Concept explainers

a)

Identify whether the given transactions are asset source, asset use, asset exchange, or claims exchange for the year 2014 and 2015.

a)

Explanation of Solution

Identify the type of each transaction for 2014:

| Event Number (2014) | Type of Transaction |

| 1. Service revenue earned on account. | Asset Source |

| 2. Collection of | Asset Exchange |

| 3. Adjusted the accounts to recognize uncollectible accounts expense. | Asset Use |

Table (1)

Identify the type of each transaction for 2015:

| Event Number (2015) | Type of Transaction |

| 1. Recognized service revenue on account. | Asset Source |

| 2. Collection of accounts receivable. | Asset Exchange |

| 3. Accounts receivable were uncollectible and written off. | Asset Exchange |

| 4. a. Allowance made for doubtful accounts. | Asset Exchange |

| 4.b. Cash collected for accounts receivable | Asset Exchange |

| 5. Payment made for operating expenses. | Asset use |

| 6. Adjusted the accounts to recognize uncollectible accounts expense. | Asset use |

Table (2)

Asset source transactions are the transactions that results in an increase of both the asset and claims on assets.

Asset use transactions are the transactions that results in a decrease of both the asset and claims on assets.

Asset exchange transactions are the transactions that results in increase in one asset and decrease in the other asset.

Claim exchange transactions are the transactions that decreases one claim and increases other claims; the total claims remains unchanged.

b)

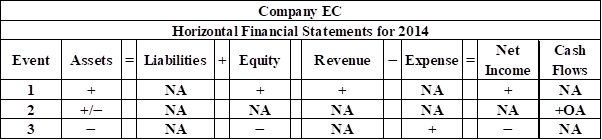

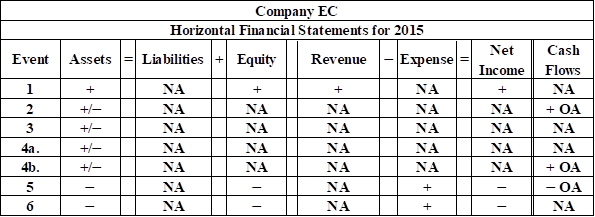

Show the effect of each transaction on the elements of the financial statements for 2014 and 2015 using horizontal statement model.

b)

Explanation of Solution

Horizontal statements model: The model that represents all the financial statements,

Effect of each transaction on the elements using horizontal statement model for 2014:

Table (3)

Effect of each transaction on the elements using horizontal statement model for 2015:

Table (4)

c.

Organize the transactions in accounts under an

c.

Explanation of Solution

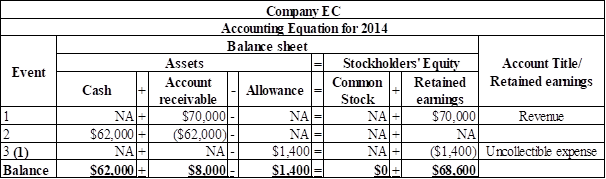

Organize the transactions in accounts under an accounting equation for 2014:

Table (5)

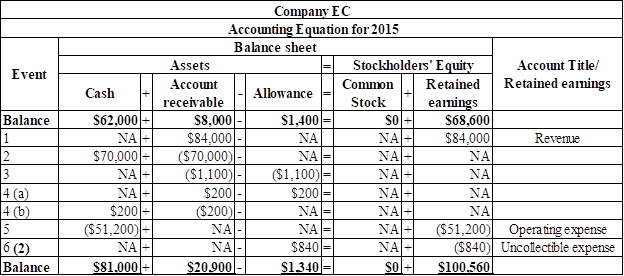

Organize the transactions in accounts under an accounting equation for 2015:

Table (6)

Working note 1:

Determine the uncollectible account expense for 2014:

Given: The services provided on account are $70,000 and the estimated percentage of uncollectible is 2%.

Working note 2:

Determine the uncollectible account expense for 2015:

Given: The services provided on account are $84,000 and the estimated percentage of uncollectible is 1%.

d)

Prepare the income statement, statement of changes in

d)

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the year 2014:

| Company EC | ||

| Income statement | ||

| For the year ended December 31, 2014 | ||

| Particulars | Amount | Amount |

| Revenue | ||

| Service revenue | $70,000 | |

| Total revenues | $70,000 | |

| Less: Expenses | ||

| Uncollectible accounts expense | $1,400 | |

| Total expenses | ($1,400) | |

| Net income | $68,600 | |

Table (7)

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Prepare the statement of changes in stockholders’ equity for the year 2014:

| Company EC | ||

| Statement of changes in stockholders’ equity | ||

| For the year ended December 31, 2014 | ||

| Particulars | Amount | Amount |

| Beginning common stock | $0 | |

| Add: Common stocks issued | $0 | |

| Ending common stock | $0 | |

| Beginning | $0 | |

| Add: Net income | $68,600 | |

| Ending retained earnings | $68,600 | |

| Total stockholders’ equity | $68,600 | |

Table (8)

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet for the year 2014:

| Company EC | ||

| Balance sheet | ||

| As of 31st December, 2014 | ||

| Particulars | Amount | Amount |

| Assets | ||

| Cash | $62,000 | |

| Accounts receivable | $8,000 | |

| Less: Allowance for doubtful accounts | ($1,400) | $6,600 |

| Total assets | $68,600 | |

| Liabilities | $0 | |

| Stockholders’ equity | ||

| Common stock | $0 | |

| Retained earnings | $68,600 | |

| Total stockholders' equity | $68,600 | |

| Total liabilities and stockholders' equity | $68,600 | |

Table (9)

Statement of Cash flows: Statement of cash flows is a statement reports the source and application of cash between two balance sheet dates. It shows how the cash is sourced and used for the company’s operating, investing, and financing activities.

Prepare the statement of cash flows for the year 2014:

| Company EC | ||

| Statement of cash flow | ||

| For the year ended 31st December, 2014 | ||

| Particulars | Amount | Amount |

| Cash flow from operating activities: | ||

| Inflow from customers | $62,000 | |

| Net cash flow from operating activities | $62,000 | |

| Cash flow from investing activities | $0 | |

| Cash flow from financing activities | $0 | |

| Net change in cash | $62,000 | |

| Add: Beginning cash balance | $0 | |

| Ending cash balance | $62,000 | |

Table (10)

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the income statement for 2015:

| Company EC | ||

| Income statement | ||

| For the year ended December 31, 2015 | ||

| Particulars | Amount | Amount |

| Revenue | ||

| Service revenue | $84,000 | |

| Total revenues | $84,000 | |

| Less: Expenses | ||

| Operating expense | $51,200 | |

| Uncollectible accounts expense | $840 | |

| Total expenses | ($52,040) | |

| Net income | $31,960 | |

Table (11)

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Prepare the statement of changes in stockholders’ equity for 2015:

| Company EC | ||

| Statement of changes in stockholders’ equity | ||

| For the year ended December 31, 2015 | ||

| Particulars | Amount | Amount |

| Beginning common stock | $0 | |

| Add: Common stocks issued | $0 | |

| Ending common stock | $0 | |

| Beginning retained earnings | $68,600 | |

| Add: Net income | $31,960 | |

| Ending retained earnings | $100,560 | |

| Total stockholders’ equity | $100,560 | |

Table (12)

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet for 2015:

| Company EC | ||

| Balance sheet | ||

| As of 31st December, 2015 | ||

| Particulars | Amount | Amount |

| Assets | ||

| Cash | $81,000 | |

| Accounts receivable | $20,900 | |

| Less: Allowance for doubtful accounts | ($1,340) | $19,560 |

| Total assets | $100,560 | |

| Liabilities | $0 | |

| Stockholders’ equity | ||

| Common stock | $0 | |

| Retained earnings | $100,560 | |

| Total stockholders' equity | $100,560 | |

| Total liabilities and stockholders' equity | $100,560 | |

Table (13)

Statement of Cash flows: Statement of cash flows is a statement reports the source and application of cash between two balance sheet dates. It shows how the cash is sourced and used for the company’s operating, investing, and financing activities.

Prepare the statement of cash flows for 2015:

| Company EC | ||

| Statement of cash flow | ||

| For the year ended 31st December, 2015 | ||

| Particulars | Amount | Amount |

| Cash flow from operating activities: | ||

| Inflow from customers | $70,200 | |

| Outflow from customers | ($51,200) | |

| Net cash flow from operating activities | $19,000 | |

| Cash flow from investing activities | $0 | |

| Cash flow from financing activities | $0 | |

| Net change in cash | $19,000 | |

| Add: Beginning cash balance | $62,000 | |

| Ending cash balance | $81,000 | |

Table (14)

Want to see more full solutions like this?

Chapter 5 Solutions

SURVEY OF ACCOUNTING-ACCESS

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education