Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

11th Edition

ISBN: 9780077861759

Author: Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 15QP

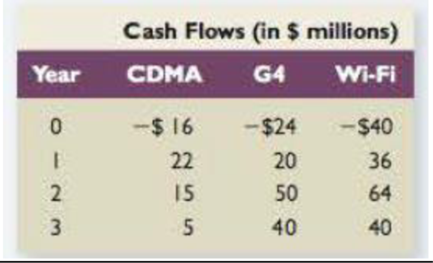

Profitability Index versus

- a. Based on the profitability index decision rule, rank these investments.

- b. Based on the NPV, rank these investments.

- c. Based on your findings in (a) and (b), what would you recommend to the CEO of the company and why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Suppose the following two independent investment opportunities are available to a

company. The appropriate discount rate is 8 percent.

Year

O

1

2

3

Project

Alpha

-$4,500

b.

2,300

2,200

1,450

a. Compute the profitability index for each of the two projects. (Do not round

intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.)

Project Alpha

Project Beta

Project Beta

-$ 6,100

1,350

4,500

4,000

Profitability Index

Which project(s), if either, should the company accept based on the profitability index

rule?

Project Alpha

O Project Beta

Neither project

O Both projects

Find the profitability index for Oman Air conditioner Company if the initial

investment is 4000 OMR and the cash Inflows are as follows: Year 1=1350

OMR; Year 2 =1400 OMR; Year 3-1450 OMR and Year 4=1500 OMR. Use

discount rate as 5%.

Select one:

Answer the following lettered questions on the basis of the information in this table:

Amount of R&D,

$ Millions

Expected Rate of

Return on R&D, %

$ 10

16

20

14

30

12

40

10

50

8

60

6

Instructions: Enter your answer as a whole number.

a. If the interest-rate cost of funds is 8 percent, what is this firm's optimal amount of R&D spending?

million

%24

Chapter 5 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 5 - Payback Period and Net Present Value If a project...Ch. 5 - Net Present Value Suppose a project has...Ch. 5 - Comparing Investment Criteria Define each of the...Ch. 5 - Payback and Internal Rate of Return A project has...Ch. 5 - International Investment Projects In March 2014,...Ch. 5 - Capital Budgeting Problems What are some of the...Ch. 5 - Prob. 7CQCh. 5 - Prob. 8CQCh. 5 - Net Present Value versus Profitability Index...Ch. 5 - Internal Rate of Return Projects A and B have the...

Ch. 5 - Net Present Value You are evaluating Project A and...Ch. 5 - Modified Internal Rate of Return One of the less...Ch. 5 - Net Present Value It is sometimes stated that the...Ch. 5 - Prob. 14CQCh. 5 - Calculating Payback Period and NPV Maxwell...Ch. 5 - Calculating Payback An investment project provides...Ch. 5 - Calculating Discounted Payback An investment...Ch. 5 - Calculating Discounted Payback An investment...Ch. 5 - Prob. 5QPCh. 5 - Calculating IRR Compute the internal rate of...Ch. 5 - Calculating Profitability Index Bill plans to open...Ch. 5 - Calculating Profitability Index Suppose the...Ch. 5 - Cash Flow Intuition A project has an initial cost...Ch. 5 - Prob. 10QPCh. 5 - NPV versus IRR Consider the following cash flows...Ch. 5 - Problems with Profitability Index The Coris...Ch. 5 - Prob. 13QPCh. 5 - Comparing Investment Criteria Wii Brothers, a game...Ch. 5 - Profitability Index versus NPV Hanmi Group, a...Ch. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Comparing Investment Criteria The treasurer of...Ch. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 19QPCh. 5 - NPV and Multiple IRRs You are evaluating a project...Ch. 5 - Payback and NPV An investment under consideration...Ch. 5 - Multiple IRRs This problem is useful for testing...Ch. 5 - NPV Valuation The Yurdone Corporation wants to set...Ch. 5 - Calculating IRR The Utah Mining Corporation is set...Ch. 5 - Prob. 25QPCh. 5 - Calculating IRR Consider two streams of cash...Ch. 5 - Calculating Incremental Cash Flows Darin Clay, the...Ch. 5 - Prob. 28QPCh. 5 - Prob. 1MCCh. 5 - Seth Bullock, the owner of Bullock Gold Mining, is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are evaluating a prospective LBO investment and determine that the Year 5 free cash flow (FCF) estimate is $850 million. Additionally, based on related work you estimate that the appropriate discount rate is 8.5% and the long term growth rate is 3.5%. Based on the perpetuity growth method, the Terminal Value of the company is _________ in Year Group of answer choices a. $17.6 bn, year 5 b. $17.0 bn, year 6 c. $10.0 bn, year 5 d. $17.6 bn, year 6arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, use the PI to determine which projects the company should accept. What is the PI of project B?(Round to two decimal places.) Cash Flow Project A Project B Year 0 −$1,800,000 −$2,400,000 Year 1 $500,000 $1,200,000 Year 2 $600,000 $1,100,000 Year 3 $700,000 $1,000,000 Year 4 $800,000 $900,000 Year 5 $900,000 $800,000 Discount rate 5% 17%arrow_forwardYou are asked to evaluate the following two projects for the Norton Corporation. Using the net present value method combined with the profitability index approach described in footnote 2 of this chapter, which project would you select? Use a discount rate of 14 percent. Project X (videotapes of the weather report) ($20,000 investment) Year Cash Flow 1. $10,000 2 8,000 3 9.000 4 8.600 Project X (videotapes of the weather report) ($40,000 investment) Year Cash Flow $20,000 2 13,000 3 14.000 4 16.800arrow_forward

- Shaylee Corporation has $2.00 million to invest in new projects. The company's managers have presented a number of possible options that the board must prioritize. Information about the projects follows: Initial investment Present value of future cash flows Required: 1. Is Shaylee able to invest in all of these projects simultaneously? 2-a. Calculate the profitability index for each project. 2-b. What is Shaylee's order of preference based on the profitability index? Complete this question by entering your answers in the tabs below. Req 1 Project A $ 435,000 785,000 Req 2A and 2B Is Shaylee able to invest in all of these projects simultaneously? Is Shaylee able to invest in all of these projects simultaneously? Project C $ 740,000 1,220,000 Project D $ 965,000 1,580,000arrow_forward(Forecasting financing needs) Beason Manufacturing forecasts its sales next year to be $5.4 million and expects to earn 4.9 percent of that amount after taxes. The firm is currently in the process of projecting its financing needs and has made the following assumptions (projections): • Current assets are equal to 19.8 percent of sales, and fixed assets remain at their current level of $0.8 million. • Common equity is currently $0.78 million, and the firm pays out half of its after-tax earnings in dividends. The firm has short-term payables and trade credit that normally equal 11.8 percent of sales, and it has no long-term debt outstanding. What are Beason's financing needs for the coming year? Beason's expected net income for next year is $ (Round to the nearest dollar.)arrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forward

- Self-Test Problems: 1. Use the percentage of sales forecasting method to compute the additional financing needed by Lambrechts Specialty Shops, Inc. (LSS), if sales are expected to increase from a current level of $20 million to a new level of $25 million over the coming year. LSS expects earnings after taxes to equal $1 million over the next year. LSS intends to pay a $300,000 dividend next year. The current year balance sheet for LSS is as follows: Lambrechts Specialty Shops, Inc. 138 Balance Sheet as of December 31, 20X3 cash $1,000,000 Accounts payable $3,000,000 Accounts receivable 1,500,000 Notes payable 3,000,000 inventories 6,000,000 Long-term debt 2,000,000 Net fixed assets 3,000,000 Stockholders' equity 3,500,00 Total Assets $11,500,000 Total liabilities and equity $11,500,000 All assets, except "cash", are expected to vary proportionately with sales. Of total liabilities and equity, only “accounts payable" is expected to vary proportionately with sales.arrow_forwardSalsa Company is considering an investment in technology to improve its operations. The investment costs $241,000 and will yield the following net cash flows. Management requires a 10% return on investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Year Net cash Flow 1 $ 48, 200 2 53,900 3 76, 400 4 95,500 5 126,500 Required: Determine the payback period for this investment. Determine the break - even time for this investment. Determine the net present value for this investment. Should management invest in this project based on net present value?arrow_forward(Forecasting financing needs) Beason Manufacturing forecasts its sales next year to be $5.6 million and expects to earn 4.3 percent of that amount after taxes. The firm is currently in the process of projecting its financing needs and has made the following assumptions (projections): • Current assets are equal to 19.3 percent of sales, and fixed assets remain at their current level of $1.1 million. • Common equity is currently $0.75 million, and the firm pays out half of its after-tax earnings in dividends. • The firm has short-term payables and trade credit that normally equal 12.1 percent of sales, and it has no long-term debt outstanding. What are Beason's financing needs for the coming year? Beason's expected net income for next year is $ 240,800 (Round to the nearest dollar.) Beason's expected common equity balance for next year is $ 870400. (Round to the nearest dollar.) Estimate Beason's financing needs by completing the pro forma balance sheet below: (Round to the nearest…arrow_forward

- Home Innovation is evaluating a new product design. The estimated receipts and disbursements associated with the new product are shown below. MARR is 10%/year. Solve, a. What is the annual worth of this investment? b. What is the decision rule for judging the attractiveness of investments based on annual worth? c. Should Home Innovations pursue this new product?arrow_forwardIn your internship with Lewis, Lee, & Taylor Inc. you have been asked to forecast the firm's additional funds needed (AFN) for next year. The firm is operating at full capacity. Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? Last year's sales = So Sales growth rate = g Last year's total assets = Ao* Last year's profit margin= PM -$14,440 B -$15,200 Ⓒ-$16,000 D-$16,800 $200,000 40% $135,000 20.0% Last year's accounts payable Last year's notes payable Last year's accruals Target payout ratio $50,000 $15,000 $20,000 25.0%arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Discounted cash flow model; Author: Edspira;https://www.youtube.com/watch?v=7PpWneOBJls;License: Standard YouTube License, CC-BY