Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 13PC

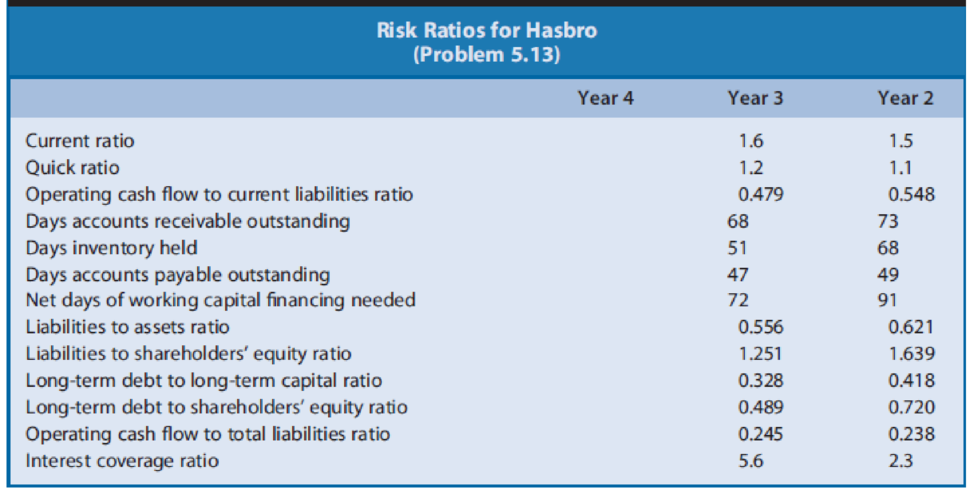

Calculating and Interpreting Risk Ratios. Refer to the financial statement data for Hasbro in Problem 4.24 in Chapter 4. Exhibit 5.15 presents risk ratios for Hasbro for Year 2 and Year 3.

Exhibit 5.15

REQUIRED

- a. Calculate the amounts of these ratios for Year 4.

- b. Assess the changes in the short-term liquidity risk of Hasbro between Year 2 and Year 4 and the level of that risk at the end of Year 4.

- c. Assess the changes in the long-term solvency risk of Hasbro between Year 2 and Year 4 and the level of that risk at the end of Year 4.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Which of the following is an idicator of financial risk ?

a)

Net Sales / Total Assets

b)

Total Liabilities / Equity

c)

Return on Assets

d)

Return on Equity

Match the ratio to the building block of financial statement analysis to which it best relates.A. Liquidity and efficiency B. Solvency C. Profitability D. Market prospects Times interest earned

These are ways in which depository financial institutions measure liquidity risk except:

a.

Liquid assets to total assets.

b.

Liquid assets to long term liabilities.

c.

Maturity gap analysis return.

d.

Net liquidity statement.

Chapter 5 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 5 - Prob. 1QECh. 5 - Prob. 2QECh. 5 - A firm has experienced an increasing current ratio...Ch. 5 - A firm has experienced a decrease in its current...Ch. 5 - Prob. 5QECh. 5 - A firm had the following values for the four debt...Ch. 5 - Prob. 7QECh. 5 - Prob. 8QECh. 5 - Prob. 9QECh. 5 - Prob. 10QE

Ch. 5 - Market equity beta measures the covariability of a...Ch. 5 - Altmans bankruptcy risk model utilizes the values...Ch. 5 - Calculating and Interpreting Risk Ratios. Refer to...Ch. 5 - Refer to the financial state-ment data for...Ch. 5 - Refer to the profitability ratios of Coca-Cola in...Ch. 5 - Delta Air Lines, Inc., is one of the largest...Ch. 5 - Prob. 17PCCh. 5 - Prob. 18PCCh. 5 - Prob. 19PCCh. 5 - Prob. 20PCCh. 5 - Prob. 21PCCh. 5 - Prob. 22PCCh. 5 - Compute the values of each of the ratios in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Refer to the financial state-ment data for Abercrombie Fitch in Problem 4.25 in Chapter 4. Exhibit 5.16 presents risk ratios for Abercrombie Fitch for fiscal Year 3 and Year 4. Exhibit 5.16 REQUIRED a. Compute the amounts of these ratios for fiscal Year 5. b. Assess the changes in the short-term liquidity risk of Abercrombie Fitch between fiscal Year 3 and fiscal Year 5 and the level of that risk at the end of fiscal Year 5. c. Assess the changes in the long-term solvency risk of Abercrombie Fitch between fiscal Year 3 and fiscal Year 5 and the level of that risk at the end of fiscal Year 5.arrow_forwardAnalyze credit risk in the past and current years Analyze profitability in the past and current yearsarrow_forwardCalculate the projected debt ratio, debt-to-equity ratio, liabilities-to-assets ratio, times-interest-earned ratio, and EBITDA coverage ratios. How does Computron compare with the industry with respect to financial leverage? What can you conclude from these ratios?arrow_forward

- Based upon risk, which of the following financial assets is likely to have the highest required rate of return? Select one: A. A corporate bond B. A U.S. Treasury bill C. A bank certificate of deposit D. A share of common stockarrow_forwardA. Briefly explain three risk exposures that an analyst should report as part of anenterprise risk management system.Page 4 of 10B. Define market risk and the economic parameters considered when calculatingmarket risk.C. Explain the concept of ‘beta’ within the framework of the Capital Asset PricingModel (CAPM). Discuss the relevance of the covariance between assets returnsfor an investor wishing to diversify the risk of a portfolioarrow_forwardQuestion 1 Fill the parts in the above table that are shaded in yellow. You will notice that there are nineline items. Question 2Using the data generated in the previous question (Question 1);a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML? d) If an investment’s expected return (mean return) does not plot on the SML, what doesit show? Identify undervalued/overvalued investments from the grapharrow_forward

- Match the ratio to the building block of financial statement analysis to which it best relates.A. Liquidity and efficiency B. Solvency C. Profitability D. Market prospects Dividend yieldarrow_forwardA balance sheet that displays only component percentages is a a.comparative balance sheet. b.condensed balance sheet. c.common-sized balance sheet. d.trend balance sheet. If the straight-line method of amortization of bond premium or discount is used, which of the following statements is true? A. Annual interest expense will remain the same over the life of the bonds with the amortization of bond discount. B. Annual interest expense will increase over the life of the bonds with the amortization of bond discount. C. Annual interest expense will decrease over the life of the bonds with the amortization of bond discount. D. Annual interest expense will increase over the life of the bonds with the amortization of bond premium. A statement of cash flows would be least useful in answering which of the following questions? Double-click on the box below to edit your answer choices. A.Cash used to purchase equipment B.Change in total expenses C.cash provided from sale of stockarrow_forwardThe debt ratio is used primarily as a measure of: Short-term liquidity. Profitability. Creditors' long-term risk. Return on Investment.arrow_forward

- Match the ratio to the building block of financial statement analysis to which it best relates.A. Liquidity and efficiency B. Solvency C. Profitability D. Market prospects Acid-test ratioarrow_forwardListed below are several terms and phrases associated with current liabilities. Pair each item from List A (by letter) with the item from List B that is most appropriately associated with it. 1. 2. Payable with current assets. 3. List A Face amount x Interest rate x Time. 4. a. b. Short-term debt to be refinanced with common stock. c. Present value of interest plus present value of principal. 5. Noninterest-bearing. 6. Noncommitted line of credit. 7. Pledged accounts receivable. 8. Reclassification of debt. 9. Purchased by other corporations. 10. Expenses not yet paid. 11. Liability until refunded. 12. Liability until satisfy performance obligation d. e. f. g. |h. I. J. k. 1. List B Informal agreement Secured loan Refinancing prior to the issuance of the financial statements Accounts payable Accrued liabilities Commercial paper Current liabilities Long-term liability Usual valuation of liabilities Interest on debt Customer advances Customer depositsarrow_forward1. Which of the following models for mathematics of the financial markets is dependent on expectations or probabilities of changes in the value of an underlying asset? A. Monte Carlo Simulation B. Black Scholes Model C. Cox-Ross-Rubinstein Model 2. Models for the financial markets are primarily used for all of the following, except, A. Algorithmic Trading B. Technical Analysis (Short term trading) C. Fundamental Analysis (Long term investing D. All of the above 3. Which among the following organizations use financial mathematics as part of their core operation? A. Investment banks B. Government C. Hedge funds D. All of the above 4. S1: Quantitative finance helps to allocate resources to provide the optimum returns. S2: Financial models are accurate. A. Both statements are true B. Both statements are false C.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License