Concept explainers

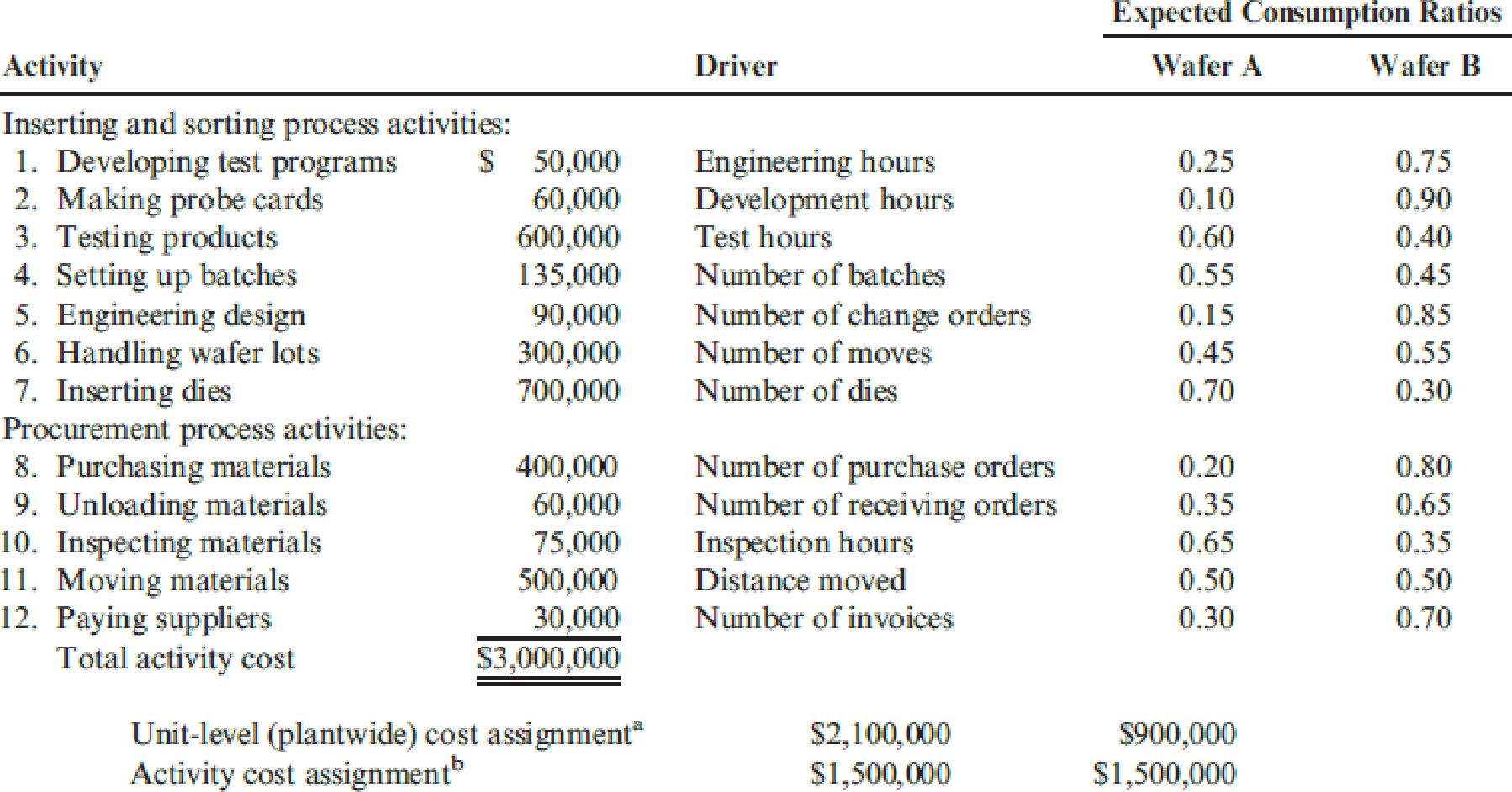

Patterson Company produces wafers for integrated circuits. Data for the most recent year are provided:

aCalculated using number of dies as the single unit-level driver.

bCalculated by multiplying the consumption ratio of each product by the cost of each activity.

Required:

- 1. Using the five most expensive activities, calculate the

overhead cost assigned to each product. Assume that the costs of the other activities are assigned in proportion to the cost of the five activities. - 2. Calculate the error relative to the fully specified ABC product cost and comment on the outcome.

- 3. What if activities 1, 2, 5, and 8 each had a cost of $650,000 and the remaining activities had a cost of $50,000? Calculate the cost assigned to Wafer A by a fully specified ABC system and then by an approximately relevant ABC approach. Comment on the implications for the approximately relevant approach.

1.

Compute the overheads assigned to each product of P Company using the five most expensive activities assuming the cost of other activities are assigned in proportion to the cost of the five activities.

Explanation of Solution

Overhead consumption ratio: An overhead consumption ratio is a measurement tool used to calculate the proportion of the overhead activity that is consumed by a particular product.

Approximately relevant activity based costing: Approximately relevant activity based costing

Compute the overhead cost to be assigned to both products of P Company using the five most expensive activities.

| Activity |

Budgeted cost ($) | Expected consumption ratio | |

| Wafer A | Wafer B | ||

| Testing products | 720,000 (1) | 60 % | 40 % |

| Handling water lots | 360,000 (2) | 45 % | 55 % |

| Inserting dies | 840,000 (3) | 70 % | 30 % |

| Purchasing materials | 480,000 (4) | 20 % | 80 % |

| Moving materials | 600,000 (5) | 50 % | 50 % |

| Total activity cost | 3,000,000 | ||

Table (1)

Working notes:

(1) Calculate the budgeted cost for the activity of testing hours of P Company.

(2) Calculate the budgeted cost for the activity of handling water lots of P Company.

(3) Calculate the budgeted cost for the activity of testing hours of P Company.

(4) Calculate the budgeted cost for the activity of purchasing materials of P Company.

(5) Calculate the budgeted cost for the activity of purchasing materials of P Company.

Compute the total approximately relevant activity based cost for all activities by using consumption ratios.

Wafer A:

| Activity |

Consumption ratio (%) |

Budgeted activity cost ($) |

Reduced ABC system ($) |

| (a) | (b) | ||

| Testing products | 60 % | 720,000 | 432,000 |

| Handling water lots | 45 % | 360,000 | 162,000 |

| Inserting dies | 70 % | 840,000 | 588,000 |

| Purchasing materials | 20 % | 480,000 | 96,000 |

| Moving materials | 50 % | 600,000 | 300,000 |

| Total activity cost | 1,578,000 | ||

Table (2)

Wafer B:

| Activity |

Consumption ratio (%) |

Budgeted activity cost ($) |

Reduced ABC system ($) |

| (a) | (b) | ||

| Testing products | 40 % | 720,000 | 288,000 |

| Handling water lots | 55 % | 360,000 | 198,000 |

| Inserting dies | 30 % | 840,000 | 252,000 |

| Purchasing materials | 80 % | 480,000 | 384,000 |

| Moving materials | 50 % | 600,000 | 300,000 |

| Total activity cost | 1,422,000 | ||

Table (3)

2.

Compute the relative error for both products with respect to fully specified activity based costing and provide information on the result.

Explanation of Solution

Calculate the relative error for both products with respect to fully specified activity based costing and provide information on the result.

Wafer A:

Wafer B:

From the above calculated result, the maximum error is 5.2 percent with respect to activity based cost assignments that indicates a positive result indicated better accuracy.

3.

Calculate the cost assigned to Wafer A by a fully specified activity based costing system and activity based costing system. Activities of developing test program, making probe cards, engineering designs, and purchasing materials costs $650,000 each and the remaining activities costs $50,000. Provide information on the implications for the relevant approach.

Explanation of Solution

Wafer A:

Compute the approximately relevant cost for the activities 1, 2, 5, and 8 of P Company.

Compute the approximately relevant cost for Wafer A.

Compute the error term of P Company with respect to the costing techniques used.

Compute the relative error between the costing techniques used by P Company.

Want to see more full solutions like this?

Chapter 4 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- Larsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Silven produces two models of cell phones with the following expected activity demands: 1. Determine the total overhead assigned to each product using the four activity drivers. 2. Determine the total overhead assigned to each model using the two most expensive activities. The costs of the two relatively inexpensive activities are allocated to the two expensive activities in proportion to their costs. 3. Using ABC as the benchmark, calculate the percentage error and comment on the accuracy of the reduced system. Explain why this approach may be desirable.arrow_forwardEvans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forward

- Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forwardRamsey Company produces speakers (Model A and Model B). Both products pass through two producing departments. Model A's production is much more labor-intensive than that of Model B. Model B is also the more popular of the two speakers. The following data has been gathered for the two products: Units produced per year Prime costs Direct labor hours Machine hours Production runs Inspection hours Maintenance hours Overhead costs: Setup costs Inspection costs Machining Maintenance Total Model A 10,000 $153,000 144,000 17,000 30 900 9,000 $216,000 220,000 172,000 300,000 $908,000 Product Data Model B 100,000 $1,530,000 310,000 204,000 60 1,300 91,000arrow_forwardWrite a linear cost function equation for each of the following conditions. Use y for estimated costsand X for activity of the cost driver. Machine operating costs include $1,000 of maintenance per month, and $15.00 of coolant usagecosts for each day the machinery is in operation.arrow_forward

- The controller of Ferrence Company estimates the amount of materials handling overhead cost that should be allocated to the company's two products using the data that are given below: The total materials handling cost for the year is expected to be $16,486.40. If the materials handling cost is allocated on the basis of material moves, how much of the total materials handling cost should be allocated to the specialty windows? (Round off your answer to the nearest whole dollar.) Question 12 options: $3,266 $9,274 $8,243 $6,595arrow_forwardUsing ABC to compute product costs per unit Spectrum Corp. makes two products: C and D. The following data have been summarized: The company plans to manufacture 250 units of each product. Calculate the product cost per unit for Products C and D using activity-based costing.arrow_forwardUse the activity rate and usage information to determine the total activity cost and activity cost per unit for each product. If required, round the per unit answers to the nearest cent. Total Activity Cost Activity Cost Per Unit 66,810 ✓ 37,403 X 220.50 X 184.25 ✓ Elliptical machines Treadmill $arrow_forward

- Driver Corp. is considering the use of activity-based costing. The following information is provided for the production of two product lines: (Click the icon to view the information.) Driver plans to produce 250 units of Product A and 200 units of Product B. Compute the ABC indirect manufacturing cost per unit for each product. (Round your answers to the nearest cent.) -C Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity. (Round your answers to the nearest cent.) Predetermined OH allocation rate = Data table Activity Setup Machine maintenance Total indirect manufacturing costs Direct labor hours Number of setups Number of machine hours Print $ Cost Allocation Base 106,000 Number of setups 60,000 Number of machine hours $ 166,000 Product A 5,000 30 960 Done Product B 7,000 170 3,040 Total 12,000 200 4,000 - Xarrow_forward3. Calculate the cycle time for each product by dividing the total hours used for each product by the units produced for each product. Now calculate the DBC cost for each product. Comment on the significance of DBC for this settingarrow_forwardFor each of the four situations, calculate the cost basis per device based on the information shown above. (Round intermediate calculations and final answers to 2 decimal places.) A. Only the differential production costs could be considered as the cost basis. B. The total cost per device for normal production of 60,000 devices could be used as the cost basis. C. The total cost per device for productions of 66,000 devices, excluding marketing costs, could be used as the cost basis. D. The total cost per device for production of 66,000 devices, including marketing costs, could be used as the cost basis.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning