1.

Calculate the material handling rate that would have been used by Person K’s predecessor at Industries NA.

1.

Explanation of Solution

Activity-based costing: It is a method that helps in finding the activities performed by a company and it tracks the indirect costs to the activities of the company that consumes resources.

Calculate the material handling rate that would have been used by Person K’s predecessor at Industries NA.

Working note:

Calculate total material handling department costs.

| Particulars | Amount |

| Payroll | $180,000 |

| Employee benefits | $36,000 |

| Telephone | $38,000 |

| Other utilities | $22,000 |

| Material and supplies | $6,000 |

| Depreciation | $6,000 |

| Total material handling department costs | $288,000 |

Table (1)

2.a.

Calculate the revised material handling costs to be allocated on a per purchase order basis.

2.a.

Explanation of Solution

Calculate the revised material handling costs to be allocated on a per purchase order basis.

| Particulars | Amount |

| Total material handling department costs | $288,000 |

| Less: Direct costs: | |

| Direct government payroll | $36,000 |

| $7,200 | |

| Direct phone line | $2,800 |

| Material handling costs applicable to purchase orders (A) | $242,000 |

| Total number of purchase orders (B) | 242,000 |

| Material handling cost per purchase order (A ÷ B) | $1.00 |

Table (2)

b.

Discuss the reason behind purchase orders might be a more reliable cost driver than the dollar amount of direct material.

b.

Explanation of Solution

Purchase orders can be a more dependable cost driver than is the dollar amount of direct material, since resources are disbursed in the handling a purchase order. The size of the order does not essentially have an effect on the depletion of resources.

3.

Calculate the change in material handling cost applied to government contracts by NAI as a result of the new cost assignment approach.

3.

Explanation of Solution

There is a $74,600 decrease in the material handling costs allocated to government contracts by NAI as a result of the new allocation method calculated as follows:

| Particulars | Amount |

| Previous Method: | |

| Government material (A) | $2,006,000 |

| Material handling rate (B) | 10% |

| Total (1 =A × B) | $200,600 |

| New Method: | |

| Directly traceable material handling costs ($36,000+($36,000 × 20%) + $2,800)) | $46,000 |

| Purchase orders (80,000 × $1) | $80,000 |

| Total ( 2 = A × B) | $126,000 |

| Net reduction ( 1–2) | $74,600 |

Table (3)

4.

Prepare a

4.

Explanation of Solution

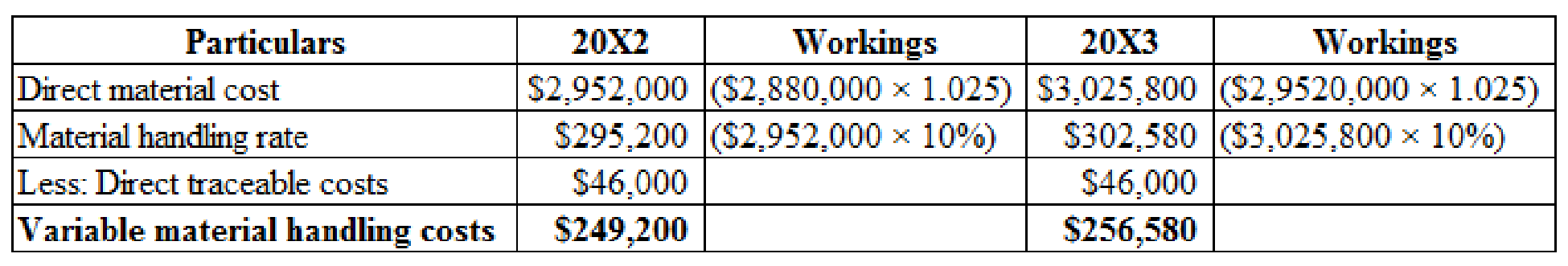

Calculate forecasted variable material handling costs.

Figure (1)

Calculate forecasted purchase orders:

| Particulars | Forecasted Purchase orders | |

| 20X2 ($242,000 × 1.05) | $254,100 | |

| 20X3 ($254,100 × 1.05) | $266,805 | |

| Governmental purchase orders (Purchase orders × 33%) | $83,853 | $88,046 |

Table (4)

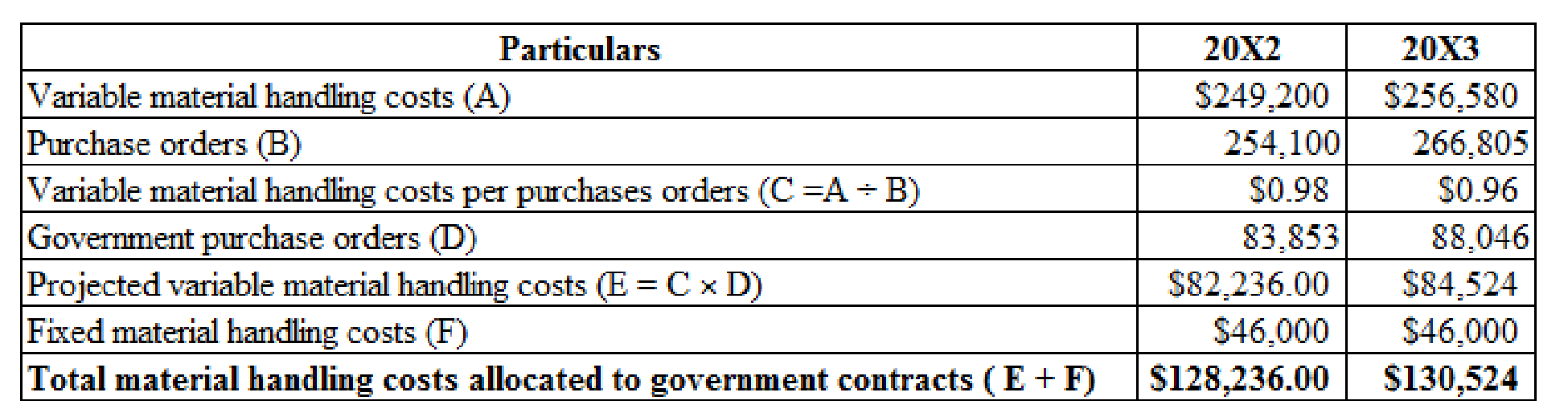

Calculate material handling costs allocated to governmental contracts.

Figure (2)

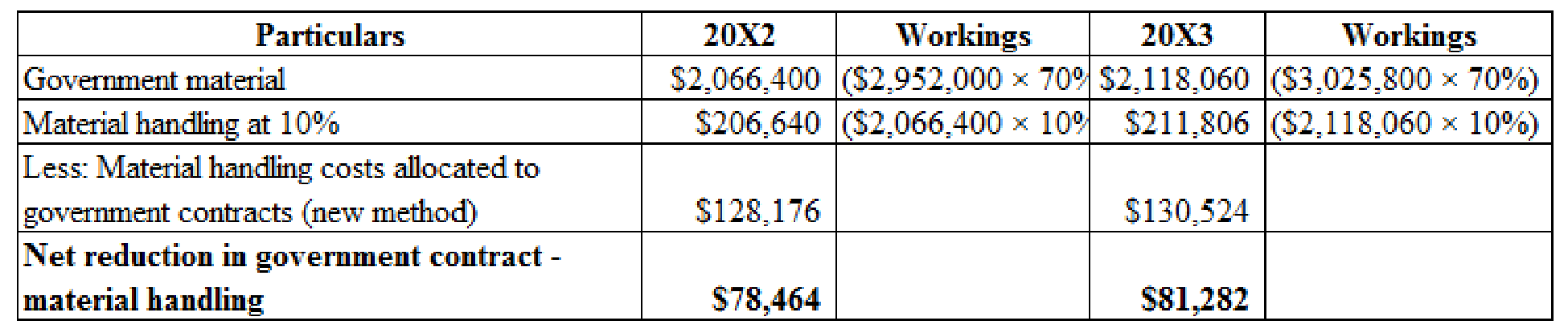

Calculate cumulative dollar impact.

Figure (3)

The cumulative dollar impact of the recommended change in allocating material handling department costs is $234,346 ($74,600 +$78,464 +$81,282).

5.a.

Discuss the reason for Person K has an ethical conflict related to the standards of ethical conduct for

5.a.

Explanation of Solution

Denoting to the standards of ethical conduct for management accountants of Person K faces the following ethical issues are given below:

Competence:

- “Provide decision support information and recommendations that are accurate, clear, consise and timely.”

Integrity:

- “Refrain from engaging in any conduct that would prejudice Person L’s ability to carry out her duties ethically.”

- “Abstain from engaging in or supporting any activity that would discredit person L’s profession.”

Credibility:

- “Disclose all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports analyses or recommendations. Person L has information that Person J should see if he is going to make a reliable judgement about the results of the Government contracts unit.”

b.

Identify the several steps that Person L could take to resolve the ethical conflict.

b.

Explanation of Solution

The steps of Person K could take to resolve these ethical conflicts are as follows:

- Person K should first follow the recognized policies at NAI.

- If this method does not decide the conflict or if such policies do not exist, Person K must communicate the problem with her immediate superior, suppose when it looks that the superior is involved. If the government contracts unit manager, Person P is her controller, then she apparently cannot debate the problem with him. In this case she must go to the next upper managerial level and proceed, up to the audit committee of the board of director, until the conflict is decided.

- She must also discuss the position with an independent advisor to explain the issues involved and find an accepting of possible courses of an action.

- If the ethical conflict still happens after draining all levels of internal review, then person K might have no other course of action than to leave from the company and submit an useful memorandum to an suitable demonstrative of the company.

Want to see more full solutions like this?

Chapter 5 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- Barfield Corporation prepares business plans and marketing analyses for start-up companies in the Cleveland area. Barfield has been very successful In recent years in providing effective service to a growing number of clients. The company provides its service from a single office building in Cleveland and is organized into two main client-service groups: one for market research and the other for financial analysis. The two groups have budgeted annual costs of $530,000 and $800,000, respectively. In addition, Barfield has a support staff that is organized into two main functions: one for clerical, facilities, and logistical support (called the CFL group) and another for computer-related support. The CFL group has budgeted annual costs of $108,000, while the annual costs of the computer group are $630,000. Tom Brady, CFO of Barfield, plans to prepare a departmental cost allocation for his four groups, and he assembles the following Information: Percentage of estimated dollars of work and…arrow_forwardExtreme Inc. is a newly established enterprise. It was set up by an entrepreneur who is generally interested in the business of providing engineering and operational support services to aircraft manufacturers. Extreme Inc., through the contacts of its owner, received a confirmed order from a wellknown aircraft manufacturer to develop new designs for ducting the air conditioning of their aircraft. For this project, Extreme Inc. needed funds aggregating to $1 million. It was able to convince venture capitalists and was able to obtain funding of $1 million from two Silicon Valley venture capitalists. The expenditures Extreme Inc. incurred in pursuance of its research and development project follow, in chronological order: January 15, 2015: Paid $175,000 toward salaries of the technicians (engineers and consultants) March 31, 2015: Incurred $250,000 toward cost of developing the duct and producing the test model June 15, 2015: Paid an additional $300,000 for revising the ducting process to…arrow_forwardBarfield Corporation prepares business plans and marketing analyses for start-up companies in the Cleveland area. Barfield has been very successful in recent years in providing effective service to a growing number of clients. The company provides its service from a single office building in Cleveland and is organized into two main client-service groups: one for market research and the other for financial analysis. The two groups have budgeted annual costs of $440,000 and $810,000, respectively. In addition, Barfield has a support staff that is organized into two main functions: one for clerical, facilities, and logistical support (called the CFL group) and another for computer-related support. The CFL group has budgeted annual costs of $216,000, while the annual costs of the computer group are $654,000. Tom Brady, CFO of Barfield, plans to prepare a departmental cost allocation for his four groups, and he assembles the following information: Percentage of estimated dollars of work and…arrow_forward

- You were appointed the manager of Storage Solutions Section (S3) at Milbank Technologies, a manufacturer of mobile computing parts and accessories late last year. S3 manufactures a drive assembly for the company’s most popular product. Your bonus is determined as a percentage of your division’s operating profits before taxes. One of your first major investment decisions was to invest $2 million in automated testing equipment for device testing. The equipment was installed and in operation on January 1 of this year. This morning, the assistant manager of the division told you about an offer by Joliet Systems. Joliet wants to rent to S3 a new testing machine that could be installed on December 31 (only two weeks from now) for an annual rental charge of $460,000. The new equipment would enable you to increase your division’s annual revenue by 7 percent. This new, more efficient machine would also decrease fixed cash expenditures by 6 percent. Without the new machine, operating…arrow_forwardExtreme Inc. is a newly established enterprise. It was set up by an entrepreneur who is generally interested inthe business of providing engineering and operational support services to aircraft manufacturers. ExtremeInc., through the contacts of its owner, received a confirmed order from a well-known aircraft manufacturerto develop new designs for ducting the air conditioning of their aircraft. For this project, Extreme Inc.needed funds aggregating to $1 million. It was able to convince venture capitalists and was able to obtainfunding of $1 million from two Silicon Valley venture capitalists. The expenditures Extreme Inc. incurred inpursuance of its research and development project follow, in chronological order: • January 15, 20X5: Paid $175,000 toward salaries of the technicians (engineers and consultants) • March 31, 20X5: Incurred $250,000 toward cost of developing the duct and producing the test model • June 15, 20X5: Paid an additional $300,000 for revising the ducting process…arrow_forwardYou were appointed the manager of Drive Systems Division (DSD) at Tunes2Go, a manufacturer of portable music devices using the latest developments in hard drive technology, on December 15 last year. DSD manufactures the drive assembly, M-24, for the company's most popular product. Your bonus is determined as a percentage of your division's operating profits before taxes. One of your first major investment decisions was to invest $6.1 million in automated testing equipment for the M-24. The equipment was installed and in operation on January 1 of this year. This morning, J. Bradley Finch III, the assistant manager of the division (and, not coincidentally, the grandson of the company founder and son of the current CEO) told you about an offer by Pan-Pacific Electronics. Pan-Pacific wants to rent to DSD a new testing machine that could be installed on December 31 (only two weeks from now) for an annual rental charge of $1,420,000. The new equipment would enable you to increase your…arrow_forward

- Public Company Ltd. is a large, publicly held company with shares actively traded on the Toronto Stock Exchange and that has earnings before tax of $300 million per year. Public Company has spent $45 million in the current year to improve basic literacy skills of its employees (i.e., reading, writing, and arithmetic) to allow the introduction of high-tech, computerized, automated equipment. Without this training, efficient and effective implementation of the new production process is unlikely to occur. Management of Public Company proposes that the entire amount be capitalized and amortized over the next 15 years (the estimated average remaining working life of the trained workers). ... The partner in charge of Public Company's external audit has approached you to prepare a memo for her on this matter. The memo should identify and discuss important theoretical and practical issues that might influence her, as the external auditor, as to whether she is prepared to accept the Public…arrow_forwardPeronto’s Inc. is an asphalt contractor located in Kansas City, Mo. Peronto’s Inc. is planning on expanding into the Chicago market is budgeting that the start-up expenditures for the new Chicago facilities will be $25,000. These expenditures will be for the location of a new facility and the incremental expenditures for conducting business in a new territory. The CFO for Peronto’s believes that the $25,000 start upexpenditures should be recognized as an asset because they will benefit the company for many periods in the future. Your role as the staff accountant is to determine the correct recognition for the start up expenditures. Your interpretation of the guidance: The correct recognition of the $25,000 start up expenditures will be: a. as an asset b. as an expensearrow_forwardYou were appointed the manager of Drive Systems Division (DSD) at Tunes2Go, a manufacturer of portable music devices using the latest developments in hard drive technology, on December 15 last year. DSD manufactures the drive assembly, M-24, for the company's most popular product. Your bonus is determined as a percentage of your division's operating profits before taxes. One of your first major investment decisions was to invest $6.2 million in automated testing equipment for the M-24. The equipment was installed and in operation on January 1 of this year. This morning, J. Bradley Finch III, the assistant manager of the division (and, not coincidentally, the grandson of the company founder and son of the current CEO) told you about an offer by Pan-Pacific Electronics. Pan-Pacific wants to rent to DSD a new testing machine that could be installed on December 31 (only two weeks from now) for an annual rental charge of $1,400,000. The new equipment would enable you to increase your…arrow_forward

- Renslen, Inc., a truck manufacturing conglomerate, has recently purchased two divisions: Meyers Service Company and Wellington Products, Inc. Meyers provides maintenance service on large truck cabs for 10-wheeler trucks, and Wellington produces air brakes for the 10-wheeler trucks. The employees at Meyers take pride in their work, as Meyers is proclaimed to offer the best maintenance service in the trucking industry. The management of Meyers, as a group, has received additional compensation from a 10 percent bonus pool based on income before income taxes and bonus. Renslen plans to continue to compensate the Meyers management team on this basis as it is the same incentive plan used for all other Renslen divisions, except for the Wellington division. Wellington offers a high-quality product to the trucking industry and is the premium choice even when compared to foreign competition. The management team at Wellington strives for zero defects and minimal scrap costs; current scrap levels are at 2 percent. The incentive compensation plan for Wellington management has been a 1 percent bonus based on gross margin. Renslen plans to continue to compensate the Wellington management team on this basis. The following condensed income statements are for both divisions for the fiscal year ended May 31, 20x1: Renslen, Inc. Divisional Income Statements For the Year Ended May 31, 20x1 Each division has 1,000,000 of management salary expense that is eligible for the bonus pool. Renslen has invited the management teams of all its divisions to an off-site management workshop in July where the bonus checks will be presented. Renslen is concerned that the different bonus plans at the two divisions may cause some heated discussion. Required: 1. Determine the 20x1 bonus pool available for the management team at: a. Meyers Service Company b. Wellington Products, Inc. 2. Identify at least two advantages and disadvantages to Renslen, Inc., of the bonus pool incentive plan at: a. Meyers Service Company b. Wellington Products, Inc. 3. Having two different types of incentive plans for two operating divisions of the same corporation can create problems. a. Discuss the behavioral problems that could arise within management for Meyers Service Company and Wellington Products, Inc., by having different types of incentive plans. b. Present arguments that Renslen, Inc., can give to the management teams of both Meyers and Wellington to justify having two different incentive plans.arrow_forwardThe manager of a division that produces add-on products for the automobile industry has just been presented the opportunity to invest in two independent projects. The first is an air conditioner for the back seats of vans and minivans. The second is a turbocharger. Without the investments, the division will have average assets for the coming year of $29.4 million and expected operating income of $4.335 million. The outlay required for each investment and the expected operating incomes are as follows: Air conditioner Turbocharger Outlay $850,000 $540,000 Operating income 90,000 98,080 Required: 1. Compute the ROI for each investment project. Round to the nearest whole percent. Air conditioner, ROI fill in the blank 1 % Turbocharger, ROI fill in the blank 2 % 2. Compute the budgeted divisional ROI for each of the following four alternatives. Round to two decimal places. a. The air conditioner investment is made. fill in the blank 3 % b. The turbocharger…arrow_forwardThe manager of a division that produces add-on products for the automobile industry has just been presented the opportunity to invest in two independent projects. The first is an air conditioner for the back seats of vans and minivans. The second is a turbocharger. Without the investments, the division will have average assets for the coming year of $28.9 million and expected operating income of $4.335 million. The outlay required for each investment and the expected operating incomes are as follows: Air Conditioner TurbochargerOutlay $750,000 $540,000 Operating income 90,000 82,080 (Note: Round all numbers to two decimal places.) Compute the budgeted divisional ROI for each of the following four alternatives: The air conditioner investment is made. The turbocharger investment is made. Both investments are made. Neither additional investment is made. CONCEPTUAL CONNECTION Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning