Engineering Economy (16th Edition) - Standalone book

16th Edition

ISBN: 9780133439274

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 21P

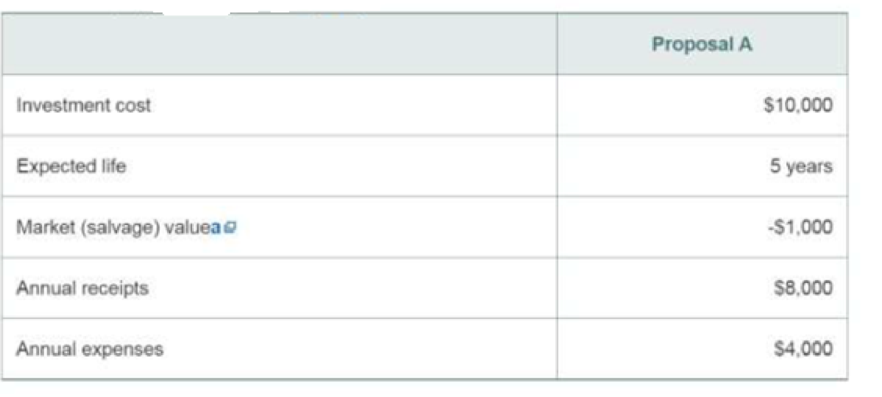

Determine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable? (5.4)

a A negative market value means that there is a net cost to dispose of an asset.

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule05:35

Students have asked these similar questions

Determine the FW of the following engineering project when the MARR is 17% per year. Is the project acceptable?

Proposal A

Investment cost

$10,500

Expected life

4 years

Market (salvage) valueª

- $1,000

Annual receipts

$9,000

$4,000

Annual expenses

³ A negative market value means that there is a net cost to dispose of an asset.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 17% per year.

The FW of the following engineering project is $. (Round to the nearest dollar.)

Determine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable?

Proposal A

Investment cost

Expected life

Market (salvage) value

Annual receipts

$11,000

5 years

-$1,000

S7,000

$4,000

Annual expenses

"A negative market value means that there is a net cost to dispose of an asset

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year

The FW of the follawing engineering froject is $ (Round to the nearest dollar.)

A$ 100,000 machine replacement project

indicates that it can generate, after-tax cash

flows, $ 35,000 per year over its 10-year

useful life. At the end of this period, it could

be sold for $ 10,000. Considering a Minimum

Attractive Rate of Return (MARR) of 10% per

year, select the equation by notation of

factors that calculates your Net Present Value

-100000 + 35000 (P/A,10%,9) + 10000 (P/F,10%,10)

-100000 + 35000 (P/A,10%,9) + 45000 (P/F,10%,10)

100000 – 35000 (P/A,10%,9) – 45000 (P/F,10%,10)

-100000 + 35000 (P/F,10%,10) + 10000 (P/A,10%,10)

Chapter 5 Solutions

Engineering Economy (16th Edition) - Standalone book

Ch. 5.A - Use the ERR method with = 8% per year to solve for...Ch. 5.A - Apply the ERR method with = 12% per year to the...Ch. 5.A - Are there multiple IRRs for the following...Ch. 5.A - Are there multiple IRRs for the following cash...Ch. 5 - Tennessee Tool Works (TTW) is considering...Ch. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Prob. 5PCh. 5 - A large induced-draft fan is needed for an...

Ch. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - Prob. 10PCh. 5 - Prob. 11PCh. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Prob. 20PCh. 5 - Determine the FW of the following engineering...Ch. 5 - Prob. 22PCh. 5 - Fill in Table P5-23 below when P = 10,000, S = 2,...Ch. 5 - Prob. 24PCh. 5 - A simple, direct space heating system is currently...Ch. 5 - Prob. 26PCh. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 - Prob. 31PCh. 5 - Prob. 32PCh. 5 - Stan Moneymaker has been informed of a major...Ch. 5 - Prob. 34PCh. 5 - Prob. 35PCh. 5 - Prob. 36PCh. 5 - Prob. 37PCh. 5 - Prob. 38PCh. 5 - Prob. 39PCh. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Prob. 43PCh. 5 - To purchase a used automobile, you borrow 10,000...Ch. 5 - Your boss has just presented you with the summary...Ch. 5 - Experts agree that the IRR of a college education...Ch. 5 - A company has the opportunity to take over a...Ch. 5 - The prospective exploration for oil in the outer...Ch. 5 - Prob. 49PCh. 5 - An integrated, combined cycle power plant produces...Ch. 5 - A computer call center is going to replace all of...Ch. 5 - Prob. 52PCh. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - Prob. 55PCh. 5 - Prob. 56PCh. 5 - Prob. 57PCh. 5 - Prob. 58PCh. 5 - Prob. 59PCh. 5 - a. Calculate the IRR for each of the three...Ch. 5 - Prob. 61PCh. 5 - Prob. 62PCh. 5 - Prob. 63PCh. 5 - Prob. 64SECh. 5 - Prob. 65SECh. 5 - Prob. 66SECh. 5 - A certain medical device will result in an...Ch. 5 - Refer to Problem 5-61. Develop a spreadsheet to...Ch. 5 - Prob. 69CSCh. 5 - Prob. 70CSCh. 5 - Suppose that the average utilization of the CVD...Ch. 5 - Prob. 72FECh. 5 - Prob. 73FECh. 5 - Prob. 74FECh. 5 - Prob. 75FECh. 5 - Prob. 76FECh. 5 - Prob. 77FECh. 5 - Prob. 78FECh. 5 - Prob. 79FECh. 5 - A new machine was bought for 9,000 with life of...Ch. 5 - Prob. 81FECh. 5 - Prob. 82FECh. 5 - Prob. 83FECh. 5 - Refer to Problem 5-2. Assuming the residual value...

Additional Business Textbook Solutions

Find more solutions based on key concepts

An annuity provides for 10 consecutive end-of-year payments of 72,000. The average general inflation rate is es...

Contemporary Engineering Economics (6th Edition)

Using the information from EA7, calculate depreciation using the straight-line method.

Principles of Accounting Volume 1

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (12th Edition)

Why a convertible security not be converted when the market price of stock raises above the conversion price an...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Who is responsible for financial management in a construction company?

Construction Accounting And Financial Management (4th Edition)

What type of information do you think an oil company should include in their sustainability report? What about ...

Principles of Accounting Volume 2

Knowledge Booster

Similar questions

- Determine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable? (5.4) *A negative market value means that there is a net cost to dispose of an asset. Investment cost Expected lifeMarket (salvage) value* Annual receiptsAnnual expenses $10,000 5 years -$1,000 $8,000 $4,000arrow_forwardA company would like to invest on a project. The rate the company uses to justify their investments, i.e. the MARR is 25% per year (compounded yearly). Their estimations about the projects are as follows: Initial Cost: ($300,000)The Study Period: 15 yearsSalvage (Market) Value of the Project: 20% of the initial cost 1-) What is the capital recovery cost, CR? 2-) Operating costs in the first year are estimated to be ($7,500) and these operating costs are estimated to increase by 5% per year. Construct cash flow table and determine the minimum amount of annual revenue ($ per year?) that makes this investment an attractive option for the company? (i.e. what is Equivalent UNIFORM (Annual) Cost, EU(A)C?) 3-) Benefits in in the first year are estimated to be $30,000 and these benefits are estimated to increase by 13% per year. Construct cash flow table and determine the net present value/worth of the project, NPW. 4-) What is the simple payback period? 5-) Determine IRR of…arrow_forwardDetermine the IRR for this projectarrow_forward

- Investment Cost Useful Life 15 years Market Value, aka salvage value (EOY 15) 3,000 Annual Operating Expenses Overhaul cost--EOY 5 Overhaul cost--EOY10 ('000s of $) 13,000 $19,553,380. NO. 1,000 $19,210,488. YES 200 Evaluate a combined cycle power plant on the basis of the PW method when the MARR is 12% per year. Pertinent cost data are shown in the table. Should the plant be built? 550 $19,553,380. Impossible to say without additional information. O $19,210,488. Impossible to say without additional information.arrow_forwardQ15. For the cash flows shown, determine the incremental cash flow between machines B and A (a) in year 0, (b) in year 3, and (c) in year 6. Machine First Cost, $ A B -13,000 -25,000 AOC, $ per Year -1,300-400 Life, Years Salvage Value, $ 5,000 6,000 3 6 a) The incremental cash flow between machines B and A in year 0 is $ . b) The incremental cash flow between machines B and A in year 3 is $. c) The incremental cash flow between machines B and A in year 6 is $ .arrow_forwardThe survey firm of Layer, Anderson, and Pope (MAP) LLP is considering the purchase of a piece of new GPS equipment. Data concerning the alternative under consideration are presented below. First Cost $28,000 Annual Income 7,000 Annual Costs 2,500 Recalibration at end of Year 4 4,000 Salvage Value 2,800 If the equipment has a life of eight years and MAP's minimum attractive rate of return (MARR) is 5%, what is the annual worth of the equipment?arrow_forward

- A4 Please complete the things I have not filled out. I believe the best way to complete this is using excel. Also make sure to do the part that says to perform the incremental IRR analysis for the remaning alternatives (The part that has The IRR delta (C - A = ?? %). Thank You!arrow_forwardClick the icon to view the alternatives description. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. The FW of the Alternative 1 is $ (Round to the nearest dollar.) Ĵ Today, you have $40,000 to invest. Two investment alternatives are available to you. One would require you to invest your $40,000 now, the other would require the $40,000 investment two years from now. In either case, the investments will end five years from now. The cash flows for each alternative are provided below. Using a MARR of 10%, what should you do with the $40,000 you have? Click the icon to view the alternatives description. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. The FW of the Alternative 1 is S. (Round to the nearest dollar.)arrow_forwardYOUR FATHER PLANS TO INVEST P500,000.00 IN AN AUTO WASHING MACHINE WITH THE FF DATA: (20 PTS.) WASHING CAPACITY- 12 CARS/HR AT 8HRS OPERATION/DAY FOR 6DAYS A WEEK AND 50 WEEKS/YEAR CAR WASH CHARGE-P25/CAR MANUAL LABOR COST ( 2 WORKERS)-P25/HR PER WORKER PLUS A PAID VACATION BENEFITS OF 2 WEEKS PER YEAR MAINTENANCE COST-P8500.00/MONTH DESIRED RATE OF RETURN ON THE CAPITAL-20% PRESENTLY YOUR FATHER IS EARNING P25,000.00/MONTH AS A REGULAR EMPLOYEE AND WANTS TO CONCENTRATE ON THIS BUSINESS AND WANT TO RECOVER HIS INVESTMENT IN 5 YEARS. USING ROR AND AW METHOD OF ECONOMY STUDIES, SHOULD YOUR FATHER PROCEED WITH THE INVESTMENT?arrow_forward

- 7. A building cost P10,000,000 and the salvage value is P150,000 after 25 years The annual maintenance cost is P60,000 costs of repair is P200,000 every 5 years. Find the capitalized cost if money worth 15% per annum?arrow_forwardThe equivalent amount of money that can be spent seven years from now in lieu of spending $50,000 now at an interest rate 18% per year is closest to:a. $15,700b. $159,300c. $199,300d. $259,100arrow_forwardRequired information The tabulation of the incremental cash flows between alternatives A and B is shown. Alternative A has a 3-year life and alternative B a 6-year life. Year Incremental Cash Flows (BA), $ -22,500 5,000 5,000 11,000 5,000 5,000 5,000 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. 0123456 If neither alternative has a salvage value, what is the first cost of alternative A? The first cost of alternative A is $-arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education