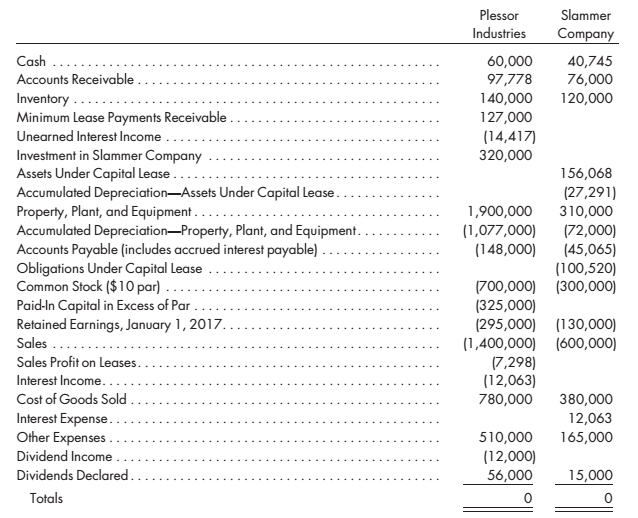

Plessor Industries acquired 80% of the outstanding common stock of Slammer Company on January 1, 2015. for S320,000. On that date, Slammer’s book values approximated fair values. and the balance of its

On January 1, 2016. Slammer signed a 5-year lease with Plessor for the rental of a small factory building with a 10-year life. Payments of $25000 are due at the beginning of each year on January 1, and Slammer is expected to exercise the $5,000 bargain purchase option at the end of the fifth year. The fair value of the factory was $103,770 at the start of the lease term. Plessor’s implicit rate on the lease is 12%. A second lease agreement. for the rental of production equipment with an 8-year life, was signed by Slammer on January 1, 2017. The terms of this 4-year lease require a payment of $15,000 at the beginning of each year on January 1. The present value of the lease payments at Plessor’s 12% implicit rate was equal to the fair value of the equipment, $52,298, when the lease was signed. The cost of the equipment to Plessor was $45,000, and there is a $2,000 bargain purchase option. Eight-year, straight-line depreciation is being used, with no salvage value.

The following

Required

Prepare the worksheet necessary to produce the consolidated financial statements of Plessor Industries and its subsidiary for the year ended December 31. 2017. Include the determination and distribution of excess and income distribution schedules.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Advanced Accounting

- On January 1, 2016, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc. for $662,000 cash. At January 1, 2016, Sedona’s net assets had a total carrying amount of $463,400. Equipment (eight-year remaining life) was undervalued on Sedona’s financial records by $96,000. Any remaining excess fair over book value was attributed to a customer list developed by Sedona (four-year remaining life), but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has declared a $20,500 dividend. Sedona recorded net income of $99,500 in 2016 and $110,300 in 2017. Selected account balances from the two companies’ individual records were as follows: Phoenix Sedona 2018 Revenues $ 544,000 $ 381,000 2018 Expenses 387,000 280,000 2018 Income from Sedona 63,350 Retained earnings 12/31/18 270,350 224,500 On its December 31, 2018, consolidated…arrow_forwardOn July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? a. P1,035,000 Cr. b. No entry c. P40,000 Dr. d. P1,060,000 Cr.arrow_forwardOn July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? O P1.060.000 Cr. O No entry O P40,000 Dr. O P1.035.000 Cr.arrow_forward

- On July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? A. No entry B. 40,000 debit C. 1,035,000 credit D. 1,060,000 creditarrow_forwardOn July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? P1,035,000 Cr. P1,060,000 Cr. P40,000 Dr. No entry How much will the Investment in Associate account be debited/credited in 2019? P960,000 Cr. No Entry P15,000 Dr. P75,000 Dr.arrow_forwardOn 1 February 2011 PETA acquired 35% of the equity shares of AVO, its only associate, for $20,000,000 in cash. The post-tax profit of AVO for the year to 30 September 2011 was $6,000,000. Profits accrued evenly throughout the year. AVO made a dividend payment of $2,000,000 on 1 September 2011. At 30 September 2011, PETA decided that an impairment loss of $1,000,000 should be recognised on its investment in AVO. In PETA's separate financial statement, PETA did not recognize any impairment loss related to its investment in AVO. What amount will be shown as 'investment in associate' in the statement of financial position of PETA as at 30 September 2011? PLEASE EXPLAIN THE ANSWER. A) $20,350,000 B) $21,050,000 C) $21,750,000 D) $19,700,000 E) None of the abovearrow_forward

- On January 1, 2017, Bright Company acquired 80% of Animo Company's common stock for 280,000 cash. At that date, Animo reported common stock outstanding of 200,000 and retained earnings of 100,000 and the fair Animo's assets and liabilities were equal, except for other intangible assets, which has a fair value 50,000 greater than book value and an 8- year remaining life. Animo reported the following data for 2017 and 2018. Year Net Income Comprehensive Income 30,000 45,000 Dividends Paid 2017 2018 25,000 35,000 5,000 10,000 Bright reported separate net income from own operations of 100,000 and paid dividends of 30,000 for both years. Based on the preceding information, what is the amount of comprehensive attributable to the controlling interest in 2018?arrow_forwardPitino acquired 90 percent of Brey’s outstanding shares on January 1, 2016, in exchange for $342,000 in cash. The subsidiary’s stockholders’ equity accounts totaled $326,000 and the noncontrolling interest had a fair value of $38,000 on that day. However, a building (with a nine-year remaining life) in Brey’s accounting records was undervalued by $18,000. Pitino assigned the rest of the excess fair value over book value to Brey’s patented technology (six-year remaining life).Brey reported net income from its own operations of $64,000 in 2016 and $80,000 in 2017. Brey declared dividends of $19,000 in 2016 and $23,000 in 2017.Brey sells inventory to Pitino as follows:At December 31, 2018, Pitino owes Brey $16,000 for inventory acquired during the period.The following separate account balances are for these two companies for December 31, 2018, and the year then ended. Credits are indicated by parentheses.Answer each of the following questions:a. What was the annual amortization resulting…arrow_forwardOn January 1, 2017, Stream Company acquired 30 percent of the outstanding voting shares of Q-Video, Inc., for $770,000. Q-Video manufactures specialty cables for computer monitors. On that date, Q-Video reported assets and liabilities with book values of $1.9 million and $700,000, respectively. A customer list compiled by Q-Video had an appraised value of $300,000, although it was not recorded on its books. The expected remaining life of the customer list was five years with straight-line amortization deemed appropriate. Any remaining excess cost was not identifiable with any particular asset and thus was considered goodwill.Q-Video generated net income of $250,000 in 2017 and a net loss of $100,000 in 2018. In each of these two years, Q-Video declared and paid a cash dividend of $15,000 to its stockholders.During 2017, Q-Video sold inventory that had an original cost of $100,000 to Stream for $160,000. Of this balance, $80,000 was resold to outsiders during 2017, and the remainder was…arrow_forward

- On January 1, 2017, Stream Company acquired 30 percent of the outstanding voting shares of Q-Video, Inc., for $770,000. Q-Video manufactures specialty cables for computer monitors. On that date, Q-Video reported assets and liabilities with book values of $1.9 million and $700,000, respectively. A customer list compiled by Q-Video had an appraised value of $300,000, although it was not recorded on its books. The expected remaining life of the customer list was five years with straight-line amortization deemed appropriate. Any remaining excess cost was not identifiable with any particular asset and thus was considered goodwill. Q-Video generated net income of $250,000 in 2017 and a net loss of $100,000 in 2018. In each of these two years, Q-Video declared and paid a cash dividend of $15,000 to its stockholders. During 2017, Q-Video sold inventory that had an original cost of $100,000 to Stream for $160,000. Of this balance, $80,000 was resold to outsiders during 2017, and the remainder…arrow_forwardOn January 1, 2012, P Corporation purchased 80% of S Company's outstanding stock for P620,000. At that date, all of S Company's assets and liabilities had market values approximately equal to their book values and no goodwill was included in the purchase price. The following information was available for 2012: Income from own operations of P Corporation, P150,000; Operating loss of S Company, P20,000. Dividends paid in 2012 by P Corporation, P75,000; by S Company to P Corporation, P12,000. On July 1, 2012, there was a downstream sale of equipment at a gain of P25,000. The equipment is expected to have a remaining useful life of 10 years from the date of sale. Also, on January 1, 2012, there was an upstream sale of furniture at a loss of P7,500. The furniture is expected to have a useful life of five years from the date of sale. Non-controlling interest is measured at fair market value. 1. How much is the consolidated net income attributable to parent shareholders' equity? A. P97,250 B.…arrow_forwardHerbert, Inc., acquired all of Rambis Company’s outstanding stock on January 1, 2017, for $574,000 in cash. Annual excess amortization of $12,000 results from this transaction. On the date of the takeover, Herbert reported retained earnings of $400,000, and Rambis reported a $200,000 balance. Herbert reported internal net income of $40,000 in 2017 and $50,000 in 2018 and declared $10,000 in dividends each year. Rambis reported net income of $20,000 in 2017 and $30,000 in 2018 and declared $5,000 in dividends each year. Assume that Herbert’s internal net income figures above do not include any income from the subsidiary. If the parent uses the equity method, what is the amount reported as consolidated retained earnings on December 31, 2018? What would be the amount of consolidated retained earnings on December 31, 2018, if the parent had applied either the initial value or partial equity method for internal accounting purposes?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education