MANAGERIAL ACCOUNTING FOR MANGER CONNEC

6th Edition

ISBN: 9781266809132

Author: Noreen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4A, Problem 4A.2E

Super-Variable Costing and Variable Costing Unit Product Costs and Income Statements L04—2, LO4—6

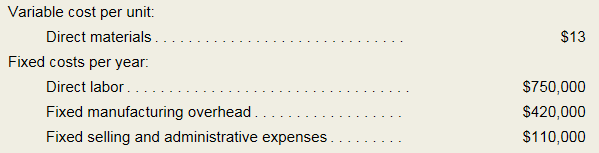

Lyons Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

t

0

ences

Mc

Graw

Hill

Required information

[The following information applies to the questions displayed below.]

Diego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West

regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and

sold 42,000 units.

Variable costs per unit:

Manufacturing:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative

Fixed costs per year:

Fixed manufacturing overhead

Fixed selling and administrative expense

Break even point

$ 25

$ 20

The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its

fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the

remaining $38,000 is a common fixed expense. The company will continue to incur the total amount of its fixed

manufacturing…

Problem 5 (Super-Variable Costing and Variable Costing Unit Product

Costs and Income Statements)

Lyns Company manufactures and sells one product. The following

information pertains to the company's first year of operations:

Variable cost per unit:

Direct materials

Fixed costs per year:

130

P7,500,000

P4,200,000

P1,100,000

Direct labor

Fixed manufacturing overhead

Fixed selling and administrative expenses

The company does not incur any variable manufacturing overhead costs or

variable selling and administrative expenses. During its first year of

operations, Lyns produced 60,000 units and sold 52,000 units. The selling

price of the company's product is P400 per unit.

Required:

1. Assume the company uses super-variable costing:

a. Compute the unit product cost for the year.

b. Prepare an income statement for the year.

2. Assume the company uses a variable costing system that assigns P125.00

of direct labor cost to each unit produced:

a. Compute the unit product cost for the year.

b.…

Problem 6-18 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements [LO6-1,

LO6-2]

Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of

operations:

Variable costs per unit:

Manufacturing:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative

Fixed costs per year:

Fixed manufacturing overhead

Fixed selling and administrative expenses

During its first year of operations, Haas produced 60,000 units and sold 60,000 units. During its second year of operations, It

produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of

the company's product is $52 per unit.

Required:

1. Compute the company's break-even point in unit sales.

2. Assume the company uses varlable costing:

a. Compute the unit product cost for Year 1, Year 2, and Year 3.

b. Prepare an income statement for Year…

Chapter 4A Solutions

MANAGERIAL ACCOUNTING FOR MANGER CONNEC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q – 5: Bettina Company incurs the following costs to produce and sell a single product. Variable costs per unit: Direct materials $15 Direct labor$7.5 Variable manufacturing overhead$3 Variable selling and administrative expenses$6 Fixed costs per year: Fixed manufacturing overhead . . . . . . . . . . . . . . . . . $45,000 Fixed selling and administrative expenses . . . . . . . $150,000 During the last year, 15,000 units were produced and 12,500 units were sold. The Finished Goods inventory account at the end of the year shows a balance of $63,750 for the 2,500 unsold units. Required: 1. Is the company using absorption costing or variable costing to cost units in the Finished Goods inventory account? Show computations to support your answer. 2. Assume that the company wishes to prepare financial statements for the year to issue to its stockholders. a. Is the $63,750 figure for Finished Goods inventory the correct amount to use on these…arrow_forwardS aw 1 Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor 2 Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense 13. If the selling price is $23.00 per unit, what is the contribution margin per unit? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Contribution margin per unit W S X H 7,616 ommand A 3 #3 E D C $ 4 R FL < Prev % 5 V Average Cost per Unit $7.00 $4.50 $ 1.40 $ 4.00 $ 4.00 $ 2.10 $ 1.10 $ 0.55 T 13 G S 14 15 6 tv Y B of 15 & 7 H U N Next A 9 +00 8 J H p 1 2023-01...0.40 PM 2023-01..2.52 PM 2022-12...6.45 A ( 9 A O ( M K He ) -C O 0 < L H P command { [ 0arrow_forwardof 15 ▪ Book Print References Mc Graw Hill Required information [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and sold 42,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense a. What is the company's break-even point in unit sales? The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $38,000 is a common fixed expense. The company will continue to…arrow_forward

- vj subject-Accounting Hanks recently produced & sold 2777 units. Fixed costs per unit at this level of activity amounted to $8; variable costs per unit were $9. How much total cost would the company anticipate if during the next period it produced & sold 6919 units? Note: assume this level is still within the relevant range Round your final answer to 2 decimal placesarrow_forwardProblem 6-18 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements [LO6-1, LO6-2] Haas Company manufactures and sells one product. The following information pertains to each of the company’s first three years of operations: Variable costs per unit: Manufacturing: Direct materials $ 24 Direct labor $ 16 Variable manufacturing overhead $ 4 Variable selling and administrative $ 1 Fixed costs per year: Fixed manufacturing overhead $ 220,000 Fixed selling and administrative expenses $ 140,000 During its first year of operations, Haas produced 40,000 units and sold 40,000 units. During its second year of operations, it produced 55,000 units and sold 30,000 units. In its third year, Haas produced 20,000 units and sold 45,000 units. The selling price of the company’s product is $54 per unit. Required: b. Prepare an income statement for Year 1, Year 2, and Year 3.arrow_forwardQuestion 4 Achimota Ltd produces a single product and has the following financial information: Selling Price Cost per unit: Direct Materials Direct Labour Variable Overheads GH¢ 50 15 14 4 Fixed manufacturing overheads are GH¢40,000 per month, production volume is 10,000 units per month and sales is 9,200 units. You are required to: a) Calculate the cost per unit under: i. Absorption costing ii. Marginal costing b) Prepare the income statement of ABC Ltd under: i. Absorption costing technique ii. Marginal costing technique c) Reconcile the profits obtained under (bi) and (bii) d) Explain the reasons for the difference in profits in (c) above.arrow_forward

- QUESTION TWO Makati Plc makes and sells a number of products. Estimated data for the forthcoming period is as follows: i) Product Data Production/Sales(units) Total direct material cost Total direct labour cost Product A 5,000 ZMW'000 80 40 Product B 10,000 ZMW'000 300 100 Other Products 40,000 ZMW'000 2,020 660 ii) Overhead costs are ZMW1, 500,000 of which 40% is related to the acquisition, storage and use of direct materials and 60% is related to the control and use of direct labour. iii) It is current practice in Makati Plc to absorb overhead costs into product units using overall companywide percentages on direct material cost and direct labour cost as the absorption bases. iv) Market prices for products A and B are ZMW 75 and ZMW 95 per unit respectively. Required: Prepare estimated unit product costs for Product A and Product B where overhead costs are charged to product units using the existing absorption basis as detailed above. Calculate the contribution for product A and B.arrow_forwardQ. No. 2: Martinez Company's relevant range of production is 15,000 units to 25,000 units. When it produces and sells 17,500 units, its average costs per unit are as follows: Average Cost per Unit ($) Selling Price Direct materials Direct labor. Variable manufacturing overhead Fixed manufacturing overhead. Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense 50 10 6. 5. 3 2 2.5 Required: a. For financial accounting purposes, what is the total amount of product costs incurred to make 17,500 units? b. If 18,500 units are produced and sold, calculate the variable cost per unit and total for units produced and sold? c. If 19,000 units are produced, what is the average fixed manufacturing cost per unit produced? d. if 19,500 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis?arrow_forwardLITE TUTTOming inuman upplies in the questions display cu cium. O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses $ 570,000 $ 110,000 During its first year of operations, O'Brien produced 100,000 units and sold 74,000 units. During its second year of operations, it produced 76,000 units and sold 97,000 units. In its third year, O'Brien produced 81,000 units and sold 76,000 units. The selling price of the company's product is $77 per unit. Case 4-29 Part-2 (Algo) 2. Assume the company uses variable costing and a LIFO inventory flow assumption (LIFO means last-in first-out. In other words, it assumes that the newest units in inventory are sold first): a. Compute the…arrow_forward

- Chapter 6: A Closer Look on Cost Accounting The company makes 2,350 units of product X a year, requiring a total os 3.300 machine hours, 250 orders and 200 inspection hours per year. The product's direct material cost is P201.50 and its direct labor cost in P211.11 per unit. The product sells for P590 per unit. According to the activity-based costing system, the gross margin for product X is? 423,087.50 b. 350,435.50 c. 416,890 d. None of the choice a. 56. The following information is available for Mary Corp. Activity Pool Setups Quality Inspections Assembly (direct labor hour) What is the activity rate for setups? Activity Base 50,000 120,000 400,000 Budgeted Amount 300,000 600,000 2,000,000 a. P5.09 c. РО.75 d. P58.00 b. Рб.00 The activity rate for quality inspection is: с. Рб.00 d. P5.09 a. P5.29 b. P5.00arrow_forwardDeng wwwgongue www. Diego Company manufactures one product that is sold for $76 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 47,000 units and sold 42,000 units. Variable costs per uniti Manufacturing Direct materials Direct labor perpet Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense a. What is the company's break-even point in unit sales? Break even point The company sold 32,000 units in the East region and 10,000 units in the West region. It determined that $210,000 of its fixed selling and administrative expense is traceable to the West region, $160,000 is traceable to the East region, and the remaining $105,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to…arrow_forwardces Ас Graw Hill ! Q A Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor N Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense 7. If 8,000 units are produced, what is the average fixed manufacturing cost per unit produced? Average fixed manufacturing cost per unit @ 2 W S #3 X 2.2 E D $ 4 8 B N J 2023-01...0.40 PM 2023-01...2.52 PM 2022-12 A 1 ( ( 9 * K M ) 0 O 3 P commarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License