Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 6PEA

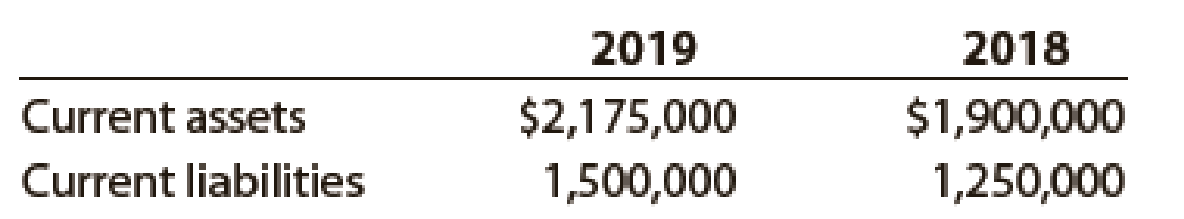

Current assets and current liabilities for HQ Properties Company follow:

a. Determine the

b.  Does the change in the current ratio from 2018 to 2019 indicate a favourable or an unfavorable change?

Does the change in the current ratio from 2018 to 2019 indicate a favourable or an unfavorable change?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For its inspecting cost pool, Brilliant Professor Mullen Company expected an overhead cost of $360,000 and an estimated 14,200 inspections. The actual overhead cost for that cost pool was $395,000 for 16,000 actual inspections. The activity-based overhead rate (ABOR) used to assign the costs of the inspecting cost pool to products is __.

Can you help me with accounting questions

Compute the depreciation charge for 2016

Chapter 4 Solutions

Financial Accounting

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - Recent fiscal years for several well-known...

Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - Marcie Davies owns and operates Gemini Advertising...Ch. 4 - Blake Knudson owns and operates Grab Bag Delivery...Ch. 4 - The following accounts appear in an adjusted trial...Ch. 4 - Prob. 3PEBCh. 4 - After the accounts have been adjusted at December...Ch. 4 - After the accounts have been adjusted at April 30,...Ch. 4 - From the following list of steps in the accounting...Ch. 4 - From the following list of steps in the accounting...Ch. 4 - Current assets and current liabilities for HQ...Ch. 4 - Current assets and current liabilities for...Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - Balances for each of the following accounts appear...Ch. 4 - Bamboo Consulting is a consulting firm owned and...Ch. 4 - Elliptical Consulting is a consulting firm owned...Ch. 4 - The following account balances were taken from the...Ch. 4 - Prob. 6ECh. 4 - FedEx Corporation had the following revenue and...Ch. 4 - Apex Systems Co. offers its services to residents...Ch. 4 - Selected accounts from the ledger of Restoration...Ch. 4 - Ex 410 Classifying assets Identify each of the...Ch. 4 - At the balance sheet date, a business owes a...Ch. 4 - Optimum Weight Loss Co. offers personal weight...Ch. 4 - List the errors you find in the following balance...Ch. 4 - Prob. 14ECh. 4 - Prior to closing, total revenues were 12,840,000...Ch. 4 - Assume that the entry closing total revenues of...Ch. 4 - Stylist Services Co. offers its services to...Ch. 4 - Which of the following accounts will usually...Ch. 4 - An accountant prepared the following post-closing...Ch. 4 - Rearrange the following steps in the accounting...Ch. 4 - The following data (in thousands) were taken from...Ch. 4 - The following data (in thousands) were taken from...Ch. 4 - Prob. 23ECh. 4 - Alert Security Services Co. offers security...Ch. 4 - Alert Security Services Co. offers security...Ch. 4 - Based on the data in Exercise 4-25, prepare an...Ch. 4 - Prob. 27ECh. 4 - Prob. 28ECh. 4 - Prob. 29ECh. 4 - On the basis of the following data, (a) journalize...Ch. 4 - On the basis of the following data, (a) journalize...Ch. 4 - Portions of the wages expense account of a...Ch. 4 - Portions of the salaries expense account of a...Ch. 4 - Beacon Signals Company maintains and repairs...Ch. 4 - Finders Investigative Services is an investigative...Ch. 4 - The unadjusted trial balance of Epicenter Laundry...Ch. 4 - The unadjusted trial balance of Lakota Freight Co....Ch. 4 - For the past several years, Jolene Upton has...Ch. 4 - Last Chance Company offers legal consulting advice...Ch. 4 - The Gorman Group is a financial planning services...Ch. 4 - The unadjusted trial balance of La Mesa Laundry at...Ch. 4 - The unadjusted trial balance of Recessive...Ch. 4 - For the past several years, Jeff Horton has...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - New Wave Images is a graphics design firm that...Ch. 4 - Prob. 3CPCh. 4 - The following is an excerpt from a telephone...Ch. 4 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For this year, Jackson Enterprises has $25,000 net earnings on the income statement and $10,000 net cash inflow from operating activities, $18,000 net cash outflow from investing activities, and $22,000 cash inflow from financing activities on the statement of cash flows. What is the accruals total reported for this period?arrow_forwardHii expert please give me correct answer general accounting questionarrow_forwardCalculate the profit marginarrow_forward

- Aide Industries is a division of a major corporation. Data concerning the most recent year appears below: Sales Net operating income $18,310,000 $920,000 Average operating assets $6,300,000 The division's margin-is closest to:arrow_forwardHow much will regal enterprises record as goodwillarrow_forwardWhat is the other comprehensive income?arrow_forward

- Cool Comfort currently sells 360 Class A spas, 520 Class C spas, and 230 deluxe model spas each year. The firm is considering adding a mid-class spa and expects that, if it does, it can sell 375 of them. However, if the new spa is added, Class A sales are expected to decline to 255 units while Class C sales are expected to decline to 240. The sales of the deluxe model will not be affected. Class A spas sell for an average of $13,500 each. Class C spas are priced at $7,200 and the deluxe model sells for $19,000 each. The new mid-range spa will sell for $11,000. What is the value of erosion? Financial Accountingarrow_forwardGoodwill if any is recorded atarrow_forwardInventory:25000, Accounts payable:16000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License