MANAGERIAL ACCOUNTING F/MGRS.

5th Edition

ISBN: 9781259969485

Author: Noreen

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4A, Problem 4A.2E

Super-Variable Costing and Variable Costing Unit Product Costs and Income Statements L04—2, LO4—6

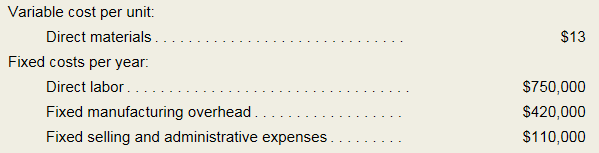

Lyons Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

t

0

ences

Mc

Graw

Hill

Required information

[The following information applies to the questions displayed below.]

Diego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West

regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and

sold 42,000 units.

Variable costs per unit:

Manufacturing:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative

Fixed costs per year:

Fixed manufacturing overhead

Fixed selling and administrative expense

Break even point

$ 25

$ 20

The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its

fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the

remaining $38,000 is a common fixed expense. The company will continue to incur the total amount of its fixed

manufacturing…

Problem 5 (Super-Variable Costing and Variable Costing Unit Product

Costs and Income Statements)

Lyns Company manufactures and sells one product. The following

information pertains to the company's first year of operations:

Variable cost per unit:

Direct materials

Fixed costs per year:

130

P7,500,000

P4,200,000

P1,100,000

Direct labor

Fixed manufacturing overhead

Fixed selling and administrative expenses

The company does not incur any variable manufacturing overhead costs or

variable selling and administrative expenses. During its first year of

operations, Lyns produced 60,000 units and sold 52,000 units. The selling

price of the company's product is P400 per unit.

Required:

1. Assume the company uses super-variable costing:

a. Compute the unit product cost for the year.

b. Prepare an income statement for the year.

2. Assume the company uses a variable costing system that assigns P125.00

of direct labor cost to each unit produced:

a. Compute the unit product cost for the year.

b.…

Q – 5:

Bettina Company incurs the following costs to produce and sell a single product.

Variable costs per unit:

Direct materials $15

Direct labor$7.5

Variable manufacturing overhead$3

Variable selling and administrative expenses$6

Fixed costs per year:

Fixed manufacturing overhead . . . . . . . . . . . . . . . . . $45,000

Fixed selling and administrative expenses . . . . . . . $150,000

During the last year, 15,000 units were produced and 12,500 units were sold. The Finished Goods inventory account at the end of the year shows a balance of $63,750 for the 2,500 unsold units.

Required:

1. Is the company using absorption costing or variable costing to cost units in the Finished Goods inventory account? Show computations to support your answer.

2. Assume that the company wishes to prepare financial statements for the year to issue to its stockholders.

a. Is the $63,750 figure for Finished Goods inventory the correct amount to use on these…

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this accounting questionarrow_forwardneed proper answerarrow_forwardQuestion: 077 O Brie Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials: $25 Direct labor: $17 Variable manufacturing overhead: $4 Variable selling and administrative: $2 Fixed costs per year: Fixed manufacturing overhead: $550,000 Fixed selling and administrative expenses: $140,000 During its first year of operations, O Brien produced 94,000 units and sold 78,000 units. During its second year of operations, it produced 80,000 units and sold 91,000 units. In its third year, O Brien produced 83,000 units and sold 78,000 units. The selling price of the company's product is $79 per unit. Assume the company uses absorption costing and a LIFO inventory flow assumption. A) Compute the unit product cost for Year 1, Year 2, and Year 3. B) Prepare an income statement for Year 1, Year 2, and Year 3.arrow_forward

- Give true answer this accounting questionarrow_forwardProblem 6-18 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements [LO6- 1, LO6-2] Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses $ 26 $ 13 $5 $ 3 $ 450,000 $ 210,000 During its first year of operations, Haas produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of the company's product is $58 per unit. Required: 1. Compute the company's break-even point in unit sales. 2. Assume the company uses variable costing: a. Compute the unit product cost for Year 1. Year 2, and Year 3. b.…arrow_forwardProblem 6-18 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements [LO6-1, LO6-2] Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses During its first year of operations, Haas produced 60,000 units and sold 60,000 units. During its second year of operations, It produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of the company's product is $52 per unit. Required: 1. Compute the company's break-even point in unit sales. 2. Assume the company uses varlable costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year…arrow_forward

- vj subject-Accounting Hanks recently produced & sold 2777 units. Fixed costs per unit at this level of activity amounted to $8; variable costs per unit were $9. How much total cost would the company anticipate if during the next period it produced & sold 6919 units? Note: assume this level is still within the relevant range Round your final answer to 2 decimal placesarrow_forwardof 15 ▪ Book Print References Mc Graw Hill Required information [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and sold 42,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense a. What is the company's break-even point in unit sales? The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $38,000 is a common fixed expense. The company will continue to…arrow_forwardHelp with 2A and 2B pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License