COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

4th Edition

ISBN: 9781260255157

Author: Haddock

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

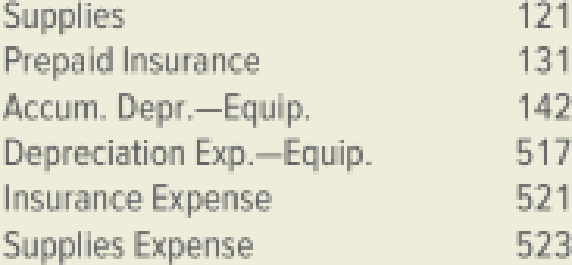

Chapter 5, Problem 5E

Journalizing and posting adjustments.

Desoto Company must make three

- a. Supplies used, $5,500 (supplies totaling $9,000 were purchased on December 1, 2019, and debited to the Supplies account).

- b. Expired insurance, $4,100; on December 1, 2019, the firm paid $24,600 for six months’ insurance coverage in advance and debited Prepaid Insurance for this amount.

- c. Depreciation expense for equipment, $2,900.

Make the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Under M. Sabio Company’s accounting system, all insurance premiums paid are debited to prepaid insurance. For interim financial reports, M Sabio makes monthly estimated charges to insurance expenses with credits to prepaid insurance. Additional information for the year ended December 31, 2019 are as follows: Prepaid Insurance at December 31, 2018 P120,500 Charges to insurance expense during 2019( including a year- End adjustment of P10,500) 437,500 Prepaid Insurance at December 31, 2019 110,000 What was the total amount of insurance premiums paid by M. Sabio during 2019?

P448,000

P427,000

P327,500

P437,500

Rasheed Company uses net method to record the sales made on credit. On June 30, 2019, it made sales of $45,000 with term 2/15, n/45. Prepare the required journal entries, if: On July 22 Rasheed company received full payment.

ABC Inc. purchased a 12-month insurance policy on January 1, 2019 for OMR 2400.

At June 30, 2019, The Adjusting Entry should be:

Select one:

Oa. Debit to Insurance Expense, OMR 1200; Credit to Prepaid Insurance for OMR1200

O b.None of the answers are correct

Oc Debit to Insurance Expense. OMR 2400; Credit to Prepaid Insurance for OMR 2400

O d. Debit to Prepaid Insurance, OMR 1400; Credit to Insurance Expense for OMR 1400

Oe. Debit to Prepaid Insurance, OMR 2400: Credit to Cash for OMR 2400

Clear my choice

Chapter 5 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

Ch. 5 - What are adjustments?Ch. 5 - Prob. 1.2SRQCh. 5 - Prob. 1.3SRQCh. 5 - Prob. 1.4SRECh. 5 - Prob. 1.5SRECh. 5 - Prob. 1.6SRACh. 5 - Prob. 2.1SRQCh. 5 - Prob. 2.2SRQCh. 5 - Prob. 2.3SRQCh. 5 - Prob. 2.4SRE

Ch. 5 - On a worksheet, the adjusted balance of the...Ch. 5 - Prob. 2.6SRACh. 5 - Prob. 1CSRCh. 5 - Prob. 2CSRCh. 5 - Prob. 3CSRCh. 5 - Prob. 4CSRCh. 5 - The Supplies account has a debit balance of 9,000...Ch. 5 - Prob. 1DQCh. 5 - Prob. 2DQCh. 5 - Prob. 3DQCh. 5 - Prob. 4DQCh. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Prob. 7DQCh. 5 - Prob. 8DQCh. 5 - What effect does each item in Question 8 have on...Ch. 5 - Why is it necessary to journalize and post...Ch. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - How does a contra asset account differ from a...Ch. 5 - Prob. 14DQCh. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Journalizing and posting adjustments. Desoto...Ch. 5 - Prob. 1PACh. 5 - Prob. 2PACh. 5 - Prob. 3PACh. 5 - Prob. 4PACh. 5 - Prob. 1PBCh. 5 - Prob. 2PBCh. 5 - Prob. 3PBCh. 5 - Sam Nix owns Nix Estate Planning and Investments....Ch. 5 - The Effect of Adjustments Assume you are the...Ch. 5 - The account balances for the Patterson...Ch. 5 - Prob. 1MFCh. 5 - Prob. 2MFCh. 5 - Prob. 3MFCh. 5 - Prob. 4MFCh. 5 - Prob. 1ED

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The balance in Ashwood Companys accounts payable account at December 31, 2019, was 1,200,000 before any necessary year-end adjustment relating to the following: Goods were in transit from a vendor to Ashwood on December 31, 2019. The invoice cost was 85,000, and the goods were shipped FOB shipping point on December 29, 2019. The goods were received on January 2, 2020. Goods shipped FOB shipping point on December 20, 2019, from a vendor to Ashwood were lost in transit. The invoice cost was 40,000. On January 5, 2020, Ashwood filed a 40,000 claim against the common carrier. Goods shipped FOB destination on December 22, 2019, from a vendor to Ashwood were received on January 6, 2020. The invoice cost was 20,000, What amount should Ashwood report as accounts payable on its December 31,2019, balance sheet? a. 1,260,000 b. 1,285,000 c. 1,325,000 d. 1,345,000arrow_forwardc. On September 1, 2019, North Dakota Manufacturing paid a premium of $13,560 in cash for a one-year insurance policy. On December 31, 2019, an examination of the insurance records showed that coverage for a period of four months had expired. Record the adjustment for insurance expired. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019arrow_forwardOn June 7,2019, Dilby Mechanical Corp completed $50,00 of servicing work for a client and billed them for that amount plus a GST of $2,500 and PST of $3,50; terms are N20. Required: a. Prepare the journal entry as it would appear in Dilby's accounting records. b. Assume the receivable established on June 7 was collected on June 27. Record the entry.arrow_forward

- Prepare the journal entries, with appropriate journal entry descriptions, for 2020, including any required year-end adjusting entries. The company prepares annual adjusting entries. - In the prior year TBTI had paid the entire year’s insurance policy upfront which expired as of December 31, 2020. The insurance premium for 2021 is $5,600. TBTI renewed and paid half the 2021 insurance premium on December 21, 2020. what would the journal entry be like?arrow_forwardYou are given the following selected transactions of Bobby merchandising for the year ended December 31, 2020. You are required to prepare the adjusting journal entries without explanations.a. Supplies on hand account is shown in the books with a balance of P450. An actual count shows only P150 worth of supplies are still on hand.b. Interest of P60 was debited to Prepaid Interest account for interest paid in advance on a 60-day-6% note dated December 16.c. Salaries of P850 remain unpaid as at the end of the year.d. Office equipment was bought for P50,000 on May 31 of the current year. It is expected to be useful for only 7 years and have a salvage value of P8,000.e. Commission Income account which is shown in the books at P1,000 is only ¾ earned.f. A bill for P2,000 for services rendered to a client has not been collected.g. It is expected that only 95% of outstanding accounts receivable of P20,000 will be collectible.h. Unearned Rental Income account which is shown in the books at…arrow_forwardOn October 1, 2019 your company paid its insurance agent P2,400 for the annual insurance premium covering the twelve-month period beginning on December 1. 1. Prepare the initial entries to record the payment of insurance. 2. What date should be used to record the December adjusting entry? 3. What are the accounts involved in the adjusting entries? 4. Prepare the adjusting entries. 5. How much is the adjusted balance of the Prepaid Insurance?arrow_forward

- The balance in the Prepaid Insurance account before adjustment at the end of the year is P7,200 which represents twelve months insurance purchased on December 1. What is the adjusting entry required on Dec. 31, 2021? debit Prepaid Insurance, P600; credit Insurance Expense, P600. debit Insurance Expense, P600; credit Prepaid Insurance, P600. debit Insurance Expense, P600; credit Insurance Payable, P600. debit Insurance Expense, P6,600; credit Prepaid Insurance, P6,600. debit Prepaid Insurance, P7,200; credit Insurance Expense, P7,200.arrow_forwardPreparing Adjusting Entries The Sang Tae Company presented the following information pertaining to accounts that will need adjustments for its November 30, 2019 year-end financial statements. On Oct. 1,2019 Sang Tae paid P10, 800 for 6 month's insurance premiums 2. The balance in the leger account Office Supplies amounted to P32,000. A count of the supplies on November 30, 2019 totaled P12,800. 1. 3. Sang Tae received P22,800 on November 1, 2019 from a customer for services to be rendered during the months of November, December, January and February 2020. 4. Sang Tae acquired Office Equipment costing P352,800 on April 1, 2019, the equipment is expected to last 5 years after which it will be worthless. The scrap value is 10,500. 5. Assume that November 30, 2019 is a Friday and that Sang Tae pays its employees a total of P87,500 on Saturday. Requirements: 1. Prepare the adjusting entries as of November 30,2019 2. Prepare ihe Dec. 1, 2019 entry to record the paymeni of the salaries. 43arrow_forwardFAITH Company presented the following information pertaining to accounts that will need adjustments forits November 30, 2020 year-end financial statements:a. On Oct. 1, 2020, Faith Company paid $10,800 for 6-months’ insurance premiums. Debited InsuranceExpense for the amount paid.b. The balance in the ledger account Office Supplies amounted to $32,000. A count of the officesupplies on hand as of Nov. 30, 2020 totaled $12,800.c. Faith Company received $22,800 on Nov. 1, 2020 from a customer for future services to be renderedduring the months of November, December, January, and February.d. Faith acquired Office Equipment costing $355,000 on April 1, 2020. The equipment is expected to last5 years after which it will have a salvage value of $2,200.e. Assume that Nov. 30, 2020 is a Thursday and that Faith pays its employees a total of $87,500 everyFridays for a 5-day working week.Required: Prepare the necessary adjusting entries for Faith Company at November 30, 2020arrow_forward

- The ledger of XYZ Ltd, on December 31, 2019, includes the below information before applying the adjusting entries for the whole month: Prepaid Insurance $ 2,640 Supplies $2,000 Motor Vehicle (book value) $9,000 Accumulated Depreciation—MV $6,000 Additional information on 31 December: Note payable interest should be paid monthly on the outstanding amount of $12000 and 12% per annum. Insurance expires at the rate of $220 fortnightly. Supplies on hand are total $2000. The Motor Vehicle useful life is 5 years. Calculate the correct adjusting entries required for the December. Motor Vehicle depreciation expense? Interest on borrowing? Supplies consumed? Insurance expires?arrow_forwardMarcellus Purse conduct cleaning business on the credit basis. He provides the collects the sccount receivable in 60 days. The Allowance October 2019 is $3,993. The following information is available Douchd D 1. The business uses aging of account receivable method to count the bad de 2. The accountant is required to update the balance of allowance of dosud des OURE at the end of each month 3. On 5 October 2019 a total of $1.997 ewed by Lucy Frone has been deemed w uncollectable and therefore written off 4. The total sales recorded during 1 October 2019 to 31 October 2019 is $812577 The balance in the Account receivable on 31 October 2019 is $198.300 5. 6. On 31 October 2019 the accountant estimates that 3% of the account receivable is estimated as doubtful. Q3 Required (a) Prepare the Accounting Entries for the transactions or events relating to bad debt for the month ended 31 October 2019, ignore GST ( (b) Prepare and balance the T-account for Allowance for Doubtful Debts accounts as…arrow_forwardMaple Tree Inc. purchased a 12-month insurance policy on March 1, 2019 for $900. At December 31, 2019, the adjusting journal entry to record expiration of this asset will include a: o Debit to Insurance Expense and a credit to Prepaid Insurance for $900 o Debit to Prepaid Insurance and a credit to Insurance Expense for $100 o Debit to Insurance Expense and a credit to Prepaid Insurance for $75 o None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY