Concept explainers

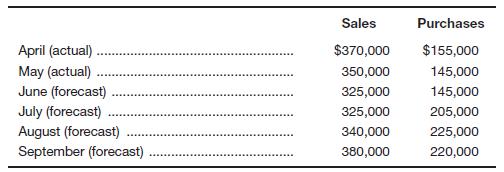

Archer Electronics Company’s actual sales and purchases for April and May are shown here along with

The company makes 20 percent of its sales for cash and 80 percent on credit. Of the credit sales, 50 percent are collected in the month after the sale and 50 percent are collected two months later. Archer pays for 20 percent of its purchases in the month after purchase and 80 percent two months after.

Labor expense equals 15 percent of the current month’s sales. Overhead expense equals

Archer Electronics’ ending cash balance in May is

Trending nowThis is a popular solution!

Chapter 4 Solutions

Foundations of Financial Management

- Halifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardCash collections for Renew Lights found that 65% of sales were collected in the month of sale, 25% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in March and April?arrow_forwardAll Temps has a policy of always paying within the discount period, and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 80% of its payments are made in the month of purchase and 20% are made the following month. The direct materials budget provides for purchases of $23,812 in February, $23,127 in March, $21,836 in April, and $28,173 in May.What is the balance in accounts payable for April 30, and May 31?arrow_forward

- Gear Up Co. pays 65% of its purchases in the month of purchase, 30% in the month after the purchase, and 5% in the second month following the purchase. What are the cash payments if it made the following purchases in 2018?arrow_forwardRanger Industries has provided the following information at June 30: Other information: Average selling price, 196 Average purchase price per unit, 110 Desired ending inventory, 40% of next months unit sales Collections from customers: In month of sale20% In month after sale50% Two months after sale30% Projected cash payments: Inventory purchases are paid for in the month following acquisition. Variable cash expenses, other than inventory, are equal to 25% of each months sales and are paid in the month of sale. Fixed cash expenses are 40,000 per month and are paid in the month incurred. Depreciation on equipment is 2,000 per month. REQUIREMENT You have been asked to prepare a master budget for the upcoming quarter (July, August, and September). The components of this budget are a monthly sales budget, a monthly purchases budget, a monthly cash budget, a forecasted income statement for the quarter, and a forecasted September 30 balance sheet. The worksheet MASTER has been provided to assist you. Ranger Industries desires to maintain a minimum cash balance of 8,000 at the end of each month. If this goal cannot be met, the company borrows the exact amount needed to reach its goal. If the company has a cash balance greater than 8,000 and also has loans payable outstanding, the amount in excess of 8,000 is paid to the bank. Annual interest of 18% is paid on a monthly basis on the outstanding balance.arrow_forwardCash collections for Wax On Candles found that 60% of sales were collected in the month of the sale, 30% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in January and February?arrow_forward

- Pilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardA companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and the remainder are credit sales. The company finds that typically 10 percent of a months credit sales are paid in the month of sale, 70 percent are paid the next month, and 15 percent are paid in the second month after sale. Expected cash receipts in July are budgeted at what amount? a. 114,520 b. 143,150 c. 145,720 d. 156,000arrow_forwardSports Socks has a policy of always paying within the discount period and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 85% of its payments are made in the month of purchase and 15% are made the following month. The direct materials budget provides for purchases of $129,582 in November, $294,872 in December, $239,582 in January, and $234,837 in February. What is the balance in accounts payable for January 31, and February 28?arrow_forward

- Drainee purchases direct materials each month. Its payment history shows that 65% is paid in the month of purchase with the remaining balance paid the month after purchase. Prepare a cash payment schedule for January using this data: in December through February, it purchased $22,000, $25,000, and $23,000 respectively.arrow_forwardDream Big Pillow Co. pays 65% of its purchases in the month of purchase, 30% the month after the purchase, and 5% in the second month following the purchase. It made the following purchases at the end of 2017 and the beginning of 2018:arrow_forwardOne Device makes universal remote controls and expects to sell 500 units in January, 800 in February, 450 in March, 550 in April, and 600 in May. The required ending inventory is 20% of the next months sales. Prepare a production budget for the first four months of the year.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College