, was 6,800. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and the average number of days required to collect receivables 6. Inventory turnover and the average number of days required to sell inventoryarrow_forwardFINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8A. All sales are credit sales. The Accounts Receivable balance on January 1,20--, was 3,800. REQUIRED Prepare the following financial ratios: (a) Working capital (b) Current ratio (c) Quick ratio (d) Return on owners equity (e) Accounts receivable turnover and average number of days required to collect receivables (f) Inventory turnover and average number of days required to sell inventoryarrow_forward

- Langstons purchased $3,100 of merchandise during the month, and its monthly income statement shows a cost of goods sold of $3,000. What was the beginning inventory if the ending inventory was $1,250?arrow_forwardFINANCIAL RATIOS Based on the financial statements foe Jackson Enterprises (income statement, statement of owners equity, and balance sheet) shown on pages 598599, prepare the following financial ratios. All sales are credit sales. The Accounts Receivable balance on January 1, 20--, was 21,600. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and average number of days required to collect receivables 6. Inventory turnover and average number of days required to sell inventoryarrow_forwardThe following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning