MANAGERIAL ACCT.-CONNECT >CUSTOM<

17th Edition

ISBN: 9781264376223

Author: Garrison

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 10E

EXERCISE 5-10 Multiproduct Break-Even Analysis LO5-9

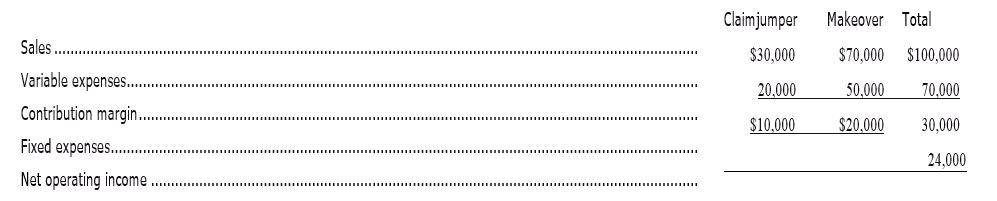

Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below:

Required:

- What is the overall contribution margin (CM) ratio for the company?

- What is the company's overall break-even point in dollar sales?

- Verify' the overall break-even point for the company by constructing a contribution format income statement showing the appropriate levels of sales for the two products.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Multiproduct Break-Even Analysis

Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below:

Required:

1. What is the overall contribution margin (CM) ratio for the company?

2. What is the company’s overall break-even point in dollar sales?

3. Verify the overall break-even point for the company by constructing a contribution format income statement showing the appropriate levels of sales for the two products.

01:09:21

ook

nt

nces

Lucido Products markets two computer games: Claimjumper and Makeover. A

contribution format income statement for a recent month for the two games appears

below:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Required 1 Required 2

Claimjumper

$ 63,900

42,600

$ 21,300

Sales

Variable expenses

Contribution margin

Required:

1. What is the overall contribution margin (CM) ratio for the company?

2. What is the company's overall break-even point in dollar sales?

3. Prepare a contribution format income statement at the company's break-even point

that shows the appropriate levels of sales for the two products.

Fixed expenses

Net operating income (loss)

Complete this question by entering your answers in the tabs below.

Required 3

Makeover

$21,300,000

106,500

42,600

$

Prepare a contribution format income statement at the company's break-even point that sh

for the two products. (Do not round intermediate calculations. Round your answers to the r…

Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent

month for the two games appears below:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

References

Required:

1. What is the overall contribution margin (CM) ratio for the company?

Ass

2. What is the company's overall break-even point in dollar sales?

3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for

the two products.

complete all parts

P

References

Sales

Claimjumper

$ 94,000

23,560

$ 70,440 $ 42,360

What is the overall contribution margin (CM) ratio for the company?

Overal CM ratio

Net operating income (loss)

Makeover

$ 47,000

4,640

Required 1 Required 2

What is the company's overall break-even point in dollar sales? (Do not round intermediate calculations.)

Overall brouk-even point

Complete this question by entering your answers in the tabs below.…

Chapter 5 Solutions

MANAGERIAL ACCT.-CONNECT >CUSTOM<

Ch. 5.A - EXERCISE 5A-1 High-Low Method LO5-10 The Cheyenne...Ch. 5.A - EXERCISE 5A-2 Least-Squares Regression LO5-11...Ch. 5.A - EXERCISE 5A-3 Cost Behavior; High-Low Method...Ch. 5.A - Prob. 4ECh. 5.A - EXERCISE 5A-5 Least-Squares Regression LO5-11...Ch. 5.A - Prob. 6PCh. 5.A - Problem 5A-7 Cost Behavior; High-Low Method;...Ch. 5.A - Problem 5A-8 High-Low Method; Predicting Cost...Ch. 5.A - Prob. 9PCh. 5.A - Prob. 10P

Ch. 5.A - Case 5A-11 Mixed Cost Analysis and the Relevant...Ch. 5.A - CASE 5A-12 Analysis of Mixed Costs in a Pricing...Ch. 5 - Prob. 1QCh. 5 - Often the most direct route to a business decision...Ch. 5 - Prob. 3QCh. 5 - What is the meaning of operating leverage?Ch. 5 - What is the meaning of break-even point?Ch. 5 - 5-6 In response to a request from your immediate...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - Prob. 1AECh. 5 - Prob. 2AECh. 5 - Prob. 3AECh. 5 - Prob. 4AECh. 5 - Prob. 5AECh. 5 - Prob. 1F15Ch. 5 - Prob. 2F15Ch. 5 - Prob. 3F15Ch. 5 - Prob. 4F15Ch. 5 - Prob. 5F15Ch. 5 - Prob. 6F15Ch. 5 - Prob. 7F15Ch. 5 - Prob. 8F15Ch. 5 - Prob. 9F15Ch. 5 - Prob. 10F15Ch. 5 - Prob. 11F15Ch. 5 - Prob. 12F15Ch. 5 - Prob. 13F15Ch. 5 - Prob. 14F15Ch. 5 - Prob. 15F15Ch. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - EXERCISE 5-10 Multiproduct Break-Even Analysis...Ch. 5 - Prob. 11ECh. 5 - EXERCISE 5-12 Multiproduct Break-Even Analysis...Ch. 5 - EXERCISE 5-13 Changes in Selling Price, Sales...Ch. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Prob. 18ECh. 5 - Prob. 19PCh. 5 - PROBLEM 5-20 CVP Applications: Break-Even...Ch. 5 - PROBLEM 5-21 Sales Mix; Multiproduct Break-Even...Ch. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 -

PROBLEM 5-26 CVP Applications; Break-Even...Ch. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 -

PROBLEM 5-31 Interpretive Questions on the CVP...Ch. 5 - Prob. 32C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need fastarrow_forwardQuestion 2 Style photo sells only one product. The statement of comprehensive income for 2021 is provided below: Sales 60,000 Less variable expenses -30,000 Contribution margini 30,000 Less fixed expenses -22,500 Net income 7,500 Required: Calculate with workings: a. The contribution margin ratio in percentage. b. Three breakeven point in total sales ringgits.arrow_forwardPlease help me with all answers thankuarrow_forward

- ok ht nt ences Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Claimjumper $ 63,900 42,600 $ 21,300 Makeover Total $ 149,100 $ 213,000 106,500 149, 100 #1 $ 42,600 63,900 51,120 $ 12,780 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's the two products. even point that shows the appropriate levels of sales forarrow_forwardQuestion 3 Study the information given below and answer: 3.2 Use the marginal income ratio to calculate the break-even value. INFORMATION Samcor Limited manufactures tables. The following information was extracted from the budget for the year ended 30 June 2022: 2. 3. 4. 5. Total production and sales Selling price per table Variable manufacturing costs per table: Direct material Direct labour Overheads Fixed manufacturing overheads Other costs: Fixed marketing and administrative costs Sales commission 2 400 units R1 200 R288 R192 R96 R216 960 R144 000 5%arrow_forwardWest Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forward

- Question 3 Study the information given below and answer: 3.1 Calculate the total Marginal Income and Net Profit/Loss if all the tables are sold. INFORMATION Samcor Limited manufactures tables. The following information was extracted from the budget for the year ended 30 June 2022: 1. Total production and sales 2. Selling price per table 3. 4. 5. Variable manufacturing costs per table: Direct material Direct labour Overheads Fixed manufacturing overheads Other costs: Fixed marketing and administrative costs Sales commission 2 400 units R1 200 R288 R192 R96 R216 960 R144 000 5%arrow_forwardQuestion 2 Two companies. The North and South sell the same type of product in the same type of market. Their budgeted profit and loss account for the year ended 31st March, 2018 were as follows: North South Sales 75,000 75,000 Variable cost 60,000 50,000 Fixed Cost 7,500 17, 500 67,500 67,500 Net Profit 7,500 7,500 You are required to: a. Calculate the break-even sales revenue of each enterprise b. State with reason which business is likely to earn greater profit in conditions of į. Heavy demand for the product and ii. Low demand for the product. c. If North Company increases its capacity by 40% and this increased fixed cost by $2,000 per annum, at what sales revenue will it make the same Net Profit as before?arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license