Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 51PA

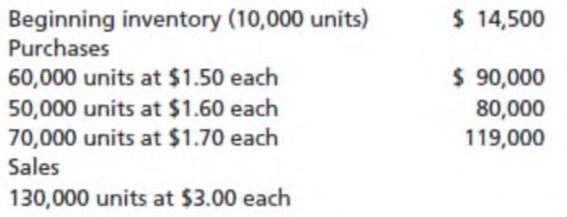

Green Bay Cheese Company is considering changing inventory cost flow method.

Green Bay’s primary objective is to maximize profits. Currently, the firm uses weighted average cost. Data for 2011 are provided.

Operating expenses were $120,000 and the company’s tax rate is 30%.

Requirements

- 1. Prepare the multistep income statement for 2011 using each of the following methods:

- a. FIFO periodic

- b. LIFO periodic

- 2. Which method provides the more current

balance sheet inventory balance at December 31, 2011? Explain your answer. - 3. Which method provides the more current cost of goods sold for the year ended December 31, 2011? Explain your answer.

- 4. Which method provides the better inventory turnover ratio for the year? Explain your answer.

- 5. In order to meet its goal, what is your recommendation to Green Bay Cheese Company? Explain your answer.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The management of Tudor Living asks for your help in determining the comparative

effects of the FIFO and average-cost inventory cost flow methods. For 2020, the

accounting records provide the data shown below.

Units purchased consisted of 40,000 units at £4.00 on May 10; 60,000 units at £4.20 on

August 15; and 20,000 units at £4.45 on November 20. Income taxes are 28%.

Instructions

a.Prepare comparative condensed income statements for 2020 under FIFO and

average cost. (Show computations of ending inventory.)

b.Answer the following questions for management:

1.Which inventory cost flow method produces the more meaningful inventory amount

for the statement of financial position? Why?

2.Which inventory cost flow method is more likely to approximate the actual physical

flow of the goods? Why?

3.How much more cash will be available for management under average-cost thanunder FIFO? Why?

Requirements 1. Prepare the company's January, multistep income statement. Calculate income using the LIFO, average-cost, and FIFO methods. Label the bottom line "Operating income." Round the average cost per unit to three decimal places and all other figures to whole-dollar amounts. Show your computations. 2. Suppose you are the financial vice president of Ohio Instruments. Which inventory method will you use if your motive is to

a. minimize income taxes?

b. report the highest operating income?

c. report operating income between the extremes of FIFO and LIFO?

d. report inventory on the balance sheet at the most current cost? e. attain the best measure of net income for the income statemehi? State the reason for each of your answers.

please answer all please answer all or skip do not waste question or time by giving incomplete or incorrect answer please provide answer with explanation computation formula please answer with steps thanks

Hubble Space Incorporated has the following data which includes inventory conversion period or ICP of the firms against which it benchmarks. The firm's new manager is looking into the company on how he could reduce its inventory enough to reduce its ICP to the benchmarks’ average. If this were done, by how much would inventories decrease? Assume a 365-day year. Cost of goods sold =P85,000; Inventory =P20,000; Inventory conversion period (ICP) =85.88; Benchmark inventory conversion period (ICP) =38.00 *

Chapter 5 Solutions

Financial Accounting

Ch. 5 - In each separate situation, identify which company...Ch. 5 - Prob. 2YTCh. 5 - Prob. 3YTCh. 5 - Prob. 4YTCh. 5 - Prob. 5YTCh. 5 - Jaynes Jewelry Store purchased three diamond and...Ch. 5 - Prob. 7YTCh. 5 - Prob. 8YTCh. 5 - Prob. 9YTCh. 5 - Prob. 1Q

Ch. 5 - What is the difference between freight-in and...Ch. 5 - What is the difference between a purchase return...Ch. 5 - What is a purchase discount? What is the effect of...Ch. 5 - Prob. 5QCh. 5 - Prob. 6QCh. 5 - Prob. 7QCh. 5 - What is the difference between a periodic and...Ch. 5 - What is inventory shrinkage?Ch. 5 - What is the difference between the physical flow...Ch. 5 - What are the common cost flow methods for...Ch. 5 - If inventory costs are rising, which method (FIFO,...Ch. 5 - If inventory costs are rising, which method (FIFO,...Ch. 5 - Does LIFO or FIFO give the bestmost currentbalance...Ch. 5 - How do taxes affect the choice between LIFO and...Ch. 5 - Does the periodic or perpetual choice affect the...Ch. 5 - What is the lower-of-cost-or-market rule and why...Ch. 5 - What does the gross profit percentage measure? How...Ch. 5 - What does the inventory turnover ratio measure?...Ch. 5 - What are some of the risks associated with...Ch. 5 - Prob. 1MCQCh. 5 - Prob. 2MCQCh. 5 - Prob. 3MCQCh. 5 - Prob. 4MCQCh. 5 - Prob. 5MCQCh. 5 - Prob. 6MCQCh. 5 - Prob. 7MCQCh. 5 - Prob. 8MCQCh. 5 - Prob. 9MCQCh. 5 - Prob. 10MCQCh. 5 - Prob. 1SEACh. 5 - Prob. 2SEACh. 5 - Prob. 3SEACh. 5 - Prob. 4SEACh. 5 - Prob. 5SEACh. 5 - Prob. 6SEACh. 5 - Prob. 7SEACh. 5 - Prob. 8SEACh. 5 - The following information pertains to item #007SS...Ch. 5 - Prob. 10SEACh. 5 - Prob. 11SEBCh. 5 - Prob. 12SEBCh. 5 - Prob. 13SEBCh. 5 - Prob. 14SEBCh. 5 - Prob. 15SEBCh. 5 - Prob. 16SEBCh. 5 - Prob. 17SEBCh. 5 - Given the following information, calculate the...Ch. 5 - Prob. 19SEBCh. 5 - Prob. 20SEBCh. 5 - Prob. 21EACh. 5 - Prob. 22EACh. 5 - Prob. 23EACh. 5 - Prob. 24EACh. 5 - August 11Purchased four units at 400 each August...Ch. 5 - Prob. 26EACh. 5 - Prob. 27EACh. 5 - Prob. 28EACh. 5 - Prob. 29EACh. 5 - Prob. 30EACh. 5 - Given the following information, calculate the...Ch. 5 - Prob. 32EBCh. 5 - Prob. 33EBCh. 5 - Prob. 34EBCh. 5 - Prob. 35EBCh. 5 - Prob. 36EBCh. 5 - Prob. 37EBCh. 5 - Assume Radio Tech uses a perpetual inventory...Ch. 5 - Prob. 39EBCh. 5 - Prob. 40EBCh. 5 - Prob. 41EBCh. 5 - Prob. 42EBCh. 5 - Prob. 43PACh. 5 - Prob. 44PACh. 5 - Prob. 45PACh. 5 - The following transactions occurred during July...Ch. 5 - Prob. 47PACh. 5 - Prob. 48PACh. 5 - Calculate cost of goods sold and ending inventory;...Ch. 5 - Prob. 50PACh. 5 - Green Bay Cheese Company is considering changing...Ch. 5 - The following information is for Leos Solar...Ch. 5 - Prob. 53PACh. 5 - Prob. 54PBCh. 5 - Prob. 55PBCh. 5 - Prob. 56PBCh. 5 - Prob. 57PBCh. 5 - Prob. 58PBCh. 5 - Prob. 59PBCh. 5 - Calculate cost of goods sold and ending inventory;...Ch. 5 - Prob. 61PBCh. 5 - Castana Company is considering changing inventory...Ch. 5 - The following information is for Falling Numbers...Ch. 5 - Prob. 64PBCh. 5 - Prob. 1FSACh. 5 - Prob. 2FSACh. 5 - Prob. 3FSACh. 5 - Prob. 1CTPCh. 5 - Prob. 2CTP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data pertain to 2012 activities of Twisp Industries: Use your completed worksheet to determine the firms cost of goods sold for 2012. Remember to change the year in row 24 and to enter new beginning inventory balances. Save the 2012 file as MFG3. Print the worksheet when done. If sales and other expenses were identical in 2011 and 2012, during which year did Twisp earn more income? Why?arrow_forwardHabicht Company was formed in 2018 to produce a single product. The production and sales for the next 4 years were as follows: Required: 1. Determine the gross profit for each year under each of the following periodic inventory methods: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places.) 2. Next Level Explain whether the companys return on assets (net income divided by average total assets) would be higher under FIFO or LIFO.arrow_forwardLast year, Nikkola Company had net sales of 2,299,500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average inventory. 2. Calculate the inventory turnover ratio. 3. Calculate the inventory turnover in days. 4. CONCEPTUAL CONNECTION Based on these ratios, does Nikkola appear to be performing well or poorly?arrow_forward

- Assume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the end of the year, with a cost value of $222,000. How will this affect your net income in the current year? How will it affect next years net income?arrow_forwardA large manufacturer of truck and car tires recently changed its cost-flow assumption method for inventories at the beginning of 2014. The manufacturer has been in operation for almost 40 years, and for the last decade it has reported moderate growth in revenues. The firm changed from the LIFO method to the FIFO method and reported the following information (amounts in millions): REQUIRED Calculate the inventory turnover ratio for 2014 using the LIFO and FIFO cost-flow assumption methods. Explain why the costs assigned to inventory under LIFO at the end of 2013 and 2014 are so much less than they are under FIFO.arrow_forwardUse the last-in, first-out (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forward

- Analyzing Inventory The recent financial statements of McLelland Clothing Inc. include the following data: Required: 1. Calculate McLellands gross profit ratio (rounded to two decimal places), inventory turnover ratio (rounded to three decimal places), and the average days to sell inventory (assume a 365-day year and round to two decimal places) using the FIFO inventory costing method. Be sure to explain what each ratio means. 2. Calculate McLellands gross profit ratio (rounded to two decimal places), inventory turnover ratio (rounded to three decimal places), and the average days to sell inventory (assume a 365-day year and round to two decimal places) using the LIFO inventory costing method. Be sure to explain what each ratio means. 3. CONCEPTUAL CONNECTION Which ratios-the ones computed using FIFO or LIFO inventory values-provide the better indicator of how successful McLelland was at managing and controlling its inventory?arrow_forwardHubble Space Incorporated has the following data which includes inventory conversion period or ICP of the firms against which it benchmarks. The firm's new manager is looking into the company on how he could reduce its inventory enough to reduce its ICP to the benchmarks’ average. If this were done, by how much would inventories decrease? Assume a 365-day year. Cost of goods sold =P85,000; Inventory =P20,000; Inventory conversion period (ICP) =85.88; Benchmark inventory conversion period (ICP) =38.00 * A. P 8,129 B. P 7,316 C. P 9,032 D. P11,151 E. P10,036arrow_forwardThe initial analysis should include the following: The ratio equation The calculation of the ratio using the equation and the pre-assigned Quick Study or Exercise from the textbook. (See below) Use the result in a sentence; i.e. For every dollar invested in assets the company is earning 22.4 cents or 22.4% in net income. Exercise 6-13 Inventory turnover and days' sales in inventory LA3 0 Use the following information for Palmer Co. to compute inventory turnover for Year 3 and Year 2, and its days' sales in inventory at December 31, Year 3 and Year 2. (Round answers to one decimal.) Comment on Palmer's efficiency in using its assets to increase sales from Year 2 to Year 3. Year 3 Year 2 Year 1 Cost of goods sold $643,825 $426,650 $391,300 Ending inventory 97,400 87,750 92,500arrow_forward

- The management of Gresa Inc. is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. The company requests your help in determining the results of operations for 2017 if either the FIFO or the LIFO method had been used. For 2017, the accounting records show these data: Inventories Purchases and Sales Beginning (7,000 units) $14,000 Total net sales (236,000 units) $1,038,400 Ending (21,000 units) Total cost of goods purchased (250,000 units) 596,500 Purchases were made quarterly as follows. Quarter Units Unit Cost Total Cost 1 65,000 $2.20 $143,000 2 55,000 2.30 126,500 3 55,000 2.40 132,000 4 75,000 2.60 195,000 250,000 $596,500 Operating expenses were $150,000, and the company’s income tax rate is 30%. Prepare comparative condensed income statements for 2017 under FIFO and…arrow_forwardThe following ratios have been provided for a company. Which of the statements below is a valid interpretation based on these ratios? Gross profit margin Operating profit margin Current ratio 20X3 38.8% 22.2% 20X4 40.2% 29.7% 4:1 3.2:1 Inventory days 27 32 Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a The company's customers paid more quickly in 20X4 than in 20X3. b The company was more profitable in 20X4 than in 20X3. The company held inventory for longer in 20X3 than in 20X4. The company has poor liquidity.arrow_forwardApply mathematical skills around cost structures and appropriate equations to answer the following, inclusive of all associated workings to maximise marks: The inventory value for the financial statements of Zyon for the year ended 31st Oct 2022 was based on an inventory count on 3rd Nov 2022, which gave a total inventory value of $836,200.Between 31st Oct and 3rd Nov, the following transactions took place:Purchases of goods $8,600. Sales of goods (profit margin 35% on sales $14,000). Goods returned by Zyon to supplier $878. What adjusted figure should be included in the financial statements for inventories at 31st Oct 2022 to nearest hundred?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License