Concept explainers

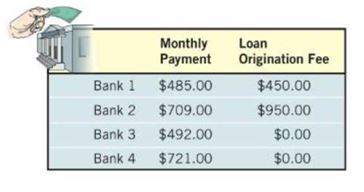

Critical Thinking You have just contracted to buy a house and will seek financing in the amount of . You go to several banks. Bank 1 will lend you at the rate of amortized over 30 years with a loan origination fee of . Bank 2 will lend you at the rate of amortized over 15 years with a loan origination fee of . Bank 3 will lend you at the rate of amortized over 30 years with no loan origination fee. Bank 4 will lend you at the rate of amortized over 15 years with no loan origination fee. Which loan would you take? Why? Be sure to have sound reasons for your choice. Use the information in the table to assist you. If the amount of the monthly payment does not matter to you, which loan would you take? Again, have sound reasons for your choice. Compare your final decision with others in the class. Discuss.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Precalculus: Concepts Through Functions, A Unit Circle Approach to Trigonometry (4th Edition)

- Find the derivative of the function. k(x) = − 6(5x +4) -arrow_forwardFind all values of x for the given function where the tangent line is horizontal. 3 =√x³-12x² + 45x+5arrow_forwardFind the equation of the tangent line to the graph of the given function at the given value of x. 6 f(x) = x(x² - 4x+5)*; x=2arrow_forward

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning