Requirement 1:

Prepare the following:

- Income statement for the year ended December 31, 2015.

- Statement of owner’s equity for the year ended December 31, 2015.

Balance sheet at December 31, 2015.

Requirement 1:

Explanation of Solution

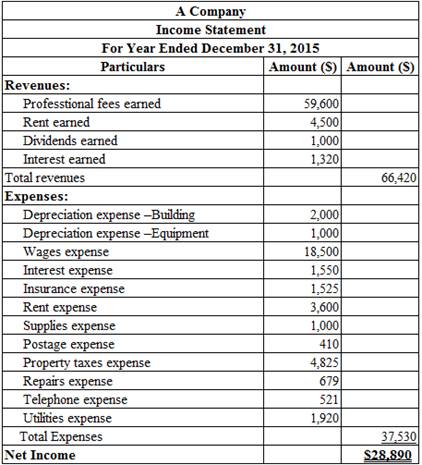

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the year ended December 31, 2015:

Table (1)

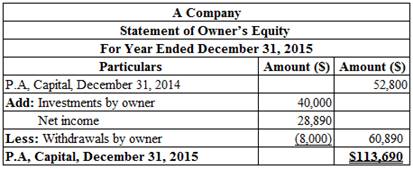

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and a drawing is deducted from beginning owner’s equity to arrive at the result, ending owner’s equity.

Prepare the statement of owners’ equity for the year ended December 31, 2015:

Table (2)

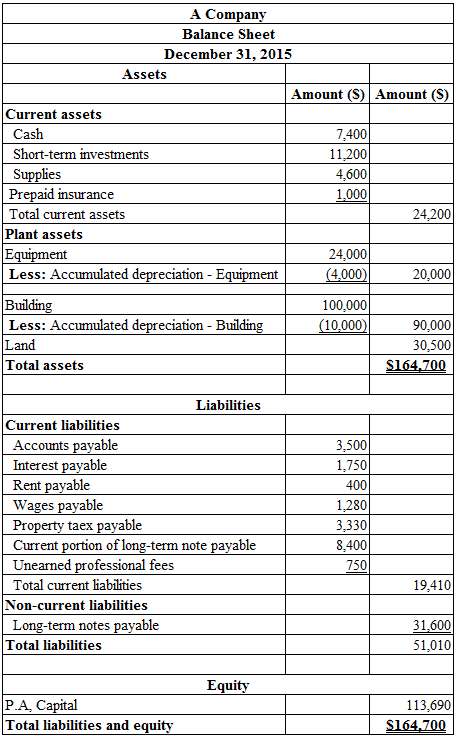

Classified balance sheet: The main elements of balance sheet assets, liabilities, and

Prepare the classified balance sheet at December 31, 2015:

Table (3)

Requirement 2:

Prepare the closing entries at December 31, 2015.

Requirement 2:

Explanation of Solution

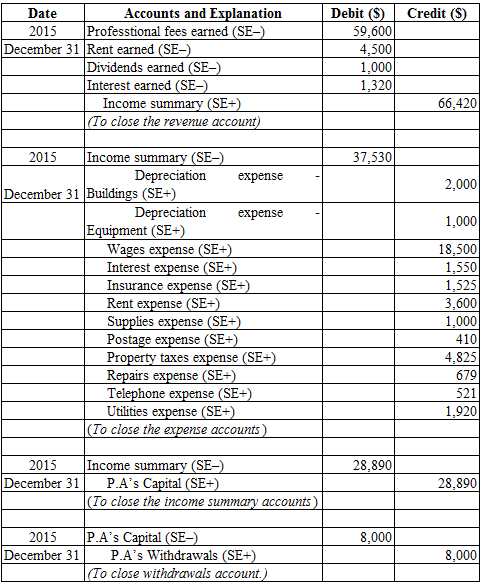

Closing

Prepare the closing entries at December 31, 2015:

Table (4)

Working Note:

Calculate the amount of P. A’s capital (transferred):

Revenue account:

In this closing entry, the Commissions earned account is closed by transferring the amount of Commissions earned account to Income summary account in order to bring the revenue account balance to zero. Hence, debit Commissions earned account and credit Income summary account.

Expense account:

In this closing entry, all expense accounts are closed by transferring the amount of total expense to the Income summary account in order to bring the expense account balance to zero. Hence, debit the Income summary account and credit all expenses account.

Income summary account:

Income summary account is a temporary account. This account is debited to close the net income value to P.A’s capital account.

P.A’s capital is a component of stockholders’ equity account. The value of P.A’s capital increased because net income is transferred. Therefore, it is credited.

Withdrawals account:

P.A’s capital is a component of owner’s equity. Thus, owners ‘equity is debited since the capital is decreased on owners’ drawings.

P.A’s withdrawals are a component of owner’s equity. It is credited because the balance of owners’ withdrawals account is transferred to owners ‘capital account.

Requirement 3:

Compute the following ratios:

- (a) Return on assets.

- (b) Debt ratio.

- (c) Profit margin ratio.

- (d)

Current ratio .

Requirement 3:

Explanation of Solution

Return on Assets (ROA): This financial ratio evaluates a company’s efficiency in operating the assets to generate net income. So, ROA is a tool used to measure the performance of a company.

The following formula is used to calculate return on assets:

(a)

Compute the return on assets ratio:

Debt Ratio:

Debt ratio is the ratio that measures the relationship between total assets and total liabilities of the company. Debt ratio reflects the finance strategy of the company. It is used to evaluate company’s ability to pay its debts. Higher debt ratio implies the higher financial risk.

The following formula is used to calculate debt ratio:

(b)

Compute the debt ratio:

Profit margin ratio:

Profit margin ratio is used to determine the percentage of net income that is being generated per dollar of revenue or sales.

The following formula is used to calculate profit margin ratio:

(c)

Compute the profit margin ratio:

Current ratio: The financial ratio which evaluates the ability of a company to pay off the debt obligations which mature within one year or within completion of operating cycle is referred to as current ratio. This ratio assesses the liquidity of a company.

The following formula is used to calculate current ratio:

(d)

Compute the current ratio:

Want to see more full solutions like this?

Chapter 4 Solutions

Principles of Financial Accounting.

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education