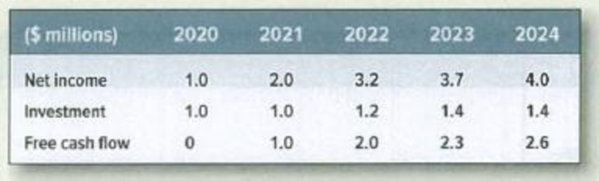

Valuing a business* Phoenix Corp. faltered in the recent recession but is recovering.

Phoenix’s recovery will be complete by 2024, and there will be no further growth in net income or free cash flow.

- a. Calculate the PV of free cash flow, assuming a

cost of equity of 9%. - b. Assume that Phoenix has 12 million shares outstanding. What is the price per share?

- c. Confirm that the expected

rate of return on Phoenix stock is exactly 9% in each of the years from 2020 to 2024.

a)

To determine: Present value of free cash flow

Explanation of Solution

Compute the present value of free cash flow:

Hence, the present value is $24.8 million.

b)

To determine: Price per share

Explanation of Solution

Note:

Assume no debt, the share price are as follows,

Hence, the price per share is $2.04.

c)

To confirm: The expected rate of return is 9%.

Explanation of Solution

Compute PV of the cash flows at various points in time:

Compute rate of return using the formula

Thus, the above calculation shows that the rate of return on Company P is exactly 9%.

Want to see more full solutions like this?

Chapter 4 Solutions

PRIN.OF CORPORATE FINANCE

Additional Business Textbook Solutions

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Fundamentals of Corporate Finance

Corporate Finance

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

- A company currently has EBIT of $25,000 and is all-equity financed. The company expect EBIT to stay at this level indefinitely. Now assume the firm issues $50,000 of debt paying interest of 6% per year, using the proceeds to retire equity. The debt is expected to be permanent. What will happen to the total value of the firm? Make a case for why X is the best option and explain what considered, what assumptions you made and why?arrow_forwardA company expects earnings in the current year to be $5 per share, and plans to pay a $3 dividend to shareholders. The company will retain $2 per share of its earnings to reinvest in new projects with an expected return of 15% per year. Suppose the company will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. a. What growth rate of earnings would you forecast for the company? b. If the equity cost of capital is 12%, what price would you estimate for the company’s stock? c. Suppose instead paying a dividend of $4 per share this year and retained only $1 per share in earnings. If the company maintains this higher payout rate in the future, what stock price would you estimate now? Should the company raise its dividend?arrow_forwardSuppose instead that the company is about to pay a dividend of $2.00 per share. You also learn that the company is expected to have net income of $100 million, dividends of $50 million, and total equity of $1.5 billion (and that these relationships are expected to be stable). If the relevant required rate of return is 10%, what is the intrinsic value per share of the company’s stock?arrow_forward

- You expect X-Co will pay a dividend of $76 million and repurchase $100 million of its common shares next year (Year 1) with both expected to grow 8% in Year 2 and 6% in Year 3. If you expect the company to be sold for $12 billion at the end of Year 3, and you have calculated the cost of equity to be 8.4%, what do you estimate the true value of the company’s net worth to be now? (First draw a timeline. Assume all cash flows are at the end of the year.)arrow_forwardAn analyst is trying to estimate the intrinsic value of the stock of ATR Kim Eng. The analyst estimates that ATR Kim Eng's free cash flow during the next year will be P25 million. The analyst also estimates that the company's free cash flow will increase at a constant rate of 7% a year and that the company's WACC is 10%. ATR Kim Eng has P200 million of long-term debt and preferred stock and 30 million outstanding shares of common stock. What is the estimated per-share price of ATR Kim Eng's common stock? 27.78 21.11 8.33 34.43arrow_forwardAn analyst is trying to estimate the intrinsic value of the stock of ATR Kim Eng. The analyst estimates that ATR Kim Eng’s free cash flow during the next year will be P25 million. The analyst also estimates that the company’s free cash flow will increase at a constant rate of 7% a year and that the company’s WACC is 10%. ATR Kim Eng has P200 million of long-term debt and preferred stock and 30 million outstanding shares of common stock. What is the estimated per-share price of ATR Kim Eng’s common stock? Group of answer choices P21.11 P27.78 P34.43 P8.33arrow_forward

- Value in Valuation, Inc. is assessing the value of two companies, Company A and Company B, which projects average net cashflows in the next five years of P4,000,000 and 3,000,000, respectively. The required rate of return is both 8%. Which of the following has the higher equity value and by how much? And assuming that Company A is being sold at P48,000,000 while Company B is being sold at P36,500,000, what should be Value in Valuation’s best recommendation among the following choices: 1. To buy Company A because the selling price is higher than its equity value 2. To buy Company A because it is being sold at a discount of P2,000,000 3. To buy Company B because the selling price is lower than its equity value 4. To buy Company B because it is being sold at a premium of P1,000,000arrow_forwardAssume you’ve forecasted the following Net Income amounts for Chipotle over the period 2021-2030. Assuming a beta of 1.28, a risk-free rate of 1.14% and a market risk premium of 4.72%. Assume Chipotle pays “dividends” each period equal to 5.24% of net income. The beginning book value of equity equals $2,020,135. Calculate residual income and the present value of each residual income amount. (Don’t forget to calculate book value of shareholders’ equity each period.) See attatched picture for work 2. Calculate the continuing value assuming a 3% growth rate.Step 1: Multiply Net Income for 2030 by (1+g)Step 2: Multiply Book Value of Shareholder’s Equity at end of 2030 by RE (cost of equity).Step 3: Subtract Step 2 amount from Step 1 amount. This is the continuing residual income.Step 4: Assume the Step 3 amount is a perpetuity with growth (this amount will grow forever at a constant rate). Divide the Step 3 amount by (RE-g). It will be a big number. 3. Add…arrow_forwardManagement wants to evaluate the projected share price for Froggy Toy Frogs, Inc. based on the projected future cash flows of the company. These cash flows are outlined below. The company anticipates a 6% growth rate per year after the 5th year, and has a weighted average cost of capital of 10%. The company has no excess cash, debt of $200 million, and 25 million shares outstanding. Use the discounted free cash flow model to determine the share price for Froggy Toy Frogs, Inc. Year 1 2 3 4 5 Free Cash Flow(Millions) 52 59 65 70 82 Using this information:• What is the terminal enterprise value of the company?• Using the terminal enterprise value, what is the current, present value of the company?arrow_forward

- R.K. Boats Inc. is in the process of making some major investments for growth and is interested in calculating its cost of equity to correctly estimate its adjusted WACC. The firm's common stock is currently trading for $43.25. Its annual dividend, which was paid last year, was $2 and should continue to grow at 7% per year. Moreover, the company's beta is 1.35, the risk-free rate is 3%, and the market risk premium is 8%. Which of the following is a reasonable estimation of the firm's cost of equity?arrow_forwardTinsley, Incorporated, wishes to maintain a growth rate of 17 percent per year and a debt-equity ratio of 1.1. The profit margin is 4.4 percent, and total asset turnover is constant at 1.04. What is the dividend payout ratio? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. What is the maximum sustainable growth rate for this company? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forwardThe table shows the forecast cash flow information of Good Time Inc. for the nextyear. The required debt payment in the next year is $88 million, with a current market valueof $60 million. The company pays no tax. If you invest in the corporate debt of Good TimeInc. today, what is your expected return on this investment?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning