To calculate: The present value of

Introduction:

The current worth of the

Answer to Problem 44QP

Solution:

The present value of

Explanation of Solution

Given information:

The payments for a fifteen-year

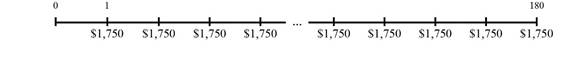

Timeline of the sales:

Formula to calculate the present value annuity:

Note: C denotes the annual cash flow, r denotes the rate of exchange, and t denotes the period. From the above information, it is necessary to compute the present value of annuity; but the rate of interest varies at the life of annuity. At first, it is essential to determine the last eight years’ present value of annuity.

Compute the present value of annuity for the last eight years:

Hence, the present value of annuity for the last eight years is $133,166.63.

Formula to calculate the present value:

Note: r denotes rate of discount and t denotes the number of years. The value of this cash flow is calculated. The lump sum is discounted for today.

Compute the present value:

Note: This is the present value of cash flow for today.

Hence, the present value of cash flow for today is $57,729.79451.

Compute the present value of annuity for the first seven years:

Hence, the present value of annuity for the first seven years is $99,134.79223.

Formula to calculate the present value of today’s cash flow:

Note: The PVA refers to present value of annuity.

Compute the present value of the cash flow today:

Hence, the present value of the cash flow today is $156,864.59.

Want to see more full solutions like this?

Chapter 4 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Calculating single-payment loan amount due at maturity. Stanley Price plans to borrow 8,000 for five years. The loan will be repaid with a single payment after five years, and the interest on the loan will be computed using the simple interest method at an annual rate of 6 percent. How much will Stanley have to pay in five years? How much will he have to pay at maturity if hes required to make annual interest payments at the end of each year?arrow_forwardYou want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years. Which table will help you determine the value of your account at the end of 12 years? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forwardIf Bergen Air Systems takes out a $100,000 loan, with eight equal principal payments due over the next eight years, how much will be accounted for as a current portion of a noncurrent note payable each year?arrow_forward

- If you have a 12-year annuity paying $496 quarterly in 10 years when interest is 6.65% compounded semi-annually, what is the number of annuity payments? Treat the deferred annuity as an ordinary annuity with the first annuity payment at the 10-year markarrow_forwardAn annuity in perpetuity with effective annual interest rate i > 0 has present value $1, 000. Find i if the annuity pays $52.50 at the end of every 6 month period, with the first payment at the end of the first year.arrow_forwardHow much interest is included in the future value of an ordinary simple annuity of $1,650 paid every six months at 6% compounded semi-annually if the term of the annuity is 6.5 years? SIX The interest is $arrow_forward

- A 20 year annuity pays $50 at the beginning of each month during the first year, $55 at the beginning of each month during the second year, $60 at the beginning of each month during the third year, and so on. The nominal annual interest rate is 6% compounded monthly. Calculate the present value of the annuity.arrow_forwardHandwritten: An 11-year annuity pays $1,800 per month, and payments are made at the end of each month. The interest rate is 11 percent compounded monthly for the first six years and 10 percent compounded monthly thereafter. What is the present value of the annuity?arrow_forwardWhat is the present value of a deferred annuity with a deferral period of 17 years at 6.7% compounded semi-annually followed by a 10-year annuity due paying $1,250 every month at 4.78% compounded semi-annually?arrow_forward

- A one-year annuity that pays $100 semi-annually will starts its payment in 6 months from now. APR is 8 percent compounded semi-annually. a. What is the present value of the annuity? b. What is the effective annual rate? c. Now consider another one-year annuity that makes a “single” payment in a year from now. How much should it pay to the investor if it is equally valuable to the previous annuity?arrow_forwardA 16-year annuity pays $1,900 per month, and payments are made at the end of each month. The interest rate is 8 percent compounded monthly for the first five years and 5 percent compounded monthly thereafter. What is the present value of the annuity? A. $218,527.19 B. $2,675,843.15 C. $286,315.12 D. $227,446.67 E. $222,986.93arrow_forwardWhat amount is required to purchase an annuity that pays $7000 at the end of each quarter for the first five years and then pays $1500 at the beginning of each month for the subsequent 15 years? Assume that the annuity payments are based on a rate of return of 4.3% compounded quarterly.arrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College