Income (loss) recognition; Long-term contract; revenue recognition over time vs. upon project completion

• LO5–9

Brady Construction Company contracted to build an apartment complex for a price of $5,000,000. Construction began in 2018 and was completed in 2020. The following is a series of independent situations, numbered 1 through 6, involving differing costs for the project. All costs are stated in thousands of dollars.

Required:

Copy and complete the following table:

The revenue recognition principle

The revenue recognition principle refers to the revenue that should be recognized in the time period, when the performance obligation (sales or services) of the company is completed.

Revenue recognized point of long term contract

A long-term contract qualifies for revenue recognition over time. The seller can recognize the revenue as per percentage of the completion of the project, which is recognized as revenue minus cost of completion until date.

If a contract does not meet the performance obligation norm, then the seller cannot recognize the revenue till the project is complete.

To determine: The amount of gross profit or loss to be recognized under various situations.

Answer to Problem 5.21E

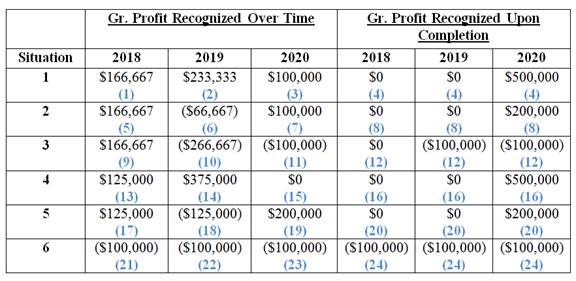

The amount of gross profit or loss to be recognized under various situations is as follows:

(Figure 1)

Explanation of Solution

Working note:

Situation – 1

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 3,600,000 | 4,500,000 |

| Estimated costs to complete | 3,000,000 | 900,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 4,500,000 | 4,500,000 |

| Estimated gross profit(actual in 2020)

|

$500,000 | $500,000 | $500,000 |

Table (1)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | 0 |

| 2020 | $500,000 |

| Total gross profit | $500,000 |

Table (2)

(4)

Situation – 2

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 2,400,000 | 4,800,000 |

| Estimated costs to complete | 3,000,000 | 2,400,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 4,800,000 | 4,800,000 |

| Estimated gross profit(actual in 2020)

|

$500,000 | $200,000 | $200,000 |

Table (3)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | 0 |

| 2020 | $200,000 |

| Total gross profit | $200,000 |

Table (4)

(8)

Situation – 3

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 3,600,000 | 5,200,000 |

| Estimated costs to complete | 3,000,000 | 1,500,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 5,100,000 | 5,200,000 |

| Estimated gross profit(actual in 2020)

|

$500,000 | $(100,000) | $(200,000) |

Table (5)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | $(100,000) |

| 2020 | $(100,000) |

| Total gross profit | $(200,000) |

Table (6)

(12)

Situation – 4

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 4,500,000 |

| Estimated costs to complete | 3,500,000 | 875,000 | 0 |

| Total estimated costs (B) | 4,000,000 | 4,375,000 | 4,500,000 |

| Estimated gross profit(actual in 2020)

|

$1,000,000 | $625,000 | $500,000 |

Table (7)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | 0 |

| 2020 | $500,000 |

| Total gross profit | $500,000 |

Table (8)

(16)

Situation – 5

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 4,800,000 |

| Estimated costs to complete | 3,500,000 | 1,500,000 | 0 |

| Total estimated costs (B) | 4,000,000 | 5,000,000 | 4,800,000 |

| Estimated gross profit(actual in 2020)

|

$1,000,000 | $0 | $200,000 |

Table (9)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | 0 |

| 2020 | $200,000 |

| Total gross profit | $200,000 |

Table (10)

(20)

Situation – 6

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 5,300,000 |

| Estimated costs to complete | 4,600,000 | 1,700,000 | 0 |

| Total estimated costs (B) | 5,100,000 | 5,200,000 | 5,300,000 |

| Estimated gross profit(actual in 2020)

|

$(100,000) | $(200,000) | $(300,000) |

Table (11)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | $(100,000) |

| 2019 | (100,000) |

| 2020 | (100,000) |

| Total gross profit | $(300,000) |

Table (12)

(24)

Want to see more full solutions like this?

Chapter 5 Solutions

GEN CMB(LL)INTRM ACCTG

- ! Required information Problem 6-10 (Static) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Westgate recognizes revenue over time according to percentage of completion. Costs incurred during the year Estimated costs to complete as of year-end Revenue Gross profit (loss) 2024 Problem 6-10 (Static) Part 5 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs incurred and costs to complete information. $ Note: Do not round intermediate calculations and round your final answers to the nearest…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: 2024 2025 2026 Cost incurred during the year $ 2,059, 000 $ 2,627,000 $ 2,655,400 Estimated costs to complete as of year - end 5, 041, 000 2,414, 000 0 Billings during the year 2, 190, 000 2, 496,000 5, 314,000 Cash collections during the year 1,895,000 2,400,000 5, 705, 000 Westgate recognizes revenue over time according to percentage of completion. 2 - a. In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc." for construction costs incurred). 2- b. In the journal below, complete the necessary journal entries for the year 2025 (credit "Cash, Materials, etc." for construction costs incurred). 2- c. In the journal…arrow_forward1 Required information Skip to question [The following information applies to the questions displayed below.]In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,400,000 $ 3,600,000 $ 2,200,000 Estimated costs to complete as of year-end 5,600,000 2,000,000 0 Billings during the year 2,000,000 4,000,000 4,000,000 Cash collections during the year 1,800,000 3,600,000 4,600,000 Westgate recognizes revenue over time according to percentage of completion. Required:1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years.arrow_forward

- Please assits with this cost accounting question Contract Masters Ltd has entered into a contract with Creative Dealers Ltd. for the construction of a new branch office. The contract began on March 1, 2022 and was completed on December 28 2022. The total value of the contract was $12,000,000. On December 30, 2022, an engineer inspected the project and issued a final certificate for work done. The following information is available with regards to the contract: $Site labour costs 3,120,000 Materials direct to site 2,000,000Materials returned 30,500 Materials from store and workshops 500,000 Maintenance of plant and use 980,000 Direct expenses 1,090,000 General overheads 750,000 Materials…arrow_forwardRequired Information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following Information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: 2025 Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year 2024 2026 $ 2,490,000 5,810,000 2,030,000 $ 3,984,000 $ 2,008,600 1,826,000 в 4,444,000 3,900,000 3,526,000 4,285,000 1,815,000 Westgate recognizes revenue over time according to percentage of completion. Problem 6-10 (Algo) Part 4 4. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs Incurred and costs to complete Information. Note: Do not round Intermediate calculations and round your final…arrow_forward1.On March 1, 2022, AGGREGATES Company enters a contract to build a hotel which is estimated to cost P31,200,000. The company recognizes construction revenue over time. Data on this project for 2022-2024 follow:Contract BillingsCosts incurredEst’d Costs to Complete2022 10,500,000 5,460,000 20,540,0002023 12,500,000 9,984,000 13,156,0002024 14,440,000 15,756,000 -The contract contains a penalty clause that penalizes the company a reduction of P70,000 from the contract price for every week of delay. In 2024, the contract was delayed for 8 weeksWhat is the gross profit for 2024?A. 1,164,000 C. 1,724,000B. 1,466,400 D. 1,824,000 2.MOC Construction Company started work on three job sites during the current year. Any costs incurred are expected to be recoverable. Data relating to the three jobs are given below:Site Contract PriceCost IncurredEstimated Costs to CompleteBillings on ContractCollections on Billings1 5,000,000 3,750,000 - 5,000,000 5,000,0002 7,000,000 1,000,000 4,000,000 900,000…arrow_forward

- Brady Construction Company contracted to build an apartment complex for a price of $5,100,000. Construction began in 2021 and was completed in 2023. The following is a series of independent situations, numbered 1 through 6, involving differing costs for the project. All costs are stated in thousands of dollars. situation 2021 1 2 3 4 5 6 Situation 1 2 3 Costs Incurred During Year 2022 1,510 2,160 1,510 1,510. $10 510 3,010 1,370 510 3,010 1,900 4,700 4 5 6 Estimated Costs to Complete (As of the End of the Year) 2022 2023 2021 930 3,090 930 2,440 3,090 2,160 1,680 3,090 3,010 1,020 930 2,440 1,580 880 Required: Complete the following table. (Do not round intermediate calculations. Enter answers in dollars. Round your final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign.) 3,570 3,570 1,580 1,790 2023 11111 Gross Profit (Loss) Recognized Revenue Recognized Over Time 2022 2023 2021 Revenue Recognized Upon Completion 2021 2022 2023arrow_forwardS Required information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Westgate recognizes revenue over time according to percentage of completion. Problem 6-10 (Algo) Part 3 Balance Sheet (Partial) Current assets: 2024 2025 $ 2,523,000 $ 3,177,000 6,177,000 1,800,000 2,070,000 3,630,000 1,835,000 3,400,000 Current liabilities: 3. Complete the information required below to prepare a partial balance sheet for 2024 and 2025 showing any items related t contract. Note: Do not round intermediate calculations. 2024 2026 $ 1,980,000 2025 0 4,300,000…arrow_forward56 On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the contract costs charged to profit or loss in 2022? On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the contract costs charged to profit or loss in 2022?arrow_forward

- Arizona Desert Homes (ADH) constructed a new subdivision during 2023 and 2024 under contract with Cactus Development Company. Relevant data are summarized below: Contract amount Cost: Gross profit: Contract billings: 2023 2024 2023 2024 2023 2024 $ 3,405,000 1,290,000 690,000 935,000 490,000 1,702,500 1,702,500 ADH recognizes revenue upon completion of the contract. What is the journal entry in 2024 to record revenue?arrow_forwardRequired information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Westgate recognizes revenue over time according to percentage of completion. Costs incurred during the year Estimated costs to complete as of year-end Revenue Gross profit (loss) $ $ Problem 6-10 (Algo) Part 5 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs incurred and costs to complete information. Answer is complete but not entirely correct. 2024 2024 $ 2,016,000 5,184,000 2,180,000 1,890,000…arrow_forwardBrady Construction Company contracted to build an apartment complex for a price of $6,400,000. Construction began in 2024 and was completed in 2026. The following is a series of independent situations, numbered 1 through 6, involving differing costs for the project. All costs are stated in thousands of dollars. Situation 1 2 3 4 5 6 Costs Incurred during Year 2024 2025 2026 $ 2,550 $ 1,320 $ 1,640 1,640 1,640 1,320 2,960 2,550 2,720 Situation 1 2 3 4 5 6 640 640 640 3,140 3,140 3,140 1,280 2,280 3,200 2024 Estimated Costs to Complete (As of the End of the Year) 2024 2025 2026 $ 1,320 $ 3,870 3,870 3,870 4,480 4,480 5,955 Required: Complete the following table. Note: Do not round intermediate calculations. Enter your answers in whole dollars and not in thousands of dollars (i.e., $400 thousand should be entered as $400,000). Round your final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign. 2,960 2,620 945 2,620 2,960 Revenue Recognized Over Time…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education