MANAGERIAL ACCOUNTING TEXT ONLY CUSTOM

17th Edition

ISBN: 2818440119866

Author: Garrison

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 12E

EXERCISE 5-12 Multiproduct Break-Even Analysis LO5-9

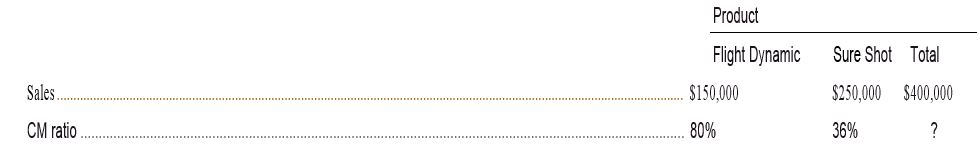

Olongapo Sports Corporation distributes two premium golf balls—Flight Dynamic and Sure Shot. Monthly sales and the contribution margin ratios for the two products follow:

Fixed expenses total $183,750 per month.

Required:

- Prepare a contribution format income statement for the company as a whole. Carry computations to one decimal place.

- What is the company's break-even point in dollar sales based on the current sales mix?

- If sales increase by $100,000 a month, by how much would you expect the monthly net operating income to increase? What are your assumptions?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question Three

AU Ltd manufactures and sells a single product, the company's sales and expenses for the

month of January 2021 were as follows:

Total (Kshs)

Value per unit (Kshs)

Sales

1,200.00

80.00

Less: Variable expenses

840.00

56.00

Contribution

360.00

24.00

Less: Fixed expenses

300.00

Net income

60.00

Required:

(i)

What is the monthly breakeven point in units and in shillings?

What is the total contribution margin at breakeven point?

(ii)

(iii)

How many units would be sold each month to earn a minimum target net income of

kshs. 36,000?

(iv)

Using the original data, compute a company's margin of safety in both shilling and in

percentage terms.

(v)

What is the contribution margin ratio, if the monthly sales increase by Kshs 16,000?

Question 2

Style photo sells only one product. The statement of comprehensive income for 2021 is provided below:

Sales

60,000

Less variable expenses

-30,000

Contribution margini

30,000

Less fixed expenses

-22,500

Net income

7,500

Required:

Calculate with workings:

a. The contribution margin ratio in percentage.

b. Three breakeven point in total sales ringgits.

Question 2

Style photo sells only one product. The statement of comprehensive income for 2021 is provided below:

Sales

60,000

Less variable expenses

-30,000

Contribution margin

30,000

Less fixed expenses

-22,500

Net income

7,500

Required:

Calculate with workings:

The contribution margin ratio in percentage.

Three breakeven point in total sales ringgits.

The sales in RM if the company wants to achieve RM40,000 in net income.

Chapter 5 Solutions

MANAGERIAL ACCOUNTING TEXT ONLY CUSTOM

Ch. 5.A - EXERCISE 5A-1 High-Low Method LO5-10 The Cheyenne...Ch. 5.A - EXERCISE 5A-2 Least-Squares Regression LO5-11...Ch. 5.A - EXERCISE 5A-3 Cost Behavior; High-Low Method...Ch. 5.A - Prob. 4ECh. 5.A - EXERCISE 5A-5 Least-Squares Regression LO5-11...Ch. 5.A - Prob. 6PCh. 5.A - Problem 5A-7 Cost Behavior; High-Low Method;...Ch. 5.A - Problem 5A-8 High-Low Method; Predicting Cost...Ch. 5.A - Prob. 9PCh. 5.A - Prob. 10P

Ch. 5.A - Case 5A-11 Mixed Cost Analysis and the Relevant...Ch. 5.A - CASE 5A-12 Analysis of Mixed Costs in a Pricing...Ch. 5 - Prob. 1QCh. 5 - Often the most direct route to a business decision...Ch. 5 - Prob. 3QCh. 5 - What is the meaning of operating leverage?Ch. 5 - What is the meaning of break-even point?Ch. 5 - 5-6 In response to a request from your immediate...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - Prob. 1AECh. 5 - Prob. 2AECh. 5 - Prob. 3AECh. 5 - Prob. 4AECh. 5 - Prob. 5AECh. 5 - Prob. 1F15Ch. 5 - Prob. 2F15Ch. 5 - Prob. 3F15Ch. 5 - Prob. 4F15Ch. 5 - Prob. 5F15Ch. 5 - Prob. 6F15Ch. 5 - Prob. 7F15Ch. 5 - Prob. 8F15Ch. 5 - Prob. 9F15Ch. 5 - Prob. 10F15Ch. 5 - Prob. 11F15Ch. 5 - Prob. 12F15Ch. 5 - Prob. 13F15Ch. 5 - Prob. 14F15Ch. 5 - Prob. 15F15Ch. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - EXERCISE 5-10 Multiproduct Break-Even Analysis...Ch. 5 - Prob. 11ECh. 5 - EXERCISE 5-12 Multiproduct Break-Even Analysis...Ch. 5 - EXERCISE 5-13 Changes in Selling Price, Sales...Ch. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Prob. 18ECh. 5 - Prob. 19PCh. 5 - PROBLEM 5-20 CVP Applications: Break-Even...Ch. 5 - PROBLEM 5-21 Sales Mix; Multiproduct Break-Even...Ch. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 -

PROBLEM 5-26 CVP Applications; Break-Even...Ch. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 -

PROBLEM 5-31 Interpretive Questions on the CVP...Ch. 5 - Prob. 32C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem II. Omega Enterprises sells two products, Model E100 and F900. Monthly sales and the contribution margin ratios for the two products, follow: Product E100 F900 Total Sales P 700,000 P 300,000 P 1,000,000 Contribution margin ratio 60% 70% The Company’s fixed expenses total P598,500 per month. What is the company’s total contribution margin ratio? What is the company’s total net operating income? The break-even point for the company based on the current sales mix is ______.arrow_forwardOwe Subject: acountingarrow_forwardAnswer full question please.arrow_forward

- Exercise 5-12 (Static) Multiproduct Break-Even Analysis [LO5-9] Olongapo Sports Corporation distributes two premium golf balls-Flight Dynamic and Sure Shot. Monthly sales and the contribution margin ratios for the two products follow: Sales CM ratio Product Flight Dynamic $ 150,000 Total Sure Shot $ 250,000 80% 36% $ 400,000 ? Fixed expenses total $183,750 per month. Required: 1. Prepare a contribution format income statement for the company as a whole. 2. What is the company's break-even point in dollar sales based on the current sales mix? 3. If sales increase by $100,000 a month, by how much would you expect the monthly net operating income to increase? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a contribution format income statement for the company as a whole. (Round your percentage answers to 2 decimal places (i.e. .1234 should be entered as 12.34).)arrow_forwardSh7arrow_forwardQ3 Menlo Company distributes a single product. The company's sales and expenses for last month follow: Total $486,000 Per Unit $30 12 194,400 Sales Variable expenses Contribution margin Fixed expenses Operating income Required: 1. What is the monthly break-even point in unit sales and in dollar sales? (Do not round intermediate calculations.) Break-even point in unit sales Break-even point in sales dollars Total contribution margin 2. Without resorting to computations, what is the total contribution margin at the break-even point? Units sold 3-a. How many units would have to be sold each month to earn a target profit of $97,200? Use the formula method. 291,600 $18 233,280 $ 58,320 units Menlo Company Contribution Income Statement. Total 3-b. Verify your answer by preparing a contribution format income statement at the target sales level. Unit sales required units units Per unit 4. Refer to part 3 and now assume that the tax rate is 30%. How many units would need to be sold each month…arrow_forward

- Chapter 6, Part 2arrow_forward3arrow_forwardQuestion 4.4 The following is Silver Corporation's contribution format income statement for last month: Sales $1,400,000 Less: variable expenses 800,000 Contribution margin 600,000 Less: fixed expenses 400,000 Operating income $200,000 The company has no beginning or ending inventories and produced and sold 20,000 units during the month. Required: What is the company's contribution margin ratio? What is the company's break-even in units? If sales increase by 100 units, by how much should operating income increase? How many units would the company have to sell to attain target operating income of $225,000? What is the company's margin of safety in dollars? What is the company's degree of operating leverage?arrow_forward

- PROBLEM 7 Tito Company sells several products. Information of average revenue and costs are as follows: Selling price per unitPhp20.00 Variable costs per unit: Direct materialsPhp4.00 Direct manufacturing labor Php1.60 Manufacturing overhead Php0.40 Selling costsPhp2.00 Annual fixed costs Php96,000 26. Calculate the contribution margin per unit. 27. Calculate the number of units Tito's must sell each year to break even. 28. Determine the breakeven point in peso. 29. Calculate the number of units Tito's must sell to yield a profit of Php144,000. PROBLEMarrow_forwardQuestion 6arrow_forwardOmega Enterprise sells two products, Model E100 and F900. Monthly sales and the contribution margin ratios for the two products, follow : Product.. Model E100 Model F900 Total Sales P700,000 P300,000 1,000,000 Contribution margin ratio The company's fixed expenses total P598, 500 per month. 60% 70% ? 3. What is the company's total contribution margin ratio? (2-43) a. 60% c. 70% b. 63% d. 65% 4. What is the company's total net operating income? (2-44) a. P630,000 b. P 31,500 5. The break-even point for the company based on the current sales mix is (2-44) a. P900,000 b. P950,000 P210,000 P420,000 C. d. P1,000,000 P1,050,000 c. d.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license