Concept explainers

Complete accounting cycle

For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2018, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond entered into the following transactions during July:

| July 1. | The following assets were received from Steffy Lopez in exchange for common stock: cash, $13,500; |

| 1. | Paid two months’ rent on a lease rental contract, $4,800. |

| 2. | Paid the premiums on property and casualty insurance policies, $4,500. |

| 4. | Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,500. |

| 5. | Purchased additional office equipment on account from Office Station Co., $6,500. |

| 6. | Received cash from clients on account, $15,300. |

| 10. | Paid cash for a newspaper advertisement, $400. |

| 12. | Paid Office Station Co. for part of the debt incurred on July 5, $5,200. |

| 12. | Recorded services provided on account for the period July 1-12, $13,300. |

| 14. | Paid receptionist for two weeks’ salary, $1,750. |

| Record the following transactions on Page 2 of the journal: | |

| 17. | Recorded cash from cash clients for fees earned during the period July 1–17, $9,450. |

| 18. | Paid cash for supplies, $600. |

| 20. | Recorded services provided on account for the period July 13–20, $6,650. |

| 24. | Recorded cash from cash clients for fees earned for the period July 17–24, $4,000. |

| 26. | Received cash from clients on account, $12,000. |

| 27. | Paid receptionist for two weeks’ salary, $1,750. |

| 29. | Paid telephone bill for July, $325. |

| 31. | Paid electricity bill for July, $675. |

| 31. | Recorded cash from cash clients for fees earned for the period July 25–31, $5,200. |

| 31. | Recorded services provided on account for the remainder of July, $3,000. |

| 31. | Paid dividends, $12,500. |

Instructions

1. journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in t he journal at this time.)

11 Cash

12 Accounts Receivable

14 Supplies

15 Prepaid Rent

16 Prepaid Insurance

18 Office Equipment

19

21 Accounts Payable

22 Salaries Payable

23 Unearned Fees

31 Common Stock

32

33 Dividends

41 Fees Earned

51 Salary Expense

52 Rent Expense

53 Supplies Expense

54 Depreciation Expense

55 Insurance Expense

59 Miscellaneous Expense

2. Post the journal to a ledger of four-column accounts.

3. Prepare an unadjusted

4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6).

(A) Insurance expired during July is $375.

(B) Supplies on hand on July 31 are $1,525.

(C) Depreciation of office equipment for July is $750.

(D) Accrued receptionist salary on July 31 is $175.

(E) Rent expired during July is $2,400.

(F) Unearned fees on July 31 are $2,750.

5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet.

6. Journalize and post the

7. Prepare an adjusted trial balance.

8. Prepare an income statement, a retained earnings statement, and a

9. Prepare and

10. Prepare a post-closing trial balance.

1.

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries:

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of retained earnings: This statement reports the beginning retained earnings and all the changes which led to ending retained earnings. Net income from income statement is added to and dividends are deducted from beginning retained earnings to arrive at the end result, ending retained earnings.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To journalize: The transactions of July in a two column journal beginning on page 1.

Explanation of Solution

Journalize the transactions of July in a two column journal beginning on page 1.

| Journal Page 1 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2018 | Cash | 11 | 13,500 | ||

| July | 1 | Accounts receivable | 12 | 20,800 | |

| Supplies | 14 | 3,200 | |||

| Office equipment | 18 | 7,500 | |||

| Common stock | 31 | 45,000 | |||

| (To record the receipt of assets) | |||||

| 1 | Prepaid Rent | 15 | 4,800 | ||

| Cash | 11 | 4,800 | |||

| (To record the payment of rent) | |||||

| 2 | Prepaid insurance | 16 | 4,500 | ||

| Cash | 11 | 4,500 | |||

| (To record the payment of insurance premium) | |||||

| 4 | Cash | 11 | 5,500 | ||

| Unearned rent | 23 | 5,500 | |||

| (To record the cash received for the service yet to be provide) | |||||

| 5 | Office equipment | 18 | 6,500 | ||

| Accounts payable | 21 | 6,500 | |||

| (To record the purchase of supplies of account) | |||||

| 6 | Cash | 11 | 15,300 | ||

| Accounts receivable | 12 | 15,300 | |||

| (To record the cash received from clients) | |||||

| 10 | Miscellaneous expense | 59 | 400 | ||

| Cash | 11 | 400 | |||

| (To record the payment made for Miscellaneous expense) | |||||

| 12 | Accounts payable | 21 | 5,200 | ||

| Office supplies | 11 | 5,200 | |||

| (To record the payment made to creditors on account) | |||||

| 12 | Accounts receivable | 12 | 13,300 | ||

| Fees earned | 41 | 13,300 | |||

| (To record the revenue earned and billed) | |||||

| 14 | Salary Expense | 51 | 1,750 | ||

| Cash | 11 | 1,750 | |||

| (To record the payment made for salary) | |||||

Table (1)

| Journal Page 2 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2018 | Cash | 11 | 9,450 | ||

| July | 17 | Fees earned | 41 | 9,450 | |

| (To record the receipt of cash) | |||||

| 18 | Supplies | 14 | 600 | ||

| Cash | 11 | 600 | |||

| (To record the payment made for automobile expense) | |||||

| 20 | Accounts receivable | 12 | 6,650 | ||

| Fees earned | 41 | 6,650 | |||

| (To record the payment of advertising expense) | |||||

| 24 | Cash | 11 | 4,000 | ||

| Fees earned | 41 | 4,000 | |||

| (To record the cash received from client for fees earned) | |||||

| 26 | Cash | 11 | 12,000 | ||

| Accounts receivable | 12 | 12,000 | |||

| (To record the cash received from clients) | |||||

| 27 | Salary expense | 51 | 1,750 | ||

| Cash | 11 | 1,750 | |||

| (To record the payment of salary) | |||||

| 29 | Miscellaneous Expense | 59 | 325 | ||

| Cash | 11 | 325 | |||

| (To record the payment of telephone charges) | |||||

| 31 | Miscellaneous Expense | 59 | 675 | ||

| Cash | 11 | 675 | |||

| (To record the payment of electricity charges) | |||||

| 31 | Cash | 11 | 5,200 | ||

| Fees earned | 41 | 5,200 | |||

| (To record the cash received from client for fees earned) | |||||

| 31 | Accounts receivable | 12 | 3,000 | ||

| Fees earned | 41 | 3,000 | |||

| (To record the revenue earned and billed) | |||||

| 31 | Dividends | 33 | 12,500 | ||

| Cash | 11 | 12,500 | |||

| (To record the dividends made for personal use) | |||||

Table (2)

2.

To record: The balance of each accounts in the appropriate balance column of a four-column account and post them to the ledger.

Explanation of Solution

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | 1 | 13,500 | 13,500 | |||

| 1 | 1 | 4,800 | 8,700 | ||||

| 2 | 1 | 4,500 | 4,200 | ||||

| 4 | 1 | 5,500 | 9,700 | ||||

| 6 | 1 | 15,300 | 25,000 | ||||

| 10 | 1 | 400 | 24,600 | ||||

| 12 | 1 | 5,200 | 19,400 | ||||

| 14 | 1 | 1,750 | 17,650 | ||||

| 17 | 2 | 9,450 | 27,100 | ||||

| 18 | 2 | 600 | 26,500 | ||||

| 24 | 2 | 4,000 | 30,500 | ||||

| 26 | 2 | 12,000 | 42,500 | ||||

| 27 | 2 | 1,750 | 40,750 | ||||

| 29 | 2 | 325 | 40,425 | ||||

| 31 | 2 | 675 | 39,750 | ||||

| 31 | 2 | 5,200 | 44,950 | ||||

| 31 | 2 | 12,500 | 32,450 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | 1 | 20,800 | 20,800 | |||

| 6 | 1 | 15,300 | 5,500 | ||||

| 12 | 1 | 13,300 | 18,800 | ||||

| 20 | 2 | 6,650 | 25,450 | ||||

| 26 | 2 | 12,000 | 13,450 | ||||

| 31 | 2 | 3,000 | 16,450 | ||||

Table (4)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | 1 | 3,200 | 3,200 | |||

| 18 | 2 | 600 | 3,800 | ||||

| 31 | Adjusting | 3 | 2,275 | 1,525 | |||

Table (5)

| Account: Prepaid Rent Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | 1 | 4,800 | 4,800 | |||

| 31 | Adjusting | 3 | 2,400 | 2,400 | |||

Table (6)

| Account: Prepaid Insurance Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 2 | 1 | 4,500 | 4,500 | |||

| 31 | Adjusting | 3 | 375 | 4,125 | |||

Table (7)

| Account: Office equipment Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | 1 | 7,500 | 7,500 | |||

| 5 | 1 | 6,500 | 14,000 | ||||

Table (8)

| Account: Accumulated Depreciation-Office equipment Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Adjusting | 3 | 750 | 750 | ||

Table (9)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 5 | 1 | 6,500 | 6,500 | |||

| 12 | 1 | 5,200 | 1,300 | ||||

Table (10)

| Account: Salaries Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Adjusting | 3 | 175 | 175 | ||

Table (11)

| Account: Unearned Fees Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 4 | 1 | 5,500 | 5,500 | |||

| 31 | Adjusting | 3 | 2,750 | 2,750 | |||

Table (12)

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | 1 | 45,000 | 45,000 | |||

Table (13)

| Account: Retained earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | 0 | |||||

| 31 | Closing | 4 | 33,475 | 33,475 | |||

| 31 | Closing | 4 | 12,500 | 20,975 | |||

Table (14)

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | 2 | 12,500 | 12,500 | |||

| 31 | Closing | 4 | 12,500 | ||||

Table (15)

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Closing | 4 | 44,350 | 44,350 | ||

| 31 | Closing | 4 | 10,875 | 33,475 | |||

| 31 | Closing | 4 | 33,475 | ||||

Table (16)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 12 | 1 | 13,300 | 13,300 | |||

| 17 | 2 | 9,450 | 22,750 | ||||

| 20 | 2 | 6,650 | 29,400 | ||||

| 24 | 2 | 4,000 | 33,400 | ||||

| 31 | 2 | 5,200 | 38,600 | ||||

| 31 | 2 | 3,000 | 41,600 | ||||

| 31 | Adjusting | 3 | 2,750 | 44,350 | |||

| 31 | Closing | 4 | 59,700 | ||||

Table (17)

| Account: Salary expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 14 | 1 | 1,750 | 1,750 | |||

| 27 | 2 | 1,750 | 3,500 | ||||

| 31 | Adjusting | 3 | 175 | 3,675 | |||

| 31 | Closing | 4 | 3,675 | ||||

Table (18)

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Adjusting | 3 | 2,400 | 2,400 | ||

| 31 | Closing | 4 | 2,400 | ||||

Table (19)

| Account: Supplies expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Adjusting | 3 | 2,275 | 2,275 | ||

| 31 | Closing | 4 | 2,275 | ||||

Table (20)

| Account: Depreciation expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Adjusting | 3 | 750 | 750 | ||

| 31 | Closing | 4 | 750 | ||||

Table (21)

| Account: Insurance expense Account no. 54 | ||||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 2018 | ||||||||

| July | 31 | Adjusting | 3 | 375 | 375 | |||

| 31 | Closing | 4 | 375 | |||||

Table (22)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 10 | 1 | 400 | 400 | |||

| 29 | 2 | 325 | 725 | ||||

| 31 | 2 | 675 | 1,400 | ||||

| 31 | Closing | 4 | 1,400 | ||||

Table (23)

(3)

To prepare: The unadjusted trial balance of Consulting D at July, 31.

Explanation of Solution

Prepare an unadjusted trial balance of Consulting D for the month ended July, 31 as follows:

|

D Consulting Unadjusted Trial Balance July 31, 2018 |

|||

| Particulars |

Account No. |

Debit $ | Credit $ |

| Cash | 11 | 32,450 | |

| Accounts receivable | 12 | 16,450 | |

| Supplies | 14 | 3,800 | |

| Prepaid insurance | 16 | 4,500 | |

| Prepaid rent | 15 | 4,800 | |

| Office Equipment | 18 | 14,000 | |

| Accounts payable | 21 | 1,300 | |

| Unearned fees | 23 | 5,500 | |

| Common stock | 31 | 45,000 | |

| Dividends | 33 | 12,500 | |

| Fees earned | 41 | 41,600 | |

| Salary expense | 51 | 3,500 | |

| Miscellaneous expense | 59 | 1,500 | |

| Total | 93,400 | 93,400 | |

Table (24)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $93,400.

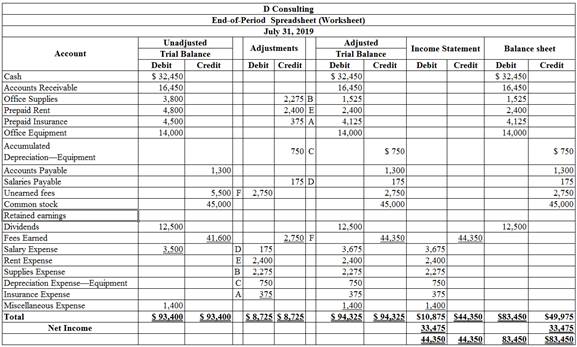

(5)

To enter: The unadjusted trial balance on an end-of-period spreadsheet

Explanation of Solution

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (25)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

(6)

To Journalize: Theadjusting entries of Consulting D for July 31.

Explanation of Solution

The adjusting entries of Consulting D for July 31, 2018 are as follows:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

|

| 2018 | Insurance expense | 55 | 375 | ||

| July | 31 | Prepaid insurance | 16 | 375 | |

| (To record the insurance expense for July) | |||||

| 31 | Supplies expense (1) | 53 | 2,275 | ||

| Supplies | 14 | 2,275 | |||

| (To record the supplies expense) | |||||

| 31 | Depreciation expense | 54 | 750 | ||

| Accumulated Depreciation | 19 | 750 | |||

| (To record the depreciation and the accumulated depreciation) | |||||

| 31 | Salaries expense | 51 | 175 | ||

| Salaries payable | 22 | 175 | |||

| (To record the accrued salaries payable) | |||||

| 31 | Rent expense | 52 | 2,400 | ||

| Prepaid rent | 15 | 2,400 | |||

| (To record the rent expense for July) | |||||

| 31 | Unearned fees (2) | 23 | 2,750 | ||

| Fees earned | 41 | 2,750 | |||

| (To record the receipt of unearned fees) | |||||

Table (26)

Working notes:

(7)

To prepare: An adjusted trial balance of Consulting D for July 31, 2018

Explanation of Solution

An adjusted trial balance of Consulting D for July 31, 2018 is prepared as follows:

|

D Consulting Adjusted Trial Balance July 31, 2018 |

|||

| Particulars |

Account No. |

Debit $ | Credit $ |

| Cash | 11 | 32,450 | |

| Accounts receivable | 12 | 16,450 | |

| Supplies | 14 | 1,525 | |

| Prepaid insurance | 16 | 4,125 | |

| Prepaid rent | 15 | 2,400 | |

| Office Equipment | 18 | 14,000 | |

| Accumulated Depreciation-Office equipment | 19 | 750 | |

| Accounts payable | 21 | 1,300 | |

| Salaries payable | 22 | 175 | |

| Unearned fees | 23 | 2,750 | |

| Common stock | 31 | 45,000 | |

| Dividends | 33 | 12,500 | |

| Fees earned | 41 | 44,350 | |

| Salary expense | 51 | 3,675 | |

| Rent expense | 52 | 2,400 | |

| Supplies Expense | 53 | 2,275 | |

| Depreciation expense | 54 | 750 | |

| Insurance expense | 55 | 375 | |

| Miscellaneous expense | 59 | 1,400 | |

| Total | 94,325 | 94,325 | |

Table (27)

The debit column and credit column of the adjusted trial balance are agreed, both having balance of $94,325.

(8)

To Prepare: An income statement for the year ended July 31, 2018.

Explanation of Solution

An income statement for the year ended July 31, 2018 is as follows:

| D Consulting | ||

| Income Statement | ||

| For the year ended July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Fees Earned | 44,350 | |

| Expenses: | ||

| Salaries Expense | 3,675 | |

| Rent Expense | 2,400 | |

| Supplies Expense | 2,275 | |

| Depreciation Expense- Building | 750 | |

| Insurance Expense | 375 | |

| Miscellaneous Expense | 1,400 | |

| Total Expenses | 10,875 | |

| Net Income | $33,475 | |

Table (28)

Hence, the net income of D Consulting for the year ended July 31, 2018 is $33,475.

9)

To Journalize: The closing entries for D Consulting.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 31, 2018 | Fees Earned | 41 | 44,350 | |

| Income Summary | 34 | 44,350 | ||

| (To record the closure of revenues account ) | ||||

| Income Summary | 34 | 10,875 | ||

| Salary Expense | 51 | 3,675 | ||

| Rent Expense | 52 | 2,400 | ||

| Supplies Expense | 53 | 2,275 | ||

| Depreciation Expense- Office Equipment | 54 | 750 | ||

| Insurance Expense | 55 | 375 | ||

| Miscellaneous Expense | 59 | 1,400 | ||

| (To close the revenues and expenses account. Then the balance amount are transferred to income summary account) | ||||

| Income Summary | 34 | 33,475 | ||

| Retained earnings | 32 | 33,475 | ||

| (To record the closure of net income from income summary to retained earnings) | ||||

| Retained earnings | 32 | 12,500 | ||

| Dividends | 33 | 12,500 | ||

| (To record the closure of dividend to retained earnings) | ||||

Table (31)

Fees earned account has a normal credit balance of $44,350 in total, now to close this account, the fees earned account must be debited with $44,350 and, income summary account must be credited with $44,350.

- In this closing entry, the fees earned account balance is being transferred to the income summary account, to bring the revenues account balance to zero.

- Thereby, the income summary account balance gets increased by $44,350 and, the revenue account balance gets decreased by $44,350.

All expenses accounts have a normal debit balance, the total of expenses are $10,875 have to be closed by transferring these account balances to the income summary account. All expenses account must be credited, and the income summary account must be debited with $ 10,875.

- In this closing entry, all the expenses account balances are transferred to the income summary account, to bring the expenses account balances to zero.

- Thereby, both the income summary account, and the expenses account balances get decreased by $10,875.

Determined amount balance of income summary is $33,475, which has to be closed by debiting the income summary account with $33,475, and crediting the retained earnings account with $33,475.

- In this closing entry, the income summary account balance is being transferred to the retained earnings account, to bring the income summary account balance to zero.

- Thereby, the income summary account gets decreased, and the retained earnings account balance gets increased by $33,475.

Dividends account has a normal debit balance of $12,500, now to close this account, retained earnings account must be debited with $12,500 and, dividend account must be credited with $12,500.

- In this closing entry, the dividend account balance is being transferred to the retained earnings account, to bring the dividend account balance to zero.

- Thereby, the retained earnings account balance gets increased by $12,500 and, the dividend account balance gets decreased by $12,500.

(10)

To Prepare: A post–closing trial balance of D Consulting for the month ended July 31, 2018.

Explanation of Solution

Prepare a post–closing trial balance of D Consulting for the month ended July 31, 2018 as follows:

|

Company D Post-closing Trial Balance July, 31, 2018 |

|||

| Particulars | Account Number | Debit $ | Credit $ |

| Cash | 11 | 32,450 | |

| Accounts receivable | 12 | 16,450 | |

| Supplies | 14 | 1,525 | |

| Prepaid rent | 15 | 2,400 | |

| Prepaid insurance | 16 | 4,125 | |

| Office Equipment | 18 | 14,000 | |

| Accumulated depreciation –Office Equipment | 19 | 750 | |

| Accounts payable | 21 | 1,300 | |

| Salaries payable | 22 | 175 | |

| Unearned rent | 23 | 2,750 | |

| S’s Capital | 31 | 45,000 | |

| Retained earnings | 32 | 20,975 | |

| Total | 70,950 | 70,950 | |

Table (32)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $70,950

Want to see more full solutions like this?

Chapter 4 Solutions

Working Papers for Warren/Reeve/Duchac's Corporate Financial Accounting, 14th

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning