Concept explainers

(25–30 min.)

Underwood is eager to impress his new employer, and he knows that in 2017. Anderson’s upper management is under pressure to show a profit in a challenging competitive environment because they are hoping to be acquired by a large private equity firm sometime in 2018. At the end of 2016, Underwood decides to adjust the manufacturing overhead rate to 160% of direct labor cost. He explains to the company president that, because overhead was underallocated in 2016, this adjustment is necessary. Cost information for 2017 follows:

| Direct materials control, 1/1/2017 | 25,000 |

| Direct materials purchased, 2017 | 650,000 |

| Direct materials added to production, 2017 | 630,000 |

| Work in process control, 1/1/2017 | 280,000 |

| Direct manufacturing labor, 2017 | 880,000 |

| Cost of goods manufactured, 2017 | 2,900,000 |

| Finished goods control, 1/1/2017 | 320,000 |

| Finished goods control, 12/31/2017 | 290,000 |

| Manufacturing overhead costs, 2017 | 1,300,000 |

Anderson’s revenue for 2017 was $5,550,000, and the company’s selling and administrative expenses were $2,720,000.

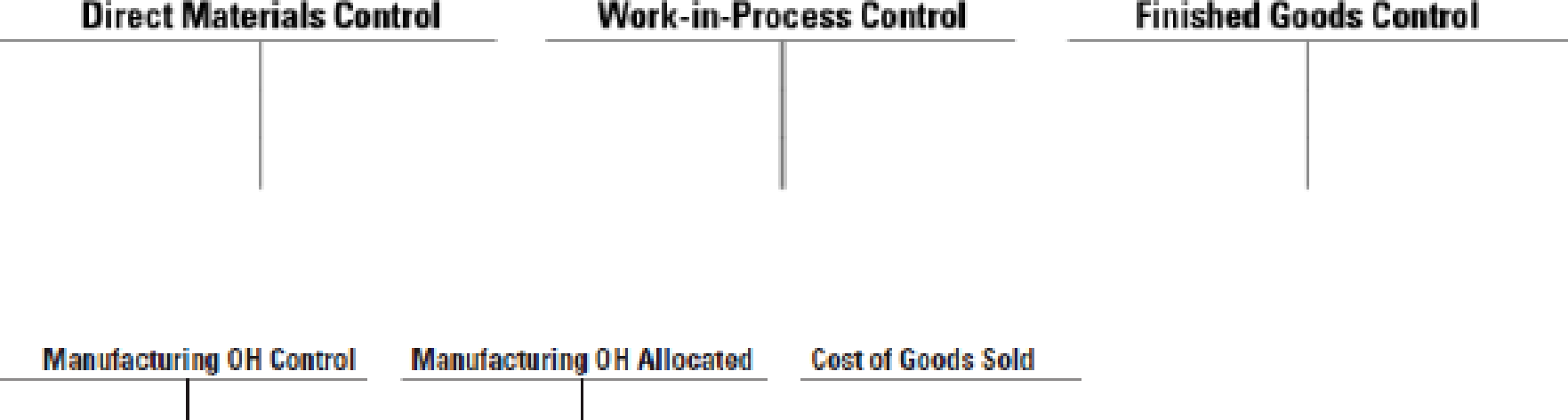

- 1. Insert the given information in the T-accounts below. Calculate the following amounts to complete the T-accounts:

Required

- a. Direct materials control, 12/31/2017

- b. Manufacturing overhead allocated, 2017

- c. Cost of goods sold, 2017

- 2. Calculate the amount of under- or overallocated manufacturing overhead.

- 3. Calculate Anderson’s net operating income under the following:

- a. Under- or overallocated manufacturing overhead is written off to cost of goods sold.

- b. Under- or overallocated manufacturing overhead is prorated based on the ending balances in work in process, finished goods, and cost of goods sold.

- 4. Underwood chooses option 3a above, stating that the amount is immaterial. Comment on the ethical implications of his choice. Do you think that there were any ethical issues when he established the manufacturing overhead rate for 2017 back in late 2016? Refer to the IMA Statement of Ethical Professional Practice.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 4 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Principles of Accounting Volume 1

Managerial Accounting (4th Edition)

Managerial Accounting (5th Edition)

Cost Accounting (15th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

- Rulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forwardDepartment costing, service company. DLN is an architectural rm that designs and builds buildings. It prices each job on a cost plus 20% basis. Overhead costs in 2017 are $8,100,000. DLN’s simple costing system allocates overhead costs to its jobs based on number of jobs. There were three jobs in 2017. One customer, Chandler, has complained that the cost and price of its building in Chicago was not competitive. As a result, the controller has initiated a detailed review of the overhead allocation to determine if overhead costs should be charged to jobs in proportion to consumption of overhead resources by jobs. She gathers the following information:arrow_forwardKeezel Company uses normal costing in its job-costing system. Partially completed T-accounts and additional information for Keezel for 2017 are as follows: a. Direct manufacturing labor wage rate was $15 per hour. b. Manufacturing overhead was allocated at $20 per direct manufacturing labor-hour. c. During the year, sales revenues were $1,550,000, and marketing and distribution costs were $810,000. Question 1. What was the amount of direct materials issued to production during 2017? 2. What was the amount of manufacturing overhead allocated to jobs during 2017? 3. What was the total cost of jobs completed during 2017? 4. What was the balance of work-in-process inventory on December 31, 2017? 5. What was the cost of goods sold before proration of under- or overallocated overhead? 6. What was the under- or overallocated manufacturing overhead in 2017? 7. Dispose of the under- or overallocated…arrow_forward

- how can i get this problem resolved? Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production 125,000 Machine-hours required to support estimated production 62,500 Fixed manufacturing overhead cost $ 350,000 Variable manufacturing overhead cost per direct labor-hour $ 3.80 Variable manufacturing overhead cost per machine-hour $ 7.60 During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials $ 201 Direct labor cost $ 240 Direct labor-hours 15 Machine-hours 5 Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550.…arrow_forwardParts World (PW) designs and produces automotive parts. In 2017, actual manufacturing overhead is $316,000. PW's simple costing system allocates manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so PW's controller Duncan Johnson realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information: (Click the icon to view the information.) Read the requirements. Requirement 1. Compute the manufacturing overhead allocated to each customer in 2017 using the simple costing system that uses machine-hours as the allocation base. Determine the formula needed to calculate overhead using the simple…arrow_forwardhow can i get this problem resolve? Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production 125,000 Machine-hours required to support estimated production 62,500 Fixed manufacturing overhead cost $ 350,000 Variable manufacturing overhead cost per direct labor-hour $ 3.80 Variable manufacturing overhead cost per machine-hour $ 7.60 During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials $ 201 Direct labor cost $ 240 Direct labor-hours 15 Machine-hours 5 Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c.…arrow_forward

- Job costing, journal entries. Donald Transport assembles prestige manufactured homes. Its job costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead allocated at a budgeted $31 per machine-hour in 2017). The following data (in millions) show operation costs for 2017:arrow_forwardAshton Construction assembles residential houses. It uses a job-costing system with two direct-cost categories (direct materials and direct labor) and one indirect-cost pool (assembly support). Direct labor-hours as the allocation base for assembly support costs. In December 2016, Ashton budgets 2017 assembly-support costs to be $8,100,000 and 2017 direct labor-hours to be 135,000. At the end of 2017, Ashton is comparing the costs of several jobs that were started and completed in 2017. Read the requirements2. Requirement 1. Compute the (a) budgeted indirect-cost rate and (b) actual indirect-cost rate. Why do they differ? Identify the formula to calculate the budgeted indirect cost rate and then calculate the rate. (1) / (2) = Budgeted indirect cost rate / = per DLH Identify the formula to calculate the actual indirect cost rate and then calculate the rate. (3) / (4)…arrow_forwardMyGame Station Sdn Bhd makes gaming devices using latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine hours. The following estimates were used in preparing the predetermined overhead rate at the beginning of the year: Machine hours 22,500 Manufacturing overhead cost RM320,000 During the year 2020, a surplus of gaming devices on the market resulted in cutting back production. The company’s cost records revealed the following actual cost and operating data for the year: Machine hours 25,000 Manufacturing overhead cost RM385,000 Inventories at year-end: Raw Materials RM12,000 Work in process (includes overhead applied of RM12,000) RM40,000 Finished goods (includes overhead applied of RM40,000) RM150,000 Cost of goods sold (includes overhead applied of RM152,000) RM400,000 REQUIRED: Compute the predetermined…arrow_forward

- MyGame Station Sdn Bhd makes gaming devices using latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine hours. The following estimates were used in preparing the predetermined overhead rate at the beginning of the year: Machine hours 22,500 Manufacturing overhead cost RM320,000 During the year 2020, a surplus of gaming devices on the market resulted in cutting back production. The company’s cost records revealed the following actual cost and operating data for the year: Machine hours 25,000 Manufacturing overhead cost RM385,000 Inventories at year-end: Raw Materials RM12,000 Work in process (includes overhead applied of RM12,000) RM40,000 Finished goods (includes overhead applied of RM40,000) RM150,000 Cost of goods sold (includes overhead applied of RM152,000) RM400,000 REFFERAL ANSWERs a) Predetermined overhead…arrow_forwardConstruction assembles residential houses. It uses a job-costing system with two direct-cost categories (direct materials and direct labor) and one indirect-cost pool (assembly support). Direct labor-hours is the allocation base for assembly support costs. In December 2016, Amesbury budgets 2017 assembly-support costs to be $8,900,000 and 2017 direct labor-hours to be 178,000. At the end of 2017, Amesbury is comparing the costs of several jobs that were started and completed in 2017. Requirement 1. Compute the (a) budgeted indirect-cost rate and (b) actual indirect-cost rate. Why do they differ? Identify the formula to calculate the budgeted indirect cost rate and then calculate the rate. (1) / (2) = Budgeted indirect cost rate / = per DLH Identify the formula to calculate the actual indirect cost rate and then calculate the rate. (3) / (4) = Actual indirect cost…arrow_forwardAtkinson Construction assembles residential houses. It uses a job-costing system with two direct-cost categories (direct materials and direct labor) and one i ndirect-cost pool (assembly support). Direct labor-hours is the allocation base for assembly support costs. In December 2016, Atkinson budgets 2017 assembly-support costs to be $8,800,000 and 2017 direct laborhours to be 220,000. At the end of 2017, Atkinson is comparing the costs of several jobs that were started and completed in 2017. Laguna Model Mission Model Construction period Feb–June 2017 May–Oct 2017 Direct material costs $106,550 $127,450 Direct labor costs $ 36,250 $ 41,130 Direct labor-hours 970 1,000 Direct materials…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College