EXERCISE 5-12 Multiproduct Break-Even Analysis LO5-9

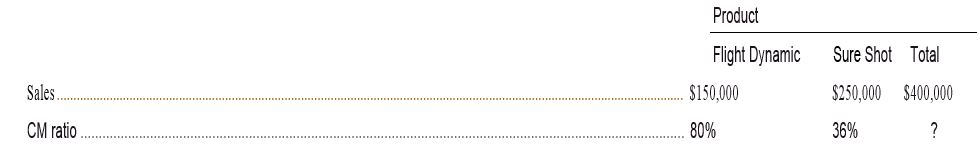

Olongapo Sports Corporation distributes two premium golf balls—Flight Dynamic and Sure Shot. Monthly sales and the contribution margin ratios for the two products follow:

Fixed expenses total $183,750 per month.

Required:

- Prepare a contribution format income statement for the company as a whole. Carry computations to one decimal place.

- What is the company's break-even point in dollar sales based on the current sales mix?

- If sales increase by $100,000 a month, by how much would you expect the monthly net operating income to increase? What are your assumptions?

Break-even analysis: It is an analysis of sales revenue or unit where a company is neither earning profits nor incurring any loss.

The preparation of contribution format income statement and break-even analysis.

Answer to Problem 12E

Solution:

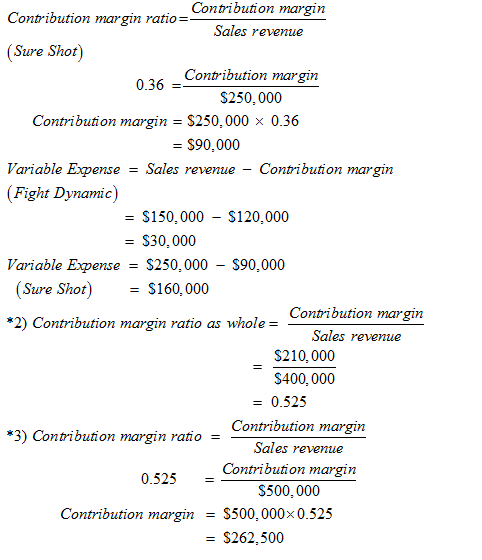

1) Contribution formal income statement for the company as a whole. Carry computations to one decimal place is shown below:-

| Product | |||

| Fight Dynamic | Sure Shot | Total | |

| Sales | $150,000 | $250,000 | $400,000 |

| CM ratio | 80% | 36% | 52.5% |

| Olongapo Sports Corporation’s Contribution format income statement | |

| Total | |

| Sales | $400,000 |

| Variable expenses | $190,000 |

| Contribution Margin | $210,000 |

| Fixed expenses | $183,750 |

| Net operating income | $26,250 |

2) The Break-even point in dollar sales based on the current sales mix is $ 350,000

3) The contribution format income statement with increase in sales by $ 100,000 is shown below:-

| Olongapo Sports Corporation’s Contribution format income statement | |

| Total | |

| Sales | $500,000 |

| Variable expenses | $237,500 |

| Contribution Margin | $262,500 |

| Fixed expenses | $183,750 |

| Net operating income | $78,750 |

It is assume that when sales increase by $100,000, the variable expense increase by 25% and the net operating income increases by 200%.

Explanation of Solution

Given:

| Product | |||

| Fight Dynamic | Sure Shot | Total | |

| Sales | $150,000 | $250,000 | $400,000 |

| CM ratio | 80% | 36% | ? |

Fixed expenses total $183,750 per month.

Hence it is concluded that the Mauro Products will neither earn profit nor incur loss at $350,000sales revenue. But if the company earns beyond this point, it will make profit and if it falls below the point, the company will suffer loss. A break-even point is technique used the companies to predict the outcome of a decision based on the analysis. It shows the exact point where a company will neither make profit nor suffer loss.

Want to see more full solutions like this?

Chapter 5 Solutions

ACC 202 Principles of Accounting 2 Ball State University

- Mackenzie is considering conducting her business, Mac561, as either a single-member LLC or an S corporation. Assume her marginal ordinary income tax rate is 37 percent, her marginal FICA rate on employee compensation is 1.45 percent, her marginal self-employment tax rate is 2.9 percent (her other self-employment income and/or salary exceeds the wage base limit for the 12.4 percent Social Security tax portion of the self-employment tax), and any employee compensation or self-employment income she receives is subject to the 0.9 percent additional Medicare tax. Also, assume Mac561 generated $200,000 of business income before considering the deduction for compensation Mac561 pays to Mackenzie and Mackenzie can claim the full qualified business income deduction on Mac561's business income allocated to her. Determine Mackenzie's after-tax cash flow from the entity's business income and any compensation she receives from the business under the following assumptions: a. Mackenzie…arrow_forwardOn December 31, 2026, the estimated remaining cost to complete was still $40,000, and $25,000 of cost had been incurred during 2026. What is the January 1. 2027, balance of Construction-in-Process? Multiple Choice $50,000 $30,000 $45,000 $40.000 Rarrow_forwardHow do you solve for the present value of face value in excel, and which cell refrences do you use?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College