Governmental and Nonprofit Accounting (11th Edition)

11th Edition

ISBN: 9780133799569

Author: Robert J. Freeman, Craig D. Shoulders, Dwayne N. McSwain, Robert B. Scott

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 1P

The city of Asher had the following transactions, among others, in 20X7:

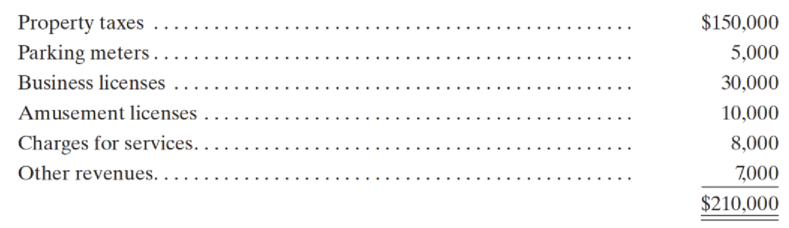

- 1. The council estimated that revenues of $210,000 would be generated for the General Fund in 20X7. The sources and amounts of expected revenues are as follows:

- 2. Property taxes of $152,000 were levied by the council; $2,000 of these taxes are expected to be uncollectible.

- 3. The council adopted a budget revision increasing the estimate of amusement licenses revenues by $2,000 and decreasing the estimate for business licenses revenues by $2,000. 4.

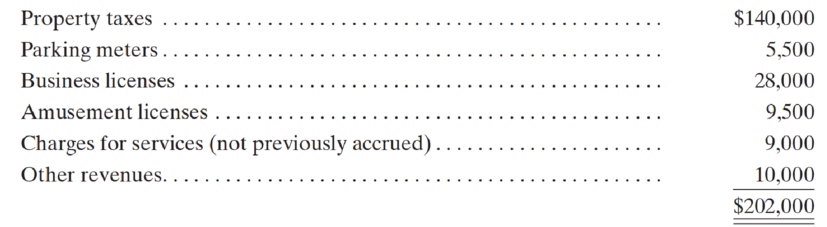

- 4. The following collections were made by the city:

- 5. The resources of a discontinued Capital Projects Fund were transferred to the General Fund, $4,800.

- 6. Enterprise Fund cash of $5,000 was paid to the General Fund to subsidize its operations.

- a. Prepare general journal entries and budgetary entries to record the transactions in the General Ledger and Revenues Subsidiary Ledger accounts.

- b. Prepare a

trial balance of the RevenuesLedger after posting the general journal entries pre- pared in item (a). Show agreement with the control accounts - c. Prepare the general

journal entry (ies) to close the revenue accounts in the General Ledger and Revenues Ledger.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Edwards City has the following information for its general fund for the upcoming

fiscal year. Which of the following would be the appropriate effect to budgetary fund

balance when the budget is recorded?

Estimated revenue

Appropriations

Property tax

3,500,000 Salaries

2,690,000

Sales tax

490,000 Capital items

1,320,000

Other

50,000 Other

15,000

None of these

Credit budgetary fund balance $30,000

Credit budgetary fund balance $15,000

Debit budgetary fund balance $30,000

The City of Lexington is preparing its

government-wide financial statements from

its fund financial statements.

The City records Deferred Revenue with a

book value of $3,500 and Compensated

Absences of $2,000 (all numbers in $1,000s)

at the beginning of the year. During the year,

these accounts increased by $1,500 and

$900, respectively. What reconciliation entries

must the City include in its government-wide

financial statements relating to Deferred

Revenues and Compensated Absences?

Please show work so I can follow along to

learn. THANK YOU!

Reconciliation Spreadsheet

Description

Debit

Credit

Revenues

To record reconciliation entry for deferred revenue.

Compensated absence expense

To record reconciliation entry for compensated absences.

Chesterfield County had the following transactions. Prepare the entries first for fund financial statements and then for government-wide financial statements.a. A budget is passed for all ongoing activities. Revenue is anticipated to be $834,000 with approved spending of $540,000 and operating transfers out of $242,000.b. A contract is signed with a construction company to build a new central office building for the government at a cost of $8 million. A budget for this project has previously been recorded.c. Bonds are sold for $8 million (face value) to finance construction of the new office building.d. The new building is completed. An invoice for $8 million is received and paid.e. Previously unrestricted cash of $1 million is set aside to begin paying the bonds issued in (c).f. A portion of the bonds comes due and $1 million is paid. Of this total, $100,000 represents interest. The interest had not been previously accrued.g. Citizens’ property tax levies are assessed. Total billing…

Chapter 5 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Ch. 5 - Prob. 1QCh. 5 - Prob. 2QCh. 5 - The term deferred revenues seems out of place in...Ch. 5 - Governments often collect cash or must record...Ch. 5 - Modified accrual basis revenue recognition is...Ch. 5 - (a) Should estimated uncollectible amounts of...Ch. 5 - (a) What are expenditure-driven intergovernmental...Ch. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - During the course of your audit of a city, you...

Ch. 5 - Prob. 11QCh. 5 - Prob. 1.1ECh. 5 - Prob. 1.2ECh. 5 - Prob. 1.3ECh. 5 - Prob. 1.4ECh. 5 - What would the answer be to number 4 if the city...Ch. 5 - A county received 3,000,000 from the state. Of...Ch. 5 - A Special Revenue Fund expenditure of 40,000 was...Ch. 5 - A state received an unrestricted gift of 80,000 of...Ch. 5 - Prob. 1.9ECh. 5 - Prob. 1.10ECh. 5 - Prob. 2.1ECh. 5 - Prob. 2.2ECh. 5 - Prob. 2.3ECh. 5 - Prob. 2.4ECh. 5 - Prob. 2.5ECh. 5 - Prob. 2.6ECh. 5 - Prob. 2.7ECh. 5 - Prob. 2.8ECh. 5 - Prob. 2.9ECh. 5 - Prob. 2.10ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - a. Prepare the general journal entries to record...Ch. 5 - Prob. 6ECh. 5 - Prepare general journal entries to record the...Ch. 5 - Prob. 8ECh. 5 - The City and County of PreVatte received a state...Ch. 5 - Make all required General Fund journal entries for...Ch. 5 - The city of Asher had the following transactions,...Ch. 5 - 1. The following are the estimated revenues for a...Ch. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Prob. 5PCh. 5 - Prob. 6PCh. 5 - Prob. 1CCh. 5 - Prob. 2C

Additional Business Textbook Solutions

Find more solutions based on key concepts

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals Of Financial Accounting

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals of Financial Accounting

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city's general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $610,000. Parks reports net expenses of $107,000. Art museum reports net revenues of $57,750. General government revenues for the year were $813,250 with an overall increase in the city's net position of $154,000. The fund financial statements provide the following for the entire year: The general fund reports a $32,250 increase in its fund balance. The capital projects fund reports a $44,000 increase in its fund balance. The enterprise fund reports a $70,500 increase in its net position. The city asks the CPA firm…arrow_forwardAs of January 1, 20X2, the City Council approved and the mayor signed a budget calling for $8,000,000 in estimated imposed and derived non-exchange revenues, $600,000 in estimated state grants, $6,000,000 in estimated expenditures and $1,500,000 to be transferred to debt service funds for the payment of principal and interest.Journal Entry would be?arrow_forwardThe City of Rio Rancho adopted the following budget for the calendar year 2020: Revenues: Property taxes Miscellaneous revenues Appropriations: General government salaries Public safety salaries Public safety supplies Culture and recreation salaries and supplies Required: $8,000,000 700,000 During the year the City decided to hold a special cultural event, which caused a need for additional police presence. To pay for the additional costs, the City Council revised the budget as follows: the appropriation for public safety salaries was increased by $30,000; the appropriation for culture and recreation salaries and supplies was increased by $25,000, and the appropriation for public safety supplies was decreased by $28,000. At the same time, because the event was expected to yield revenues, the Council increased estimated miscellaneous revenues by $20,000. a. b. 1,500,000 5,400,000 300,000 1,700,000 Prepare the general journal entry to record the budget. Prepare the general journal entry…arrow_forward

- The voters of Salinas City authorized the construction of a new north-south expressway for a total cost of no more that $90 million. The voters also approved the issuance of $60 million of 5 percent general obligation bonds. The balance of the necessary funds will come from the following sources: $20 million from a federal grant and $10 million from a state grant. The city controls expenditures in capital project funds through project management. The city does not formally incorporate budgetary entries in the capital projects fund but it does use encumbrance accounting for control purposes. Assume that the city maintains its books and records in a manner that facilitates the preparation of the fund financial statements. Prepare journal entries in the capital projects fund, for the following transactions. The city (a) Issues $60 million of 5 percent general obligation bonds at 101. (b) Transfers the premium to the appropriate fund. (c) Incurs bid-related expenditures of $1,000. (d)…arrow_forwardAssume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $600,000. Parks reports net expenses of $100,000. Art museum reports net revenues of $50,000. General government revenues for the year were $800,000 with an overall increase in the city's net position of $150,000. The fund financial statements provide the following for the entire year: The general fund reports a $30,000 increase in its fund balance. The capital projects fund reports a $40,000 increase in its fund balance. The enterprise fund reports a $60,000 increase in its net position. The city asks the…arrow_forwardAssume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $702,000. Parks reports net expenses of $144,000. Art museum reports net revenues of $50,250. General government revenues for the year were $966,750 with an overall increase in the city's net position of $171,000. The fund financial statements provide the following for the entire year: The general fund reports a $45,250 increase in its fund balance. The capital projects fund reports a $53,750 increase in its fund balance. The enterprise fund reports a $69,000 increase in its net position. The city asks the…arrow_forward

- Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $615,000. Parks reports net expenses of $102,000. Art museum reports net revenues of $51,000. General government revenues for the year were $894,000 with an overall increase in the city's net position of $228,000. The fund financial statements provide the following for the entire year: The general fund reports a $44,000 increase in its fund balance. The capital projects fund reports a $64,500 increase in its fund balance. The enterprise fund reports a $62,250 increase in its net position. The city asks the…arrow_forwardOn June 1, 2020, the City of Cape May authorized the construction of a police station at an expected cost of $250,000. Financing will be provided through transfers from a Special Revenue Fund. The following transactions occurred during the fiscal year beginning June 1, 2020, relating to the Capital Project Fund. 1. The $250,000 receivable from the Special Revenue Fund was recorded. 2. The Special Revenue Fund transferred $125,000 to the Capital Project Fund to begin construction on the police station. 3. The Capital Project Fund invested the transfer of monies in a six-month certificate, at 5%. 4. A contract in the amount of $250,000 was let to the lowest bidder. 5. Architect and legal fees in the amount of $3,125 were approved for payment. There was no encumbrance for these expenditures. 6. Contract billings in the amount of $250,000 were approved for payment on the completion of the police station and the encumbrance was removed. 7. The six-month certificate was redeemed at maturity…arrow_forwardThe City of Townsend’s city council authorized the establishment of an internal service fund to provide human resource services to city departments.The following transactions took place in the inaugural month of Townsend’s Human Resource internal service fund: The General Fund transferred $100,000 to cover initial expenses. The transfer is not expected to be repaid. The Human Resources Fund entered into a 2-year computer lease with an initial $5,000 payment. The present value of the remaining payments is $82,218. Salaries and wages paid to employees totaled $15,000. Office supplies were purchased on account for $2,500. Billings totaling $3,000 were received from the enterprise fund for utility charges. Billings to other departments for services provided to them were as follows: General Fund $ 16,000 Special Revenue Fund 4,700 Closing entries were prepared. Required a-1. Assume all expenses at the government-wide level are charged to the General…arrow_forward

- 3. On the last day of the calendar year, the City of Soccerton borrowed $400,000 from the local bank as a short-term loan in anticipation of property tax collections in the month of January. The note is non-interest bearing, due in 30 days, and is discounted as a rate of 12% per year. Record this transaction from two perspectives: 1) from the governmental activities' perspective on the government-wide statements, and 2) from the General Fund perspective. (1) From the governmental activities' perspective: Date Account Name 12/31 (2) From the General Fund perspective Date Account Name 12/31 Debit Credit Debit Creditarrow_forwardThe City of Iroy collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, the city estimated that it will require $1,800,000 to finance governmental activities for the remainder of the fiscal year. On that date, it had $700,000 of cash on hand and $760,000 of current liabilities. Collections for the remainder of the year from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at $750,000. Required a. Calculate the estimated amount of tax anticipation financing that will be required for the remainder of the current fiscal year. b. Assume that on April 2, the City of Troy borrowed the amount calculated in part a by signing tax anticipation notes bearing 7 percent per annum to a local bank. Record the issuance of the tax anticipation notes in the…arrow_forwardAssume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $766,000. Parks reports net expenses of $163,000. Art museum reports net revenues of $58,250. General government revenues for the year were $1,069,750 with an overall increase in the city's net position of $199,000. The fund financial statements provide the following for the entire year: The general fund reports a $35,750 increase in its fund balance. The capital projects fund reports a $45,750 increase in its fund balance. The enterprise fund reports a $72,750 increase in its net position. The city asks…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License