Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 34P

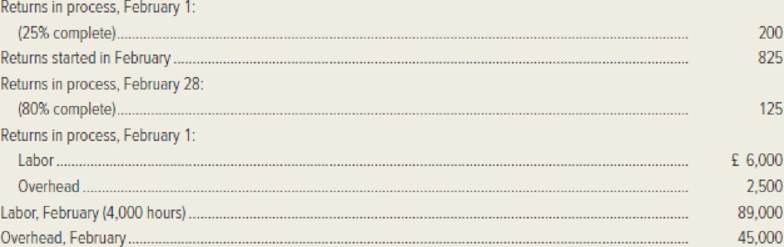

Scrooge and Zilch, a public accounting firm in London, is engaged in the preparation of income tax returns for individuals. The firm uses the weighted-average method of

*Although the euro is used in most European markets, day-to-day business in the United Kingdom continues to be conducted in pounds sterling.

Required:

- 1. Compute the following amounts for labor and for overhead:

- a. Equivalent units of activity.

- b. Cost per equivalent unit. (Remember to express your answer in terms of the British pound sterling, denoted by £.)

- 2. Compute the cost of returns in process as of February 28.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Shushi Bae is a Koren based in South Korea. She established Shushi Samgyup in the Philippines and registered

the same at the Department of Trade and Industry and the Bureau of Internal Revenue as Non-VAT. She hired

Nicanor as the General Manager in-charge of all the operations of the head office and its branches. Total

receipts for the 2021 are hereunder accounted:

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Head Office NCR

500,000

400,000

500,000

400,000

Cebu Branch

250,000

300,000

200,000

Davao Branch

100,000

200,000

How much

the total percentage tax is she required to pay for the year 2021?

Taft Corporation operates primarily in the United States. However, a few years ago it opened a plant in Spain to produce merchandise to sell there. This foreign operation has been so successful that during the past 24 months the company started a manufacturing plant in Italy and another in Greece. Financial information for each of these facilities follows:The company’s domestic (U.S.) operations reported the following information for the current year:Taft has adopted the following criteria for determining the materiality of an individual foreign country: (1) Sales to unaffiliated customers within a country are 10 percent or more of consolidated sales or (2) long-lived assets within a country are 10 percent or more of consolidated long-lived assets.Apply Taft’s materiality tests to identify the countries to report separately with respect to (a) revenues and (b) long-lived assets.

The following transactions have been processed on the VAT control account in October:

Balance b/f

Output tax

Input tax

Payments to tax authority

£

21,850CR

Answer:

132,430

109,110

25,000

What is the value of the balance carried forward into November?

Enter your answer as a value with no E sign, commas or decimal places.

Chapter 4 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 4 - Explain the primary differences between job-order...Ch. 4 - List five types of manufacturing in which process...Ch. 4 - Prob. 3RQCh. 4 - What are the purposes of a product-costing system?Ch. 4 - Define the term equivalent unit and explain how...Ch. 4 - List and briefly describe the purpose of each of...Ch. 4 - Show how to prepare a journal entry to enter...Ch. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - Prob. 10RQ

Ch. 4 - How does process costing differ under normal or...Ch. 4 - How would the process-costing computations differ...Ch. 4 - Explain the concept of operation costing. How does...Ch. 4 - Prob. 14RQCh. 4 - In each case below, fill in the missing amount.Ch. 4 - Rainbow Glass Company manufactures decorative...Ch. 4 - Terra Energy Company refines a variety of...Ch. 4 - The Evanston plant of Fit-for-Life Foods...Ch. 4 - Idaho Lumber Company grows, harvests, and...Ch. 4 - Otsego Glass Company manufactures window glass for...Ch. 4 - Savannah Textiles Company manufactures a variety...Ch. 4 - The following data pertain to Tulsa Paperboard...Ch. 4 - The November production of MVPs Minnesota Division...Ch. 4 - Timing Technology, Inc. manufactures timing...Ch. 4 - Piscataway Plastics Company manufactures a highly...Ch. 4 - The following data pertain to the Vesuvius Tile...Ch. 4 - Triangle Fastener Corporation accumulates costs...Ch. 4 - Moravia Company processes and packages cream...Ch. 4 - Albany Company accumulates costs for its product...Ch. 4 - Goodson Corporation assembles various components...Ch. 4 - A-1 Products manufactures wooden furniture using...Ch. 4 - The following data pertain to the Hercules Tire...Ch. 4 - Scrooge and Zilch, a public accounting firm in...Ch. 4 - GroFast Company manufactures a high-quality...Ch. 4 - Plasto Corporation manufactures a variety of...Ch. 4 - (Contributed by Roland Minch.) Glass Glow Company...Ch. 4 - Orbital Industries of Canada, Inc. manufactures a...Ch. 4 - Laredo Leather Company manufactures high-quality...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC Juice Limited manufactures and sells juice locally in Trinidad and in the Caribbean. The business is VAT registered with tax authorities in Trinidad. How would you work out: Imports of $75,000 inclusive of Jmd$15,000 VATarrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that manufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help finance its growth. The bank requires financial statements before approving the loan. Required: Classify each cost listed below as either a product cost or a period cost for the purpose of preparing financial statements for the bank. 8 00-45-49 Costs Product Cost / Period Cost 1. Depreciation on salespersons' cars. 2. Rent on equipment used in the factory. 3 lubricants used for machine maintenance Salaries of personnel who work in the finished goods warehouse 5. Soap and paper towels used by factory workers at the end of a shift. 6. Factory supervisors' salaries. 7. Heat, water, and power consumed in the factory. 8. Materials used for boxing products for shipment overseas. (Units are not normally boxed.) 9. Advertising…arrow_forwardmework i Saved Help Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate com Chapeau Company, a U.S. corporation, operates through a branch in Champagnia. The source rules used by Champagnia are identical to those used by the United States. For 2019, Chapeau has $5.200 of gross incomer $3,120 from U.S. sources and $2,080 from sources within Champagnia. The $3,120 of U.S. source income and $1,820 of the foreign source income are attributable to manufacturing activities in Champagnia (foreign branch income). The remaining $260 of foreign source income is passive category interest income. Chapeau had $1,300 of expenses other than taxes, all of which are allocated directly to manufacturing income ($520 of which is apportioned to foreign sources). Chapeau paid $278 of income taxes to Champagnia on its manufacturing income. The interest income was subject to a 10 percent withholding tax of S26! Compute Chapeau's total…arrow_forward

- Assume that you are the managerial accountant at Infostore, a manufacturer of hard drives, CDs, and DVDs. Its reporting year-end is December 31. The chief financial officer is concerned about having enough cash to pay the expected income tax bill because of poor cash flow management. On November 15, the purchasing department purchased excess inventory of CD raw materials in anticipation of rapid growth of this product beginning in January. To decrease the company’s tax liability, the chief financial officer tells you to record the purchase of this inventory as part of supplies and expense it in the current year; this would decrease the company’s tax liability by increasing expenses. Required 1. In which account should the purchase of CD raw materials be recorded? 2. How should you respond to this request by the chief financial officer?arrow_forwardWestico Foods Limited (WFL) is a trading company that does brisktrading in the baking and delivery industry. WFL is located in abusy hub of Kingston, St. Andrew. Jamaica and has subsidiaries inCaribbean countries such as Trinidad and Tobago and Barbados. Thebusiness is VAT/GCT registered with Tax Administration Jamaica,and the subsidiaries also registered with the Tax Authorities in therespective countries. WFL has just come to the end of it sbi-monthlyVAT/GCT period. The company has recorded the following transactionsover the period:Sales -VAT/GCT inclusive J$130,000Sales - VAT/GCT exclusive J$120,000Purchases VAT inclusive J$75,000Purchases VAT inclusive J$50,000Imports of J$75,000 inclusive of J$15,000 VATThe VAT/GCT rate is 12.5% on Sales and on PurchasesRequirements:1. Show the summarized transactions as they would appear in thebooks of WFL.2. What are the VAT/GCT Payable / Refundable for the period?arrow_forwardwhat is the formula of input and output tax? how tp compute? example is this : The transactions for ABC Company for the month of April, 2015 are shown below. (Assume the company is a vat registered business and assume 12% VAT is inclusive in the amounts in the transactions.) April 3 Sold merchandise to Mr. Santos on account, P280,000, FOB shipping point, terms: 2/10, n/30.arrow_forward

- Donovan Ramsey, the Chief Financial Officer of LevelUp Business Consulting, has advised you that the company is considering closing its Calgary, Alberta office and transitioning the staff of that location to permanent work from home employees. The employees home offices would not be considered a permanent establishment of the employer. Eight staff members currently report to the Alberta office, and the total payroll is $775,000.00. The organization’s head office and payroll department are in Mississauga, Ontario. The current Ontario payroll is $4,750,000.00. You have been asked to prepare an analysis showing how closing this permanent establishment in Alberta will impact the employee’s coverage for provincial healthcare and the organization’s payroll expense for provincial health taxes.arrow_forwardDonovan Ramsey, the Chief Financial Officer of LevelUp Business Consulting, has advised you that the company is considering closing its Calgary, Alberta office and transitioning the staff of that location to permanent work from home employees. The employees home offices would not be considered a permanent establishment of the employer. Eight staff members currently report to the Alberta office, and the total payroll is $775,000.00. The organization’s head office and payroll department are in Mississauga,arrow_forwardWillingham Construction is in the business of building high-priced, custom, single-family homes. The company,headquartered in Anaheim, California, operates throughout the Southern California area. The construction periodfor the average home built by Willingham is six months, although some homes have taken as long as nine months.You have just been hired by Willingham as the assistant controller and one of your first tasks is to evaluate thecompany’s revenue recognition policy. The company presently recognizes revenue upon completion for all of itsprojects and management is now considering whether revenue recognition over time is appropriate.Required:Write a 1- to 2-page memo to Virginia Reynolds, company controller, describing the differences between theeffects of recognizing revenue over time and upon project completion on the income statement and balance sheet.Indicate any criteria specifying when revenue should be recognized. Be sure to include references to GAAP asthey pertain to…arrow_forward

- Required information [The following Information applies to the questions displayed below.] The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,500 plus sales tax of 7 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $82,500 plus sales tax of 7 percent. e. On which financial statement will the sales tax liability appear? The liability is shown on thearrow_forwardc. Intuit Inc. develops tax preparation software that it sells to its customers for a flat fee. No further Explain when each of the following businesses fulfills the performance obligations implicit in the sales b. Oracle Corp. develops general ledger and other business application software that it sells to its E5-34. a. RealMoney.Com, a division of TheStreet Inc., provides investment advice to customers for an up front fee. It provides these customers with password-protected access to its website, where they 01 Assessing Revenue Recognition Timing and Income Measurem contract and recognizes revenue. Identify any revenue measurement ISsues that could arise can download investment reports. RealMoney has an obligation to provide updates on its they customers. The customer pays an up-front fee for the right to use the software and a monthly its support services. payment is required, and the software cannot be returned, only exchanged if defective. d. Electronic Arts develops and sells…arrow_forwardRequired Information [The following information applies to the questions displayed below.] The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,500 plus sales tax of 7 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $82,500 plus sales tax of 7 percent. b. What was the total amount of sales tax paid in Year 1? Sales tax paidarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License