Concept explainers

Prepare journal entries to record the transactions from January to March.

Explanation of Solution

Prepare journal entries to record the transactions from January to March.

| Date | Account title and explanation | PR | Amount | |

| Debit | Credit | |||

| 2018 | ||||

| 4-Jan | Wages Expense | 623 | $125 | |

| Wages Payable | 210 | $500 | ||

| Cash | 101 | $625 | ||

| (To record the Paid employee) | ||||

| 5-Jan | Cash | 101 | $25,000 | |

| Common Stock | 307 | $25,000 | ||

| (To record the Additional investment by owner for stock.) | ||||

| 7-Jan | Merchandise Inventory | 119 | $5,800 | |

| Accounts Payable - Corporation K | 201 | $5,800 | ||

| (To record the Purchase of merchandise on credit) | ||||

| 9-Jan | Cash | 101 | $2,668 | |

| 106.6 | $2,668 | |||

| (To record the Collected accounts receivable) | $5,500 | |||

| 11-Jan | Accounts Receivable—Company AE | 106.1 | $5,500 | |

| Unearned Computer Services Revenue | 236 | $1,500 | ||

| Computer Services Revenue | 403 | $7,000 | ||

| ( To record the Completed work on project) | ||||

| 13-Jan | Accounts Receivable—Corporation L | 106.5 | $5,200 | |

| Sales | 413 | $5,200 | ||

| (To record the merchandise sold on credit.) | ||||

| 13-Jan | Cost of Goods Sold | 502 | $3,560 | |

| Merchandise Inventory | 119 | $3,560 | ||

| ( To Record the cost of January 13 sale) | ||||

| 15-Jan | Merchandise Inventory | 119 | $600 | |

| Cash | 101 | $600 | ||

| ( To record the freight paid on incoming merchandise) | ||||

| 16-Jan | Cash | 101 | $4,000 | |

| Computer Services Revenue | 403 | $4,000 | ||

| (To record the cash collected revenue from customer) | ||||

| Jan. 17 | Accounts Payable - Corporation K | 201 | $5,800 | |

| Merchandise Inventory | 119 | $58 | ||

| Cash | 101 | $5,742 | ||

| (To record the payment of account payable within discount period) | ||||

| 20-Jan | Sales Returns and Allowances | 414 | $500 | |

| Accounts Receivable—Corporation L | 106.5 | $500 | ||

| ( To record the defective goods returned from customers) | ||||

| 22-Jan | Cash | 101 | $4,653 | |

| Sales Discounts | 415 | $47 | ||

| Accounts Receivable—Corporation L | 106.5 | $4,700 | ||

| (To record the Collections from accounts receivable) | ||||

| 24-Jan | Accounts Payable | 201 | $496 | |

| Merchandise Inventory | 119 | $496 | ||

| (To record the return of merchandise for credit) | ||||

| 26-Jan | Merchandise Inventory | 119 | $9,000 | |

| Accounts Payable - Corporation K | 201 | $9,000 | ||

| ( To record the purchase of merchandise for resale) | ||||

| 26-Jan | Accounts Receivable—Incorporation KC | 106.8 | $5,800 | |

| Sales | 413 | $5,800 | ||

| (To record the merchandise sold on credit) | ||||

| 26-Jan | Cost of Goods Sold | 502 | $4,640 | |

| Merchandise Inventory | 119 | $4,640 | ||

| ( To record the cost of January 26 sales) | ||||

| 31-Jan | Wages Expense | 623 | $1,250 | |

| Cash | 101 | $1,250 | ||

| ( To record the payment of employee wages) | ||||

| 1-Feb | Prepaid Rent | 131 | $2,475 | |

| Cash | 101 | $2,475 | ||

| ( To record the payment of three months’ rent in advance) | ||||

| 3-Feb | Accounts Payable | 201 | $8,504 | |

| Merchandise Inventory | 119 | $90 | ||

| Cash | 101 | $8,414 | ||

| (To record the payment of account payable within discount period) | ||||

| 5-Feb | Advertising Expense | 655 | $600 | |

| Cash | 101 | $600 | ||

| ( To record the payment for advertising expense) | ||||

| 11-Feb | Cash | 101 | $5,500 | |

| Accounts Receivable—Alex’s Eng. Co. | 106.1 | $5,500 | ||

| ( To record the collection of cash from customers) | ||||

| 15-Feb | Dividends | 319 | $4,800 | |

| Cash | 101 | $4,800 | ||

| (To record the payment of dividends) | ||||

| 23-Feb | Accounts Receivable—Corporation D | 106.7 | $3,220 | |

| Sales | 413 | $3,220 | ||

| ( To record the sale of merchandise on credit) | ||||

| 23-Feb | Cost of Goods Sold | 502 | $2,660 | |

| Merchandise Inventory | 119 | $2,660 | ||

| ( To record the cost of February 23 sales) | ||||

| 26-Feb | Wages Expense | 623 | $1,000 | |

| Cash | 101 | $1,000 | ||

| ( To record the payment of wages to employee) | ||||

| 27-Feb | Mileage Expense | 676 | $192 | |

| Cash | 101 | $192 | ||

| (To record the Reimbursement of business mileage) | ||||

| 8-Mar | Computer Supplies | 126 | $2,730 | |

| Accounts Payable-Company H | 201 | $2,730 | ||

| ( To record the purchase of supplies on credit) | ||||

| 9-Mar | Cash | 101 | $3,220 | |

| Accounts Receivable—Corporation D | 106.7 | $3,220 | ||

| ( To record the collection of accounts receivable) | ||||

| 11-Mar | Repairs Expense–Computer | 684 | $960 | |

| Cash | 101 | $960 | ||

| (To record the payment for computer repairs) | ||||

| 16-Mar | Cash | 101 | $5,260 | |

| Computer Services Revenue | 403 | $5,260 | ||

| ( To record the collection cash revenue from customer) | ||||

| 19-Mar | Accounts Payable | 201 | $3,830 | |

| Cash | 101 | $3,830 | ||

| ( To record the payment of accounts payable ($1,100 + $2,730)) | ||||

| 24-Mar | Accounts Receivable—Company EL | 106.3 | $9,047 | |

| Computer Services Revenue | 403 | $9,047 | ||

| (To record the billed customer for services) | ||||

| 25-Mar | Accounts Receivable—Company WS | 106.2 | $2,800 | |

| Sales | 413 | $2,800 | ||

| ( To record the sale of merchandise on credit) | ||||

| 25-Mar | Cost of Goods Sold | 502 | $2,002 | |

| Merchandise Inventory | 119 | $2,002 | ||

| ( To record the cost of sales of March 25 ) | ||||

| 30-Mar | Accounts Receivable—Company IFM | 106.4 | $2,220 | |

| Sales | 413 | $2,220 | ||

| ( To record the sale of merchandise on credit) | ||||

| 30-Mar | Cost of Goods Sold | 502 | $1,048 | |

| Merchandise Inventory | 119 | $1,048 | ||

| ( To record the cost of sales of March 30 ) | ||||

| 31-Mar | Mileage Expense | 676 | $128 | |

| Cash | 101 | $128 | ||

| (To record the Reimbursement of business mileage) | ||||

Table (1)

2.

2.

Explanation of Solution

Account: A record, that documents or records the change in assets, liabilities, or equity for a particular period, is referred to as an account.

| Cash No. 101 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | $48,372 | ||||

| 4-Jan | $625 | $47,747 | |||

| 5-Jan | $25,000 | $72,747 | |||

| 9-Jan | $2,668 | $75,415 | |||

| 15-Jan | $600 | $74,815 | |||

| 16-Jan | $4,000 | $78,815 | |||

| 17-Jan | $5,742 | $73,073 | |||

| 22-Jan | $4,653 | $77,726 | |||

| 31-Jan | $1,250 | $76,476 | |||

| 1-Feb | $2,475 | $74,001 | |||

| 3-Feb | $8,414 | $65,587 | |||

| 5-Feb | $600 | $64,987 | |||

| 11-Jan | $5,500 | $70,487 | |||

| 15-Feb | $4,800 | $65,687 | |||

| 26-Feb | $1,000 | $64,687 | |||

| 27-Feb | $192 | $64,495 | |||

| 9-Mar | $3,220 | $67,715 | |||

| 11-Mar | $960 | $66,755 | |||

| 16-Mar | $5,260 | $72,015 | |||

| 19-Mar | $3,830 | $68,185 | |||

| 31-Mar | $128 | $68,057 | |||

| Accounts Receivable—Company AE No. 106.1 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $0 | |||

| 11-Jan | $5,500 | $5,500 | |||

| 11-Feb | $5,500 | $0 | |||

| Accounts Receivable—Company WS No. 106.2 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $0 | |||

| 25-Mar | $2,800 | $2,800 | |||

| Accounts Receivable—Company EL No. 106.3 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $0 | |||

| 24-Mar | $9,047 | $9,047 | |||

| Accounts Receivable—Company IFM No. 106.4 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $3,000 | |||

| 30-Mar | $2,220 | $5,220 | |||

| Accounts Receivable—Corporation L No. 106.5 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $0 | |||

| 13-Jan | $5,200 | $5,200 | |||

| 20-Jan | $500 | $4,700 | |||

| 22-Jan | $4,700 | $0 | |||

| Accounts Receivable—Company G 106.6 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $2,668 | |||

| 9-Jan | $2,668 | $0 | |||

| Accounts Receivable—Company D No. 106.7 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $0 | |||

| 23-Feb | $3,220 | $3,220 | |||

| 9-Mar | $3,220 | $0 | |||

| Accounts Receivable—Incorporation KC No. 106.8 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $0 | |||

| 26-Jan | $5,800 | $0 | $5,800 | ||

| Accounts Receivable—Incorporation D No. 106.8 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $0 | |||

| Merchandise inventory—Incorporation D No. 119 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $0 | |||

| 7-Jan | $5,800 | $5,800 | |||

| 13-Jan | $3,560 | $2,240 | |||

| 15-Jan | $600 | $2,840 | |||

| 17-Jan | $58 | $2,782 | |||

| 24-Jan | $496 | $2,286 | |||

| 26-Jan | $9,000 | $11,286 | |||

| 26-Jan | $4,640 | $6,646 | |||

| 3-Feb | $90 | $6,556 | |||

| 23-Feb | $2,660 | $3,896 | |||

| 25-Mar | $2,002 | $1,894 | |||

| 30-Mar | $1,048 | $846 | |||

| Compute supplies No. 126 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $580 | |||

| 8-Mar | Balance | $2,730 | $3,310 | ||

| Prepaid Insurance No. 128 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $1,665 | |||

| Prepaid Rent No. 131 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $825 | |||

| 1-Feb | $2,475 | $3,300 | |||

| Office equipment No. 163 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $8,000 | |||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $400 | |||

| Computer equipment No. 167 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $20,000 | |||

| Accumulated depreciation- Computer equipment No. 168 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $1,250 | |||

| Accounts payable No. 201 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $1,100 | |||

| 7-Jan | Balance | $5,800 | $6,900 | ||

| 17-Jan | Balance | $5,800 | $1,100 | ||

| 24-Jan | Balance | $496 | $604 | ||

| 26-Jan | Balance | $9,000 | $9,604 | ||

| 3-Feb | Balance | $8,504 | $1,100 | ||

| 8-Mar | Balance | $2,730 | $3,830 | ||

| 9-Mar | Balance | $3,830 | $0 | ||

| Wages payable No. 210 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $500 | |||

| 4-Jan | $500 | $0 | |||

| Unearned computer services revenue No. 236 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $1,500 | |||

| 11-Jan | $1,500 | $0 | |||

| Common stock No. 307 | |||||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $73,000 | |||

| 5-Jan | $25,000 | $98,000 | |||

| Date | PR | Debit | Credit | Balance | |

| 31-Dec | Balance | $7,360 | |||

| Dividends No. 319 | |||||

| Date | PR | Debit | Credit | Balance | |

| 15-Feb | $4,800 | $4,800 | |||

| Computer services revenue No. 403 | |||||

| Date | PR | Debit | Credit | Balance | |

| 11-Jan | $7,000 | $7,000 | |||

| 16-Jan | $4,000 | $11,000 | |||

| 16-Mar | $5,260 | $16,260 | |||

| 24-Mar | $9,047 | $25,307 | |||

| Sales No. 413 | |||||

| Date | PR | Debit | Credit | Balance | |

| 13-Jan | $5,200 | $5,200 | |||

| 26-Jan | $5,800 | $11,000 | |||

| 23-Feb | $3,220 | $14,220 | |||

| 25-Mar | $2,800 | $17,020 | |||

| 30-Mar | $2,220 | $19,240 | |||

| Sales returns and allowances No. 414 | |||||

| Date | PR | Debit | Credit | Balance | |

| 20-Jan | $500 | $500 | |||

| Sales discounts No. 415 | |||||

| Date | PR | Debit | Credit | Balance | |

| 20-Jan | $47 | $0 | $47 | ||

| Cost of goods sold No. 502 | |||||

| Date | PR | Debit | Credit | Balance | |

| 13-Jan | $3,560 | $3,560 | |||

| 26-Jan | $4,640 | $8,200 | |||

| 23-Feb | $2,660 | $10,860 | |||

| 25-Mar | $2,002 | $12,862 | |||

| 30-Mar | $1,048 | $13,910 | |||

| Depreciation expense - Office equipment No. 612 | |||||

| Date | PR | Debit | Credit | Balance | |

| Depreciation expense - Computer equipment No. 613 | |||||

| Date | PR | Debit | Credit | Balance | |

| Wages expense No. 623 | |||||

| Date | PR | Debit | Credit | Balance | |

| 4-Jan | $125 | $125 | |||

| 31-Jan | $1,250 | $1,375 | |||

| 26-Feb | $1,000 | $2,375 | |||

| Insurance expense No. 637 | |||||

| Date | PR | Debit | Credit | Balance | |

| Rent expense No. 640 | |||||

| Date | PR | Debit | Credit | Balance | |

| Computer supplies expense No. 652 | |||||

| Date | PR | Debit | Credit | Balance | |

| Advertising expense No. 655 | |||||

| Date | PR | Debit | Credit | Balance | |

| 5-Feb | $600 | $600 | |||

| Mileage expense No. 676 | |||||

| Date | PR | Debit | Credit | Balance | |

| 27-Feb | $192 | $192 | |||

| 31-Mar | $128 | $320 | |||

| Miscellaneous Expenses No. 677 | |||||

| Date | PR | Debit | Credit | Balance | |

| Repairs Expense—Computer No. 684 | |||||

| Date | PR | Debit | Credit | Balance | |

| 11-Mar | $960 | $960 | |||

3.

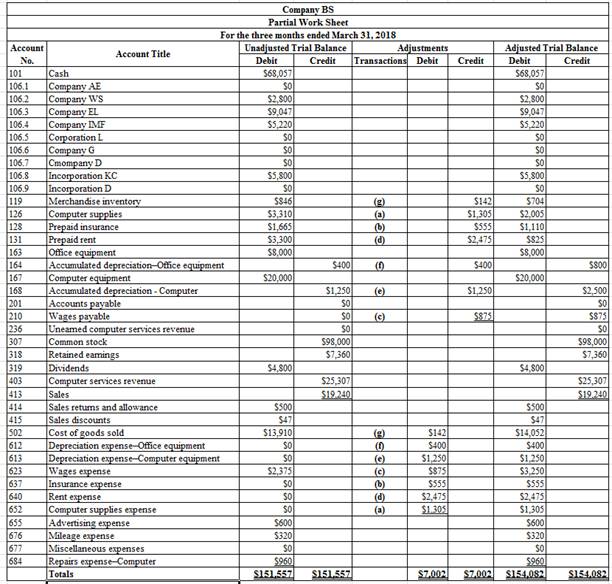

Prepare a partial worksheet of Company BS for the three months ended March 31, 2018.

3.

Explanation of Solution

Worksheet: A worksheet is the summarized form of accounting information which is made in order to ensure that the accounts are made properly.

Prepare a partial worksheet of Company BS for the three months ended March 31, 2018.

Table (2)

4.

Prepare a single step income statement of Company BS for the three months ended March 31, 2018.

4.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Single-step income statement: This statement displays the total revenues as one line item from which the total expenses including cost of goods sold is subtracted to arrive at the net profit /net loss for the period.

Prepare a statement of income of Company BS for the three months ended March 31, 2018.

| Company BS | ||

| Statement of Income | ||

| For the three months ended March 31, 2018 | ||

| Particulars | Amount | Amount |

| Revenues | ||

| Computer services revenue | $25,307 | |

| Net sales () | $18,693 | |

| Total revenues | $44,000 | |

| Expenses | ||

| Cost of goods sold | $14,052 | |

| $400 | ||

| Depreciation expense—Computer equipment | $1,250 | |

| Wages expense | $3,250 | |

| Insurance expense | $555 | |

| Rent expense | $2,475 | |

| Computer supplies expense | $1,305 | |

| Advertising expense | $600 | |

| Mileage expense | $320 | |

| Repairs expense—Computer | $960 | |

| Total expenses | ($25,167) | |

| Net income | $18,833 | |

Table (3)

The net income of Company BS for the three months ended March 31, 2018 is $18,833.

5.

Prepare a statement of retained earnings of Company BS for the three months ended March 31, 2018.

5.

Explanation of Solution

Statement of retained earnings: This is an equity statement which shows the changes in the

Prepare a statement of retained earnings of Company BS for the three months ended March 31, 2018.

| Company BS | ||

| Statement of Retained earnings | ||

| For the three months ended March 31, 2018 | ||

| Particulars | Amount | Amount |

| Retained earnings as on December 31, 2017 | $7,360 | |

| Add: Net income | $26,193 | |

| $33,553 | ||

| Less: Dividends | ($4,800) | |

| Retained earnings as on March 31, 2018 | $21,393 | |

Table (4)

The retained earnings of Company BS for the three months ended March 31, 2018 is $21,393.

6.

Prepare a classified

6.

Explanation of Solution

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare a classified balance sheet as of March 31, 2018.

| Company BS | ||

| Balance sheet | ||

| As of March 31, 2018 | ||

| Assets | Amount | Amount |

| Current assets | ||

| Cash | $68,057 | |

| Accounts receivable () | $22,867 | |

| Merchandise inventory | $704 | |

| Computer supplies | $2,005 | |

| Prepaid insurance | $1,110 | |

| Prepaid rent | $825 | |

| Total current assets | $95,568 | |

| Plant assets | ||

| Office equipment | $8,000 | |

| Accumulated depreciation—Office equipment | ($800) | $7,200 |

| Computer equipment | $20,000 | |

| Accumulated depreciation—Computer equipment | ($2,500) | $17,500 |

| Total plant assets | $24,700 | |

| Total assets | $120,268 | |

| Liabilities and Stockholder's Equity | ||

| Liabilities | ||

| Current liabilities | ||

| Wages payable | $875 | |

| Stockholders’ Equity | ||

| Common stock | $98,000 | |

| Retained earnings | $21,393 | |

| Total equity | $119,393 | |

| Total liabilities and equity | $120,268 | |

Table (5)

Want to see more full solutions like this?

Chapter 4 Solutions

Financial Accounting Fundamentals

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education